Chart in Focus

China

China has a deflation problem, and it will take some time to fix. Low consumer confidence, falling home sales and weak manufacturing utilization rates all suggest lower priced exports for certain manufactured goods could continue to flood global markets over the next six to 12 months.

We are already seeing a backlash from a diverse set of countries that fear cheap imports could weaken their domestic industries. And I believe companies competing with Chinese-manufactured goods, particularly in areas of renewable energy equipment, machinery and electric vehicles (EV), will likely face an uphill climb for the foreseeable future.

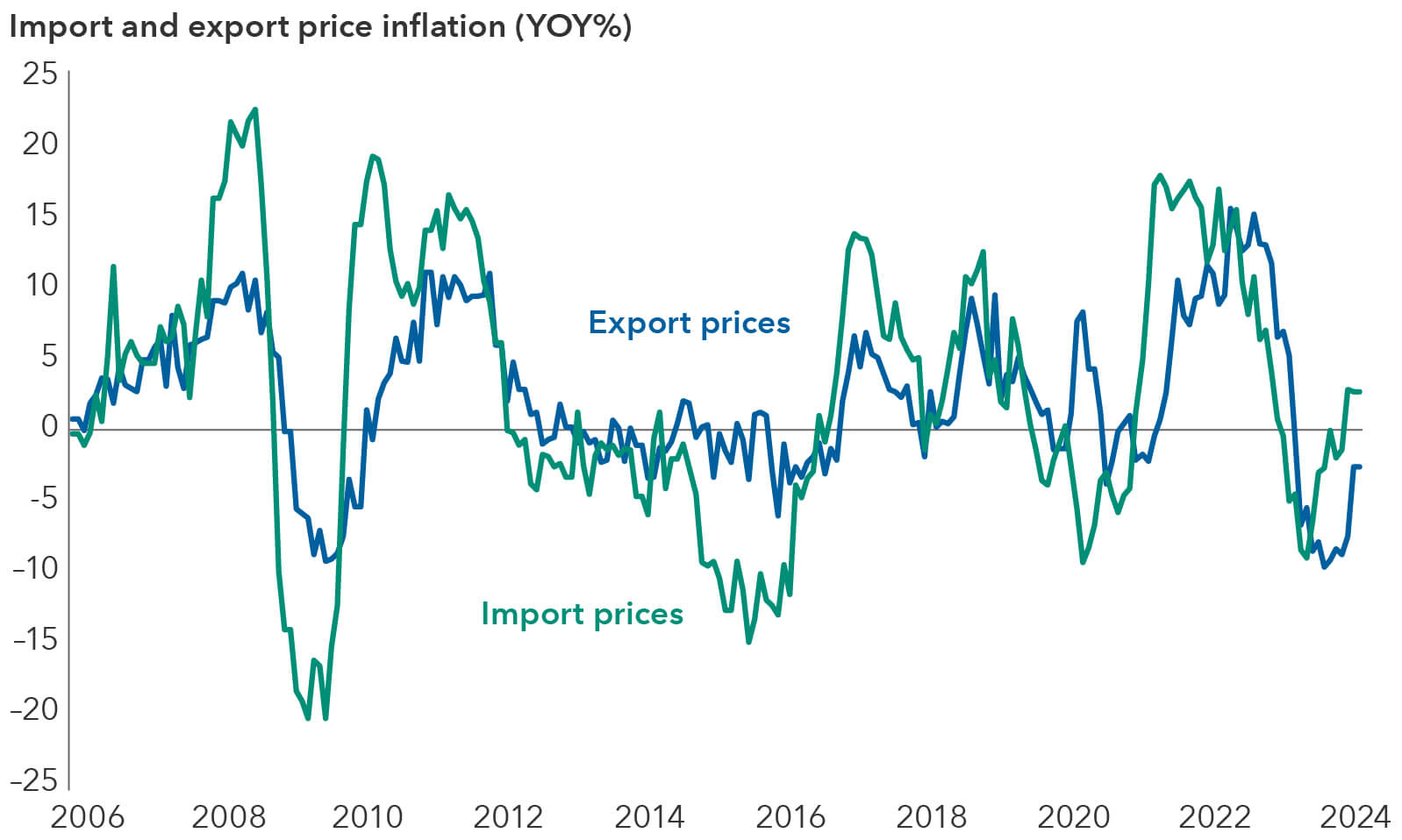

As China’s economy has struggled since lifting COVID lockdowns in late 2022, policy makers have emphasized a manufacturing-led recovery as part of its official goal of achieving annual growth of around 5%. This has become more apparent in the export data. Export volumes rose 13% in the first quarter, but those prices declined 6% overall in dollars.

