ESG

7 MIN ARTICLE

At Capital Group, using third-party data is only the beginning of how we monitor potential and current investments. Corporate holdings1 are reviewed against third-party ESG scores to identify potential ESG risks. Then we draw on our investment professionals' deep knowledge and understanding of the investment to determine if the issues are material, how they are being addressed, and how we will act on that information.

KEY TAKEAWAYS

- Third-party data add an element of objectivity to the investment process, but ESG score providers often disagree.

- Our own deep research is crucial as we analyze how issuers are addressing potential ESG risks.

- It's important to look beyond individual events and consider the larger systemic issues as we continue to monitor investments.

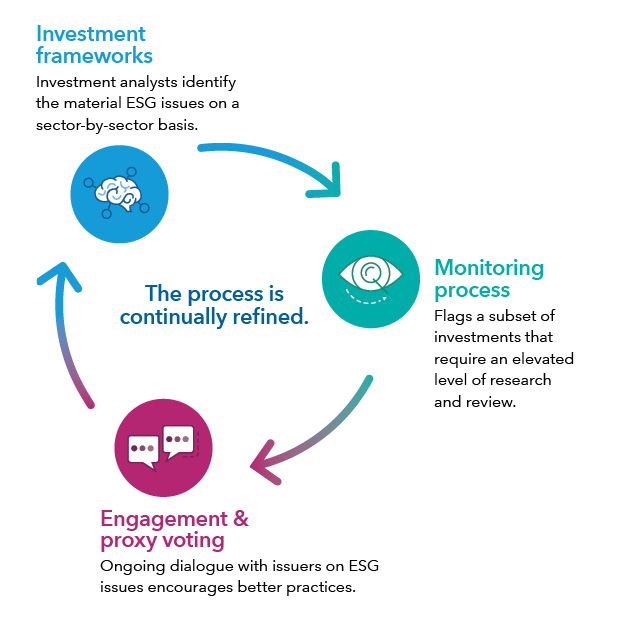

Capital Group looks at material environmental, social and governance (ESG) concerns when deciding on potential investments. In 2020, we outlined how ESG is integrated into our investment process, The Capital System™, via three elements designed to enhance our bottom-up investment research and analysis: investment frameworks, monitoring and proxy voting and engagement.

Our ESG approach features three interrelated components

Source: Capital Group

The monitoring element of our investment process for corporates involves reviewing holdings against third-party ESG scores and norms, where data is available, to identify potential ESG risks that merit further investigation. We then draw on our investment professionals’ deep knowledge and understanding of the investment to see if the issues flagged by the third parties are material, how the issuer is addressing them and if any additional action is warranted.

The monitoring stage helps ensure that we are being systematic in our approach to ESG for corporate holdings. It also guards against confirmation bias by introducing external data systematically which helps ensure we aren’t only seeking out or favoring information that reinforces already-held beliefs. Monitoring our investments against third-party data adds an element of objectivity to our ESG integration process.

What are our monitoring criteria?

Capital Group uses six criteria when monitoring equity and corporate debt issuers against third-party data. We have a different methodology in place to cover sovereign debt, which will be examined in future publications.

The criteria for corporates include a norms-based review. In other words, investments are assessed based on how well they adhere to the social norms embodied by the United Nations Global Compact. Any company that a third-party data provider scores as “fail” raises a red flag to us, and we investigate the issue further.

Our process also leverages MSCI and Sustainalytics data. We look at the overall ESG scores provided by each data source, the extent to which the two sources agree, and how a corporate scores on the MSCI governance indicator. We have identified specific thresholds for each indicator that help us flag issues that are most likely to be material.

Monitoring criteria

For equities and corporate fixed income investments, we use two data providers (MSCI and Sustainalytics) and six different scoring methods, illustrated in this table.

Importantly, our investment in technology has enabled us to implement this process at scale. On a monthly basis, we monitor our corporate holdings to ensure that, to the extent they are covered by third-party data providers, changes in scores from third-party data providers are promptly identified.

How accurate are third-party ESG scores?

On the surface, ESG scores from different providers appear to be similar. For example, both MSCI and Sustainalytics consider an issuer’s exposure to industry-specific ESG risks and how well they are being managed. Some commentators have compared ESG scores to credit ratings.

However, a recent study by MIT Sloan School of Management found a correlation of just 0.61 between the major providers.2 Correlation measures the strength of a relationship between two variables: a correlation of 1 means there’s a strong positive relationship, –1 that there’s a strong negative relationship and 0 means no relationship. A correlation of 0.61 shows that major providers’ scores have a relatively weak relationship with each other. In comparison, credit rating agencies share a more reliable and stronger correlation of 0.92.

