RESEARCH AND INSIGHTS

7 American Funds deemed “Thrilling” by Morningstar§

Discover what sets our Series apart

Target date funds have a lot in common. But the American Funds Target Date Series takes a distinctive approach that has delivered uncommon investment outcomes and helped thousands of participants come closer to achieving their financial dreams.

A history of strong results

Our Series has outpaced its peers over the long haul.

-

-

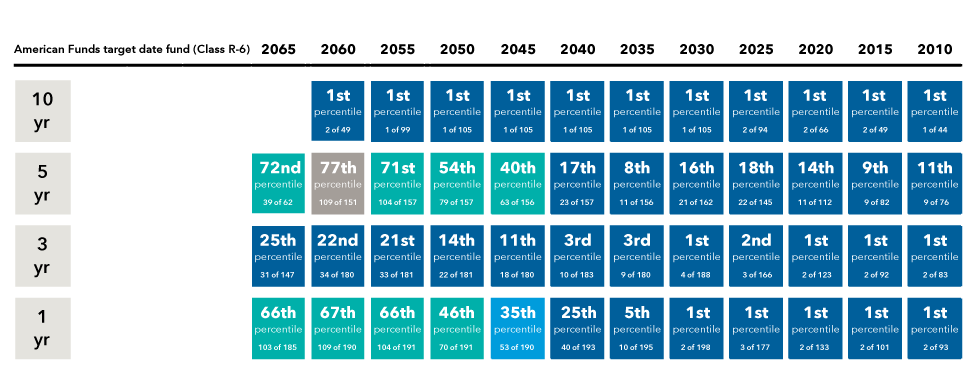

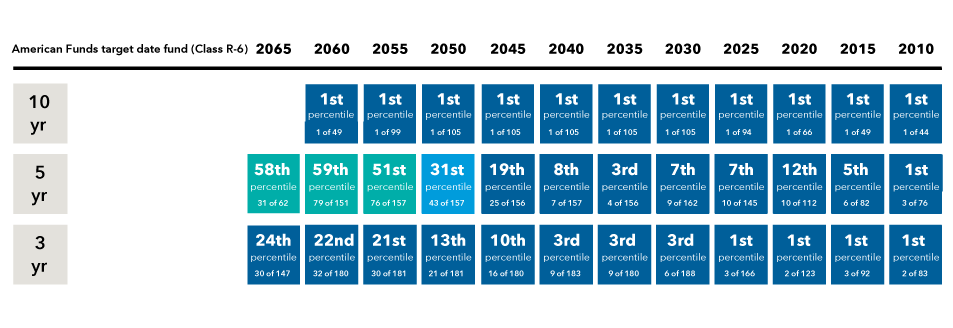

Return rankings

Retirement takes a lifetime to earn. Our Series focuses on building and preserving wealth over the long term.

Morningstar category percentile return rankings

(with absolute rank and number of funds in category indicated)

Source: Capital Group, using Morningstar data as of March 31, 2025. Percentile rankings are calculated by Morningstar and reflect relative performance versus peers. A lower number is better: First percentile indicates a fund’s performance was in the top 1% of its peer group.

All funds began on February 1, 2007, except for 2055 (February 1, 2010), 2060 (March 27, 2015) and 2065 (March 27, 2020). Rankings are based on the funds’ average annual total returns (Class R-6 shares at net asset value) within the applicable Morningstar categories and don’t reflect the effects of sales charges, account fees or taxes. Past results are not predictive of results in future periods. Category averages include all share classes for the funds in the category. While American Funds Class R-6 shares don’t include fees for advisor compensation and service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges, resulting in higher expenses and lower returns.

For a list of each fund’s Morningstar category, please see the “Morningstar categories” section. Categories include active, passive and hybrid target date funds, as well as those that are managed both “to” and “through” retirement. Approximately one-third of the funds within the 2000–2010 category have a target date of 2005. In an effort to manage the risk of investors outliving their savings while managing volatility, our approach to allocating between stocks and bonds puts more emphasis on stocks (particularly on dividend-paying stocks) than some other target date funds. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect expense reimbursements, without which they would have been lower.

-

Recognized for our results.

As of January 21, 2025. For the American Funds Target Date Retirement Series mutual funds, Morningstar awarded a Morningstar Medalist Rating™† of Gold for share classes R-6 and F-3. All other share classes in the Series are either unrated or have received lower Medalist Ratings.