And that is evident in U.S. data as well. While U.S. import prices from Europe and Mexico continue to rise year-on-year, those from China (and the Association of Southeast Asian Nations) were down 3% annually in March.

China’s export prices have been sliding

Sources: Capital Group, CEIC. Data as of April 1, 2024.

China’s manufacturing sector is massive and growing

The government has doubled down on manufacturing as part of a comprehensive policy to move up the technology value chain in areas such as electric vehicles and batteries, renewable energy equipment and robotics. This effort coincides with the government’s aim to rectify a highly indebted property sector.

With a slew of private property developers mired in debt, the manufacturing sector has benefitted from a sharp increase in state-owned bank credit since 2020. Manufacturing constituted 28% of China’s GDP in 2022. In my view, Beijing’s agenda is likely to increase China’s huge manufactured goods surplus, the world’s largest.

Meanwhile, the latest reading on China’s economy has raised hopes of a long-awaited recovery. Officially, gross domestic product rose 5.3% from a year earlier. But the growth is mostly coming from outside China. While the export recovery may have legs, I see it having limited impact on the domestic economy — at least until I see more evidence of government stimulus measures gaining traction.

The all-important residential real estate market — the main source of household wealth — continues to contract, with sales declining 20% year on year in the first quarter. Household savings are up even with COVID restrictions lifted, with surveys suggesting a preference for gold and bank deposits.