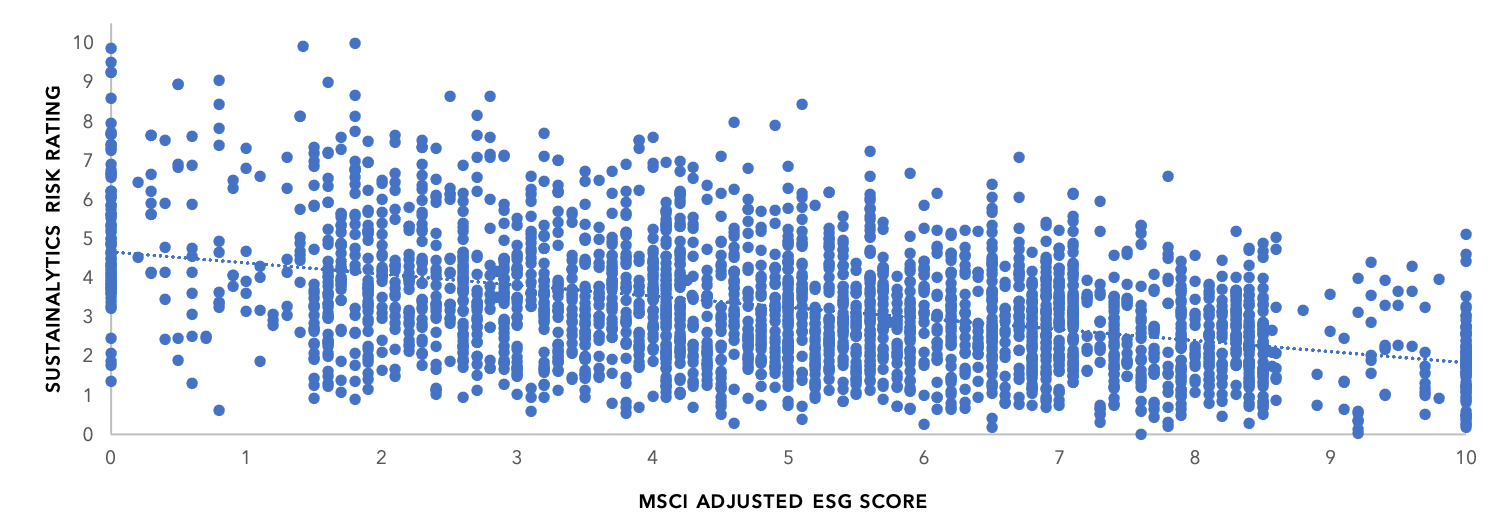

Our own analysis of the relationship between ESG scores from different providers (below) shows a similarly unclear picture. The two providers score the same universe of companies very differently across the same metrics.

MSCI vs. Sustainalytics scores

The MSCI and Sustainalytics ESG scores for the ACWI index, for instance, show the same universe of companies receiving very different ESG scores.

Source: Capital Group, MSCI, Sustainalytics

Data as of December 31, 2020. ESG: Environmental, Social and Governance. Source: Capital Group MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. *This was done for MSCI, RobecoSAM and Sustainalytics across various environmental and social dimensions. y = -0.2837x + 4.674. R² = 0.1887.

Many suggest that the accuracy of ESG scores will improve over time as they mature. But another paper found that greater ESG disclosure leads to greater ratings disagreement.3

Methodologies are at the heart of this difference. MSCI’s ratings, for example, evaluate a company in relation to its peers in the same industry. Sustainalytics, from Morningstar, scores a company based on its exposure to the ESG risks of an industry or region, accounting for a company’s actions to manage that risk. In addition, the weight given to each issue (environmental, social or governance) varies across providers, as can the importance given to different historic controversies.

This evidence supports our use of multiple inputs and providers in our monitoring process. It also demonstrates the importance of digging deeper beyond any single ESG score.

Monitoring tends to flag events rather than systemic issues

At the beginning of 2021, our ESG specialists reviewed approximately 200 monitoring reports completed by analysts and portfolio managers in 2020. This involved putting key questions to our investment professionals to understand whether they viewed flagged issues as significant to their investment thesis and the extent to which they had engaged with company management on these issues. We also reviewed the flagged companies to better understand trends across industries.

Reviewing our monitoring reports over 2020

Key questions |

Capital Group’s insights |

Is our methodology flagging issues that analysts agree are significant? |

Analysts agree that issues are significant in about 70% of cases. |

Which ESG issues are most commonly flagged? |

|

Which industries are most commonly flagged? |

|

Are analysts engaging with issuers on the ESG issues raised in monitoring? |

Yes, analysts have engaged in 63% of cases. Engagements are focused on areas where the analyst views the issue as significant to the company’s long-term performance. |

Source: Capital Group

Each part of our ESG process is designed to be constantly improving. We have used these insights to further strengthen the entire process. Commonly flagged issues in each sector have been incorporated into our 2021 investment frameworks, and the top flagged issues have been added to our thematic research agenda.

In the cases where we believe the issues raised are significant to the company's long-term performance, we generally engage with the company on those issues.

