Chart in Focus

Capital Ideas

Investment insights from Capital Group

Asset Allocation

- Small-cap stocks continued to deliver solid results this year.

- Tax reform and shelter from tariffs have lifted small U.S. companies’ shares.

- A strategic approach to small-cap stocks can be beneficial for portfolios.

Investors watching the powerful rally in small-cap stocks are probably asking themselves the same question: Did I miss it?

Shares of smaller companies have delivered solid results this year. The Russell 2000 small-cap index is up 8.8% through July 31, outpacing the 5.3% gain by the large-cap Russell 1000 index. It’s a significant trend not seen since 2016 because large-cap stocks — especially in the technology sector — dominated markets last year.

What’s driving small caps?

Several macro factors are playing to the advantage of small companies, which are drawing more investor attention, says Greg Wendt, a portfolio manager and analyst at Capital Group, including on the SMALLCAP World Fund®. These factors include:

1. Greater domestic focus

U.S. small-company shares delivered better results than global small-caps and U.S. large caps in part because they rely much less on global trade, Wendt says. These companies in 2018 have been somewhat shielded from tough talk on trade and tariffs between the U.S. and other nations. “They are more protected from the trade rhetoric,” he says.

Small U.S. companies garner 80% of their revenue domestically, compared with the roughly 60% of revenue that comes from the U.S. for larger firms. Capital Group defines small-cap companies as those with market capitalizations of $6 billion or less, based on the most recent prospectus of SMALLCAP World Fund.

2. Strong interest from investors and companies

Large companies looking for a quick way to address a new market have been aggressively buying smaller firms. Global merger and acquisition activity surged 57% to $2.49 trillion, the highest level since the first half of 2007, according to Dealogic. Large companies looking to grow often find that buying smaller firms with interesting products or those that address a lucrative market is the fastest solution, Wendt says

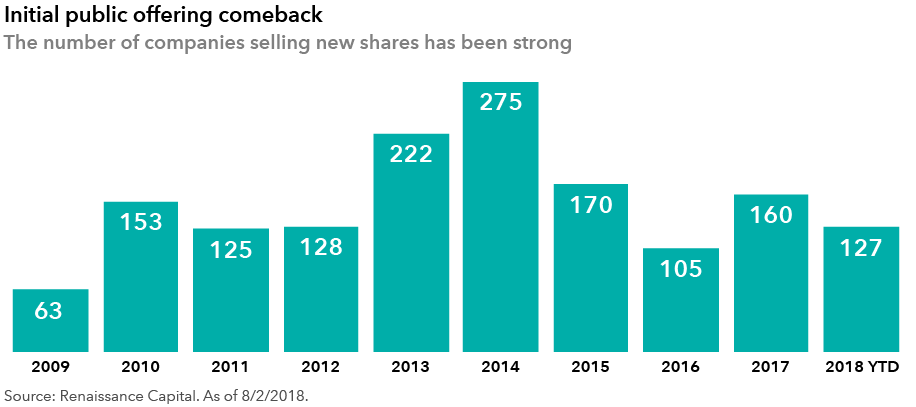

Meanwhile, the supply of small companies going public continues to proliferate, underscoring the sector’s growth promise to investors. Already this year, 127 companies have sold shares to the public, up 42.7% from the same period last year and on pace to be the busiest year for new issues since at least 2014, according to Renaissance Capital.

3. Tax reform

Efforts to lower tax rates for companies may benefit smaller firms more than larger ones because they typically pay higher rates. Companies in the Russell 2000 paid an effective tax rate of 31.9%, compared with the 28% effective tax rate of larger companies in the S&P 500, according to a September 2017 analysis by Reuters. Large firms kept their tax rates down in part by shifting revenue and cash to countries with lower tax rates, a strategy not usually available to small firms, Wendt says.

Have I missed the rally?

The key question isn’t whether the small-cap rally can continue, but whether investors are positioned to take advantage of the sector’s long-term opportunity.

Smaller companies can continue to create value by being nimble and innovative, says Sujit Chakravarthy, a Capital Group analyst. Innovation is present across sectors and takes various forms: from technological advances in biotech to process improvement in industrials and data-driven customer targeting in financial services. Creating a competitive advantage through innovation can help small-cap companies grow irrespective of macro events.

Identifying these opportunities requires research. One important aspect of small-cap investing is finding acorns that can grow into oak trees, says Peter Eliot, portfolio manager at Capital Group. “By turning over a lot of rocks, we have managed to find several excellent companies early in their life cycles,” he says. “We look for young companies with large market opportunities, outstanding management teams and high-quality businesses and then follow them closely as they grow.”

These opportunities have emerged across a variety of industries and geographies, including healthcare, consumer, software, tech hardware, industrials and banks. The largest equity holdings of U.S.-based companies in SMALLCAP World Fund include health-care administrative services provider Molina Healthcare, online communications services provider RingCentral and gene therapy developer Bluebird Bio. Molina, RingCentral and Bluebird Bio accounted for 1%, 0.8% and 0.7%, respectively, of SMALLCAP World Fund’s assets as of July 31, 2018.

