Planning & Productivity

8 MIN ARTICLE

For advisor use only. Not for use with investors.

A lot of ink has been spilled on finding the keys to business growth. For financial professionals, that growth often comes from adding new clients or offering high-value services to existing clients. Both approaches are highlighted as traits of the fastest-growing advisor practices in our Pathways to Growth: 2024 Advisor Benchmark Study.

But for either approach, you’ll likely need more time in your day, which is the underlying challenge we all face. That’s why I believe the hidden key to growth can be found in productivity gains.

One of the best ways to increase productivity is to look at your team’s routine tasks — everything from client onboarding to investment management — and systematize them. If you can create standard processes around these aspects of your day, you can spend more time and energy on your most important tasks like prospecting and talking to clients. And the resulting productivity gains you glean from a more consistent process can ultimately pave the way for growing your practice into a true enterprise.

You can do much of this work on your own, although some financial professionals opt to hire consultants to help. To help you get started, here are three steps you can take in order to increase productivity in your business.

Step 1: Identify your standard operating procedures (SOPs) and document them

Start with your firm’s business routines and standard processes, which compose the “engine room” of the practice. By establishing standard procedures for routine tasks, you can remove friction and drag and create consistency, so you don’t end up recreating the wheel with each new project. This also provides a crucial baseline to assess whether you're delivering the impact you intended while charting a path for continuous improvement.

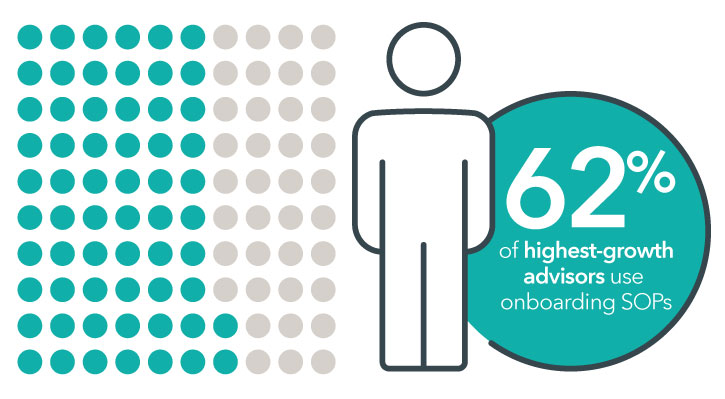

High-growth advisors embrace SOPs

Among the highest-growth segment of advisors we surveyed, more than six out of 10 have systemized their onboarding processes.

Source: Capital Group, Pathways to Growth: 2021 Advisor Benchmark Study

The first order of business is documenting your everyday processes and procedures. Any process your firm does repeatedly — from the simplest to the most complex — should be committed to paper. Be forewarned: This won’t be something you complete in a day.

When advisor Ray Evans, founder and senior partner of Pegasus Capital Management, decided to codify some of his team’s procedures, the task took a full year. He hired coaching and consulting firm Pareto Systems to help document all of his team’s processes. Before that point, those processes were only in his head, and he needed to disseminate that information throughout the team. Establishing SOPs became ever more important as the team added people. “Did we have a process for everything? Yes. Was it anywhere except in my head? No,” said Evans.

So, Pareto talked through everything his team did. “They went through every single process we have,” Evans said, with an eye toward determining if there were better ways or best practices to adopt. “Those meetings typically involved the entire team, so we were getting input from people who didn’t get as much of a chance to contribute before,” he says.

One thing Evans learned throughout the SOP process was just how little some of the operations staff knew about what happened in front of clients. Despite in-depth weekly staff meetings, not everyone had a firm understanding of the various processes — the differences between the first and second meetings with clients, for example, or which materials were used in review meetings. “But now, there is a much broader appreciation of those things,” Evans says, “and that’s been a really valuable exercise.”

When creating your own SOPs, it helps to start with the basics. Think like a reporter and start with the W questions: who, what, when, where and why.

- Who completes this task? The answer may be a specific person, or the task may require more than one role.

- What is your desired outcome of this task? Remind yourself of the larger goal of your task. For example, you may have a goal like increasing the number of clients, building awareness of your brand, or ensuring that your office keeps up with technology.

- When do we do this task? Understand where the task falls in the larger ecosystem/operations of your business.

- Where do we keep the information? Make sure you know where to find what you need, whether it’s kept as a hard copy, saved on your computer, or archived in a database.

- Why do you do this task? Think about the reason this task is important, whether it’s a step in a much larger process (like client onboarding) or exists in a vacuum (like business continuity in an emergency).