The importance of the improvers

Interestingly, our review highlighted that external flags tend to highlight events (bribery scandals, toxic waste, etc.) more frequently than consistent underperformance on ESG risk indicators (e.g., poor human capital management practices). In many cases, we found that the company in question is taking appropriate steps to remedy the source of controversy, but this isn’t captured by the third-party provider’s score. This underlines the importance of having an ESG process that incorporates engagement alongside monitoring.

We believe that this engagement can support our investment results. MSCI’s own research of their scores supports the logic of examining scores that may be improving rather than focusing solely on ESG leaders. In 2015, MSCI conducted an analysis on best-in-class ESG companies (a tilted investment strategy) versus those with improving ESG scores (momentum investment strategy) over the past 12 months.4 ESG momentum outperformed ESG tilt by 1.1% on an annualized basis — and outperformed the MSCI World by 2.2%, from February 2007 to March 2015.

This focus on events, rather than systemic issues and performance over time, also highlights the importance of our sector-specific investment frameworks. Our more than 30 frameworks focus on those ESG issues that we believe are material for future value creation, and we examine how they are being managed by companies. This approach gives us a distinct perspective on future ESG risk.

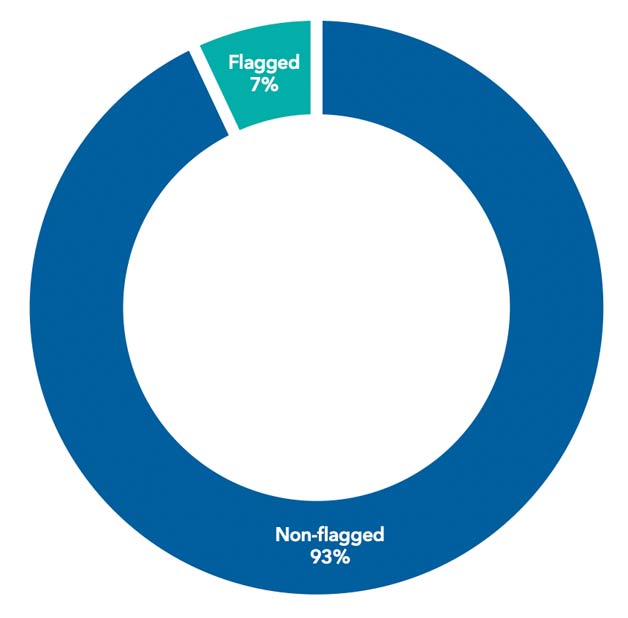

How are we disclosing our monitoring?

All American Funds are subject to our monitoring process. On average, between 3% and 11% of holdings (by number) are flagged, as of 8/31/2021, for additional review. We recognize that ESG transparency is important; clients value being shown how the process works in practice. Therefore, we have recently added fund-level disclosure of the results of our corporate monitoring process, disclosing which holdings are being flagged for in-depth review.

A view of the New Perspective Fund (NPF) portfolio

NPF holdings are systematically monitored for material ESG issues using multiple leading data providers and risk methodologies. These include a UN Global Compact assessment, as well as ratings from MSCI and Sustainalytics.

Twenty-one of the holdings in NPF's portfolio, as of March 31, 2021, or about 7%, were flagged in the ESG monitoring process. These holdings are monitored by analysts, meaning they require a heightened level of research and engagement.

Data as of March 31, 2021

Source: Capital Group. Monitored holdings include corporate bonds and equity holdings. NOTE: There are a small number of holdings in the fund that are not currently rated by the ESG data providers we use for monitoring.

There are benefits of our monitoring process and disclosure. Because third-party ratings are increasingly used across the market, it is helpful to understand this “market view” of a company and why our view may differ. Our clients are using third-party ESG tools, such as those provided by Morningstar or MSCI, which score the holdings in portfolios. Our monitoring process helps us go beyond third-party data to address ESG risks.

Monitoring strengthens the other elements in the process

We are committed to an approach to ESG integration that's rooted in investment materiality and that enhances The Capital System. Monitoring is an important part of how we do this. We are also committed to driving ongoing improvement in all areas of our process, and monitoring is no exception. As ESG data grow and mature over time, we will continue to drive our process forward.

1 Certain holdings are currently not covered by third-party monitoring providers.

2 Berg, Florian, Kölbel, Julian and Rigobon, Roberto. 2019. "Aggregate Confusion: The Divergence of ESG Ratings." MIT Sloan School Working Paper 5822-19, MIT Sloan School of Management, Cambridge, MA.

3 American Accounting Association, "Why is Corporate Virtue in the Eye of the Beholder? The Case of ESG Ratings," April 8, 2021.

4 Nagy, Zoltán, Kassam, Altaf and Lee, Linda-Eling. June 2015. "Can ESG Add Alpha? An Analysis of ESG Tilt and Momentum Strategies." MSCI ESG Research Inc.