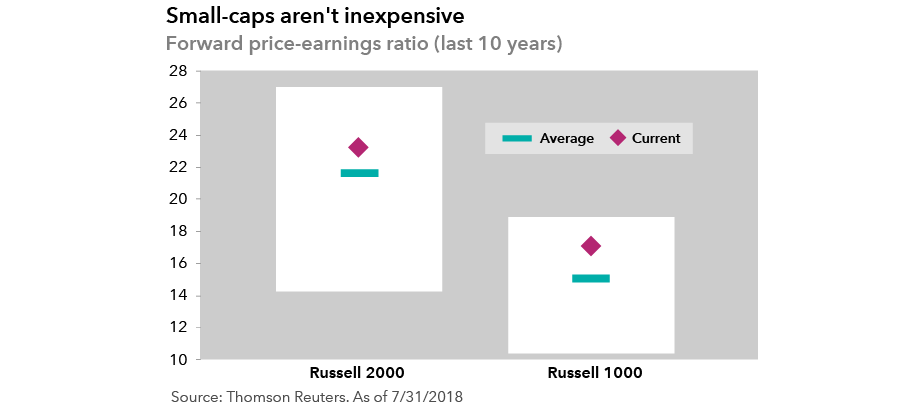

Interest in small-cap companies has driven valuations higher. The Russell 2000 is trading at 23 times what the companies are expected to earn this year, which is at the high end of its historic range, so this higher valuation level is not to be ignored, Eliot says. But investors can still find opportunities.

"It still comes down to looking for those future oak trees,” he says.

Small cap’s role in your portfolio

Small-cap stocks may offer large returns for investors, but not without risk. Of the thousands of publicly traded small companies, many will never deliver on the hopes of their founders and investors. Some may never launch their product. Others may be trampled by larger rivals or lose out to more fleet-footed companies.

That’s why investors looking at small-cap stocks may want to consider a few ways to approach the market:

1. Be strategic.

An allocation to small-cap stocks is a key component of a well-diversified portfolio. Small-cap stocks tend to be volatile in the short term, so investors should commit to them for at least a decade, Wendt says. “The way you protect yourself from the volatility is to be a long-term investor with at least a 10-year horizon.”

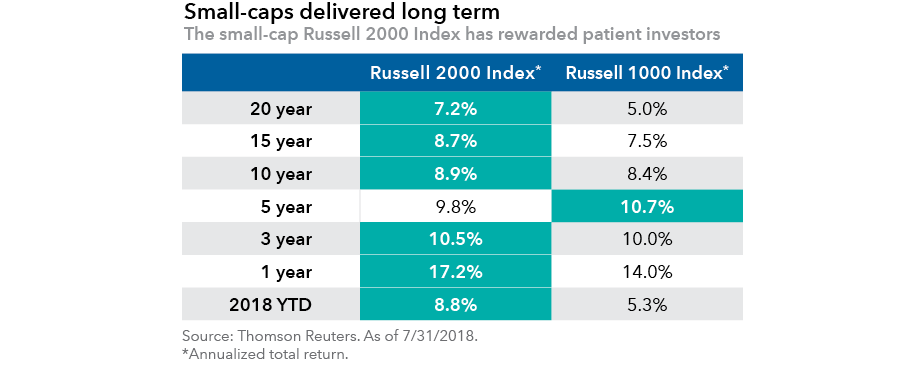

Data bears this out. The small-cap Russell 2000’s 8.9% average trailing 10-year return outstripped the 8.4% return of the large-cap Russell 1000 during the same period. During the trailing 20-year period, small caps pulled ahead even more: 7.2% to 5%. That’s even though large company stocks have topped small cap ones only about half the time over the past 30 years.

2. Be selective.

Find the disruptors.* *Not all small companies will grow up to dominate, such as Netflix did, but some will and they often are the ones that make a small-company portfolio successful. Finding small companies that can grow to be big ones requires extensive research since many of the companies are not widely followed or even known. Capital Group analysts and portfolio managers travel the globe looking for unique companies with breakthrough technology.

Some industries present better opportunities than reflected in indexes, Chakravarthy says. Biotech and software are two fields with some promising companies. Deep, fundamental research can help uncover investment opportunities in small companies that may be underrepresented in the index but can grow to be much larger over time.

3. Be diversified.

Given that small-caps are more volatile, they should be part of most portfolios but not the “core anchor tenant of an overall diversified retirement-focused investment strategy,” Eliot says.

More risk-tolerant investors should work with their financial advisors to determine whether an allocation to small-cap stocks is appropriate for them. Capital Group’s Global Growth and Growth models hold 10% allocations in the SMALLCAP World fund. But even less aggressive investors can benefit from holdings in small-cap stocks. The chart below shows a breakdown of how Capital Group’s model portfolios are exposed to small-cap stocks as a percentage of their overall equity allocations.

What’s more, investors can add another layer of diversification by owning non-U.S. small companies, Wendt says. U.S. and non-U.S. small-cap cycles are not correlated, so investing in both may offer additional portfolio advantages.

Some of today’s small-cap companies have the potential to grow into large ones, sometimes very quickly. “It’s interesting when a small company becomes a big company,” Wendt says. “Where you can take something and continue to grow it, those are the areas that interest me.”

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Any reference to a company, product or service does not constitute endorsement or recommendation for purchase and should not be considered investment advice.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Asset Allocation

-

Global Equities

-

Global Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Greg Wendt

Greg Wendt

Peter Eliot

Peter Eliot

Sujit Chakravarthy

Sujit Chakravarthy