ESG

6 MIN ARTICLE

Despite efforts across the aviation industry to reduce CO2 emissions by ramping up the use of sustainable aviation fuels (SAFs), the path to net zero greenhouse gas (GHG) emissions remains challenging. Capital Group’s ESG team examined various scenarios for potential decarbonization pathways to 2050, assessing regulatory risks and potential opportunities.

KEY TAKEAWAYS

- Regulatory pressure on the aviation industry is likely to intensify.

- The bulk of emissions cuts is anticipated to come from new fuels and aircraft technologies.

- The combination of regulation and new technologies is expected to support growing demand for low- or zero-carbon fuels.

The aviation industry currently accounts for about 2.1% of all human-induced carbon dioxide (CO2) emissions in the world,1 but it is expected to be one of the fastest growing sources over the next few decades as demand for passenger aviation continues to rise.2

Against the backdrop of more countries aiming for net zero, companies across the aviation value chain face pressure to pursue lower-carbon options quickly. Most North American and European-based airlines have declared net-zero emissions targets within the last 18 months or so, but low-carbon options remain limited. Development and adoption of sustainable aviation fuel are still in the very early stages and new aircraft technology remains a decade or more away from commercialization.

Airlines will likely bear the brunt of carbon policy risk, while there could be opportunities for aircraft and fuel producers to provide low-carbon options.

Are current regulations doing enough to drive decarbonization?

Currently, regulation is ineffective if the industry is to significantly reduce impacts on climate change over the next few decades. The International Civil Aviation Organization’s (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) targets emissions from international flights yet only aims for emissions to be flat against 2019 levels. And to do this, it relies largely on offsets, which is in stark contrast to the deep cuts of other industries. In addition, the scheme is only voluntary to 2027.

More than 100 countries have volunteered, but these only represent three-quarters of international flights3; and large growth markets, including China, are absent from the first phase. Despite a national pledge from China to be carbon-neutral by 2060, neither China nor its government-owned airlines have announced targets for domestic or international aviation that are aligned with this goal.

How can the industry decarbonize?

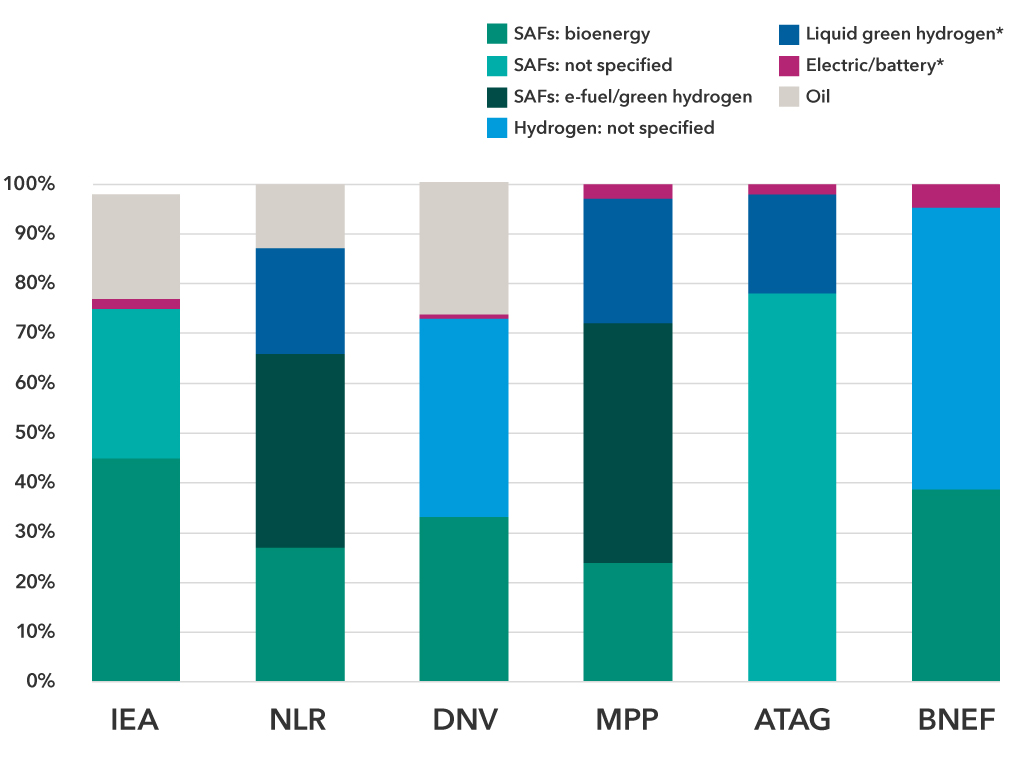

A range of forecasts or scenarios from consulting and industry groups was examined to assess the industry’s potential pathways to lowering emissions. Findings show that the bulk of emissions cuts is anticipated to come from new fuels and aircraft technologies. About 80% or more of projected CO2 emissions reductions in 2050, from a business-as-usual path, can be achieved through a combination of sustainable aviation fuels (SAFs) and advanced aircraft technologies, primarily the use of liquid hydrogen fuel.4

The remaining emissions cuts needed to reach net zero can be achieved through a mix of continuous aircraft efficiency improvements, measures such as air traffic control and flight path efficiencies, and ongoing use of carbon offsets.

