Market Volatility

Global Equities

Signs of the wavering dominance of U.S. equities renewed interest in global equities in early 2025. Now, the market volatility following the April 2nd “Liberation Day” announcement of U.S. tariffs is giving investors even more impetus to take a fresh look at global equity strategies and rethink assumptions embedded in their portfolios. The current disruption is the latest step in a multi-year trend of changing global trading patterns and tariffs. This dislocation presents risks and opportunities for investors and underscores the importance of active management in global equity mandates.

Change brings opportunity for active investors

Our portfolio managers see this moment as ripe with opportunity for thoughtful stock selection.

While new tariffs pose challenges, portfolio managers believe that multinational companies that adapt could gain enduring strategic advantages. Their scale, flexibility and experience in global markets make them more capable of navigating disruptive environments than their single-market competitors.

In this environment, investors need to put individual company and sector positions under the microscope. For example, tariffs were levied quickly on commoditized heavy industries such as metals and autos, weighing on companies in or adjacent to those industries. Conversely, there may be less impact in growth sectors like biopharma and semiconductor equipment, where some companies operate with limited competition. Those that provide essential products to the U.S. — such as patented drugs and specialized semiconductors and semiconductor-making equipment — also may be less affected if their products cannot easily be replaced by U.S. producers.

To be sure, the impact of tariffs could vary substantially, even within the same industry and country of domicile. Certain companies may be more affected by tariffs than others based on the locations of their supply chains and customers.

This new era of tariffs and protectionism could put “multilocal” companies at a strategic advantage. These are multinationals with the resources to respond to local-market consumer preferences and regulatory regimes, even as they enjoy economies of scale, diversified customer bases and global brand recognition. Pharmaceutical companies Novo Nordisk and AstraZeneca, based in Denmark and the U.K., respectively, are good examples. They are expanding research and manufacturing operations in the U.S., which could help reduce their exposure to U.S. tariffs. This highlights the importance of a global approach to equity investing as companies’ domiciles become less important.

Ultimately, we believe that active managers are well positioned to nimbly adjust portfolios to navigate these uncertainties and respond to fast-moving developments in global trade policy.

How our global equity portfolio managers view the opportunity set

For investors assessing the evolving trade picture, the focus may be less on whether U.S. or non-U.S. companies will prevail than on finding the winners and losers in all geographies — an effort requiring fundamental research at the core.

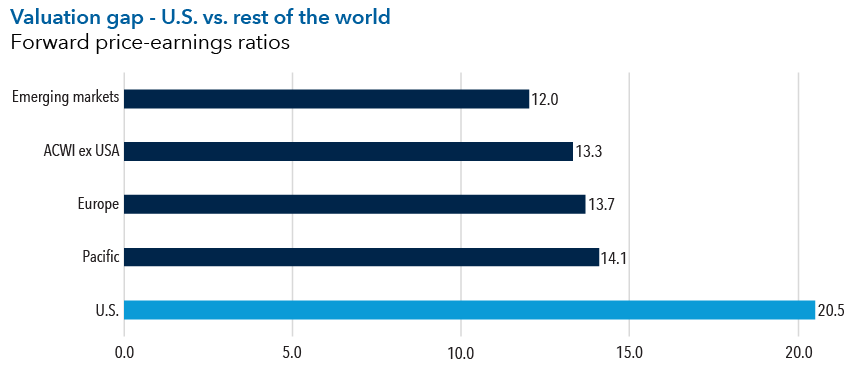

But global trade developments are not the only source of potential opportunities. Equity valuations, for instance, clearly point to opportunities outside the U.S. market. Non-U.S. stocks carry far lower multiples than U.S.-based competitors, offering a broad set of attractively priced equities to then assess through the lens of tariffs.

Source: RIMES. As of March 31, 2025. Data reflects price-to-earnings ratios based on future earnings expectations. Calculations are based on the MSCI Emerging Markets Index, MSCI All Country World Index ex USA, MSCI Europe Index, MSCI Pacific Index and MSCI USA Index, respectively.

A potential decline in U.S. market concentration may also create fresh opportunities for investors. The Magnificent 7 stocks that have driven U.S. equity market gains in recent years are the latest in a string of once impregnable market leaders that includes technology stocks in the 1990s, Japanese stocks in the 1980s and the “Nifty Fifty” growth stocks that dominated U.S. markets in the early 1970s.

