This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

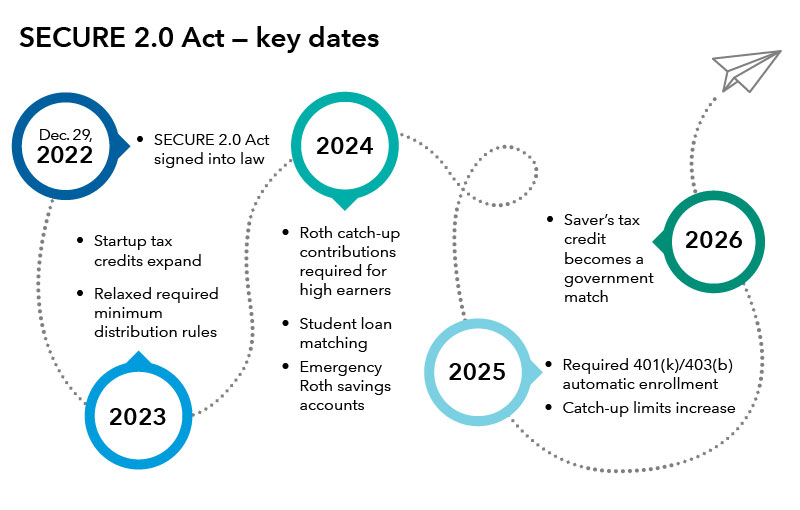

With more than 90 new provisions, the SECURE 2.0 Act of 2022 confronts plan sponsors with a number of mandatory provisions that take effect over a period of time. The good news is that most of the provisions are voluntary, and some are generating real interest across employers – especially small business owners.

An overview of provisions highlights the effort to incentivize small business retirement plans and to make it easier overall for Americans to save. Financial professionals may add value and potentially build business by clarifying the requirements and pointing out the business opportunities of the most significant piece of retirement legislation in years.