Six predictions for potential sources of energy in the aviation industry in 2050

Sources: International Energy Agency (IEA), Netherlands Aerospace Centre (NLR), Det Norske Veritas (DNV), Mission Possible Partnership (MPP), Air Transport Action Group (ATAG) and BloombergNEF (BNEF). Where forecasters present multiple pathways, we assessed the most technologically ambitious ones.

*New aircraft technology is required to use these energy sources, whereas existing aircraft can use SAFs.

What are sustainable aviation fuels (SAFs)?

The primary SAF in use is produced from oils from plants or waste (biomass). A proven technology today, they can be easily substituted for conventional jet fuel. Many airlines are trialing and using these fuels in small volumes, and this is likely to be the primary decarbonization option in coming years.

In 2019, SAFs supplied less than 0.1% of jet fuel demand, but this decade could bring significant growth in supply. Announced projects still only increase supply to 1.7% of global jet fuel demand by 2025. However, it does imply a huge runway for growth, to the potential benefit of SAF producers and refiners.5

Another type of SAF, e-fuel, could play an increasingly important role over time. Developed from renewable electric energy via green hydrogen, e-fuel may not face the same supply issues, as it’s made up of green hydrogen and captured CO2, which are theoretically unlimited. That said, this pathway remains commercially immature. Studies indicate e-fuels are unlikely to impact jet fuel demand until after 2040. However, policies such as Germany’s planned blending mandate may provide a tailwind to e-fuel development.6, 7

How effective are SAFs in reducing emissions?

Compared with jet fuel biomass SAFs can cut CO2 emissions by up to 80% today.8 They have the potential to reach nearly 100%, but variability is significant between the types of SAF. E-fuel can reach nearly 100% emissions reduction if renewables power the production process and green hydrogen is used.

What are the barriers in switching to SAFs?

The short answer is cost. The most widely used (and cheapest) SAF is approximately two to three times the price of jet fuel.9 Furthermore, there is little room for improvement since limited feedstock contributes the most to total costs. At the top end SAFs are seven times more expensive.

Some European countries such as Sweden, Norway and France have introduced SAF blending mandates, which require airlines to use a proportion of SAF when refueling aircraft in their territories. The cost of regulations like these are mostly borne by the airlines. On the upside, they could help boost supply of lower-carbon fuels, but widespread adoption will require policy that reduces the fuel’s cost, as fuel already accounts for 20‒25% of airlines’ operating expenses.10

What other low-carbon technologies are being considered?

Green hydrogen is likely to play a key role in aviation decarbonization. In addition to hydrogen-based e-fuels, some aircraft and engine manufacturers are considering liquid hydrogen-fueled planes. However, this fuel requires new aircraft designs and technology development. Several of the forecasts we examined expect that liquid hydrogen will play a role particularly in long-range aviation by 2050, eventually accounting for 20‒25% of overall aviation energy use.

What’s the bottom line for investors?

The industry is unlikely to eliminate its impact on climate change by mid-century with technology alone, and regulatory pressure — borne mostly by airlines — will intensify. This translates into growing demand for low- or zero-carbon fuels and technologies.

Equipment manufacturers already benefit from ongoing demand for more fuel-efficient aircraft, and those developing new low-carbon aircraft technologies this decade may see high demand from the mid-2030s onward. Further aircraft technology innovation will be needed, providing tailwinds for green hydrogen.

SAFs present a compelling opportunity for the aviation industry to begin to reduce emissions this decade. However, it is not a clear-cut solution, not least because of the issues in scaling SAF supply, higher costs and long-term feedstock challenges. Nevertheless, there may be potential investment opportunities materializing among incumbent SAF producers and refiners planning new capacity.

1 Air Transport Action Group. “Facts & Figure.” atag.org. September 2020.

2 Brandon Graver, Ph.D., Kevin Zhang, Dan Rutherford, Ph.D. “CO2 emissions from commercial aviation, 2018.” The International Council on Clean Transportation. September 2019.

3 Source: International Air Transportation Association (IATA).

4 Source: International Energy Agency (IEA), Netherlands Aerospace Centre (NLR), Det Norske Veritas (DNV), Mission Possible Partnership (MPP), Air Transport Action Group (ATAG) and BloombergNEF (BNEF).

5 “Sustainable Aviation Fuels: The Outlook.” BloombergNEF. June 17, 2021, p. 1.

6 F. Ueckerdt, C. Bauer, A. Dirnaichner et al. "Potential and risks of hydrogen-based e-fuels in climate change mitigation." Nature Climate Change. vol. 11, pp. 384–393 (2021).

7 Sophie Barthel. "German government, industry agree SAF development plan." Argus Blog. Argus Media, May 7, 2021.

8 BloombergNEF, p. 2.

9 Destination 2050: A Route to Net Zero Aviation." SEO Amsterdam Economics. February 2021. p. 91.

10 BloombergNEF, p. 5.