Chart in Focus

Capital Ideas

Investment insights from Capital Group

Asset Allocation

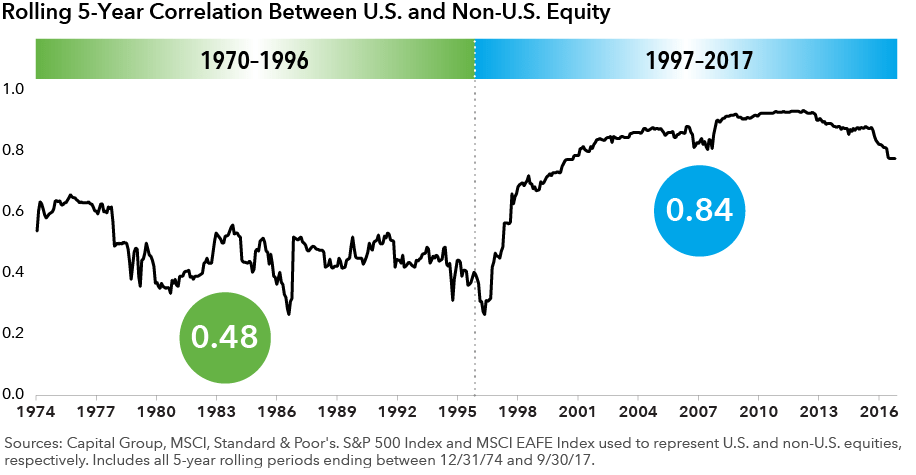

U.S. and non-U.S. equity correlations have been rising for years

International investing was once seen as a source of diversification and risk mitigation for U.S. investors, but the world is changing. This theory mostly held up until 1997, but since then the impact of globalization has resulted in a greater correlation between U.S. and non-U.S. equities, causing a decline in the diversification benefits international equities provide portfolios. So can investors forget international investments altogether? No, but they should re-think what global investing means for their portfolios. By focusing on top individual companies regardless of domicile rather than being limited by rigid geographic allocations, investors will have a broader opportunity set that can potentially generate better outcomes.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

related insights

-

Asset Allocation

-

Global Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.