FREQUENTLY ASKED QUESTIONS

Your SMA questions, answered

We share the latest questions our specialists are answering for financial professionals.

A separately managed account (SMA) is a professionally managed portfolio of securities selected by an investment manager and owned by the end investor.

The primary difference is that with an SMA, your client directly owns the stocks and bonds. With a mutual fund or ETF, your client owns shares of the fund, which in turn invests in stocks and bonds.

Minimums differ by sponsor firm, but Capital Group minimums are typically $100K for equity SMAs and $250K for fixed income SMAs.

- Customization and control — Your client can request that specific companies or business sectors be excluded from the portfolio (as agreed to by the investment manager).

- Transparency — Portfolio holdings can be viewed at all times, because your client owns the underlying securities.

- Tax efficiency — Your client has more opportunities to reduce the impact of federal tax on investment returns.

It’s a technique to manage capital gains and losses to help limit tax liability. If a stock that’s lost value is sold, that realized loss can be used to offset gains at another time or in a different investment. In certain cases, holdings that have appreciated in value can also be harvested — for example, to take advantage of embedded losses elsewhere, increase cost basis or reduce concentrated positions.

Yes. Speak with your home office representative to understand how to pursue your client’s desired tax gain/loss harvesting objectives. Discretionary services may be offered by the financial intermediary, depending on the platform.

- Equity SMAs — Your client can request exclusion of specific securities or business involvement in certain industries. Industries differ by sponsor firm but may include abortion, adult entertainment, alcohol, defense and weapons, firearms, fossil fuels, gambling and tobacco.

