It’s déjà vu all over again. With the outbreak of the coronavirus and the ensuing economic slowdown and violent market reaction, many have grown fearful of investing.

The last time it felt this way was during the Great Recession. I remember the day in August 2008 when I shared with my colleagues a classic speech from former Capital Group Chairman Jim Fullerton. This speech, delivered in November 1974 amid a prolonged bear market, provided us with much-needed historical perspective and a dose of optimism when it was in short supply.

The “Fullerton letter” as it has come to be known, has been recirculated among Capital Group’s investment team at least four times in my career. My colleague Claudia Huntington, a veteran equity portfolio manager, shared it in 1987, saying, “I have been saving this speech, one of my favorites, for a time like today.” I think it’s been shared so often because Jim captured so well what we all know. It is always darkest before the dawn.

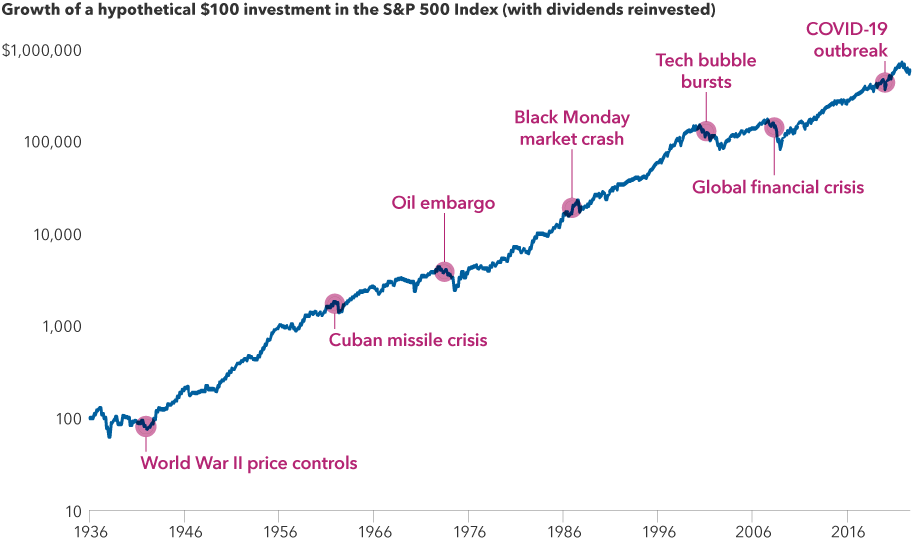

I think it’s been shared so often because Jim captured so well what we all know: It is always darkest before the dawn. Over time, and in time, the financial markets have demonstrated a remarkable ability to anticipate a better tomorrow even when today’s news feels so bad.