One early, potential winner of trade war volatility?

Actively managed exchange-traded funds (ETFs). The funds, which are managed by professionals who select among securities with the goal of outperforming a benchmark index, have seen a surge in assets amid early-year market volatility.

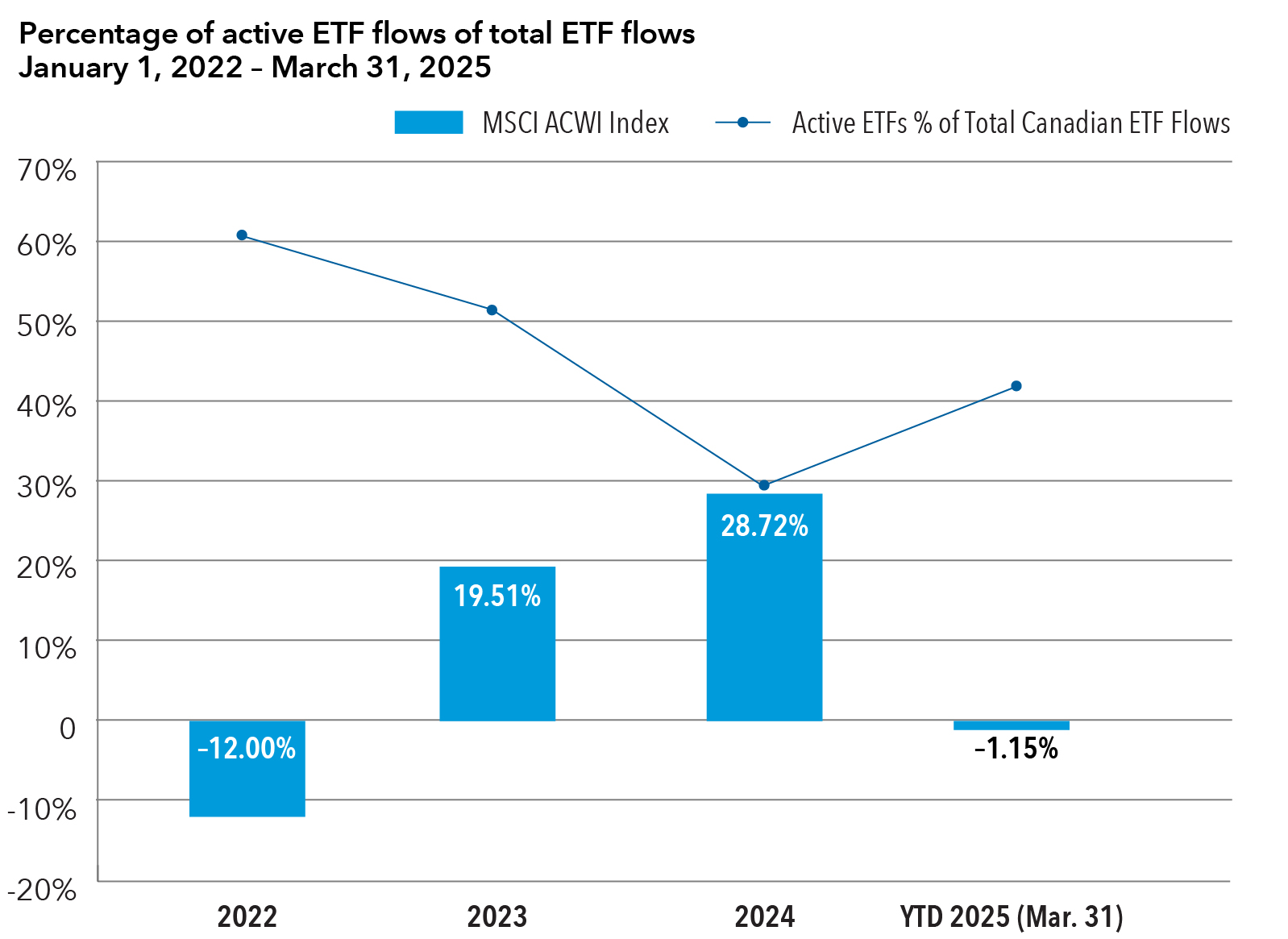

As the chart immediately below shows, flows into active ETFs of all kinds — equity, fixed income, specialty — have spiked in 2025 through March 31, reaching 42% of total Canadian-listed ETF flows. That puts active ETFs on course to reclaim some, if not all, of the ground lost since they last peaked in 2022 at 61% of total flows. Not uncoincidentally, that was during the last bout of major market volatility amid the COVID-19 pandemic, highlighting the negative correlation between active ETF investments and down markets.

