Market Volatility

Market Volatility

There are no facts about the future — this much is certain.

But when policy uncertainty reaches extreme levels, it can send markets tumbling and weigh on business as well as consumer and investor confidence.

Since the Trump administration unveiled sweeping tariffs on April 2, financial markets have swung wildly from steep declines to robust gains, often turning on the latest news headlines. As of April 24, the S&P 500 Index declined 8.9% year to date in U.S. dollar terms. What’s more, U.S. GDP contracted 0.3% in the first quarter, the largest drop since 2022, according to the U.S. Commerce Department.

Trade uncertainty may continue to drive markets

Sources: Capital Group, Standard & Poor’s, Bloomberg Index Services Ltd. Percent change for the S&P 500 Index reflects total returns in USD. As of April 10, 2025. Past results are not predictive of results in future periods.

The tariffs represent the latest development in a fundamental shift away from the rules-based international order in place since the end of World War II. “This erosion of the old geopolitical order didn’t just start with the current administration. It’s been going on since at least the global financial crisis from 2007 to 2009,” says international policy advisor Tom Cooney.

What’s new is that the U.S., the leading defender of global free trade, is now seeking to reframe it. “The administration wants to achieve a fundamental restructuring of the system that it perceives as more advantageous to the United States and working middle-class Americans,” Cooney says. “That’s a lofty and admirable goaI, but there are serious risks.”

In the near term, attempts to fundamentally restructure global trade, or even an extended period of uncertainty, could slow growth, boost inflation and raise the risk of a recession. Longer term, protracted uncertainty could negatively affect the reputation of the U.S. as a reliable trade partner and security ally. On the other hand, markets could respond positively to announcements of swift and successful trade negotiations that rapidly lead to a new normal.

The wide range of potential policy outcomes presents unprecedented challenges for investors.

Night Watch sheds daylight on uncertainty

So what comes next for the global economy and markets? “When uncertainty reaches extreme levels, single-point forecasts can fall short in helping portfolio managers make good investment decisions,” says investment director Jayme Colosimo.

Enter the Night Watch, a team of Capital Group economists, political analysts and portfolio managers that explores market disruptions to help make better investment decisions.

Named after a painting by 17th century Dutch master Rembrandt, the Night Watch uses scenario analysis as a framework to explore a range of outcomes rather than try to predict a specific result. “The goal is to gather a range of perspectives from across Capital to provide a dynamic forum for forward-looking scenarios, and ultimately connect these scenarios to investment implications,” adds Colosimo.

“We don’t make predictions,” says U.S. economist Jared Franz, who chairs the Night Watch. “We try to identify a set of narratives that all plausibly construct a view of the future. We then connect investment implications to each outcome, so portfolio managers are prepared to make investment decisions as the future unfolds.”

The Night Watch has evaluated major crises including the COVID pandemic, global military conflicts and debt crises, among others. “The team looks to consider issues in advance or before they escalate and identify in advance potential low probability or tail events that could have high impact,” Colosimo says.

A framework for an uncertain future

This year, the group has taken on the Trump administration’s imposition of historic tariffs and shake-up of traditional security alliances. The groundwork for this analysis was launched shortly after President Trump’s election in November 2024.

