A prudent approach to international investing

Capital Group International Vantage strategy

INCEPTION DATE

January 1, 1987

IMPLEMENTATION

Consider as a core international allocation

OBJECTIVE

Seeks to provide prudent growth of capital and conservation of principal

VEHICLES

American Funds® International Vantage Fund

Capital Group International Equity SMA

Focuses on companies with characteristics associated with long-term growth and resilience to market declines, including strong balance sheets and dividend payments.

Pursues prudent growth of capital and conservation of principal by investing in companies predominately based in developed markets that may offer attractive growth opportunities.

SEEKING RESILIENCE

A focus on prudent growth of capital

The Capital Group International Vantage strategy has a proven track record of participating in rising markets, while seeking to provide relative protection on the downside by focusing on international growth companies with resilient characteristics.

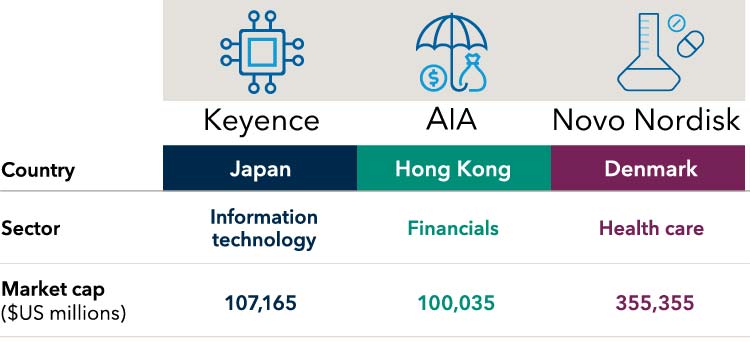

IDENTIFYING LONG-TERM LEADERS IN A BROAD RANGE OF SECTORS

Examples of top holdings in the portfolios1

Sources: Bloomberg Index Services Limited and FactSet. As of December 31, 2023.

One investment strategy, multiple ways to invest

The first is American Funds International Vantage Fund, which is offered in various share classes designed for retirement plans, nonprofits, and other institutional and individual investors.

For high net worth clients, consider the Capital Group International Equity SMA, which has a similar objective as the fund and is managed by the same team of portfolio managers.

1Companies shown are among the top 20 holdings by weight in Capital Group International Vantage fund representative account* as of December 31, 2023. (Novo Nordisk, ASML, AstraZeneca, TotalEnergies, Safran, SAP, London Stock Exchange Group, Nestlé, Sika, EssilorLuxottica, L'Oréal, TSMC, Keyence, AIA Group, ABB, Engie, STMicroelectronics, Industria de Diseno Textil SA, LVMH Moet Hennessy Louis Vuitton, Air Liquide).

*Capital Group International Vantage Strategy is represented by the International Equity Composite, managed by Capital Group Private Client Services.

For the fund, portfolios are managed, so holdings will change. Certain fixed income and/or cash and equivalents holdings may be held through mutual funds managed by the investment adviser or its affiliates that are not offered to the public.

For the SMA holdings, portfolios are managed, so holdings will change. Holdings mentioned and their results are not representative of other holdings in the portfolio or the portfolio's results.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

© 2024 Capital Group. All rights reserved.