“When markets fall, active ETF investments rise,” says Capital Group Canada senior product specialist Warner Wen, whose product focus is ETFs.

Active ETF investments rise in step with volatility

Sources: Capital Group, Morningstar Direct, MSCI.

The ability of active ETFs to invest in some — but not all — stocks in a benchmark appears to be an increasingly attractive option for investors who have watched many of the world’s leading passive equity indices fall through the first quarter, with U.S. stocks among the leaders on the downside.

The pullback comes amid worries U.S. President Donald Trump’s aggressive trade policies will slow global growth while increasing prices for consumers in many countries.

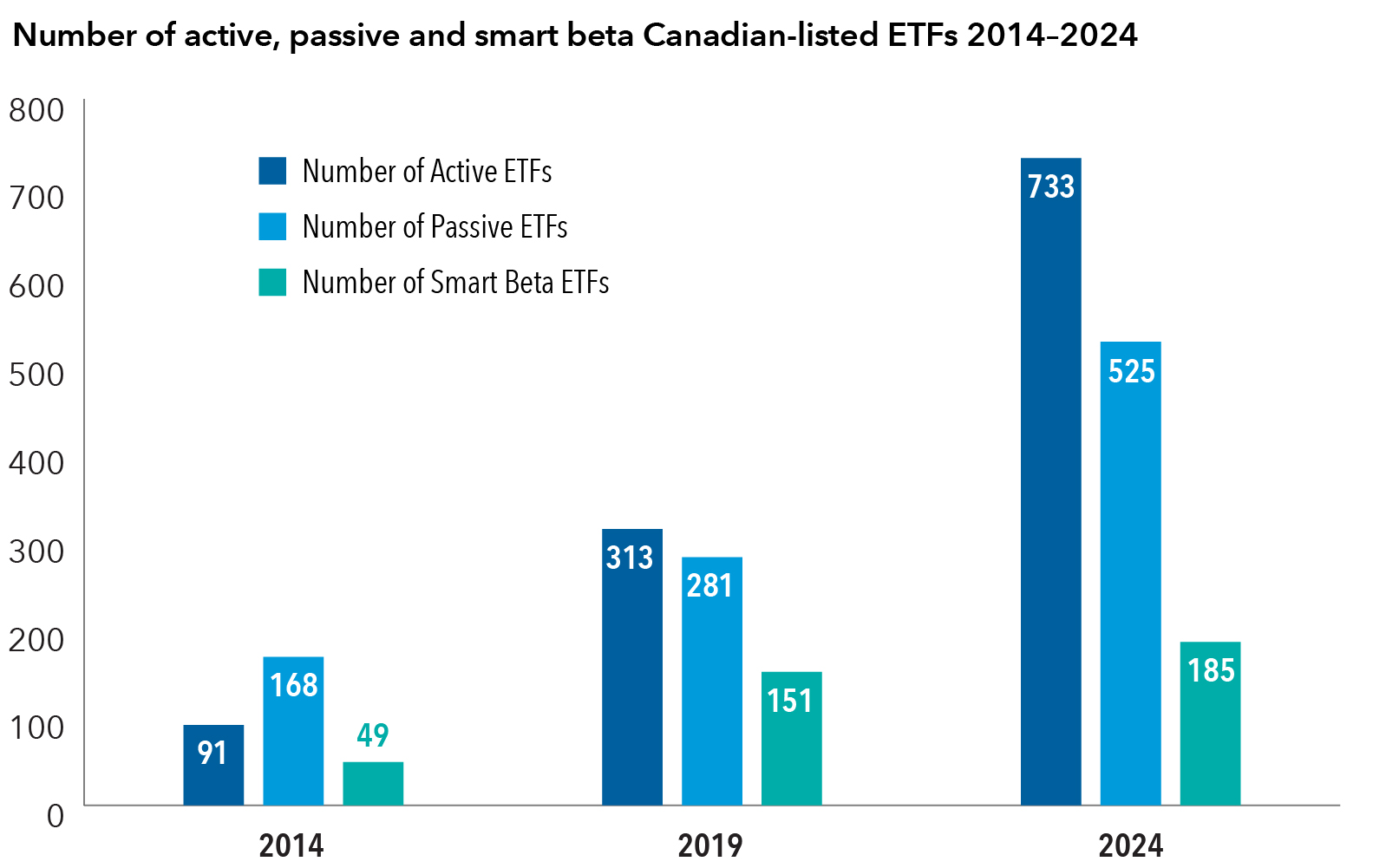

The early-year surge builds on the already impressive ascendancy of active ETFs in the Canadian market as illustrated by product growth in the chart below. It shows the growth in the number of active, passive and smart beta Canadian-listed ETFs over the past 10 years, with smart beta ETF holdings based on pre-determined or “smart” guidelines.

In 2014 there were 91 active ETFs compared to 733 at the end of 2024, an increase of almost 800%. Over that time period, the number of active ETFs leapfrogged the number of passive ETFs, surpassing them by 40%.

“Active ETF product growth is remarkable,” says Wen.

Active ETFs up, up and away

Source: Morningstar Direct.

In addition to being able to select which stocks to invest in, active ETFs are also able to hold stocks with smaller or larger footprints than a referent index. This may be another active ETF advantage that is resonating with investors after the selloff in the previously high-flying, U.S.-based Magnificent 7 tech-related companies.

As the chart below shows, share prices of the individual companies that make up the so-called Magnificent 7 — Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla — have significantly declined over the first quarter of 2025, with perhaps the exception of Meta, which still trended negative.

Losing some of their Magnificence

Source: Bloomberg.

