Capturing the growth potential of emerging markets

New World Fund®

INCEPTION DATE

June 17, 1999

IMPLEMENTATION

Consider for an emerging markets allocation

OBJECTIVE

Seeks to provide long-term capital appreciation

VEHICLE

New World Fund

A MULTIDIMENSIONAL APPROACH TO EMERGING MARKETS INVESTING

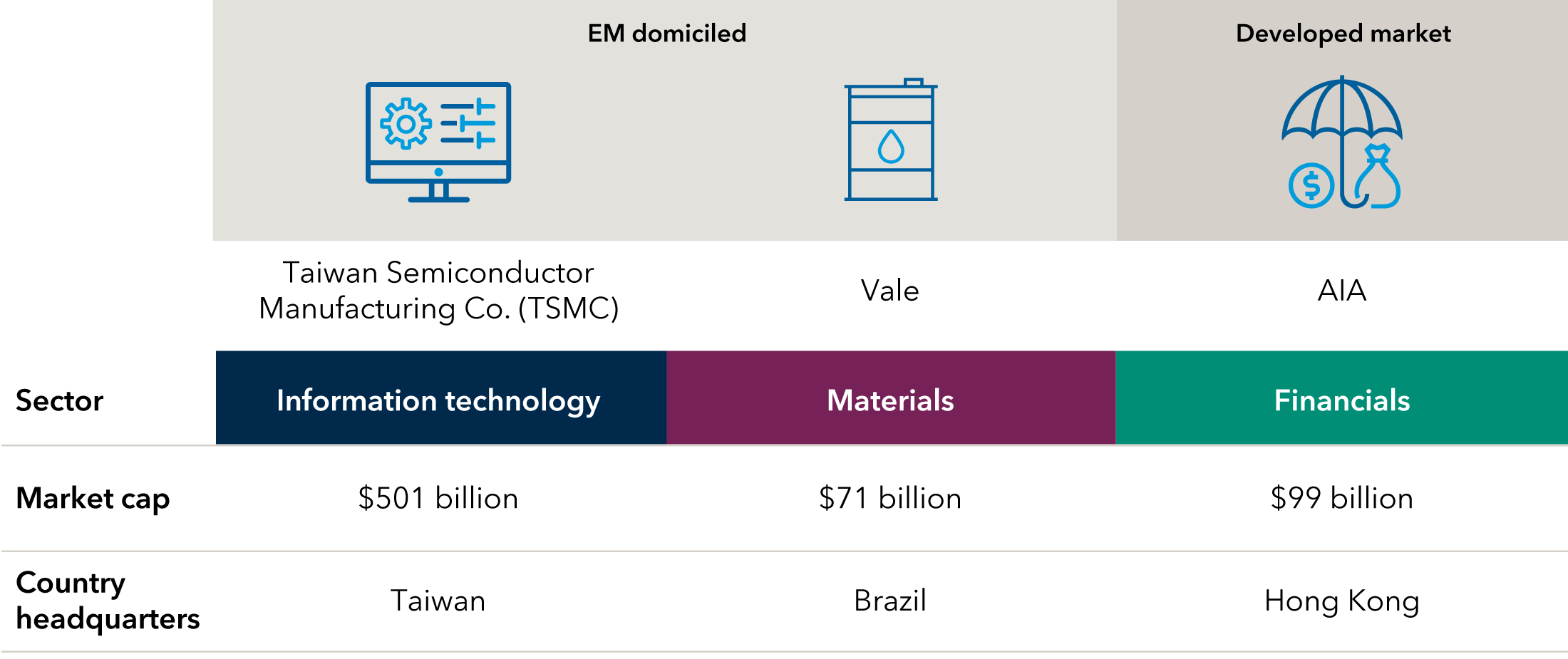

A three-pronged approach

New World Fund utilizes a multidimensional, three-pronged approach to pursue its goal of generating long-term capital appreciation:

- Investing in companies based in emerging markets

- Investing in companies based in developed markets that are doing business in emerging markets

- Utilizing an opportunistic sleeve of emerging markets debt

INVESTING IN EMERGING MARKETS GROWTH WITH A MULTIDIMENSIONAL, GLOBAL FOCUS

Examples of top holdings in the portfolios*

*Companies shown are in the top 20 holdings by weight in New World Fund as of 12/31/23. (Microsoft, Novo Nordisk, Taiwan Semiconductor Manufacturing Co. Ltd., Airbus, Mercadolibre, Eli Lilly, Kotak Mahindra Bank, LVMH Moet Hennessy Louis Vuitton, Broadcom, Vale, Meta Platforms, HDFC Bank, AIA Group, Max Healthcare Institute, Alphabet, Bharti Airtel, ASML, Tencent, Midea, Thermo Fisher Scientific)

Source: FactSet as of 12/31/23.