ESG

9 MIN ARTICLE

Our approach to ESG centers on identifying the issues that are most material to the long-term success and sustainability of companies. It is aligned with the long-term orientation we’ve always taken to pursuing superior investment results.

KEY TAKEAWAYS

- Our sector-specific ESG investment frameworks emphasize the issues we believe will drive long-term value creation.

- We complement our proprietary research with select third-party data inputs to round our ESG views.

- As active managers, we’re able to adjust our ESG analysis to account for shifting conditions.

At Capital Group, we recognize the need — and value — of integrating environmental, social and governance (ESG) insights into our investment process. This objective is consistent with our longstanding mission to improve people's lives through successful investing.

Part of what sets Capital Group apart is our long-term focus. Our equity funds' average holding period is nearly 3 years — roughly 55% longer than our peers.* This is not a coincidence, as our deep research, regular dialogue with companies, and diversity of thought tend to lead us toward companies focused on creating long-term value. We understand that the enduring profitability and growth of a company is directly tied to its relationships with customers, employees, suppliers, regulators and the environment in which it operates.

Thinking in a 3-, 5- and even 10-year timeline also helps us identify and invest in companies strategically positioned to bring substantial change to the world. ESG is just as much about identifying opportunities as it is about understanding risk.

Many elements of ESG are a natural fit with our investment process and have historically been a focus of our analysts and portfolio managers. We have intensified investments in our firm-wide approach to ESG integration, making the process transparent and systematic, and building in the potential to improve it over time.

Our integration of ESG is centered on three components: investment frameworks, a monitoring process, and engagement and proxy voting. Progress in one directly supports the others, creating an ongoing cycle of development. We have been intentional about creating a process that reinforces itself, so we can continuously learn.

Integrating ESG into The Capital System℠

Research is at the heart of our approach and is grounded in investment materiality. In other words, we focus on the ESG issues that directly impact results and valuations.

In 2020, our investment analysts created more than 30 industry-specific ESG investment frameworks that capture the issues we believe to be material to each sector, help us understand how those issues affect companies financially, and enable us to measure and integrate those insights into our investment process. Every analyst across Capital Group’s equity and fixed income investment units participated in these collaborative discussions. In all, Capital Group invested about 4,000 hours, integrating views from 200 investment analysts and 14 ESG specialists.

Focusing on material information emphasizes one of our greatest strengths: a highly experienced group of analysts building perspective on long-term industry trends and company potential.

Importantly, in these frameworks, we are seeking to measure and evaluate the risks and opportunities not fully captured by traditional financial metrics. These issues include long-term secular trends, such as energy transition and inequality. We also consider how companies operate. For example, can they build a competitive advantage by attracting, retaining and promoting the right people? Are they able to increase consumer trust by providing safer products?

Capital Group is not alone in seeking to understand and measure material ESG issues. Companies, too, are acutely focused on managing these topics and reporting meaningful information to investors. In 2019, 90% of S&P 500 companies published a sustainability report. This stands in contrast to 2011, when only 20% did so. The increased focus on sustainability reporting is still in its early stages. The Sustainability Accounting Standards Board (SASB) has developed standards that help public corporations disclose material information that can affect investment decisions. We believe this work is important and actively participate in SASB’s Investor Advisory Group.

Importance of materiality

We know that the definition of what is material is dynamic. It is not uncommon for an immaterial factor to quickly become material. As we were in the process of building our industry frameworks, the COVID-19 health crisis and ensuing economic shutdown unfolded, providing a real-life use case. Companies representing nearly every sector were forced to make drastic changes to protect the health and well-being of employees, customers and communities. Failing to do so carried major business risks. So top material priorities were issues like employee safety, wages and benefits, supply-chain management and cybersecurity (supporting the rapid transition to digital).

We view the challenges of determining which issues are material and gauging the time frame over which that materiality will get reflected within share prices as opportunities to which we are particularly well-suited, given our focus on deep, fundamental, first-hand research.

We don’t outsource fundamental research, and we don’t outsource our thinking on ESG.

Health and safety in restaurants amidst a pandemic

COVID-19 added considerable risk to the restaurant industry, one of which is how to keep employees safe while returning to essential work. Health and safety have always been an issue for restaurants, but COVID-19 pushed it to the forefront. Leading companies were required to rethink how to protect employees and incentivize them to stay home if they were at risk for infection, while supporting overall well-being through benefits like paycheck stability, access to health care (including mental health), and childcare where possible.

