Summer may be over, but your clients might still be thinking about jumping into a pool — a pooled employer plan, that is.

Historically, an individual employer — no matter how small — has had to set up and run their own individual retirement plan. Regulators and legislators have sought for years to ease this administrative burden by putting multiple employers together into one buying pool — thus offering potential cost savings and reduced legal liability.

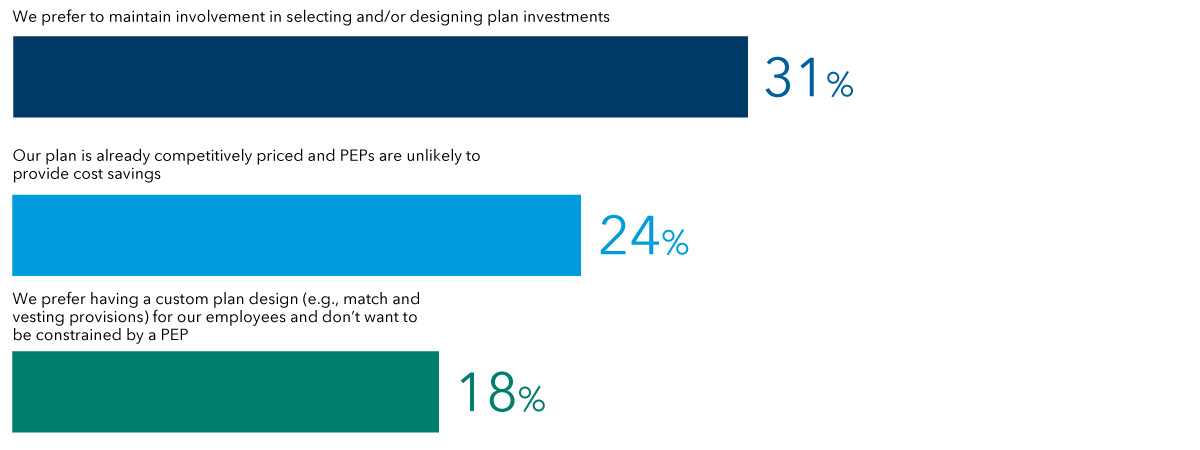

Pooled employer plans (PEPs), created under the SECURE Act, have been the latest attempt to make 401(k) plans more accessible for small businesses. Rolled out on January 1, 2021, PEPs have gained attention among financial professionals and employers alike but have been off to a slow start.