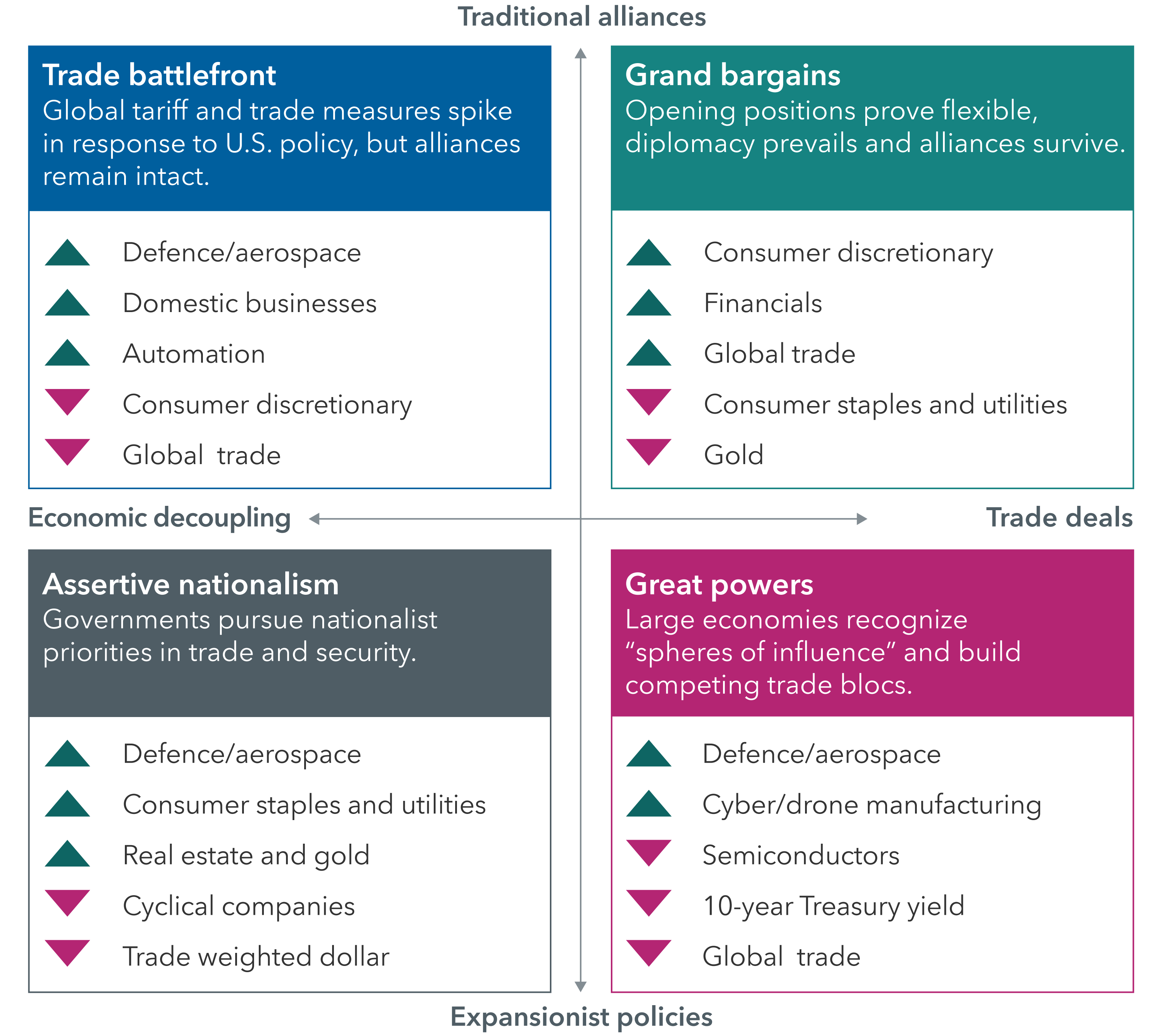

Geopolitical realignment: Potential outcomes and investment implications

Source: Capital Group. Scenarios reflect analysis of Capital Group’s Night Watch team as of April 2025, and are not predictive of future outcomes.

The team has identified four broad potential outcomes: trade battlefront, grand trade bargains, return of global powers and assertive nationalism.

In the grand bargain scenario, traditional alliances are restored, possibly with some adjustments. Geopolitical conflicts are diminished, and political leaders strike broad trade deals. “This is the most benign scenario and generally a good environment for equity markets and the economy,” Franz says.

Assertive nationalism, the inverse of that benign scenario, is characterized by a global trade war and increased use of hard power to address security concerns, with a tail risk potential for military clashes between major powers. “This is the worst-case scenario that combines trade wars with potential shooting wars,” Franz says.

The return of great powers would feature a mix of nonaggression pacts among the major powers, which would each dominate a regional bloc. “Think of this as going back to the age of empires, where the U.S., China and Russia each have individual spheres of influence,” Franz adds.

Where are we today — and where are we headed?

