Retirement Plan Business

8 MIN ARTICLE

If you’re looking for a new avenue to grow your practice, 2023 may be the year to prioritize retirement plans. Several factors are converging to create an ideal environment to add plan business to your wealth management practice. These include:

- Opportunities created by SECURE 2.0 Act of 2022

- Potential for plan assets to help offset market volatility

- Small-business owners as a possible referral network

Adding defined contribution plans to your practice can help you take advantage of the opportunities presented by new legislation — and potentially help offset some of the risks of volatility. Here are three reasons why 2023 is a great year to add retirement plans to your practice.

1. SECURE 2.0 opens doors

With new legislation, small businesses get increased incentivizes to set up retirement plans.

- SECURE 2.0 created a new startup plan tax credit based on contributions the employer makes on behalf of participants and expanded the existing startup tax credit on employer out-of-pocket plan costs. These tax credits may provide a significant cost savings for small businesses that are starting a plan. Learn more about the SECURE 2.0 tax credits.

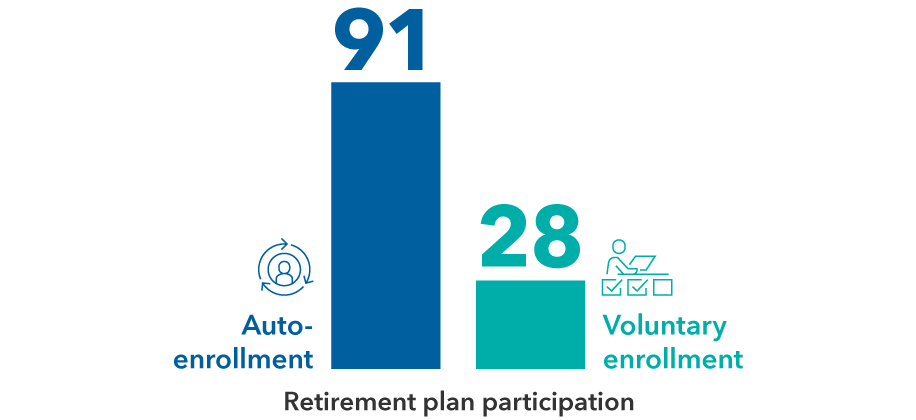

- New 401(k) and 403(b) plans established on or after December 30, 2022, must implement auto-enrollment and auto escalation for plan years beginning after 2024. These plans must automatically enroll participants in the plan with a beginning salary deferral of 3%-10%, increasing by 1% per year up to 10%-15%. Exemptions apply, including small businesses (10 or fewer employees), new businesses (less than three years old) and church and governmental plans. Employers starting a plan in 2023 may want to consider including automatic enrollment at plan inception to avoid having to make changes later. Not only does this support retirement savings goals, but it may also offer some assurance that plans you set up will gain participation. A 2021 study by Vanguard found that new hires’ participation rates triple to 91% under auto-enrollment, compared with 28% under voluntary enrollment.

Plan participation for auto-enrollment vs. voluntary enrollment

Source: Automatic Enrollment: The Power of the Default, February 2021, Vanguard Research

Another provision of SECURE 2.0 — and a potential inflow to the plan — involves a new employer contribution option. Specifically, effective 2024, employers with 401(k), 403(b) or SIMPLE plans have the option to make matching contributions on workers’ qualified student loan payments. While this isn’t mandatory and might not appeal to every employer, it could add extra incentive to help businesses establish plans.

For a more in-depth look at SECURE 2.0, see 5 ways SECURE 2.0 Act may impact wealth management clients.

2. Plan assets tend to be “sticky,” even in volatility

Resilience is one of the key benefits of retirement plan business. People often continue 401(k) contributions, even during times of financial strain, thanks to automatic payroll deductions. Because of this, plans tend to have a continual inflow of assets, which could potentially provide a buffer for your book through volatility.

Since retirement specialist advisors are typically compensated with an asset-based fee, continual inflows to the retirement plan offer a potential long-term benefit as the plan’s assets rise.

