Strategic Scale

6 MIN ARTICLE

While there is no single career trajectory for successful financial advisors, one common experience may be rapid or sustained business growth that plateaus over time.

This trend was clear in the findings of our Pathways to Growth: 2021 Advisor Benchmark Study of more than 1,500 advisors. The higher-growth segments we studied generally skewed younger, and more than half of the experienced advisors began to settle into a low-growth or declining trend after about 16 years in practice.

For some professionals, slowing down is all part of the plan. Once you have reached a certain level of success, you may be perfectly happy to enjoy the benefits of serving the clients you have. Others are able to buck the mid-career trend by focusing on practice management behaviors associated with growth. Our benchmark study helped us identify ways advisors are achieving growth at every practice stage and age—even for firms 16 years old or older.

Here are five ways to overcome or completely avoid a mid-career slump.

1. Refocus on client acquisition

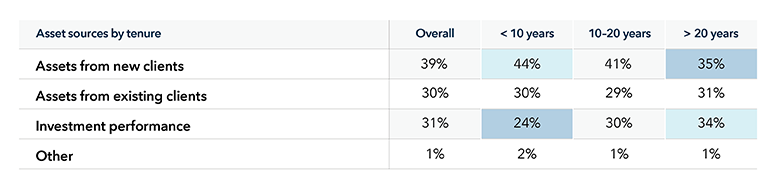

New clients contribute the most to assets under management (AUM) for high-growth advisors at every stage of their careers. But it’s interesting to note that as an advisor’s tenure increases, the assets from new clients tend to decrease. For more established firms with 20-plus years in business, investment performance becomes an increasingly important source of growth over time.

Newer advisors tend to rely more on assets from new clients and less on investment performance for growth compared to more seasoned advisors.

A deliberate focus on client acquisition helps higher-growth advisors buck this trend. Among mid- to late-career advisors, those experiencing the highest revenue growth were 42% more likely to have an established goal for acquiring clients.

Sources of growth evolve over time

Newer advisors tend to rely more on assets from new clients and less on investment performance for growth compared to more seasoned advisors.

Source: Capital Group, Pathways to Growth: 2021 Advisor Benchmark Study

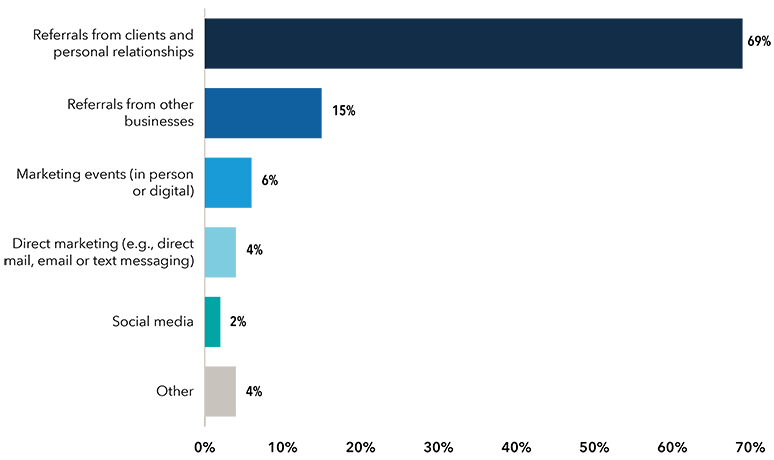

And social media in general is an untapped channel for advisors, currently representing just 2% of new business for all advisors in our study.

2. Find additional referral sources

There’s no doubt that referrals fuel this business. And as your business matures, your reputation for service and results may be the only referral program you need. But for advisors in growth mode, you can find opportunities to boost your referral sources.

For example, while referrals from existing clients or personal relationships account for about 70% of advisors’ new business, the next best source is from other businesses. Professional referrals represent about 15% of new clients on average, and a potential area of opportunity.

