Chart in Focus

Economic Indicators

Despite one of the fastest interest rate hiking cycles in decades, the U.S. economy has defied expectations, notching quarter after quarter of solid growth. Consumer strength, buoyed by pandemic stimulus, has been a big driver of this resilience. But government spending may only be part of the story. Homeowners who locked in low-rate mortgages could be benefiting from some “silent” wealth effects, which may also be adding to the economy’s surprising robustness.

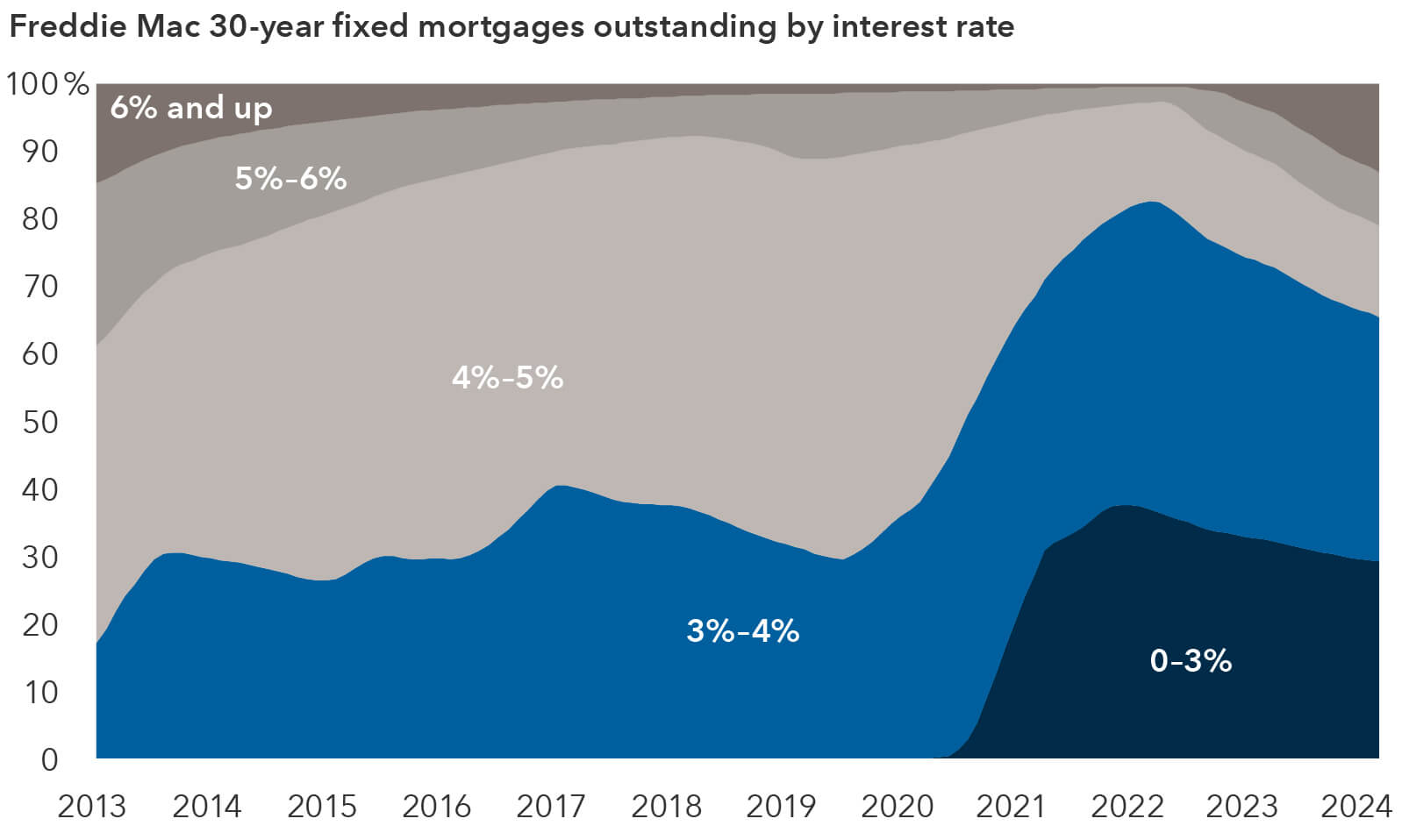

Properly quantifying these silent benefits can be difficult to do with precision, but the data we have available can help approximate their potential magnitude. Roughly 65% of the outstanding mortgages currently backed by Freddie Mac are held at a coupon rate of 4% or lower. If we extrapolate this to the broader U.S. mortgage market, it implies somewhere between $8 trillion and $12 trillion of home value could be locked in low-coupon financing.

