After years of giving investors heartburn, interest rate volatility has some lingering impacts. While the U.S. Federal Reserve cut rates three times in late 2024, it paused cuts in its January meeting and now anticipates only two cuts for 2025. With remaining cuts more meandering, likely to be deliberate and data-dependent, interest rates may remain elevated for a longer period. This would create an excellent opportunity for investors looking for income.

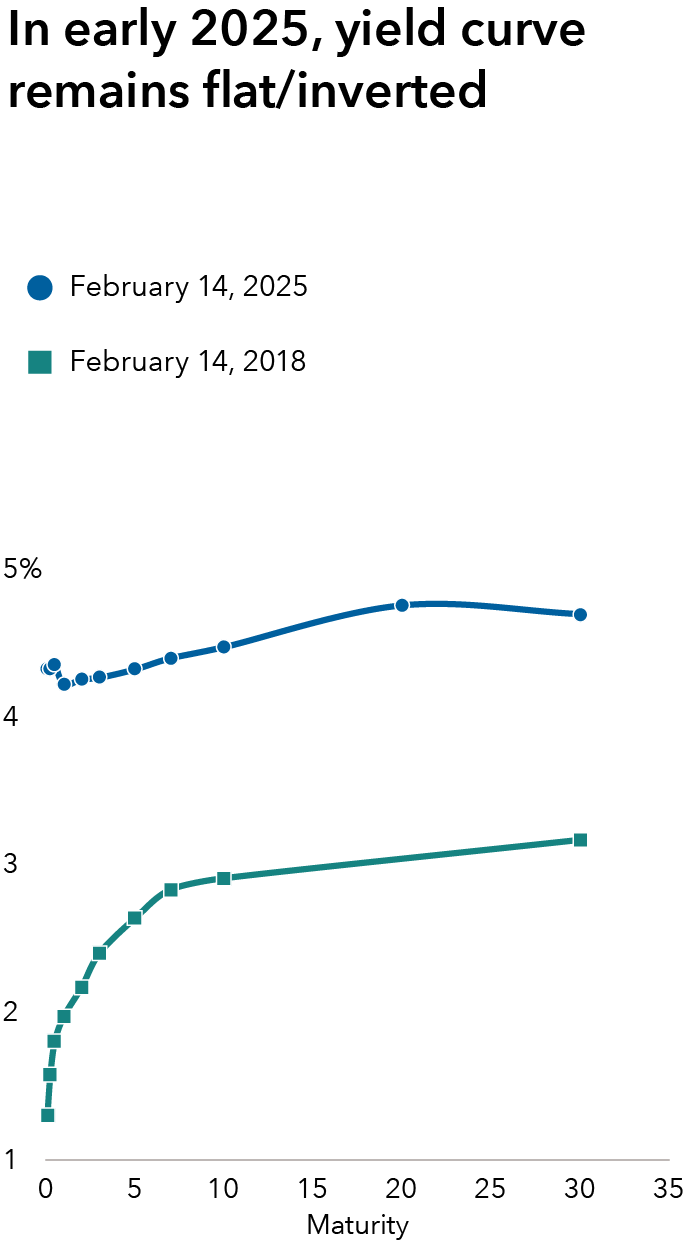

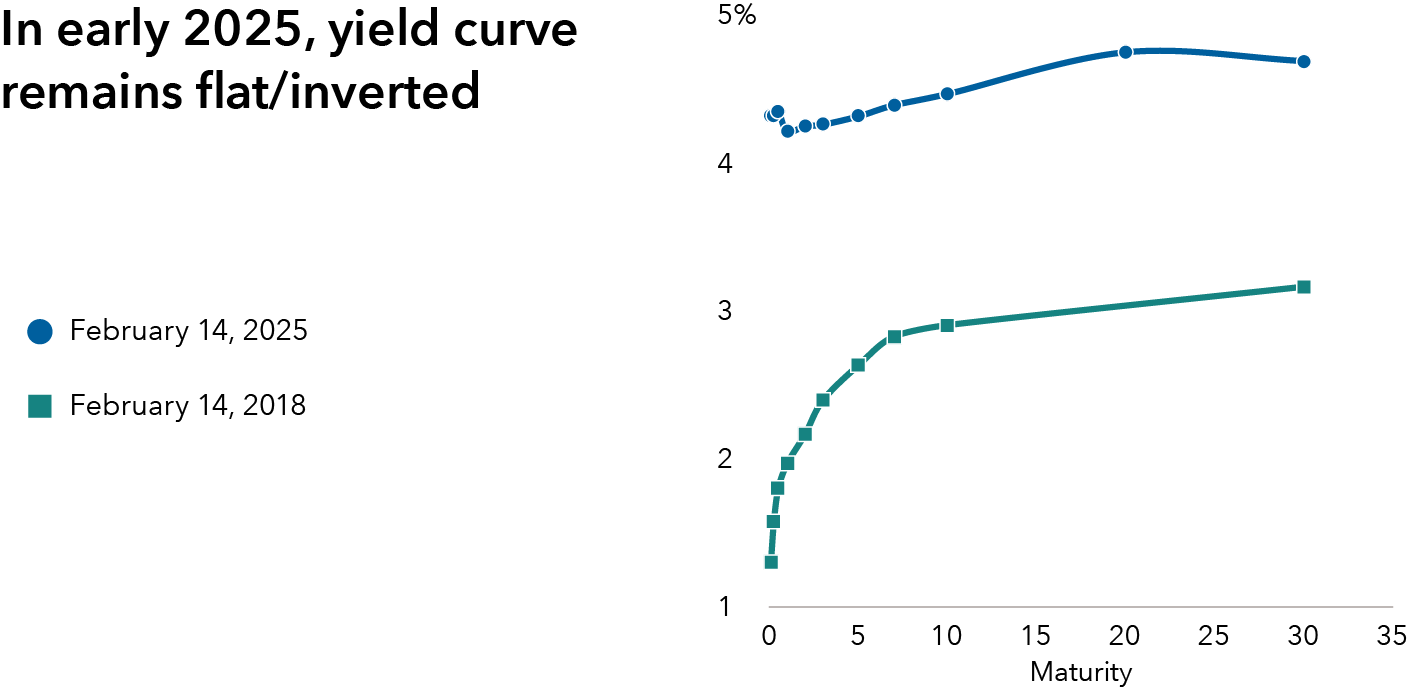

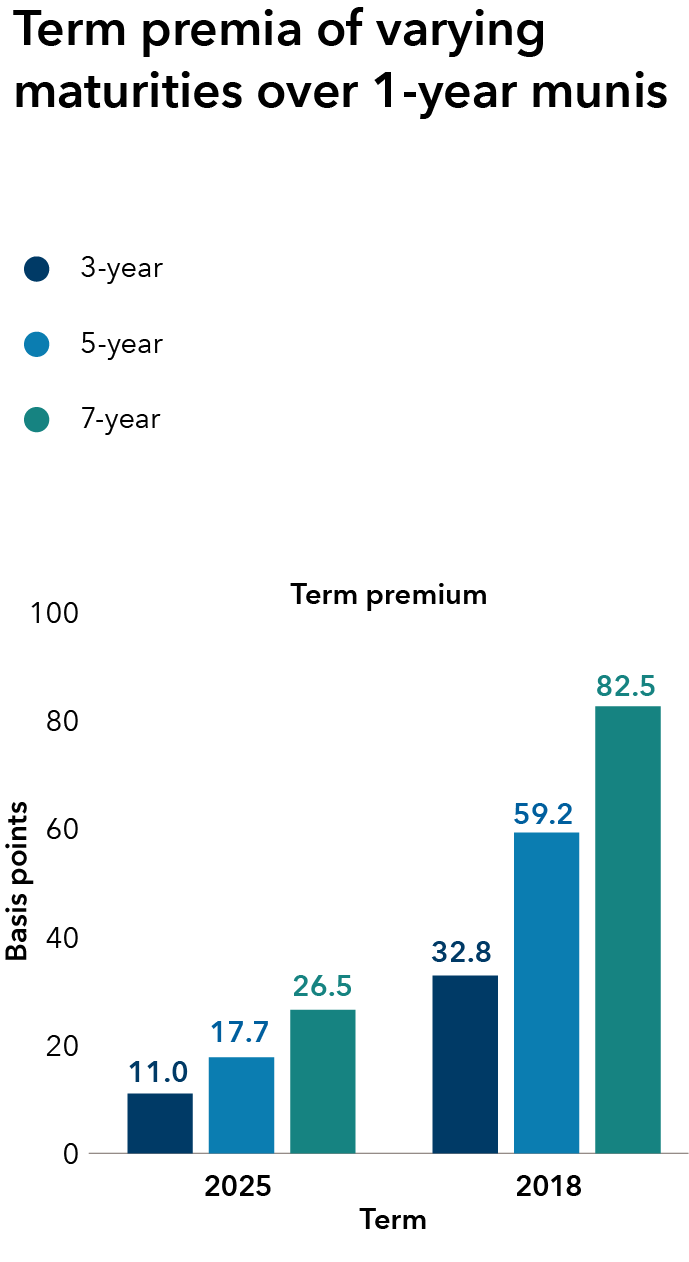

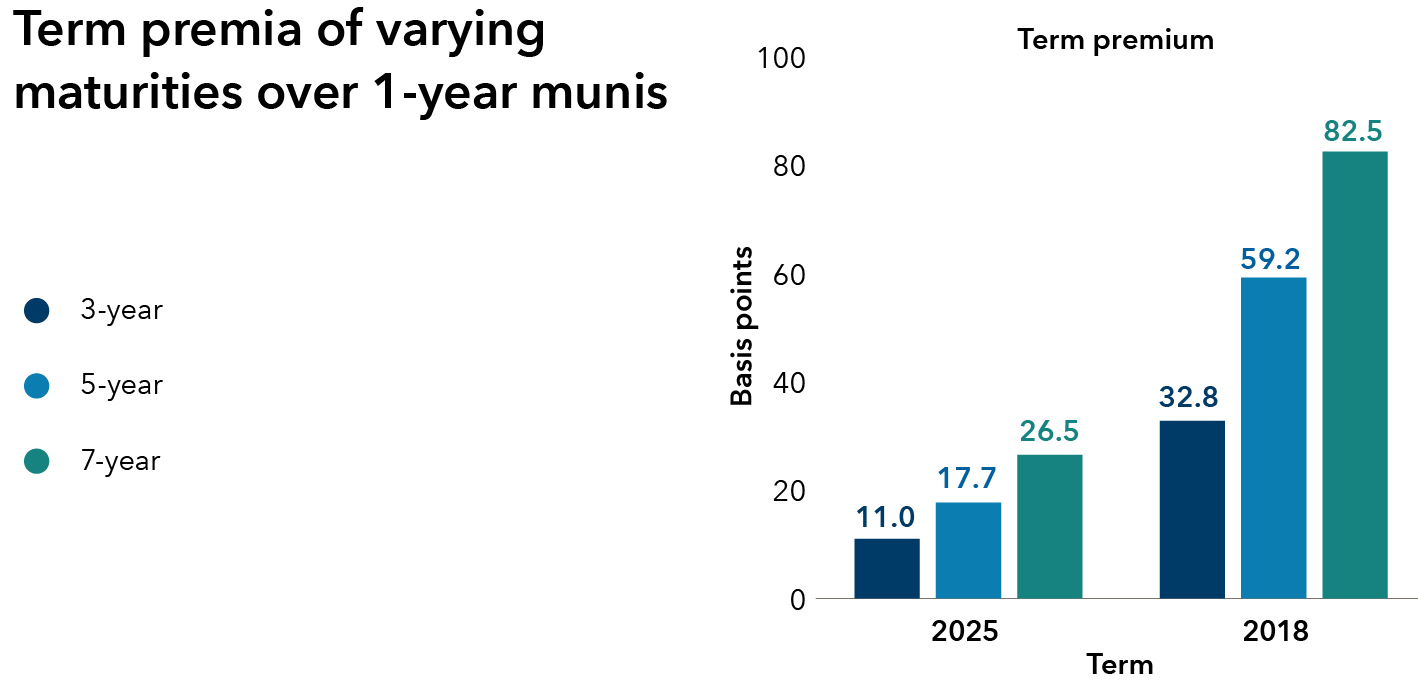

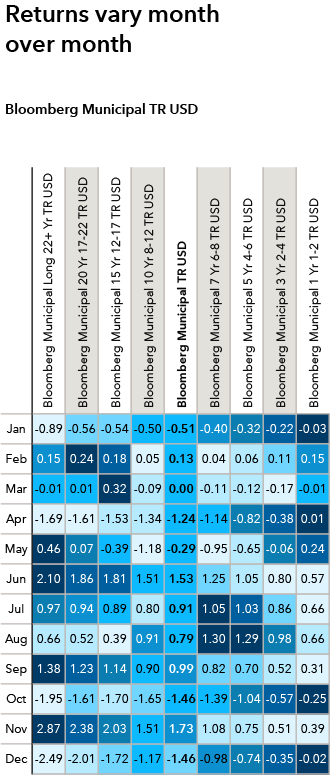

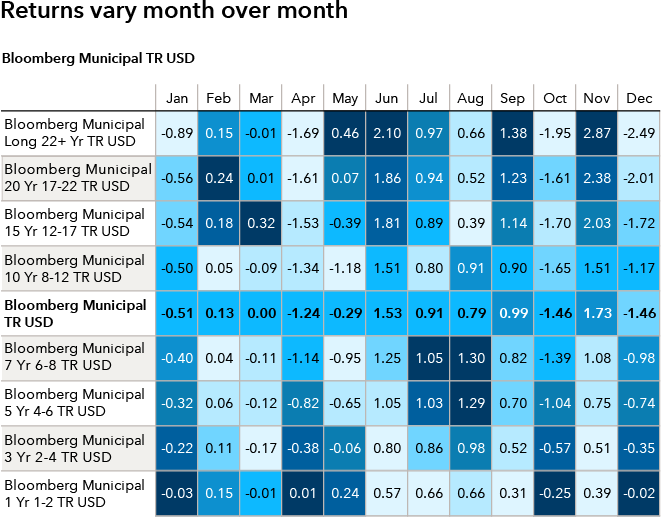

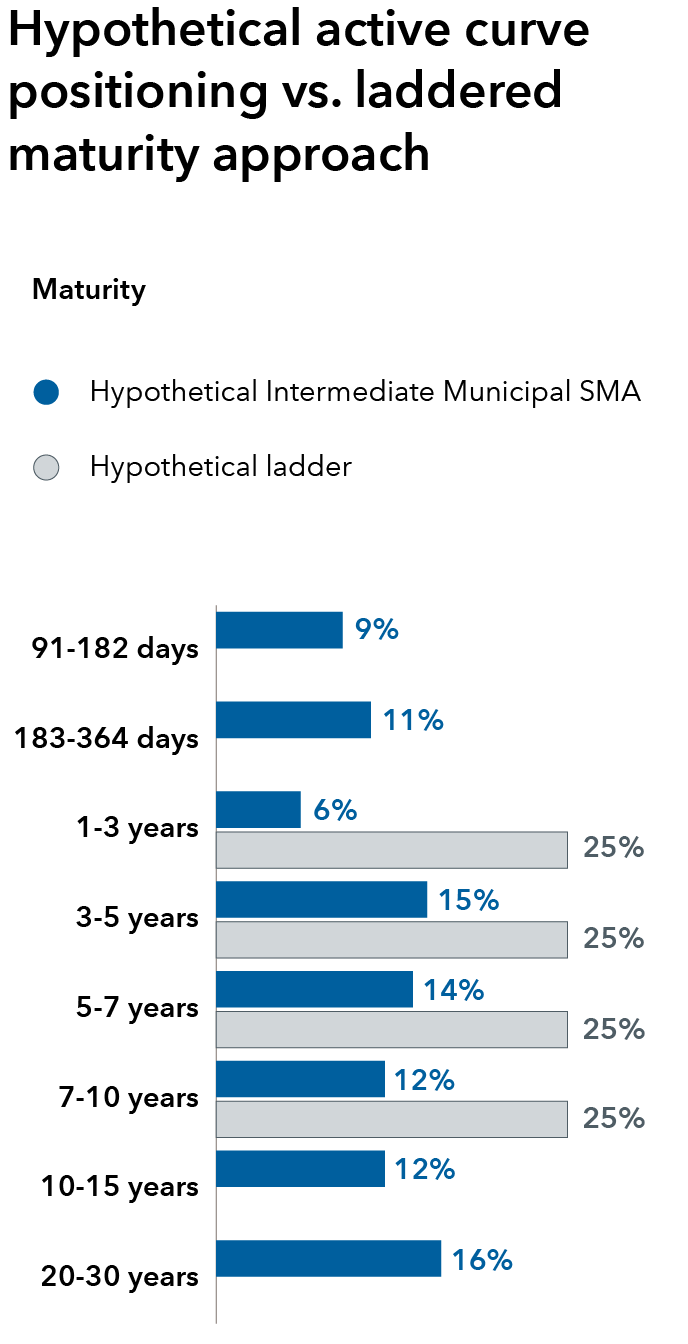

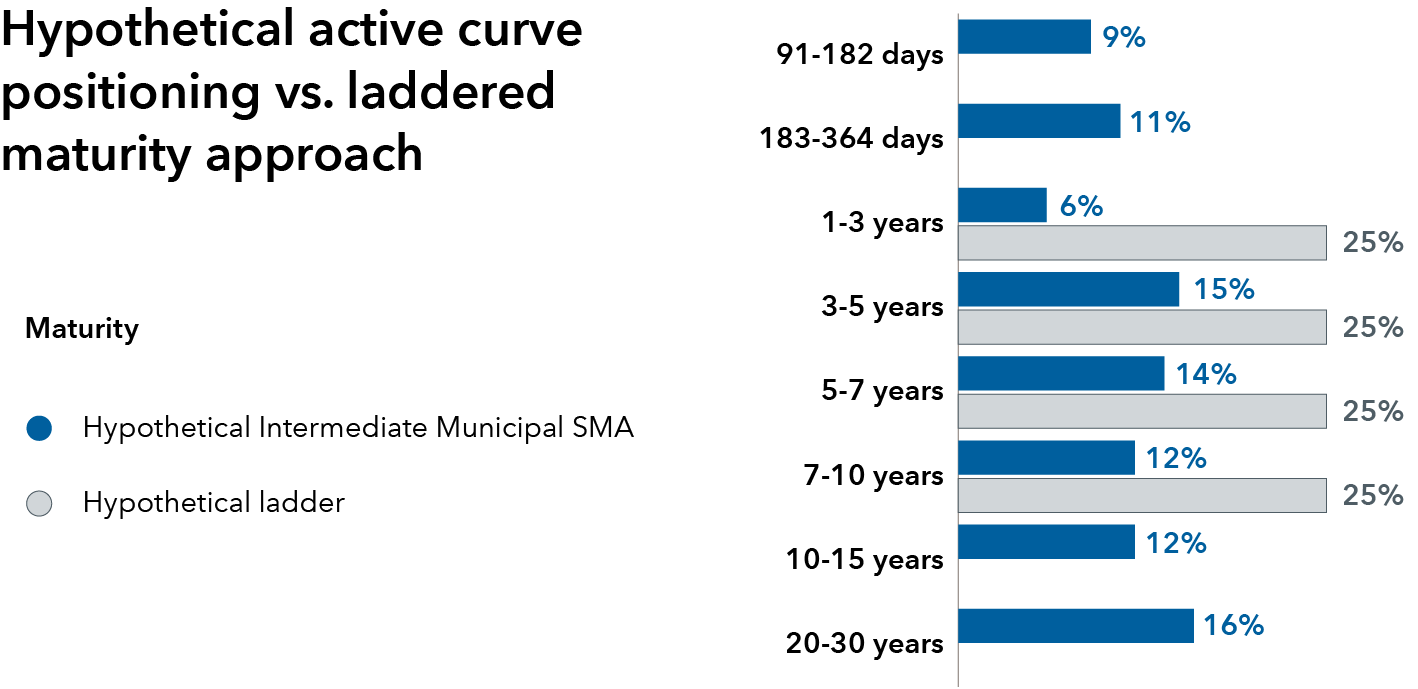

One group of income-seekers – municipal bond investors – has another consideration: The shape of the yield curve poses a problem for those who have relied on laddered strategies. A prolonged period of yield curve inversion – meaning shorter term interest rates were higher than longer term rates – turns the strategy of building a portfolio of bonds with increasing maturities and yields on its head. Even as the curve now just begins to normalize, it could be years before ladders’ value proposition makes sense again. Instead, an active approach to interest rate positioning that seeks to seize opportunities as the rates landscape evolves could benefit municipal bond investors.

Muni bond ladders: Popular, but potentially problematic

A muni bond ladder constitutes a portfolio of muni bonds of differing maturities, from shorter to longer. Upon maturity of the bond with the shortest life, the proceeds are typically reinvested in a new bond. That new bond becomes the longest maturity bond in the portfolio. This extends the ladder. The interest received from bond ladders is designed to be regular and predictable, and a ladder approach is easy to understand.

In a “normal” yield curve environment – when longer term bonds provide a term premium consisting of more yield than shorter term bonds – investors can benefit from the higher yields offered by the longer maturities. But we haven’t had a truly normal yield curve for some time. That means investors building ladders could be missing out on higher income potential.