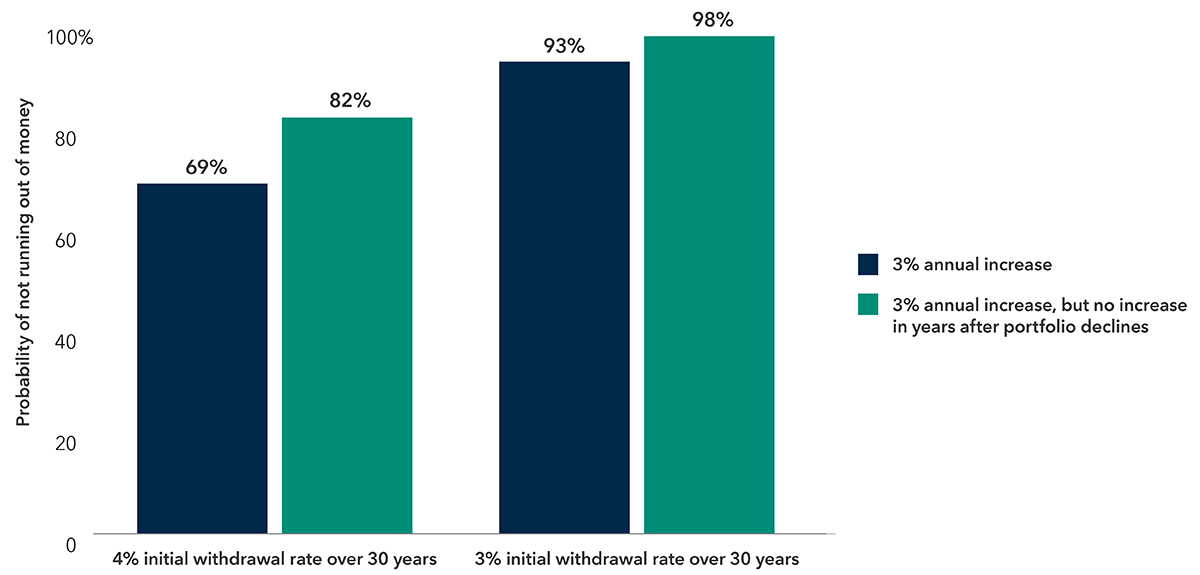

*A 90% probability of success factor in a Monte Carlo simulation strikes a balance between conservative and aggressive planning. It is often utilized to ensure a high level of confidence that hypothetical outcomes have the potential to be achieved, accommodating for potential uncertainties and variations in the model. A lower probability would accept a potential higher risk with a greater chance the projected outcomes may fall short.

A Monte Carlo simulation was used to calculate the probable range of outcomes and probabilities for hypothetical portfolio reliance.

Information about Monte Carlo simulations: Monte Carlo simulation is a statistical technique that, through a large number of random scenarios, calculates estimated returns and a range of outcomes that is based on the assumptions included in this analysis. This is provided for informational purposes only and is not intended to provide any assurance of actual results. The simulation will not capture low-probability, high-impact outcomes. The results of the simulations may be presented in the form of percentiles, reflecting the probability distribution of the portfolio values and statistics. While we believe the calculations to be reliable, we cannot guarantee their accuracy.

