Chart in Focus

Technology & Innovation

Lather, rinse repeat. This set of simple instructions found on shampoo bottles is also proving to be, metaphorically, a sound business approach in today’s digital economy. From personal care items like shampoo and razors to streaming video and even technology, consumers and businesses are increasingly signing up for subscriptions to a widening range of goods and services.

Subscription businesses are hardly new. Americans have been signing up for newspapers and other periodicals since the Colonial era, and in the 1970s and ‘80s music lovers who subscribed to Columbia House’s mail order music service could look forward to a new record or cassette in the mail every month.

Once the purview of old-economy companies — such as makers of elevators offering lifelong service contracts, or Gillete’s approach to practically giving away razors and selling the blades — recurring revenue businesses have come into fashion with cutting edge technology companies. Digital platforms and the advent of cloud computing have added a new dimension to the subscription model by providing smart, nimble companies with three potential benefits: expand their addressable markets, provide repeatability of cash flow and deepen client loyalty.

“Companies that adopt a subscription-based model have good prospects for growth and the potential to deliver better earnings predictability and visibility,” says equity portfolio manager Alan Berro. “Earnings visibility is an important consideration for long-term investors.”

At this point in the economic cycle there is much talk about growth versus value, or U.S. versus international, but the subscription model is one that transcends all categories and represents a long-term secular trend. But not all subscription businesses flourish. Selectivity is critical. “Our fundamental research seeks to find the best of those companies, and when we find them we like to partner with them for the long term,” Berro says. “The best investments are the ones that just keep working for you.”

Here is a look at consumer- and business-focused industries where subscriptions are driving opportunity for companies and investors.

Streaming has altered the course of media consumption

Digital and mobile platforms have been at the epicenter of a seismic shift in the way people consume entertainment. These technologies helped foster the transformation from exclusively linear TV viewing to streaming media content on demand. Rather than being required to watch TV programs and movies by appointment in their living room, consumers can now receive content on their smartphones, tablets and laptops whenever they choose.

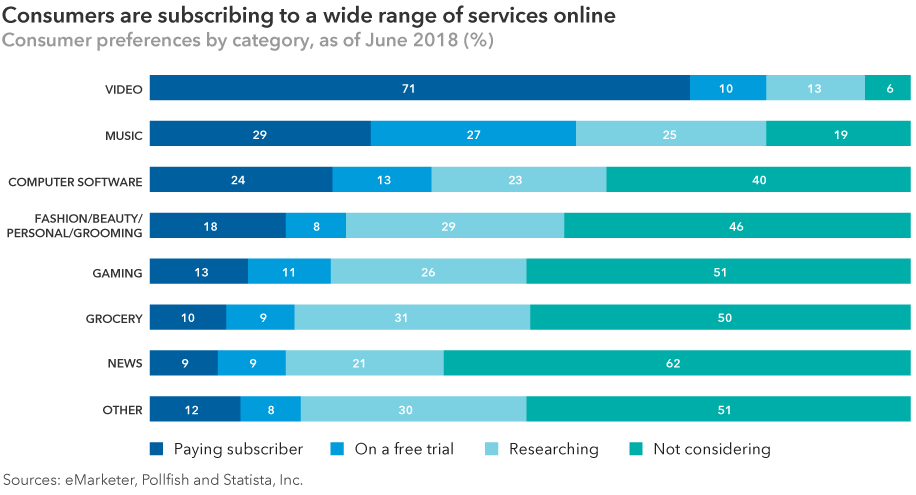

“The technology that’s now available and the infrastructure that’s in place has allowed streaming media companies to grow incredibly rapidly,” says equity investment analyst Brad Barrett, who covers U.S. media companies. Indeed, 46% of U.S. consumers polled in a 2018 McKinsey and Company report subscribed to a streaming media service such as Netflix, Hulu or Google’s YouTube.

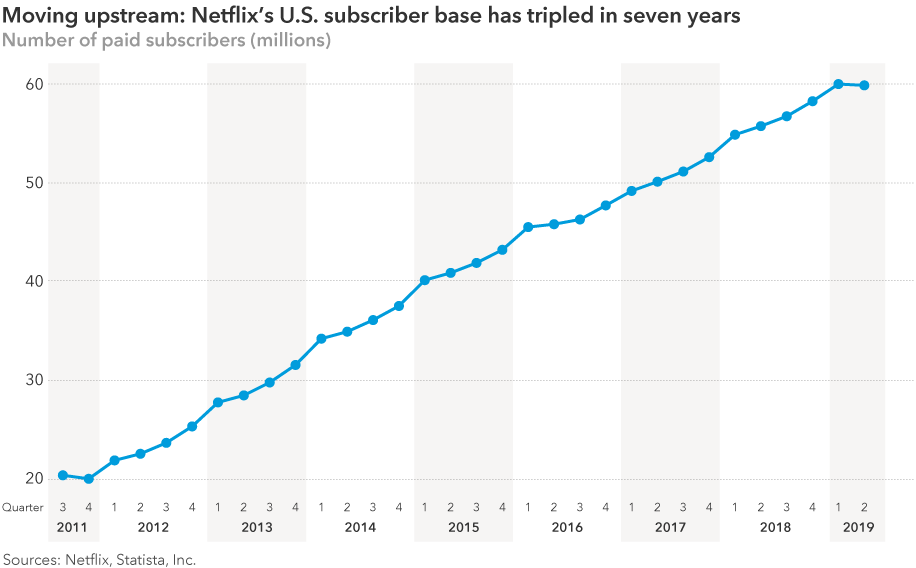

As of June 2019, Netflix had about 60 million U.S. subscribers, triple its total in 2011. Worldwide the number increases to nearly 150 million across dozens of markets. The competitive landscape may shift again later this year as Apple and The Walt Disney Company introduce their own platforms. However, the earlier entries have what may prove to be a significant head start, Barrett notes.