In fact, some wirehouse firms have begun focusing more on retirement plans. This push underscores the potential for plans to stabilize — and grow — wealth management business.

3. More businesses adding plans increases opportunities for wealth management

Your roster of wealth management clients likely already includes some small-business owners. Even if they have not been interested in setting up plans in the past, new legislation may prompt them to do so now. Working with existing clients to set up plans not only deepens your relationships with them, but also expands your referral network. For instance, employees could be candidates for your services now or in the future.

Cerulli Associates estimates more than $440 billion in defined contribution assets were rolled into IRAs with the help of an advisor in 2021, illustrating the potential addressable market for sourcing wealth management business from retirement plan business. Cerulli also found:

- Of those who work with a financial advisor, 66% met their financial advisor through a family member, friend, or their 401(k) provider/advisor.

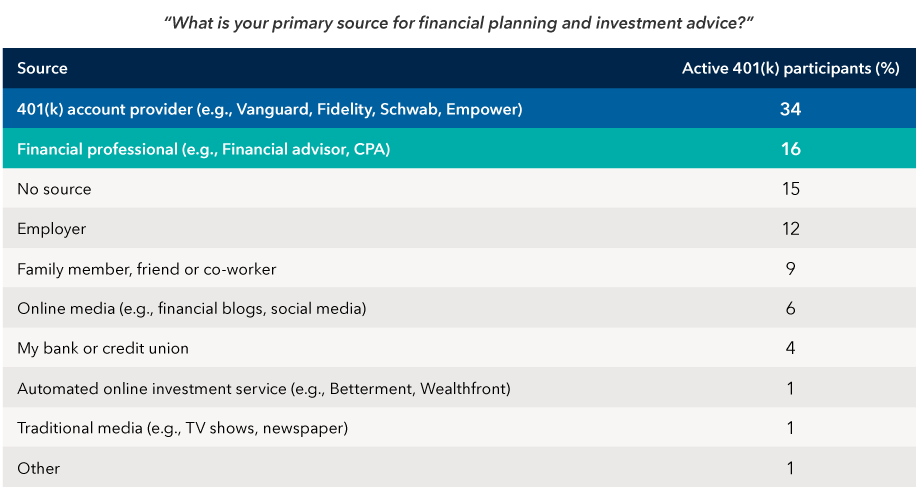

- Among all 401(k) participants, the most common source for retirement planning and financial advice is the retirement plan provider.

401(k) providers are the most common source of retirement planning and financial advice

Source: Cerulli Associates, September 2022

To help nurture those relationships with plan participants, some financial professionals, like LPL advisor Howard Martinez, will carve out time for individuals to ask questions one-on-one. This can be a great way to build trust and be top of mind when and if these participants need wealth management services.

You can even leverage new legislation to help educate plan participants on topics that may affect them, such as:

- Changes to the required minimum distribution (RMD) age. Participants may be interested to learn how higher RMD ages could affect their future savings plans.

- Rise in catch-up contribution limitations. While catch-up contributions for IRAs are currently maxed out at $1,000, they will be adjusted for inflation in increments of $100 beginning in 2024. This could incentivize saving even more for individuals nearing retirement.

There’s also an opportunity to expand your circles of influence. By delivering value to business owners, you are well poised to fuel referrals within their networks. You may get introduced to business owners or executives who need new plans, advice on changes to their plans or assistance with their personal finances. According to Vestwell’s 2023 Advisor Trends Report, “44% of employers stated that they were considering plan design changes, an area employers … seek counsel from advisors on.” If that holds true, there may be a significant opportunity to differentiate yourself and earn referrals among business owners.

A prudent investment

Wealth management continues to evolve, thanks to changes in technology, legislation and client expectations. If state mandates and tax incentives increase the popularity of small plans, they could become a more vital piece of the wealth management puzzle. Developing proficiency in plan business now can potentially help you stay ahead of peers, in addition to diversifying your book as a hedge against uncertainty.