Material ESG issue: Health & safety |

||

|---|---|---|

Relevance in investment analysis |

Best practices |

|

Companies differentiate through providing health care benefits and making employees feel safe, which can lead to a competitive advantage. Everyone is competing for workers. |

Provide wages and benefits beyond minimum standards, including tuition reimbursement, health care coverage, mental health care, and childcare resources. |

|

COVID-related additions |

COVID-19 is an additional risk factor, with many cased tied to employees (essential workers) contracting the virus at work. |

Provide needed sick time off, ensuring that no employee has an incentive to come to work sick. |

Proprietary research + third-party data:

A powerful combination

ESG data, when based on quantitative or standardized information, can be valuable inputs to our investment process. Alongside a robust understanding of material ESG issues, we have found that the information used to measure and evaluate companies matters greatly.

With the increased interest in ESG, there has been an influx of ESG ratings and scores. It’s important to understand the limits of third-party data. Currently, the discrepancy in ratings across leading ESG data providers is so wide it’s nearly impossible to state a singular market view on a company’s ESG profile. A 2019 study by MIT Sloan School of Management found a very low correlation of just 0.61 between top-level ESG ratings from major providers.† This is in sharp contrast to a correlation of 0.92 for traditional credit-rating agencies.

The same intention, widely varying conclusions

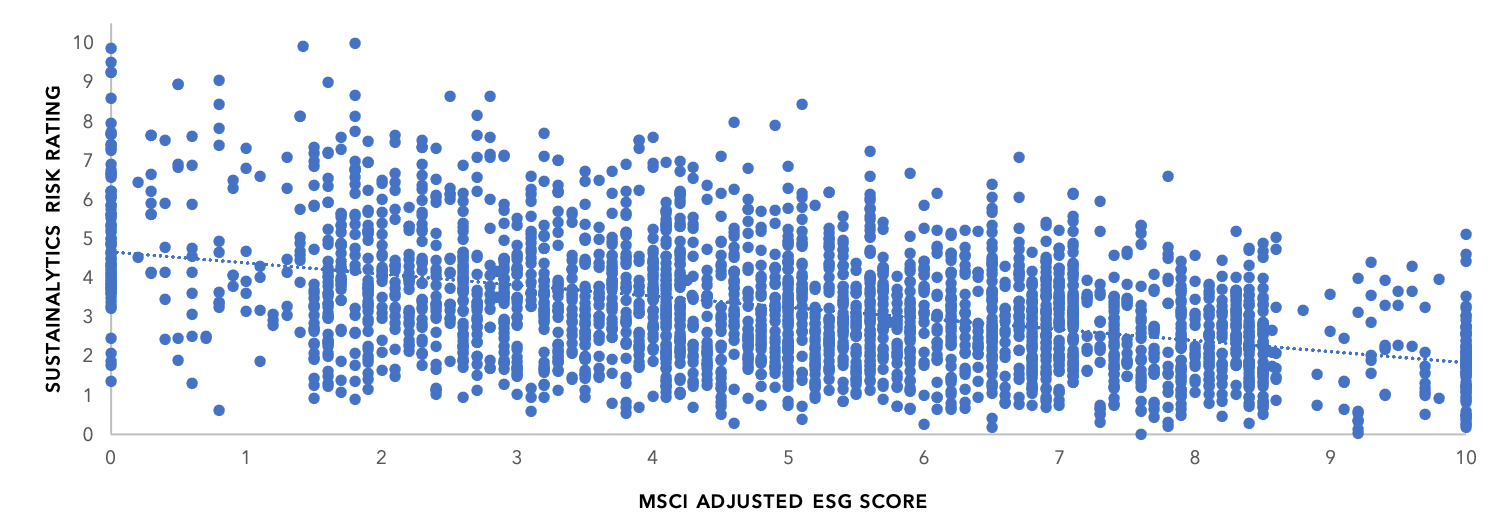

Sustainalytics Risk Rating and MSCI's ESG score both measure a company's ESG risk exposure and management. In this chart, each dot represents a company within the MSCI All-Country World Index. As shown, there is a weak relationship between the two scores. This demonstrates a lack of agreement on how to measure a company on ESG issues, and underscores differences in rating methodologies and a limited amount of directly comparable ESG data.

Sustainalytics vs. MSCI Adjusted (ACWI)

Source: Capital Group

Each rating agency has its own way of defining and measuring ESG issues. There are differences in how they choose which issues to evaluate, how they calculate risk, and how they attempt to bridge the vast data gaps created when companies report limited or inconsistent information. The result is little consensus across the market and a significant degree of noise.

We need to be selective about the ESG data we use. There are certainly robust data points, based on quantitative or comparable information that can be valuable to our investment process. To inform our ESG evaluation process, our analysts identify quantifiable third-party data, which is incorporated into our investment frameworks. In some industries, there may be very few valuable third-party data points, requiring a heavy reliance on bottom-up, boots-onthe- ground analysis or unconventional data sources. In other sectors, there are several highquality indicators that can be readily integrated into investment analysis.

