Chart in Focus

Global Equities

International stocks have struggled for much of the past decade, challenged by a multitude of headwinds, ranging from Eurozone politics to the strength of the U.S dollar to skittishness over China’s economy.

With U.S. stocks dominating global results in recent years, many investors question how much of their portfolio should be devoted to international stocks after years of subpar returns.

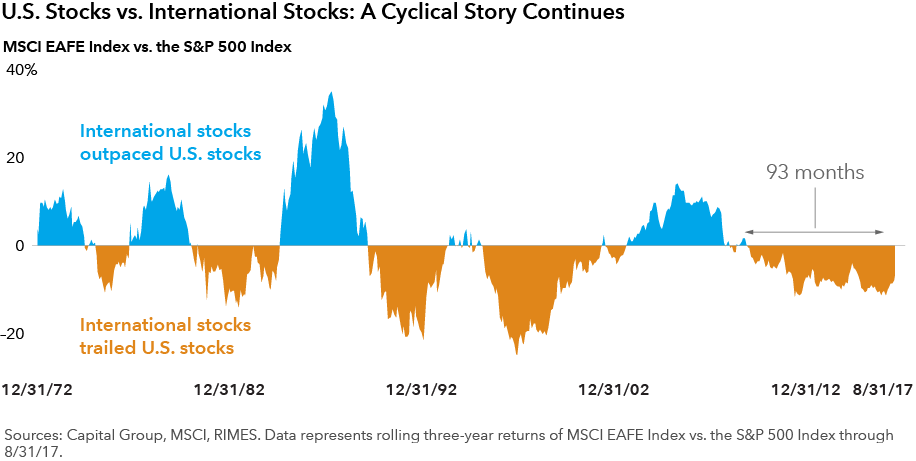

Markets are cyclical, and history shows that the pendulum eventually swings back the other way. This reversal may well be underway as we are beginning to see some encouraging signs for non-U.S. equities.

1. Tide appears to be turning in Europe.

In my view, the outlook for picking stocks in Europe is now more constructive. After lurching from crisis to crisis over the past several years, Europe appears to be stabilizing on the political and economic fronts, and this advancement should help alleviate some of the uncertainty that has weighed on equities there.

After a wave of populism spooked the markets, political risks seem to be ebbing. Namely, Emmanuel Macron’s presidential victory in France on a business friendly and pro-European Union platform was a key turning point. Along with Macron’s triumph, other centrist politicians across Europe appear to be beating back a populist backlash against the EU.

While Europe’s economic recovery has gone through fits and starts for nearly a decade, there are reassuring signs that growth may finally be turning a corner. GDP growth in the 19-member euro zone is accelerating, unemployment is at its lowest level in eight years and consumer confidence is improving.

All of this sets the stage for a more stable backdrop in which structural reforms can be addressed to strengthen the EU, as well as a more conducive environment to find good companies in which to invest.

2. Dollar headwind abates amid global economic recovery.

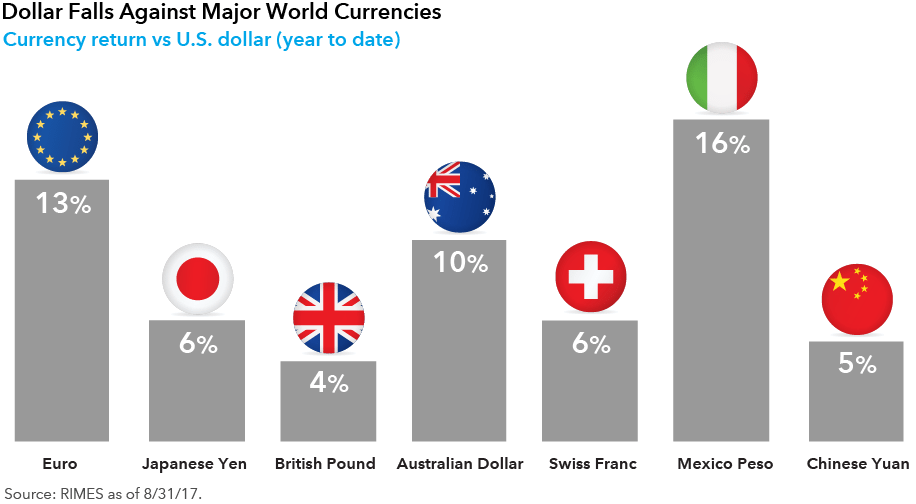

The U.S. dollar is finally weakening against several major currencies — including the euro, British pound and Japanese yen — after a remarkable run that began in early 2011. For dollar-based investors, this development could have a significant impact on returns for global and international portfolios as our research has found that historically a significant portion of total return has accrued from the currency portion.

Past history shows that currency cycles have generally lasted for five to eight years, and our currency analyst believes we are now in a period of gradual dollar weakening after an extended period of strength.

Concurrent with the dollar depreciating, the world’s major economies all appear to be moving in the same general direction for the first time since the 2008 credit crisis. Manufacturing activity is expanding in many countries, China’s economy has avoided a much-feared hard landing and raw material prices have stabilized. Even Japan’s economy, long mired in a slump, is finally undergoing a revival with gross domestic product expanding for six straight quarters. Meanwhile, corporate profits for companies based in emerging markets are increasing after several uneven years, driven by demand for commodities, strong earnings from technology companies and rising wealth that is boosting overall consumption.

At the same time, a weaker dollar should help earnings for U.S. multinationals that generate most of their revenue overseas.

3. Mind the valuation gaps.

Given the improving landscape for international equities and eight-year bull market for U.S. stocks, it may be time to consider markets outside the U.S. A look at the world’s market capitalization levels shows that the U.S. is hovering near the top of its historical range while overseas markets are near all-time lows. Large valuation gaps between U.S. and European firms have been narrowing in recent months, but there are still select investment opportunities.

Lately, I’ve been finding attractive opportunities to invest in global companies that act as middlemen for their respective industries — some call these the “picks and shovels” companies, meaning they supply the materials rather than digging for gold. These are corporations that I believe trade at reasonable valuations based on my projections for their earnings growth.

One example of a company in this category would be Taiwan Semiconductor, one of the world’s largest manufacturers of semiconductors used in computers, consumer electronics, automobiles and industrial equipment. Another is Thermo Fisher Scientific, a U.S. company providing instruments, laboratory equipment and consumables to pharmaceutical and biotech companies, governments and academic institutions.

When considering these companies and others with similar characteristics, I don’t necessarily have to make short-term calls on the direction of the global economy, interest rates or the likelihood of major legislative reforms. Instead, I can focus on fundamentals, looking at companies across the world while trying to take advantage of tailwinds I see in this ongoing global economic recovery.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Related Insights

-

Asset Allocation

-

Global Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Jody Jonsson

Jody Jonsson