Chart in Focus

Millennials

Thirty-five years of loyal service, a gold watch and a champagne send-off, followed by a steady pension. That was once the path to the American dream. Nowadays, it’s more like a fantasy. In its place is the so-called gig economy – the technology-enabled trend of individuals using their cars, homes, skills and spare time to earn income as freelancers.

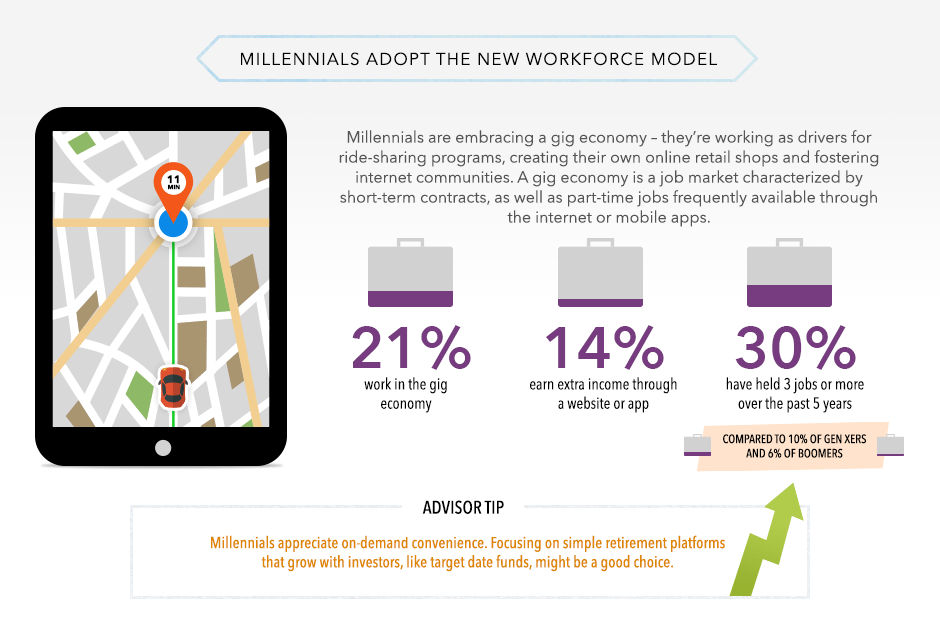

Millennials, many of whom entered the labor force just as the financial crisis was upending the job market, are at the forefront of this growing trend. The “Wisdom of Experience” survey, commissioned by Capital Group, reveals that 21% of millennials work primarily in the gig economy, while an additional 14% earn extra income through a website or app. And the trend doesn’t show signs of slowing: A separate Intuit 2020 Report estimates that more than 40% of the U.S. workforce will be freelancers by the year 2020.

Without an employer-sponsored retirement plan, freelancers must handle their own savings — and that can pose problems. Some reports indicate that as many as 70% of freelancers have no long-term savings at all. But the Wisdom of Experience survey found that millennials really care about saving for retirement: One in five ranked retirement saving as their top financial priority; the rest put it second, just below rent or mortgage payments.

So how can millennials in the gig economy take control of their retirement? We spoke to four financial advisors to get their tips:

Fill multiple buckets to weather droughts

Divam N. Mehta, founder of Mehta Financial Group:

“Income can be unsteady and unpredictable for millennials working in the gig economy. It is vital to start saving early in a tax-advantaged vehicle. Savings automation may not be the best idea for workers in the gig economy because of unsteady cash flow. Instead, it is critical that individuals remain disciplined and make timely contributions to a tax-advantaged vehicle as they get paid.

“Since financial flexibility is going to be critical for freelance millennials, it may be beneficial to have multiple accounts (tax-advantaged and taxable). Tax-advantaged retirement accounts will have liquidity restrictions, whereas taxable accounts will not. To retain maximum flexibility and liquidity, it may be suitable for millennials to contribute to both type of accounts as cash flow allows.”

Saving receipts saves money

Tony Chan, founder of Crossroads Planning:

“The first thing I advise is to get ahold of your recordkeeping. Good recordkeeping is priceless for a freelancer or a business owner. Not just recording your expenses, but your travel, your meeting with clients and anything that would traditionally be covered by employers. There are many upfront expenses and many expenses that are tax-deductible.”

“You need to have your books in great shape in order to know how much estimated tax you need to pay. And then I suggest millennials automate their savings, putting away 20% in savings to take care of taxes and retirement.”

Take (tax) advantage of lower earnings

Sophia Bera, founder of Gen Y Planning:

“I love Roth IRAs, and think that they could be a great fit for millennials because they’re usually in their lower income-earning years, which means that they are in a low tax bracket. Since you pay taxes on the money before you put it into the Roth IRA, you get to take it out tax-free in retirement.

“It is also possible to set a retirement account for your own business, with a SEP IRA or a Solo 401(k). As your business starts to take off, you’ll likely have a much bigger tax bill than in the past. The money you put into these types of accounts is tax-deductible, which can help reduce what you owe in taxes each year. The max on these is $54,000 for 2017, so you are able to sock away a ton more money for retirement.”

Hire your own HR manager

Douglas Boneparth, president of Bone Fide Wealth LLC, co-author of The Millennial Money Fix:

“It’s essential to bring in a professional. In the gig economy, you have a lot more freedom, but you are your own HR department. And that means taking care of everything from retirement to disability insurance. It gets very complex, and can be very time-consuming.

“Bringing a professional in may seem expensive, but you have to remember that your time is worth something. Typically your time would be better spent working on your hustle and becoming a better businessperson than spending hours trying to structure your financial safety net all alone. And without professional help, it could end up more expensive in the long run. Financial professionals give you back your time and give you peace of mind.”

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Related Insights

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.