1 DALBAR, Inc., 2024 QAIB-VA Report, www.dalbar.com

2 The average investor in a variable annuity subaccount has 80% of their portfolio in equities compared with the average mutual fund investor who has 74% in equities (similar to 2022, when allocations were 80% and 72%, respectively).

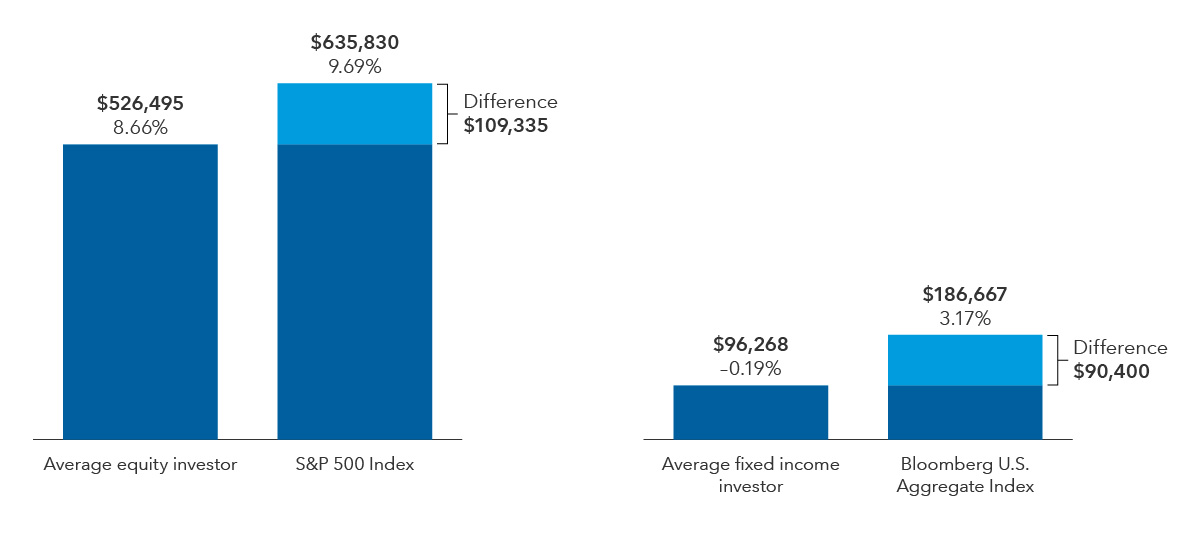

3 Returns for average equity and fixed-income investors calculated by DALBAR. DALBAR uses data from the Investment Company Institute (ICI), Standard & Poor’s, Bloomberg and proprietary sources to compare mutual fund investor returns to an appropriate set of benchmarks. These results are then compared to the returns of respective indexes. Ending values for the indexes and hypothetical equity and fixed-income investor investments are based on average annual total returns.

4 These features often come at an additional cost to the policyholder.

DALBAR's Quantitative Analysis of Investor Behavior (QAIB) uses data from the Investment Company Institute (ICI), Standard & Poor’s and proprietary sources to compare the average equity subaccount investor (“Average Subaccount Investor”) returns to the average mutual fund investor (“Average Mutual Fund Investor”) and an appropriate benchmark. Covering the period from January 1, 2000, to December 31, 2023, the study utilizes variable annuity equity and fixed income subaccount sales, redemptions and exchanges each month as the measure of investor behavior. These behaviors reflect the “Average Investor.” Based on this behavior, the analysis calculates the “average investor return” for various periods.

Past results are not predictive of results in future periods.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity's value fluctuates with the market value of the underlying investment options, and all assets accumulate tax deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

“Bloomberg®” and Bloomberg U.S. Aggregate Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Capital Group. Bloomberg is not affiliated with Capital Group, and Bloomberg does not approve, endorse, review, or recommend Capital Group products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Capital Group products.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.