These low-coupon borrowers could ostensibly be experiencing higher real wages (income adjusted for inflation) because their lower monthly payments help insulate them from the impact of rising real estate prices as measured in inflation gauges like the Consumer Price Index. And that could have significant effects on the economy.

Trillions in low-coupon mortgages could be boosting U.S. consumer spending

Source: Bloomberg. Data as of March 1, 2024.

Low-rate homeowners may also be forgoing plans to upgrade to pricier homes due to affordability concerns and, choosing instead, to spend more on goods and services or other investments. With shrinking supply leading to soaring home prices, they also will have presumably built up substantial amounts of equity in their homes, which could potentially create an even higher “net worth effect,” making them feel richer and thus more likely to spend.

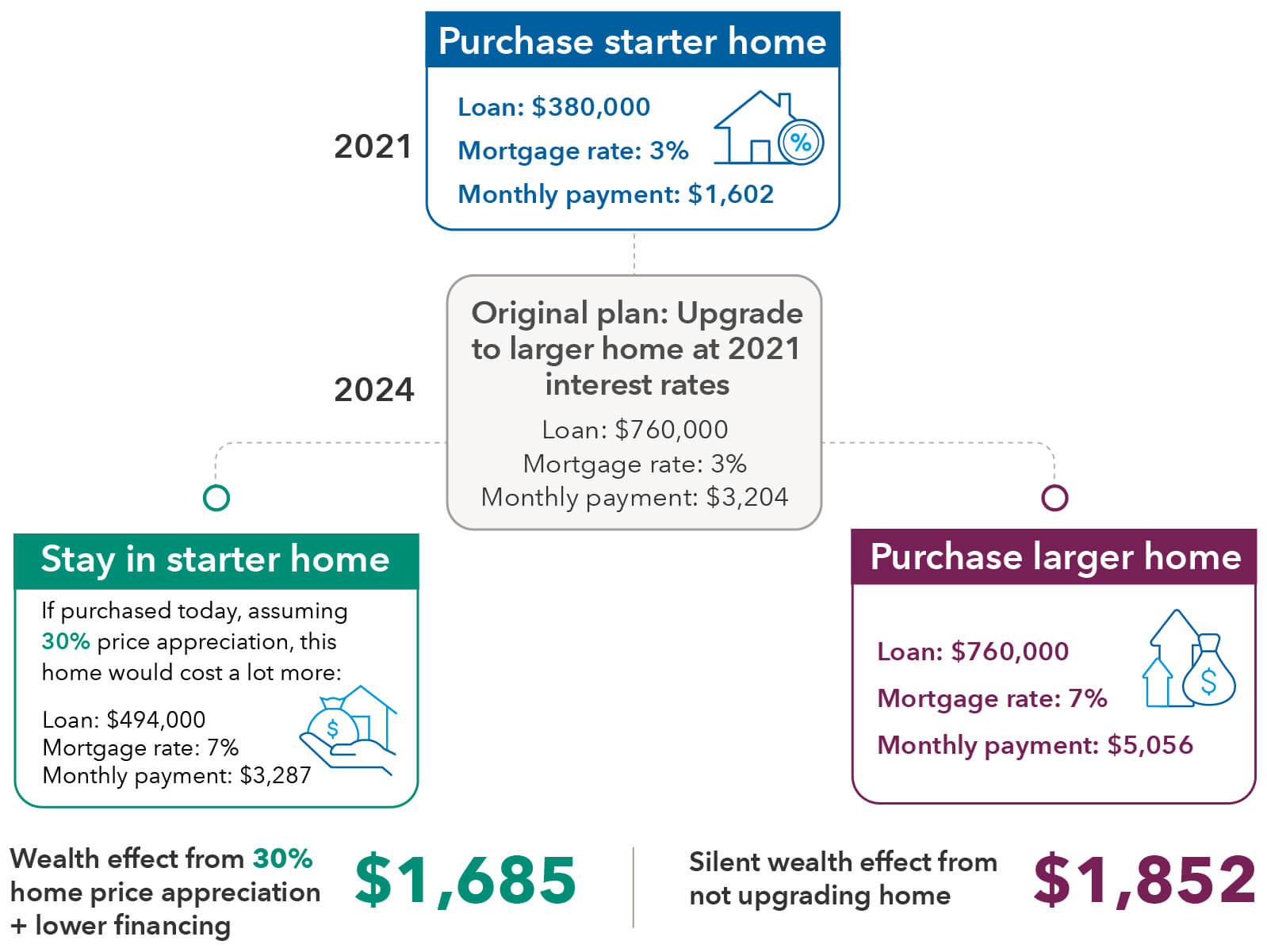

A hypothetical example

This silent wealth effect may work as follows. Let’s say a homeowner, Jane Doe, bought a house in 2021. She got a $380,000 mortgage (around the average agency mortgage loan size at the time) at a 3% rate. Between 2021 and 2024, Jane had two more kids and received a promotion. Now, she could use a little more space. She always intended to move as her family grew, but the landscape has shifted in the three years since she purchased her home.

The current value of her home has gone up 30%. Jane expected to be able afford a house twice as expensive as her 2021 purchase by 2024. But changes in rates and home prices dashed her plans — a house that cost double her current home would not only be smaller than she imagined but would require monthly payments more than three times higher what she currently pays. So instead, Jane decides to invest in some bunk beds and take the family on a vacation.

Source: Capital Group.

Although Jane may be living in cramped quarters, she feels surprisingly good. Her monthly disposable income feels higher than it did in 2021, even though her actual cashflow doesn’t look much different. Some say happiness is the gap between expectations and reality. In the context of consumer behavior, I view the wealth effect similarly.

Admittedly, this wealth effect would be somewhat mitigated by inflation. Jane will have to spend a larger percentage of her budget than she would have expected in 2021 on food, transportation, etc. But she has enough cushion to shoulder these higher costs.

