*Survey methodology

The survey was conducted over the month of November 2021. Results were received from Escalent (the survey partner firm) in February 2022. Capital Group was not identified as the sponsor of the survey.

A total of 2,361 respondents participated in the survey. The mix of respondents had to meet the following criteria to qualify for the survey:

· Age 20 or older

· A mix of retiree/pre-retiree status among age 50+

· Have primary or shared financial decision-making power in the household

· Actively investing

· Mix of advised and unadvised

· Recruit mix based on investible assets

Capital Group investors DCM simulator (feature preferences)

Of the 2,361 respondents who participated in the survey, 1,212 qualify for the discrete choice modeling (DCM). To qualify for the DCM, investors must be retired or 61 or more years old. Both investors and advisors were given sets of choices with varying end account values, max drawdown and investment horizons. Each combination of three parameters was paired with a "realistic" withdrawal rate.

Features and levels

Ending account balance

1. 25%

2. 50%

3. 75%

4. 100%

Years of withdrawal

1. 10 years

2. 20 years

3. 30 years

Tolerance for account balance loss

1. 15% or a decline from $30 to $25.50/share

2. 20% or a decline from $30 to $24.00/share

3. 25% or a decline from $30 to $22.50/share

4. 30% or a decline from $30 to $21.00/share

5. 35% or a decline from $30 to $19.50/share

**Preferred sources of withdrawals

Would you rather have the majority of your withdrawals come from the dividends and interest earned on your account(s) or from the sale of assets within your account(s)?

1. Capital gains (sale of assets)

2. Dividends and interest

3. No preference

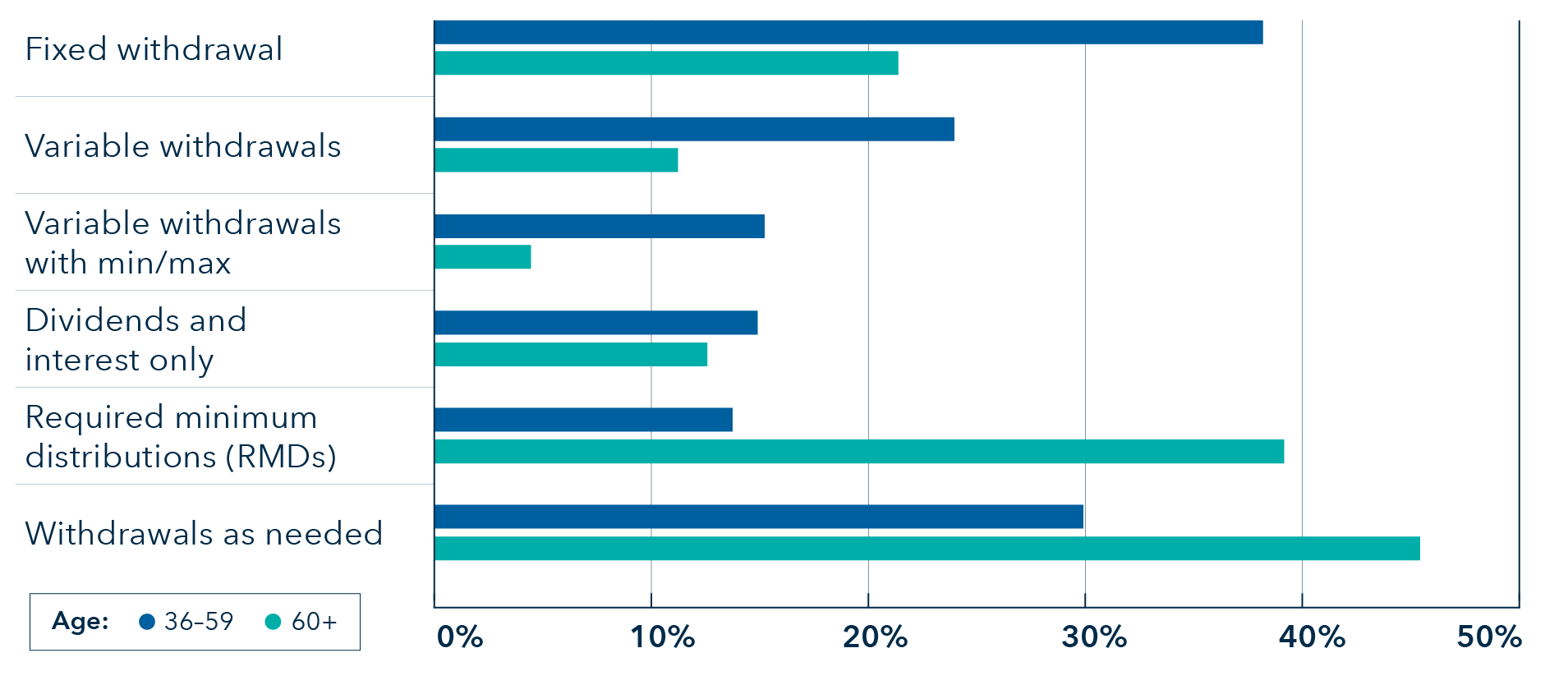

Withdrawal approaches among retired clients

Ask if retired: Which of the following withdrawal approaches from your retirement account do you use? (Select all that apply.)

Ask if not retired: Which of the following withdrawal approaches from your retirement account would you use once you reach retirement? (Select all that apply.)

1. Fixed withdrawal — as a percentage of initial account value, growing with inflation over time

2. Variable withdrawals — as a percentage of the current account value, which can change over time

3. Variable withdrawals with min/max — as a percentage of the current account value, which can change over time, but with a minimum or maximum dollar amount for each withdrawal

4. Dividends and interest only — using dividends and interest but not taking anything from the original account value

5. Required minimum distributions — will only withdraw the minimum required amount

6. Withdrawals as needed — will only withdraw funds as needed for expenses

††Expectations on the role of retirement

Ask if not retired: Which of the following resources or sources of income do you expect to use during retirement? (Select all that apply.)

Ask if retired: Which of the following resources or sources of income have you used during retirement? (Select all that apply.)

Randomized answers

1. Social Security

2. Distributions from retirement savings (401(k), IRA, 403(b), etc.)

3. Long-term care insurance

4. Distributions from nonretirement savings (interest bearing bank accounts, individual stocks/bonds in nonretirement accounts, etc.)

5. Employer- or government-sponsored pensions

6. Insurance or annuity payments

7. Income from business or real estate

8. Employer stock

9. Other resources or sources of income; describe here

N/A exclusive: None come to mind

† Social Security Administration. “Starting your retirement benefits early,” SSA.gov. Accessed May 2023.

‡ Social Security Administration. “Normal Retirement Age,” SSA.gov. Accessed May 2023.

§ Jones, Jeffrey M. “More in U.S. Retiring, or Planning to Retire, Later,” Gallup Poll Social Series, July 22, 2022.

‖ Bengen, William P. “Determining Withdrawal Rates Using Historical Data,” Journal of Financial Planning, October 1994.

# American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, http://www.longevityillustrator.org

Accessed May 2023.