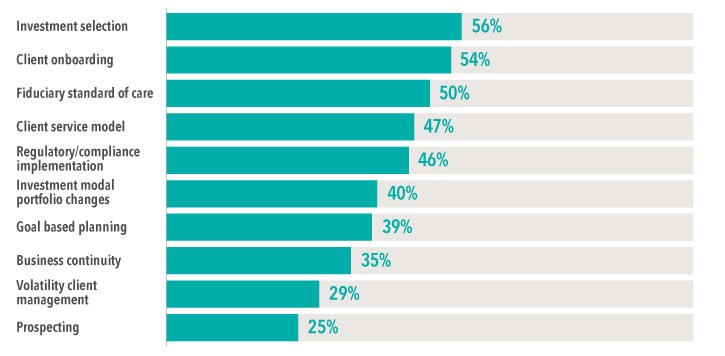

Industry standard SOPs

A substantial number of advisors have established SOPs in their practices.

Source: Capital Group, Pathways to Growth: 2021 Advisor Benchmark Study

Step 2: Standardize your investment process and client service model

The benefits of standard business processes go beyond the practice management aspects of your firm. They can also apply to investment processes and client interactions.

Greg Mendoza, a senior vice president at UBS who works with many retirement plans, says his team has a very dedicated investment process for its defined contribution business in the U.S., offering just a handful of vehicles to invest in.

This streamlined approach is backed up by research showing that participants can feel overwhelmed by too many investment choices. And fewer options can facilitate better participant decision-making.1 A smaller investment menu also helps Mendoza’s team get to know the funds intimately, he says.

When it comes to client interactions, Mendoza says his team doesn’t have a secret sauce, but they have routines and they follow them consistently. “All clients or prospects go through a robust financial planning process and portfolio assessment. We ask a lot of questions, and we tell people what our process is,” he says. That process was created with the help of Supernova Consulting Group, which recommends a sharp focus on your best clients and a detailed service model. It boils down to something he calls a “12-4-2 model”: 12 monthly contacts and four quarterly reviews, two of which are probably in-person. And if clients call or email, they’ll get a response within 24 hours.

“Our best relationships are managed because expectations are known upfront and then can be met on an ongoing basis. New clients enter into it with their eyes wide open, so there are no surprises,” he says.

Mendoza also emphasizes the need for constant communication among team members. Even in a remote work environment, they maintain daily interactions. “We maintain a spreadsheet and communicate about initiatives with existing clients or new onboarding procedures,” he says. “The more you can hardwire into your schedule, the more predictability you’ll have along the way.”

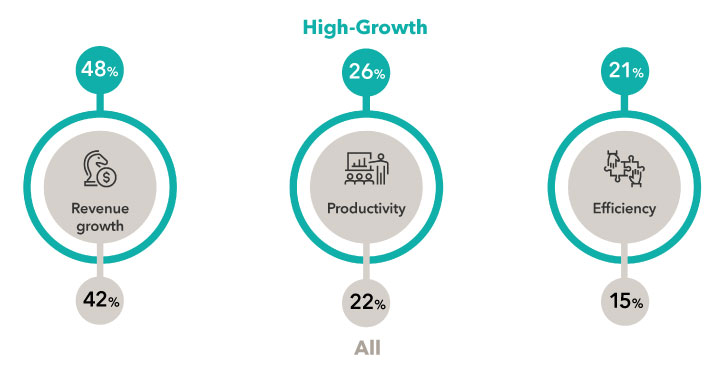

A focus on efficiency and productivity

High-growth advisors are more likely to set defined and measurable goals in key areas.

Source: Capital Group’s Pathways to Growth: 2021 Advisor Benchmark Study

Step 3: Take measure of your work

Consultants aren’t the only groups to offer lessons on procedures and routines. You can look to the military as well. Jonathan Wilson, retirement plan counselor at Capital Group and former Navy SEAL, says the checklists and processes he learned in the military can be leveraged in your business. He describes a framework used regularly by the SEALs in managing uncertainty, called the four P’s:

- Problem: Define your mission

- Plan: What are all the steps to reach a milestone

- Perform: How will the plan be carried out with individual roles and responsibilities

- Probe: Always have an after-action review that allows the team to learn from any mistakes.

Probing in particular can help lead to continuous improvement in your business processes. You can do root-cause analysis in an objective way and determine if you’re getting the right outcome but for the wrong reasons, or vice versa. This allows you to reframe or redefine what you're doing (if necessary).

My experience is that the most successful teams have a standard operating process to track business results and make any mid-course corrections along the way. They review key metrics on a monthly basis and check on their progress against their business plans at least quarterly. And they go through an annual business planning process to identify key goals for the following year.

Measuring your efforts can help inform much of what you do, including how you bring on new clients or how you engineer the way they’ll engage with your team. The more discipline you can put around a process, the more you’ll be able to determine how well you're doing and make modifications down the road.

Having a set of SOPs in place can provide a baseline to assess your performance and productivity, and put you on a path for continuous improvement. It’s one key to growing your advisory practice into a thriving enterprise.

Related content

-

Planning & Productivity

-

Planning & Productivity

-

Planning & Productivity

1 “Simplifying Choices in Defined Contribution Retirement Plan Design,” Donald B. Keim and Olivia S. Mitchell, National Bureau of Economic Research, Working Paper No. 21854, January 2016.