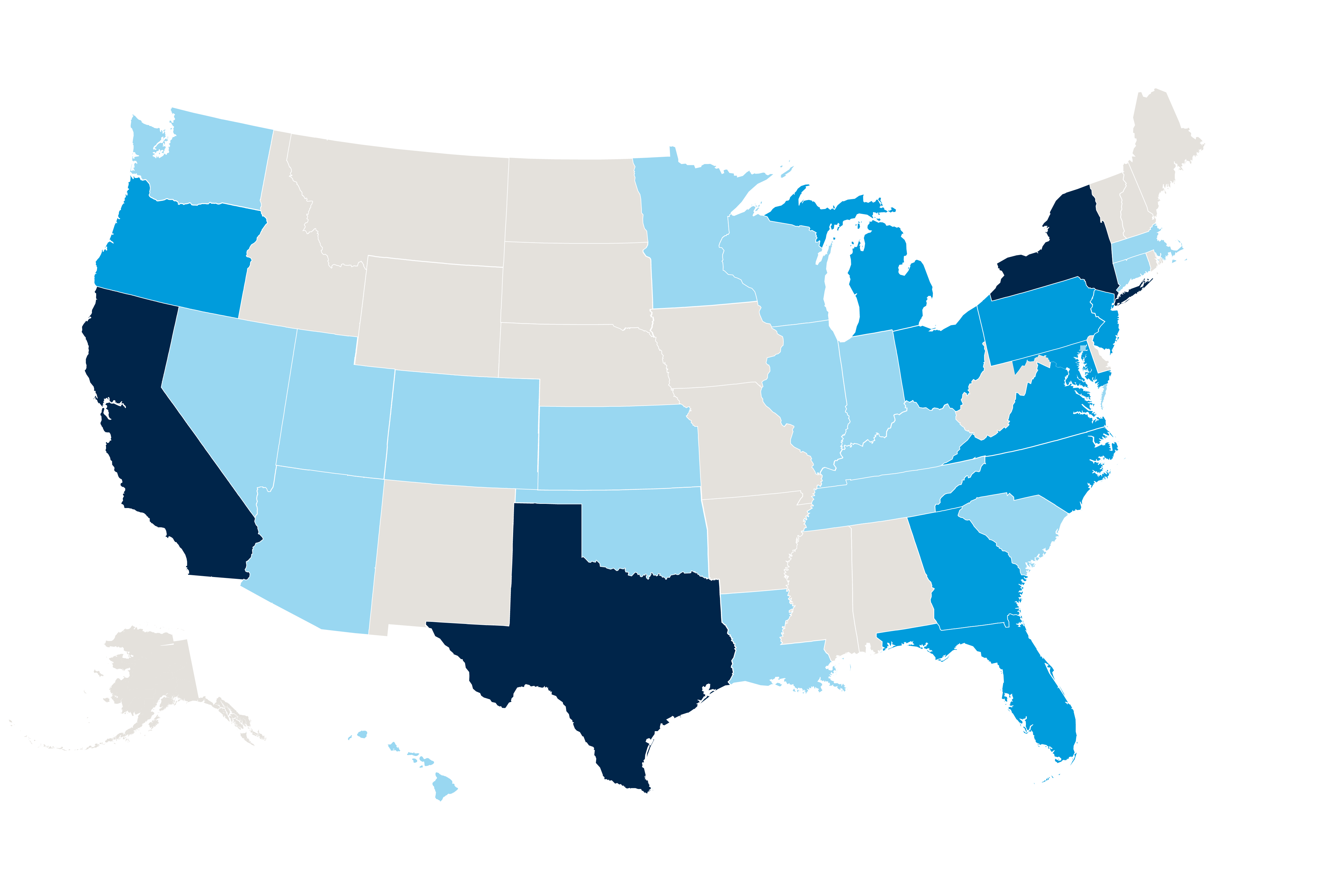

- Municipal bond SMAs — A range of state-focused portfolios are available. In addition, subject to approval and/or account minimums, your client can request directed sales/transitions, exclusionary requests and extended transition times.

In many cases, yes. If your client is considering this option, Capital Group offers an in-kind portfolio analysis to identify which securities would be kept (because they align with the investment strategy) and which would be liquidated. Contact your sales representative for more information.

Fees differ by sponsor firm, asset class and other factors. Your sales representative can help you understand the fee structure for your client.

To get started, contact your sales representative or call (800) 421-0180, option 1.

1 Industry exclusion availability and other customization options vary by sponsor and program. Please check with your home office.

2 Holdings may fall below these amounts due to various factors including, but not limited to, market conditions, availability of the securities and investment conviction.

For registered investment advisors only.

Important investment disclosure

Source: Capital Group. ACWI = All Country World Index; EAFE = Europe, Australasia, Far East. For Global Growth SMA vs. benchmark comparison, previous to 9/30/11, benchmark returns reflect MSCI World Index. For International Growth SMA vs. benchmark comparison, previous to 3/31/07, returns reflect MSCI EAFE Index.

Returns are in USD, are asset weighted, and reflect the reinvestment of dividends, interest and other earnings (net of withholding taxes). Results are preliminary and subject to change.

Past results are not predictive of results in future periods. There may have been periods when the results lagged the index(es). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Composite net returns are calculated by deducting from the monthly “pure” gross returns a model fee equivalent to an annual 3% fee. Actual fees will vary. For information concerning program sponsor fees, contact your financial advisor.

"Pure" gross composite returns do not reflect the deduction of any trading costs, fees or expenses; results would have been lower if they were subject to fees and expenses.

Index total returns (%)