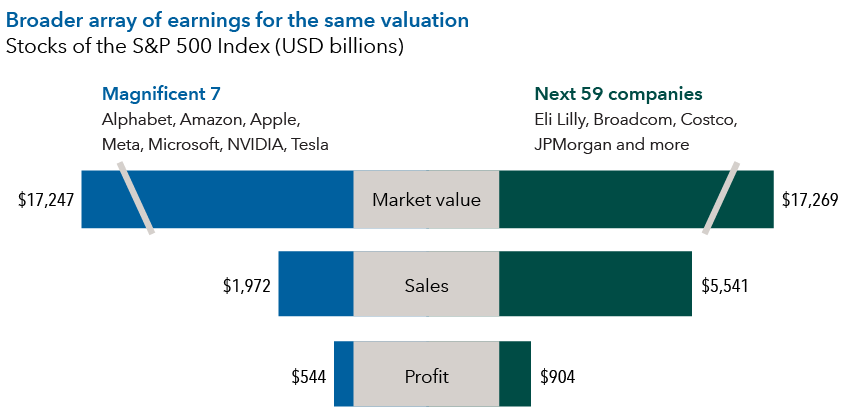

A pullback in the Magnificent 7 could lead to gains in a broader swath of large-cap companies. As shown below, several dozen companies whose market caps collectively equaled the Magnificent 7’s at year-end 2024 generated significantly higher sales and profits. This highlights another large and diverse opportunity set.

Source: FactSet. As of December 31, 2024. Next 59 stocks are determined based on market capitalization. Sales and profit represent net sales and operating profits, respectively, and are based on corporate reports for the trailing 12 months.

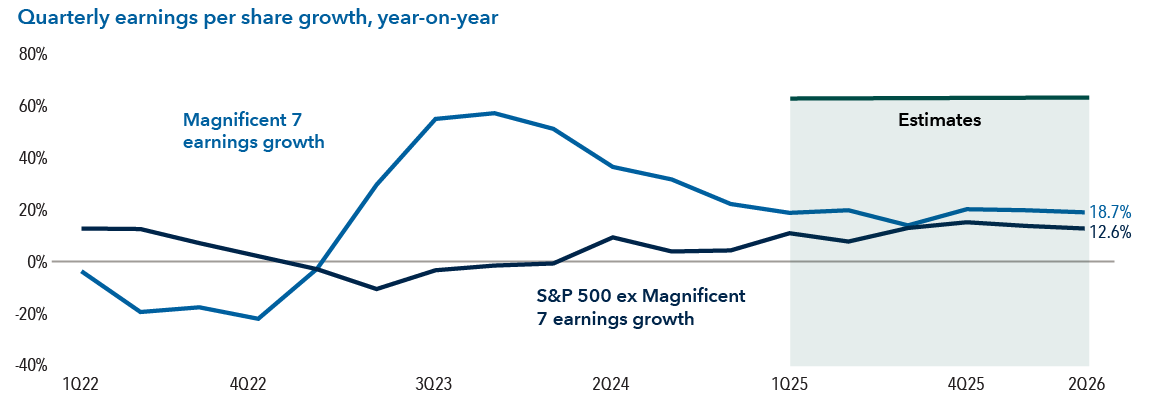

Our global equity team believes earnings growth will support this trend. They expect S&P 500 Index companies outside the Magnificent 7 to narrow the growth gap with the Magnificent 7. This could increase the likelihood that a larger swath of companies will contribute to equity market returns.

Mag 7 earnings growth converging with the rest of the S&P 500

Source: Bloomberg. As of December 31, 2024. Earnings = net income. Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla.

Summary

The new U.S. administration has brought a renewed emphasis on restructuring global trade and other policies intended to rewire the U.S. economy. As these efforts take hold, multinational companies will be challenged to navigate a rapidly changing operating environment. For investors, the key will be to assess the growth prospects of multinationals and their ability to navigate evolving global trade patterns, regardless of their geographies.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI All Country World (ACWI) ex USA Index is a free float-adjusted, market capitalization-weighted index that measures equity market results in the global developed and emerging markets, excluding the United States.

MSCI Europe Index measures the performance of equity markets in 15 developed countries in Europe.

MSCI Pacific Index is designed to measure the equity market performance of the developed markets in the Pacific region. It consists of Japan, Australia, Hong Kong, New Zealand and Singapore.

MSCI Emerging Markets Index is a free-float-adjusted market-capitalization-weighted index designed to measure equity market results in more than 20 global emerging markets.

MSCI USA Index is designed to measure the performance of the large and mid cap segments of the U.S. market.

Our latest insights

-

-

-

Chart in Focus

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Market Volatility

-

-

Chart in Focus

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

David Polak

David Polak