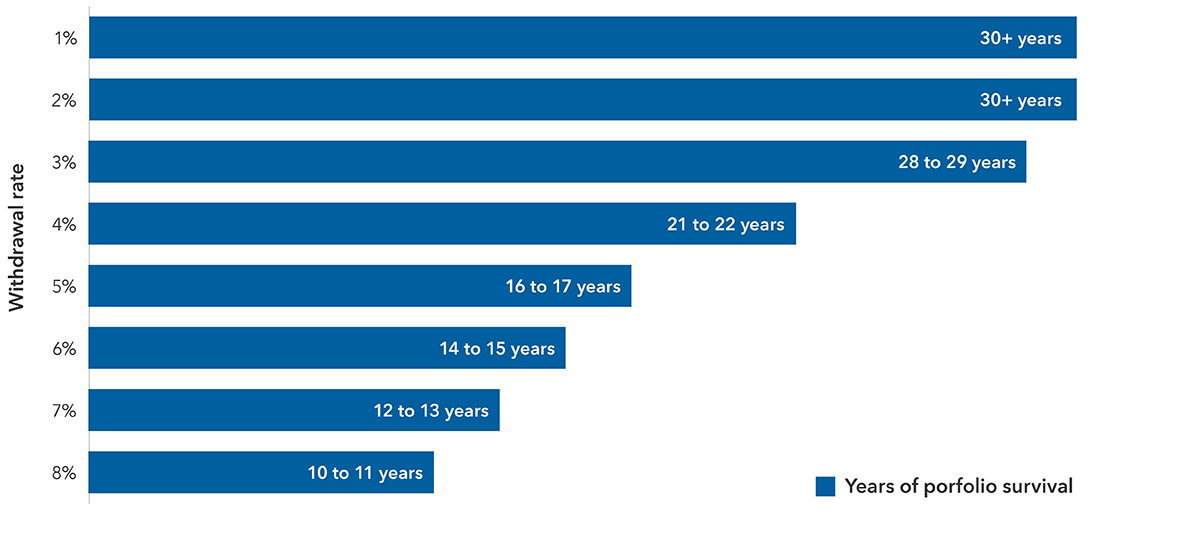

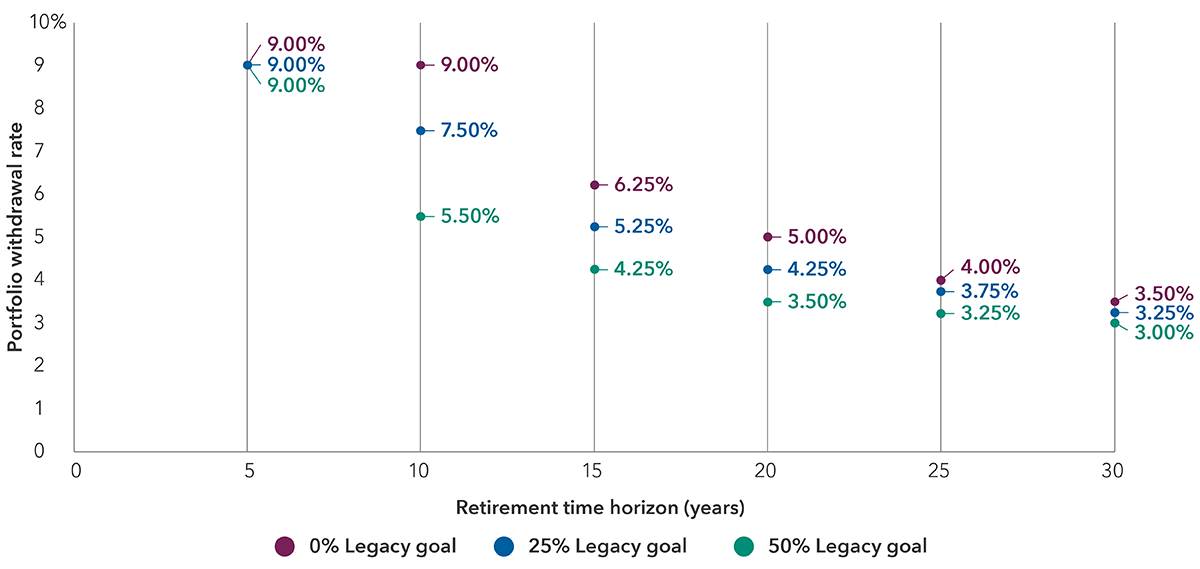

The following assumptions were used in the Monte Carlo simulation:

- The investor withdraws a fixed percentage of the initial portfolio value each year for up to 30 years. Withdrawals are increased by either 2.25% or 3.0% where noted each year after the first year to adjust for inflation.

- The 3% and 4% withdrawal rate scenarios are shown for illustrative purposes only.

- The hypothetical portfolio used in these simulations employed Capital Group’s capital markets assumptions (CMAs) for 60% global equities (represented by the MSCI All Country World Index) and 40% U.S. aggregate fixed income (represented by the Bloomberg U.S. Aggregate Index). Assumed hypothetical returns for the equity portfolios were 6.5% with a standard deviation of 15.6%; assumed hypothetical returns for U.S. fixed income were 4.1% with a standard deviation of 3.9% as of December 31, 2023.

The portfolio success rate in the hypothetical illustration is the percentage of simulations where the hypothetical portfolio sustained the applicable withdrawal percentage each year for 30 years (inclusive of a 2.25% or 3.0% annual inflation increase where noted). While we believe the calculations to be reliable, we cannot guarantee their accuracy. Simulation results may vary.

About capital markets assumptions: This analysis represents the views of a small group of investment professionals based on their individual research and are approved by the Capital Market Assumptions Oversight Committee. They should not be interpreted as the view of Capital Group as a whole. As Capital Group employs The Capital System™, the views of other individual analysts and portfolio managers may differ from those presented here. They are provided for informational purposes only and are not intended to provide any assurance or promise of actual returns. They reflect long-term projections of asset class returns and are based on the respective benchmark indices, or other proxies, and therefore do not include any fees or any outperformance gain or loss that may result from active portfolio management. Note that the actual results will be affected by any adjustments to the mix of asset classes. All market estimates are subject to a wide margin of error.

Standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

MSCI All Country World Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.