as of December 31, 2024

| Cumulative | Average annual | ||

|---|---|---|---|

| 1 year | 5 years | 10 years | |

| Capital Group U.S. Conservative Growth and Income | |||

| "Pure" gross | 15.18 | 9.76 | 9.83 |

| Net of fees | 11.81 | 6.54 | 6.60 |

| Capital Group U.S. Core | |||

| "Pure" gross | 24.88 | 14.89 | 12.48 |

| Net of fees | 21.25 | 11.52 | 9.18 |

| Capital Group U.S. Equity | |||

| "Pure" gross | 21.39 | 13.02 | 12.67 |

| Net of fees | 17.85 | 9.70 | 9.36 |

| Capital Group U.S. Flexible Growth | |||

| "Pure" gross | 26.84 | 15.10 | 14.23 |

| Net of fees | 23.16 | 11.73 | 10.88 |

| Capital Group U.S. Flexible Growth and Income | |||

| "Pure" gross | 24.08 | 13.70 | 12.85 |

| Net of fees | 20.47 | 10.37 | 9.54 |

| Capital Group U.S. Growth | |||

| "Pure" gross | 21.41 | 12.14 | 11.86 |

| Net of fees | 17.87 | 8.84 | 8.58 |

| Capital Group U.S. Income and Growth | |||

| "Pure" gross | 17.96 | 12.39 | 11.95 |

| Net of fees | 14.51 | 9.09 | 8.66 |

| Capital Group International Equity | |||

| "Pure" gross | 3.75 | 5.37 | 6.88 |

| Net of fees | 0.69 | 2.27 | 3.73 |

| Capital Group International Growth | |||

| "Pure" gross | 7.29 | 5.40 | 6.90 |

| Net of fees | 4.14 | 2.29 | 3.75 |

| Capital Group Global Equity | |||

| "Pure" gross | 9.35 | 8.93 | 10.20 |

| Net of fees | 6.14 | 5.73 | 6.96 |

| Capital Group Global Growth | |||

| "Pure" gross | 18.92 | 12.88 | 12.46 |

| Net of fees | 15.45 | 9.57 | 9.16 |

| World Dividend Growers (strategy inception 7/1/12) | |||

| "Pure" gross | 13.57 | 7.64 | 7.84 |

| Net of fees | 10.24 | 4.47 | 4.66 |

Index total returns (%)

as of December 31, 2024

| Cumulative | Average annual | ||

|---|---|---|---|

| 1 year | 5 years | 10 years | |

| S&P 500 Index | |||

| 25.02 | 14.53 | 13.10 | |

| MSCI EAFE Index | |||

| 3.82 | 4.73 | 5.20 | |

| MSCI ACWI ex USA | |||

| 5.53 | 4.10 | 4.80 | |

| MSCI World Index | |||

| 18.67 | 11.17 | 9.95 | |

| MSCI ACWI | |||

| 17.49 | 10.06 | 9.23 | |

The Capital Group U.S. Conservative Growth and Income SMA Composite inception is October 1, 2020. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Conservative Growth and Income SMA strategy. Prior to October 1, 2020, no SMA portfolios were managed in the U.S. Conservative Growth and Income strategy, and for that reason, the results presented are based on Capital Group American Mutual Composite (inception is March 1, 1950) returns, which contain non-SMA similar strategy portfolios. Composite creation date is October 1, 2020.

The Capital Group U.S. Core SMA Composite inception is March 1, 2017. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Core strategy. Beginning March 1, 2017, the Capital Group U.S. Core SMA Composite includes all SMA portfolios applicable to the U.S. Core strategy. Prior to March 1, 2017, no SMA portfolios were managed in the U.S. Core strategy, and for that reason, the results presented are based on Capital Group Investment Company of America Composite (inception is January 1, 1934) returns, which contain non-SMA similar strategy portfolios. Composite creation date is March 1, 2017.

The Capital Group U.S. Equity SMA Composite inception is September 1, 2009. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Equity strategy. Prior to September 1, 2009, no SMA portfolios were managed in the U.S. Equity strategy, and for that reason, the results presented are based on the Capital Group Private Client Services (“CGPCS”) U.S. Equity Composite (inception is October 1, 1974) returns, which contain non-SMA similar strategy portfolios. Beginning September 1, 2009, the composite includes all SMA portfolios applicable to the U.S. Equity strategy. Prior to January 1, 2019, both restricted and unrestricted portfolios were included. Beginning January 1, 2019, only unrestricted portfolios are included in the composite. Beginning November 1, 2020, the composite includes only unrestricted SMA portfolios that are managed according to the U.S. Equity strategy and excludes SMA portfolios that are managed according to other U.S. equity customized strategies. The composite creation date is December 1, 2012.

The Capital Group U.S. Flexible Growth SMA Composite inception is October 1, 2020. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Flexible Growth SMA strategy. Prior to October 1, 2020, no SMA portfolios were managed in the U.S. Flexible Growth strategy, and for that reason, the results presented are based on Capital Group Growth Fund of America Composite (inception is December 1, 1973) returns, which contain non-SMA similar strategy portfolios. Composite creation date is October 1, 2020.

The Capital Group U.S. Flexible Growth and Income SMA Composite inception is October 1, 2020. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Flexible Growth and Income SMA strategy. Prior to October 1, 2020, no SMA portfolios were managed in the U.S. Flexible Growth and Income strategy, and for that reason, the results presented are based on Capital Group Fundamental Investors Composite (inception is August 1, 1978) returns, which contain non-SMA similar strategy portfolios. Composite creation date is October 1, 2020.

The Capital Group U.S. Growth SMA Composite inception is August 1, 2016. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Growth strategy. Beginning August 1, 2016, the Capital Group U.S. Growth SMA Composite includes all SMA portfolios applicable to the U.S. Growth strategy. Prior to August 1, 2016, no SMA portfolios were managed in the U.S. Growth strategy, and for that reason, the results presented are based on Capital Group AMCAP Composite (inception is June 1, 1967) returns, which contain non-SMA similar strategy portfolios. Composite creation date is August 1, 2016.