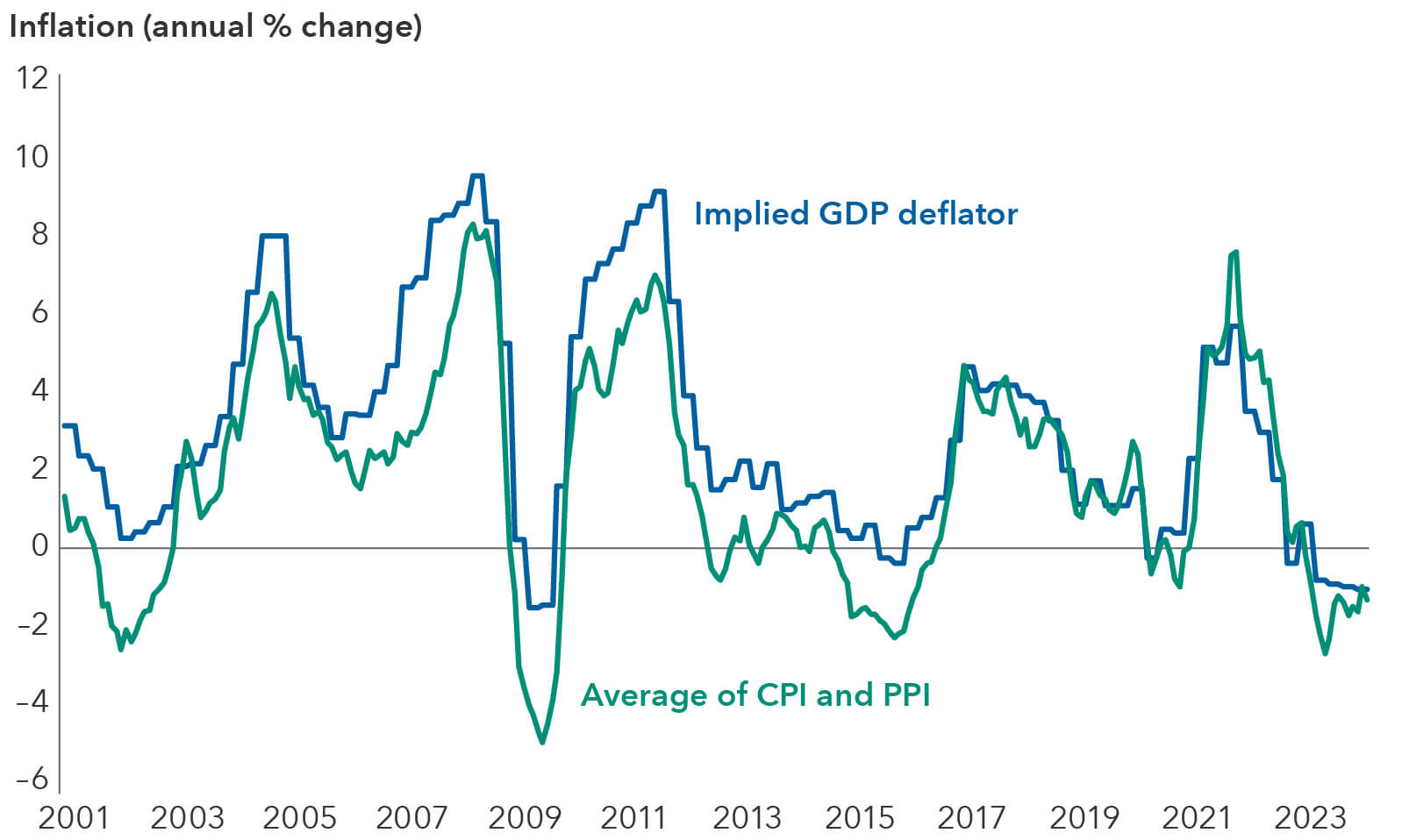

Hence, we may continue to see deflationary pressures persist until China’s domestic recovery gains momentum. The GDP deflator, a broad measure of inflation, has been negative for three consecutive quarters.

Key inflation gauge for China near 2009 low

Sources: Capital Group, CEIC. Data as of March 1, 2024. GDP deflator = broad measure of inflation. It is the value of all goods and services produced within a country (nominal GDP) divided by the inflation-adjusted value of those goods and services (real GDP). CPI = Consumer Price Index. PPI = Producer Price Index.

That said, there recently have been some encouraging signs that have sparked a mini rally in China’s equity market since late April. I believe policy makers have realized they need to solve the negative property spiral and set a floor on prices. They recently unveiled a plan for local governments to buy unsold properties and convert them into affordable housing. They also reduced required downpayment amounts and lowered mortgage rates to entice would-be home buyers.

Many obstacles need to be overcome for the apartment purchase plan to work – not least the fact that it’s going to be funded by banks, which would like to be repaid. But for all the problems, Beijing seems to have finally grasped it needs to intervene to absorb housing inventory.

Outside of housing, consumption is improving in certain areas of the economy. For example, domestic travel has rebounded this year, surpassing 2019’s pre-pandemic levels. In Macau, a popular entertainment destination, there are indications of a continued recovery. Overall visits rose through April, compared to the prior year, though gross gambling revenues have yet to reach 2019 levels. We could see further improvement. Regulators recently sped up the process for acquiring travel visas to Macau, opening them up to more visitors and groups. There is evidence of consumers trading down to lower priced items as well. Luckin Coffee, for instance, had a strong first quarter, while the higher end, Starbucks, saw sales contract.

Protectionist measures may escalate

In international markets, the backlash to China’s exports is intensifying, complicating an already tense geopolitical landscape. Many companies who compete have urged their governments to impose fresh trade barriers on a range of products.

The U.S. recently imposed $18 billion worth of new tariffs on a range of products from China, including EVs, lithium-ion batteries, semiconductors and steel. Meanwhile, the European Union is weighing its own levies on EVs and renewable energy gear. Additionally, India, Brazil, Indonesia and Vietnam have opened various anti-dumping probes related to steel, chemicals and ceramics.

The complaints highlight China’s rise as a manufacturing powerhouse over the past two decades. For instance, China’s solar panel exports are booming. Thanks to subsidies, technological improvements and massive manufacturing capacity, unit prices dropped while quality improved. China already holds an 80% share of global panel production, and its dominance is expected to rise.