“I believe Netflix — as well as Hulu, YouTube and Amazon — have gotten sophisticated in using data analytics to put the right show in front of the right person at the right time,” observes Barrett. “In the future, that will be an important core competency of the winners in streaming video.”

Streaming is also transforming the way people listen to music. Just a few years after iTunes upended the music industry with the popularization of digital downloads, listeners today have moved en masse from downloads and CDs toward services such as Spotify, Pandora, YouTube and Apple Music. As of the end of 2018, total revenues for music streaming reached $7.4 billion, accounting for more than 75% of total digital music revenue in the U.S., according to the Recording Industry Association of America.

In the cloud, opportunity for software services is sky-high

Just as mobile platforms provided a tailwind for consumer-focused businesses like Netflix and Amazon, the advent of cloud computing has already created tremendous demand for online software service providers.

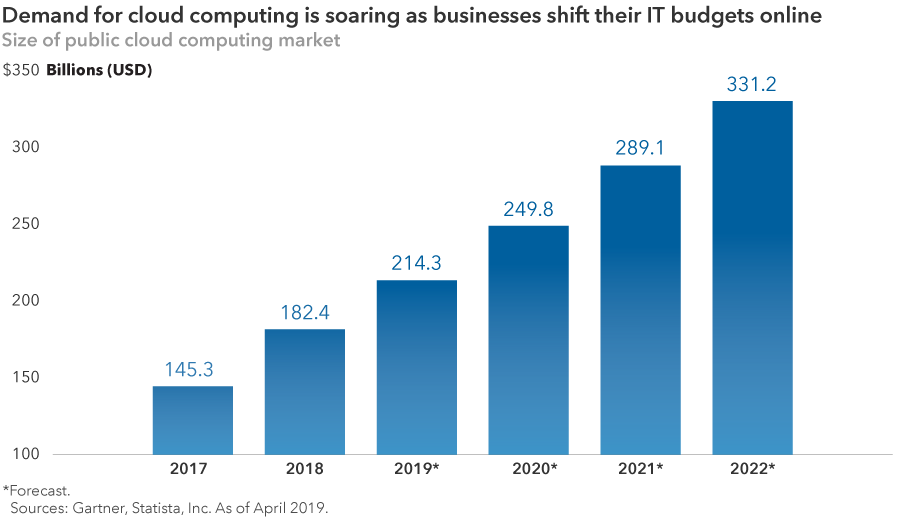

The cloud is a massive network of servers that provides users with remote access to storage and computing power through the internet. In other words, rather than making major investments in their own IT infrastructure, companies can gain access to data and software applications for a fraction of the cost through the cloud. By 2022, total spending in the public cloud computing market could reach $331 billion, up from $145 billion in 2017, according to industry researcher Gartner.

Boosting efficiency, slashing IT budgets

Cloud computing has already slashed infrastructure expenditures for companies and begun to transform business models. As the movement of IT workloads to the cloud accelerates in the coming years, demand will likely rise for Amazon Web Services and Microsoft’s Azure, the current leaders in cloud infrastructure.

“Over the next decade, there will also be significant opportunity for companies focused on providing software as a service to businesses in the banking industry, in pharmaceutical and in industrials,” says equity portfolio manager Anne-Marie Peterson. “By shifting from sales of hardware and software maintenance to a subscription-based model online, many service providers are expanding their addressable markets significantly. This is disrupting established business models while driving significant opportunity for early adopters.”

Consider ServiceNow, a subscription-based software services provider that manages human resources, help desk and other IT support. ServiceNow, which describes itself as a “digital workflow company,” claims 42% of the 2,000 largest global companies among its customer base, according to Fortune’s 2018 Future 50 report.

“ServiceNow’s subscription-based cloud offering has helped it retain customers at a high rate and also expand its addressable market,” Peterson says. “Many of their customers weren’t using software before.”

Within the financial industry, enterprise software firm Temenos Group provides software services to retail, private and community banks around the world. The company, based in Geneva, Switzerland, has more than 3,000 clients in 150 countries and is increasingly shifting its business toward a cloud-based subscription model.

“Temenos is well-positioned to increase its share of banks’ IT spending,” says equity portfolio manager Jody Jonsson.

Banks, often the product of mergers, often have IT systems that can’t communicate with each other. “Whenever I meet with banks, I hear them talk about their need to modernize their technology,” Jonsson notes. “So they subscribe to a service provider like Temenos that can provide them with a complete IT solution.”

Shifting to a subscription model can pay dividends

The increasing tendency among some technology companies to reward investors with regular dividend payments has depended partly on the shift from sales to a cloud-based subscription and service model. Exhibit A is Microsoft, once the world’s leading provider of desktop software. In 2011 the company shifted toward a subscription model with the introduction of Office 365, a cloud-based offering of its productivity software that includes Microsoft Word, Excel and PowerPoint. In addition, the company’s Azure is a top provider of cloud-based IT infrastructure.

“Microsoft has changed its business model,” explains Berro. “Today it is mostly a subscription business, and its earnings sustainability and visibility are better than they’ve ever been. As a value-oriented investor I love earnings visibility because it can help me better understand the sustainability of a company’s dividends.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Asset Allocation

-

Global Equities

-

Dividends

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Brad Barrett

Brad Barrett

Alan Berro

Alan Berro

Anne-Marie Peterson

Anne-Marie Peterson