The Capital Group U.S. Income and Growth SMA Composite inception is September 1, 2016. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the U.S. Income and Growth strategy. Beginning September 1, 2016, the Capital Group U.S. Income and Growth SMA Composite includes all SMA portfolios applicable to the U.S. Income and Growth strategy. Prior to September 1, 2016, no SMA portfolios were managed in the U.S. Income and Growth strategy, and for that reason, the results presented are based on Capital Group Washington Mutual Composite (inception is August 1, 1952) returns, which contain non-SMA similar strategy portfolios. As of January 1, 2019, only unrestricted portfolios are included in the composite. Prior to January 1, 2019, both restricted and unrestricted portfolios were included. Composite creation date is September 1, 2016.

The Capital Group International Equity SMA Composite inception is July 1, 2012. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the International Equity strategy. Prior to July 1, 2012, no SMA portfolios were managed in the International Equity strategy, and for that reason, the results presented are based on the Capital Group Private Client Services (“CGPCS”) International Equity Composite (inception is January 1, 1987) returns, which contain non-SMA similar strategy portfolios. Beginning July 1, 2012, the composite includes all SMA portfolios applicable to the International Equity strategy. Prior to January 1, 2019, both restricted and unrestricted portfolios were included. Beginning January 1, 2019, only unrestricted portfolios are included in the composite. Beginning June 1, 2020, the composite includes only unrestricted SMA portfolios that are managed according to the International Equity strategy and excludes SMA portfolios that are managed according to other international equity customized strategies. The composite creation date is December 1, 2012.

The Capital Group International Growth SMA Composite inception is September 1, 2017. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the International Growth strategy. Beginning September 1, 2017, the Capital Group International Growth SMA Composite includes all SMA portfolios applicable to the International Growth strategy. Prior to September 1, 2017, no SMA portfolios were managed in the International Growth strategy, and for that reason, the results presented are based on Capital Group EuroPacific Growth Composite (inception is May 1, 1984) returns, which contain non-SMA similar strategy portfolios. Composite creation date is September 1, 2017.

The Capital Group Global Equity SMA Composite inception is September 1, 2011. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the Global Equity strategy. Prior to September 1, 2011, no SMA portfolios were managed in the Global Equity strategy, and for that reason, the results presented are based on the Capital Group Private Client Services (“CGPCS”) Global Equity Composite (inception is April 1, 1992) returns, which contain non-SMA similar strategy portfolios. Beginning September 1, 2011, the composite includes all SMA portfolios applicable to the Global Equity strategy. Prior to January 1, 2019, both restricted and unrestricted portfolios following the Capital Group Global Equity SMA Model and a sponsor-specific Global Equity SMA Model were included. Beginning January 1, 2019, only unrestricted portfolios that follow the Capital Group Global Equity SMA Model are included in the composite. The composite creation date is December 1, 2012.

The Capital Group Global Growth SMA Composite inception is July 1, 2017. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the Global Growth strategy. For non-U.S. holdings, a portfolio may invest up to 100% of assets outside the United States, though the strategy has typically invested in issuers throughout the world. Beginning July 1, 2017, the Capital Group Global Growth SMA Composite includes all SMA portfolios applicable to the Global Growth strategy. Prior to July 1, 2017, no SMA portfolios were managed in the Global Growth strategy, and for that reason, the results presented are based on Capital Group New Perspective Composite (inception is April 1, 1973) returns, which contain non-SMA similar strategy portfolios. Composite creation date is July 1, 2017.

The Capital Group World Dividend Growers SMA Composite inception is September 1, 2013. The composite consists of all unrestricted, discretionary separately managed account (“SMA”) portfolios that are managed according to the World Dividend Growers strategy. Prior to September 1, 2013, no SMA portfolios were managed in the World Dividend Growers strategy, and for that reason, the results presented are based on the Capital Group World Dividend Growers Composite (inception is July 1, 2012) returns, which contain non-SMA similar strategy portfolios. Beginning September 1, 2013, the composite includes all SMA portfolios applicable to the World Dividend Growers strategy. Prior to January 1, 2019, both restricted and unrestricted portfolios were included. Beginning January 1, 2019, only unrestricted portfolios are included in the composite. The composite creation date is September 1, 2013.