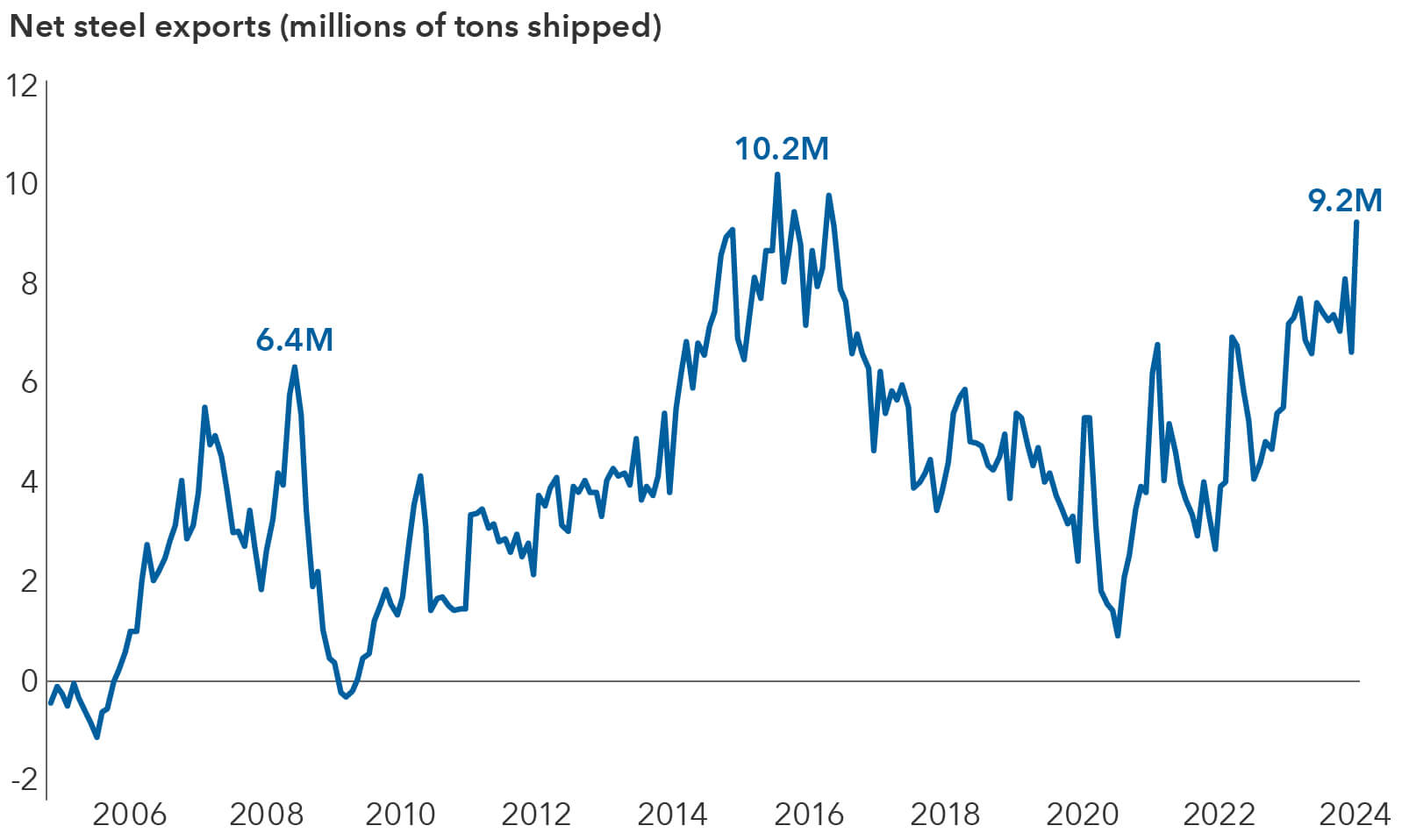

China is also exporting large amounts of steel, similar to the last time its economy slowed in 2015 and 2016. In reaction, Mexico, Chile and Brazil have all hiked import duties on China’s steel products.

China’s steel exports have surged near 2015–2016 levels

Sources: Capital Group, CEIC. Data reflects January 1, 2005, through March 1, 2024. Values below zero indicate periods when China had a steel trade deficit.

The bottom line

Beijing continues to signal that “high-quality growth,” economic restructuring and its medium-term ambitions are more important than the big-bang credit stimulus that many market observers have hoped for over the last few years.

So, China’s exports are likely to keep falling in price, causing headaches for overseas competitors. However, the inflation problem faced by the U.S. and other developed countries primarily stems from the service sector and domestic wages. Consequently, China may not play a significant role in central banks’ efforts to combat inflation.

Despite China’s challenges, some members of our investment team believe the deep selloff in the country’s equity market in the past few years has created opportunities to selectively invest. Valuations are cheap on a historical price-to-earnings basis, and the government is pushing companies to increase share buybacks and dividend payouts. In our international and emerging markets strategies, our portfolio managers have primarily gravitated to companies with strong cash flows and dominant market share positions. This has ranged from the larger technology giants to industrial automation and travel-related companies.

CPI = Consumer Price Index.

PPI = Producer Price Index.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Markets & Economy

-

Artificial Intelligence

-

U.S. Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Stephen Green

Stephen Green