Analyst-driven 100%

Data coverage 100%

American Funds was among the leading DC plan providers selected most often as “a company I trust” and “easy for advisors to do business with.”‡

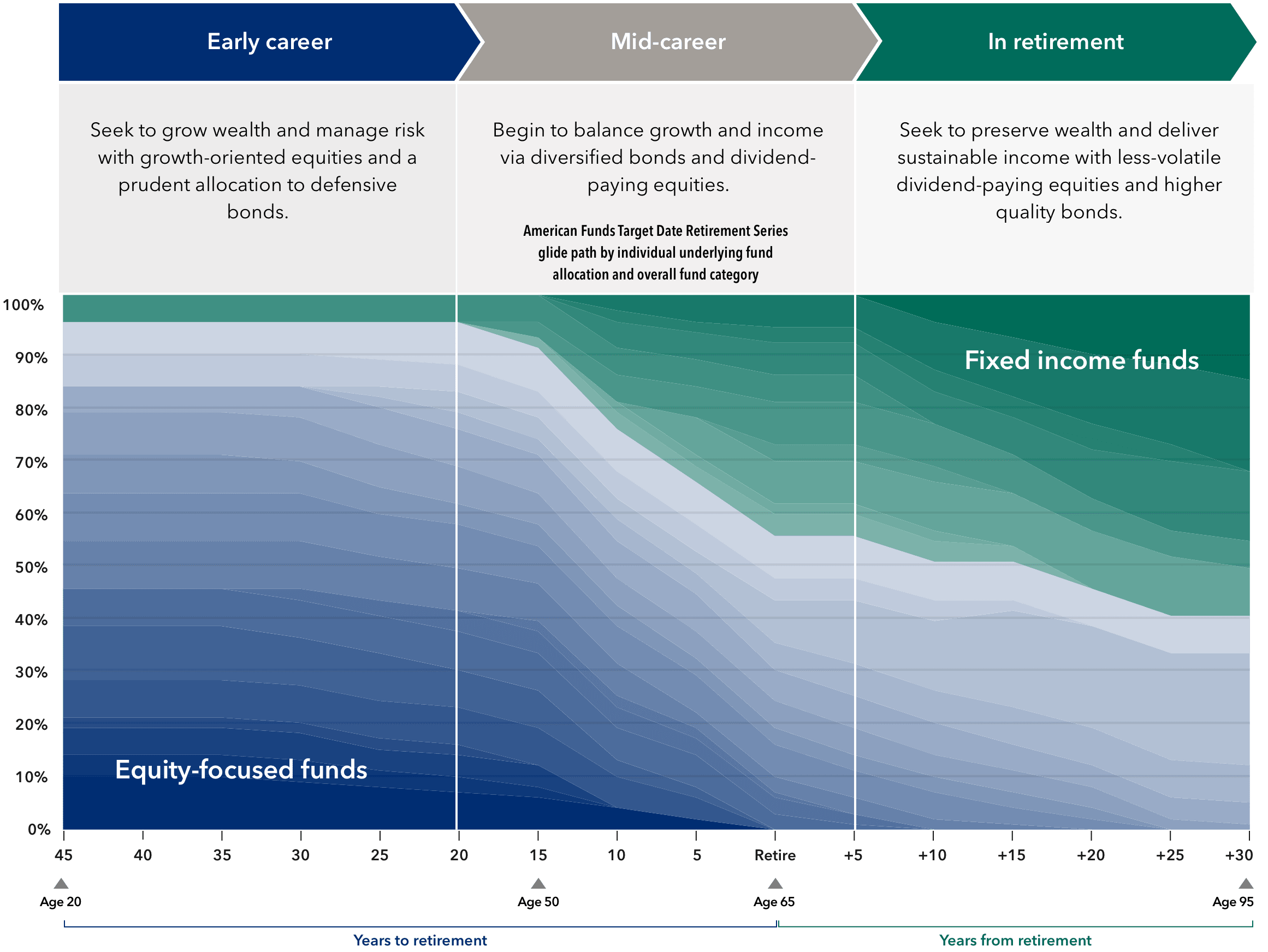

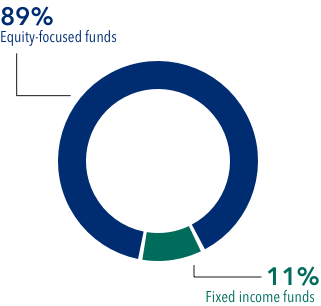

Seeking to build and preserve wealth

Our Series adapts to changing participant needs by adjusting both its stock/bond mix and the types of assets held through each stage of life.

Our Series adapts to changing participant needs by adjusting both its stock/bond mix and the types of assets held through each stage of life.

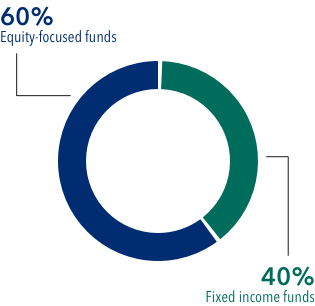

Early career

(roughly 45 to 20 years before retirement)

Seek to grow wealth and manage risk with predominantly growth-oriented equities and a prudent allocation to defensive bonds.

American Funds Target Date Retirement Series glide path approximation

Mid-career

(roughly 20 years before retirement to 5 years after retirement)

Begin to balance growth and income via diversified fixed income and dividend-paying equities.