The silent wealth effect could also extend to non-homeowners who may choose to continue renting and spend money that might have gone to a down payment on a house on other goods and services. Rents, however, are more reflective of prevailing interest rates than mortgage payments, so these renters may not feel as wealthy as low-coupon homeowners. Renters also don’t get the net worth boost from increasing home prices, but should rents continue to trend lower while home prices remain sticky, the silent wealth effect may increase for non-homeowners.

The big picture

The cumulative impact of this housing-related wealth effect on the economy is difficult to measure, but a look at the mortgage-backed securities market may help provide an estimate. Currently, the market is pricing 3% coupon mortgages (which we can use as a proxy for these borrowers) at roughly 15% below par. Assuming $12 trillion of home value in the U.S. is tied up in low coupon mortgages, it implies around $1.8 trillion could be creating a wealth effect for borrowers.

Could this be part of the reason the Federal Reserve’s rate hikes have not impacted the economy as drastically as expected? If the transmission of higher rates to individual budgets has been limited largely to areas outside of housing, it may help explain why the Fed has struggled to cool the economy compared to central banks in countries where a higher proportion of mortgages are floating-rate debt obligations. It may also explain why a large segment of consumers continue to feel wealthy enough to spend on a variety of goods and services, keeping the economy chugging along.

Agency mortgages are issued by three quasi-governmental agencies — the Government National Mortgage Association (GNMA), which is commonly called Ginnie Mae, the Federal National Mortgage Association (FNMA), which is generally referred to as Fannie Mae, and the Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac. Ginnie Mae operates as a government agency (unlike Fannie Mae and Freddie Mac) and its guarantees are backed by the full faith and credit of the U.S. government. Mortgage-backed securities issued by Fannie Mae and Freddie Mac are not backed by the full faith and credit of the U.S. government, but the agencies have special authority to borrow from the U.S. Treasury.

Consumer Price Index (CPI) — A commonly used measure of inflation that measures the average change over time in the prices paid by consumers for a basket of goods and services.

Par is the face value at which a bond is issued. When bonds trade well below their face value, risk is reduced as they will mature at par.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Markets & Economy

-

Artificial Intelligence

-

U.S. Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Shriya Gehani

Shriya Gehani