The selloff has not been lost on some passive ETF investors who may hold specialty index tracking investments in the Mag 7. More broadly, the group’s losses have also handicapped the Nasdaq, S&P 500 and MSCI All Country World Index — three major indices that have large exposures to the seven companies.

Market declines do, as investors should know, reverse themselves over time, and some investors who may have opted for active ETFs amid this year’s early volatility may well return. Though this may take some of the steam out of the current upswing in adoption of active ETFs, other factors also appear to be tilting the scales in their favour.

Active is in for younger generations

One factor is the growing affinity for active ETFs among younger generations of investors, according to a recent, U.S.-based survey by the global Capital Group organization. In the survey, which was conducted between December 2024 and January 2025, nearly half of Gen Z, millennial and Gen X investors polled (45%) said they would be more likely to choose a financial professional who includes active ETFs in their investment approach. In fact, younger investors with US$100,000 to US$1 million in investable assets reported both awareness and a growing appetite for active ETFs.

Another factor is the increasing number of advisors and firms who are replacing traditional mutual funds with ETFs in model portfolios. According to Broadridge Financial Solutions, ETFs accounted for 51% of underlying assets in model portfolios in the U.S. at the end of last year, up from 46.7% in early 2022. Broadridge, a U.S.-based fintech company, puts the size of the U.S. model portfolio market at US$5.1 trillion.

Model portfolios are standardized, pre-built investment portfolios that advisors can use to invest client money. They are optimized to conform to an investor’s goals, risk tolerance and investment time horizon, generally containing four to 20 underlying ETFs to create a diversified mix of holdings at the core of the portfolio.

Taking these two factors into account, it may be safe to say that industry trends point toward a bright future for active ETFs, at least for the near term.

“Although passive burst out of the ETF starting gate well ahead of active, the long race is revealing a quickly lessening gap,” says Wen.