Our ESG research in action

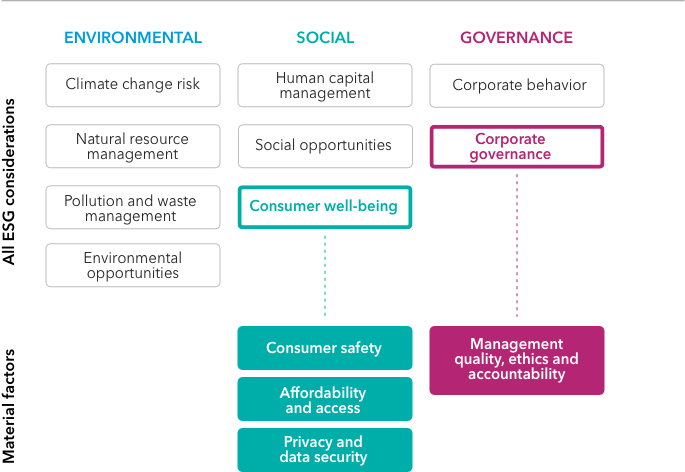

The health care services sector is a good example of our holistic, evidence-based approach to ESG. Capital Group analysts identified social topics as being the most material ESG issues within the industry. This meant a focus on consumer safety and product quality, affordability and access, and data security and privacy, all underpinned by strong management quality and accountability.

Zeroing in on material issues

When evaluating the ESG issues within the U.S. health care services sector, Capital Group analysts sought to identify those they believed were most material to the success of the company as a long-term investment.

In U.S. health care services, one key thesis is that value-based care (i.e., incentives aimed at keeping people healthy rather than additional fees for services) is the most sustainable model over the long term. Doctors in value-based care models tend to conduct more proactive patient outreach and emphasize preventive care and ongoing maintenance. We believe this approach helps raise the health of the broader population, and in turn likely saves costs and increases patient satisfaction and retention.

To evaluate a company against this investment thesis, analysts conduct primary research through dialogue with the company itself. The analysts ask questions directly to companies at all levels of management, not just the executive suite, which helps them understand if the stated priorities are manifested in the company’s culture and operations. Additionally, our analysts don’t ask just once — or even once a year. It’s an ongoing effort.

Beyond dialogue with companies, analysts look at indicators such as customer satisfaction tracking and net promoter scores. From regulators, analysts review and assess the risk of sanctions, including warning letters, fines, restrictions and recalls.

A differentiated ESG view

Our research efforts will lead us at times to disagree with ESG rating agencies. One major ESG rating agency, for example, rates a company we view as a pioneer in value-based care below its peers. The company is penalized for publishing limited information on customer satisfaction rates and not establishing policies on emerging health risks, such as obesity and environmental pollutions. We take a different view — that by changing the incentive structure for doctors, this company encourages preventive care and contributes to overall better health outcomes, which, in our view, is more material to the company’s long-term success as an organization and as an investment.

Our singular purpose is to identify companies that are likely to drive sustainable long-term results. External agencies, while supporting that outcome, each have a different focus that can help explain differences in results. MSCI’s ESG Ratings focus on a company’s operations in the context of its industry and scores each company relative to its peers. Sustainalytics released a new methodology in 2018 focused on “unmanaged ESG risks,” scoring each company on industry or regional ESG risk exposure minus company actions to manage that risk. SASB’s mission is different, focused on developing reporting standards to help companies disclose material, decision-useful information to investors. We evaluate each of these inputs in our process, then rely on our own investment frameworks to build our view.

An evolving process focused on better outcomes

We believe our focus on ESG research continues to help us pursue our mission of improving lives through successful investing. But our work is not done. In our fast-moving global economy and society, material ESG issues can change quickly. We will constantly review and adapt our frameworks.

To ensure they remain useful research tools, we still rely on our legacy of engaging companies as partners rather than as adversaries. That is not to say that we don’t challenge companies to improve. As pressure mounts on firms to be more sustainable, we expect this spirit of partnership will be meaningfully enhanced. We believe we’ll learn together and contribute to the improved management of ESG issues across the board. The journey will take time, but we remain more convinced than ever that a materiality-based approach to ESG will reinforce the types of sustainable business practices that we believe will drive better results and outcomes for our investors.

*On average, the equity-focused American Funds hold their investments for 2.9 years, whereas their peers hold their investments for 1.9 years, based on the equal-weighted blended averages across each of the 20 equity-focused American Funds' respective Morningstar categories as of December 31, 2020. Fixed income funds are not included in this calculation due to the differing nature of trading in the asset class versus equity investing.

†Berg, Florian, Kölbel, Julian and Rigobon, Roberto. 2019. "Aggregate Confusion: The Divergence of ESG Ratings." MIT Sloan School Working Paper 5822-19, MIT Sloan School of Management, Cambridge, MA.