The U.S. Federal Reserve, once the primary driver of markets, has taken a back seat this year to government actions and politics. So far, it’s been a bumpy ride.

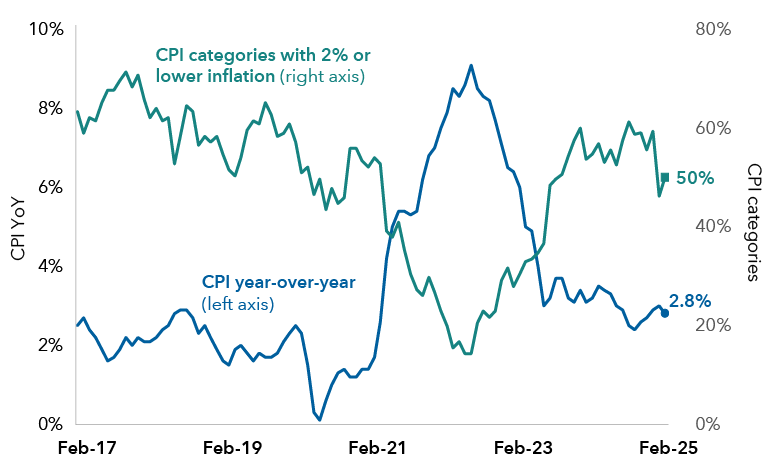

An avalanche of changes coming out of Washington, D.C., around tariffs, federal layoffs and immigration has raised questions about the trajectory of inflation and growth, sending the U.S. stock market into a correction and clouding the Fed’s outlook. Market discussions have shifted away from optimism about a soft landing to worries about declining growth and stagflation. Against this backdrop, the Fed kept its finger firmly on the pause button at Wednesday’s policy meeting as it adopted a wait-and-see approach. Investors are now left wondering about the Fed’s next move.

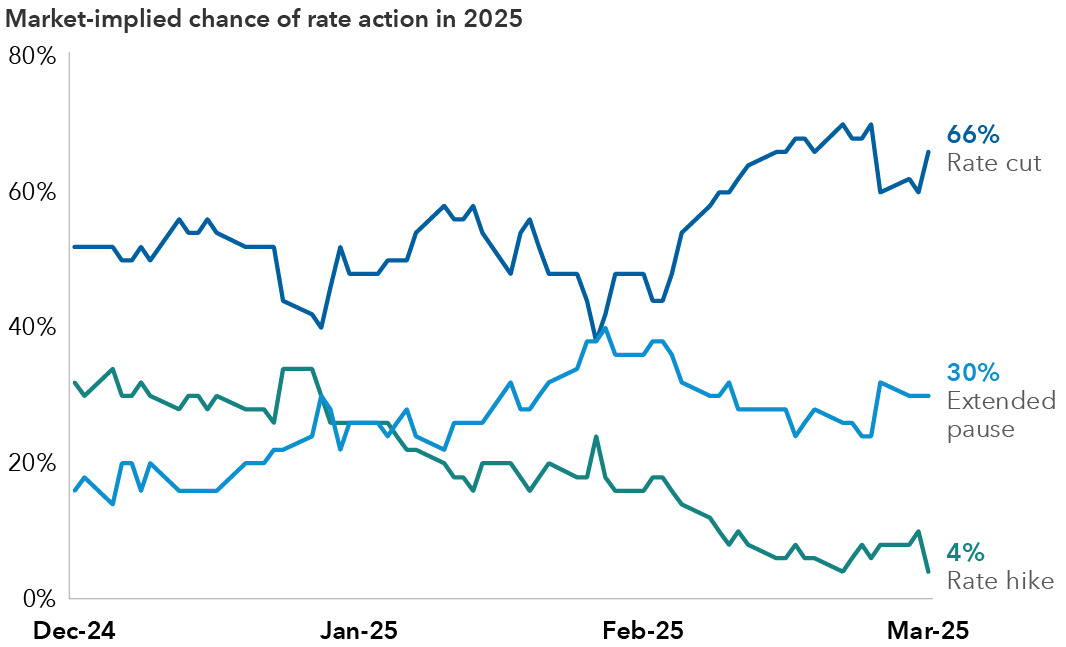

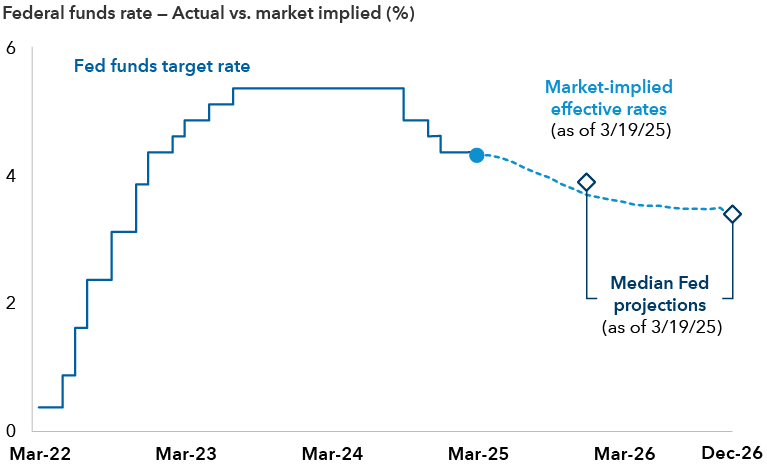

In my view, rate cuts remain the most likely outcome this year, though I see a patient Fed taking its time before pulling the trigger. Rate reductions are also on the market’s radar; futures markets indicate that the likelihood of a rate cut in 2025 reached about 66% after the March 19 meeting, compared with about 50% in mid-February. Meanwhile, the likelihood of a rate hike this year has fallen into single-digit territory. Separately, the market is pricing in between two to three 25 basis point cuts in 2025, compared with the two projected by the Fed.