The Night Watch team’s view is that the world has left the old order behind and recently entered the trade battlefront scenario, characterized by significant tariffs, technology export restrictions, and other protectionist measures that would accelerate economic decoupling and supply chain shifting. “This is the scenario of tough trade wars but not shooting wars,” Cooney explains. “Great powers like the U.S. and China clash in terms of technology and trade but have no wish for a military confrontation.”

If the world remains in a protracted trade struggle, economic growth will likely be more subdued going forward, and inflation could rise, Franz says. “If these tariffs are around long term, we are likely to see slower growth beyond 2025. On the other hand, if trade deals are struck relatively quickly, then a transition to the grand bargain scenario becomes more likely.”

How long will it take for a clear picture of the new global order to take shape? Given the complexity of trade negotiations and the vast number of trading partners, investors should not expect a speedy resolution, Cooney explains. “The world is in a transition state. It took years to build the post-war order, and it could be several years before a new geopolitical order stabilizes.”

“The Office of the U.S. Trade Representative (USTR) does not have the capacity to iron out detailed agreements with some 90 countries during the 90-day pause that ends in July,” Cooney says, adding that the USTR, with a relatively small staff, has limited bandwidth to tackle many complex deals quickly. “This could be a multiyear process, especially among our largest and most complex trading relationships with economies like China and Europe.”

To calm markets, the Trump administration will want to announce a series of deals as swiftly as possible. These could be mini deals, which fall short of a full free trade agreement. During the first Trump administration, mini deals were reached with Japan, China and Brazil. It also could extend the 90-day tariff pause, though uncertainty would remain elevated, and that could cause ongoing market volatility if each extension is accompanied by political brinksmanship.

“I do expect that the administration will look for some early deals with Japan and Korea, which would be easier to achieve,” Cooney says. “But renegotiating the U.S.-Mexico-Canada Agreement is complicated, and formal negotiations haven’t started yet, so that will take some time. Similarly, negotiations with the EU will take quite a bit longer. And the U.S.-China trade relationship, the core of this conflict, could take years and again only result in a partial trade conflict ‘ceasefire.’ Currently, there is no substantive government-to-government dialogue underway between China and the U.S.”

Lengthy negotiations could further weigh on markets and the economy. “The lack of certainty is one of the biggest problems here,” Cooney explains. “Companies will be reluctant to make long-term capital spending commitments without a firmer sense of the rules going forward.” Corporate spending could be depressed for an extended period.

Even after deals are struck, there is some risk that U.S. credibility as a partner and linchpin of global trade and security could be diminished over the longer term, as could the world’s view of the dollar as a reserve currency and the perceived safety of U.S. government debt, Cooney says.

Investment implications

For investors, the key to navigating this uncertainty is to stay humble about what's knowable, not get anchored to a particular world view, and to be prepared for the unexpected, believes Jody Jonsson, Vice Chair of Capital Group and equity portfolio manager.

Jonsson seeks to strike a balance between defensive and offensive investments in her portfolio. “If there's any favorable resolution, the markets could shoot upwards, as we saw when the announcement of a 90-day pause on tariffs April 9 set off a strong market rally,” Jonsson says. “This is an important time to pay close attention to valuations and dividend income, a time when boring is beautiful.”

For example, insurance companies like Chubb do not export or import any goods, so their business wouldn’t be meaningfully impacted by tariffs. Elsewhere in financials, CME Group, which operates derivatives exchanges, has seen higher trading volumes when markets have been volatile.

“I also believe all of this strengthens the case for a globally diversified portfolio. It is tough to know when or where trade negotiations will succeed,” Jonsson explains.

Lastly, once trade negotiations begin to result in agreements, investors and companies will have some clarity, and the investing picture may brighten. “I do think that we're probably at a point of maximum uncertainty right now,” Jonsson adds, “but eventually things will look less bad.”

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and therefore has no expenses. Investors cannot invest directly in an index.

Bloomberg U.S. Economic Policy Uncertainty Index measures the level of uncertainty surrounding economic policy decisions in the United States and is calculated by counting the number of articles in newspapers that discuss economic policy uncertainty..

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Tom Cooney

Tom Cooney

Jared Franz

Jared Franz

Jayme Colosimo

Jayme Colosimo

Jody Jonsson

Jody Jonsson