American Funds Target Date Retirement Series glide path approximation

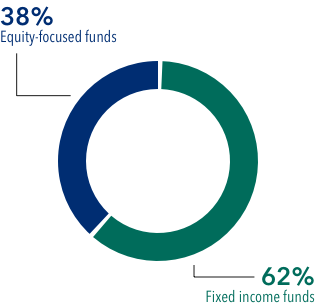

In retirement

(Roughly 5 to 30 years after retirement)

Seek to preserve wealth and deliver sustainable income with less-volatile dividend-paying equities and higher quality bonds.

American Funds Target Date Retirement Series glide path approximation

Source: Capital Group. Target allocations as of March 31, 2025, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. For current allocations to the underlying funds, visit capitalgroup.com.

Source: Capital Group. Target allocations as of March 31, 2025, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. For current allocations to the underlying funds, visit capitalgroup.com.

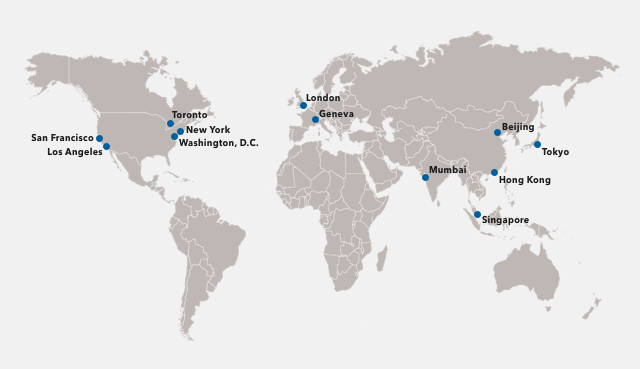

Making a difference

Our Target Date Solutions Committee, which oversees the Series, brings a diversity of experience and draws on the fundamental research and quantitative resources of the global Capital Group team.

Years of experience as of December 31, 2024.

Global research offices

About Capital Group

Capital Group has a distinctive, long-term global investment approach that relies on fundamental research. Privately held since its founding in 1931 and with more than $2.8 trillion under management, the firm has more than 479 investment professionals worldwide.**

**As of March 31, 2025.

Global research offices

Global research offices:

Los Angeles |

Geneva |

San Francisco |

Mumbai† |

New York |

Hong Kong |

Washington, D.C. |

Tokyo |

Toronto |

Singapore |

London |

|

†Mumbai is a macro-research office only.

Compare us to the competition

View our funds

§Source: Morningstar, "The Thrilling 36" by Russel Kinnel, August 20, 2024. Morningstar's screening took into consideration expense ratios, manager ownership, returns over manager's tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds, and must be rated by Morningstar analysts. Class A shares were evaluated for American Funds. Not all seven funds listed in the “The Thrilling 36” list are in each target date fund. Underlying funds may change over time. Visit morningstar.com for more details.

†Source: Kephart, Jason. "American Funds Target Date Retirement Series®," Morningstar Target-Date Fund Series Report, January 29,2024. For the American Funds Target Date Retirement Series mutual funds, Morningstar awarded a Morningstar Medalist Rating™ of Gold for vintages 2010 through 2065 for share classes R-5, R-6 and F-3. All other vintages (which use five-year intervals) and share classes in the Series are either unrated or have received lower Medalist Ratings. © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from this information. Past performance is no guarantee of future results. Refer to Additional Information for more information.

‡Source: Escalent, Cogent Syndicated. Retirement Plan Advisor Trends, October 2024. Methodology: 411 respondents participated in a web survey conducted September 9–17, 2024. The respondents consisted of financial advisors managing less than $50 million in defined contribution plans. In Ownership of Core Brand Attributes — Tier 1, across the most vital attributes, American Funds was the first plan provider selected in response to the question “Which — if any — of these DC plan providers are described by this statement: ‘Is a company I trust?’ and ‘Easy for advisors to do business with’?”

Important investment disclosures

Capital Group did not compensate Morningstar for the ratings and comments contained in this material. However, the firm has paid Morningstar a licensing fee to access and publish its ratings data. The payment of this subscription fee does not give rise to a material conflict with Morningstar.

- Class R-6 shares were first offered on 5/1/2009.

Morningstar categories

American Funds Target Date 2010 |

Morningstar Target Date 2000–2010 |

American Funds Target Date 2015 |

Morningstar Target Date 2015 |

American Funds Target Date 2020 |

Morningstar Target Date 2020 |

American Funds Target Date 2025 |

Morningstar Target Date 2025 |

American Funds Target Date 2030 |

Morningstar Target Date 2030 |

American Funds Target Date 2035 |

Morningstar Target Date 2035 |

American Funds Target Date 2040 |

Morningstar Target Date 2040 |

American Funds Target Date 2045 |

Morningstar Target Date 2045 |

American Funds Target Date 2050 |

Morningstar Target Date 2050 |

American Funds Target Date 2055 |

Morningstar Target Date 2055 |

American Funds Target Date 2060 |

Morningstar Target Date 2060 |

American Funds Target Date 2065 |

Morningstar Target Date 2065+ |

For quarterly updates of fund allocations, click here.