Among all advisors, referrals from clients and personal relationships were the primary source of new business. Business referrals were the second-best source – and may offer areas of improvement.

Attorneys, accountants, bankers, insurance agents and other connected professionals can be great partners or centers of influence (COIs). COIs offer a rich source of referrals. You can also widen your reach to include large regional organizations or local businesses that may be interested in financial education, or investigate opportunities in clients’ corporate retirement plans.

Referrals remain essential

Among all advisors, referrals from clients and personal relationships were the primary source of new business. Business referrals were the second-best source – and may offer areas of improvement.

Source: Capital Group, Pathways to Growth: 2021 Advisor Benchmark Study

Affinity and interest groups can also be great places to meet COIs who work with clients you’d like to meet. LinkedIn is a great place to connect with these types of groups and explore networks to find the best potential sources of referrals.

3. Deepen the client relationship

Seasoned advisors make client satisfaction and retention a priority. Those with more than 20 years of experience in our study are more likely to have standard operating procedures for keeping clients happy. That’s great news, because happy and loyal clients can be potential sources of business.

Our study identified relationship alpha – or added value through client services, such as tax, estate and charitable planning – as one key driver of success in high-growth practices. If your practice is not currently offering these services, get to know the roles advisors can play and how this can benefit your clients and your practice.

4. Take a multigenerational approach

While many financial professionals consider high net worth (HNW) clients essential to rapid AUM growth, our survey found that practices whose books contain 50% or more HNW clients (defined as those with more than $2 million in AUM) are not growing any faster than average. Instead, we found practices that create multigenerational engagement and wealth transfer plans are more likely to achieve high growth.

Generational wealth transfer may account for this higher proportion of multigenerational households among higher-growth firms. Still, a multigenerational approach allows you to prospect for new business among existing clients and create renewed loyalty by strengthening family ties. It’s also an investment in the future — one which can pay off over many years to come.

5. Shift your priorities

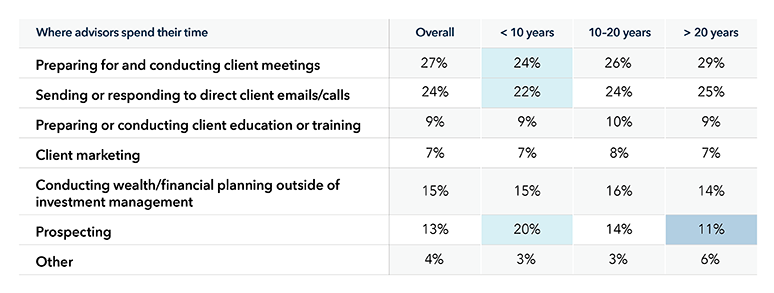

Time management is everything. We found that longer-tenured advisors spend slightly more time on tasks that can be considered inefficient or better handled by other team members.

For example, rather than personally overpreparing for client meetings or responding to every call and email, higher-growth advisors overall tend to rely on standard operating procedures (SOP) that allow other team members to pitch in. That leaves more time for marketing and prospecting.

Newer advisors spend slightly less time preparing for client meetings and responding to calls, while seasoned advisors spend less time prospecting.

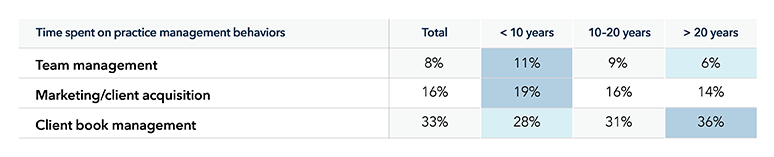

When it comes to practice management, newer advisors are also more likely to engage in behaviors that lead to growth. A focus on client book management increases with tenure.

Where advisors spend time may depend on tenure

Newer advisors spend slightly less time preparing for client meetings and responding to calls, while seasoned advisors spend less time prospecting.

When it comes to practice management, newer advisors are also more likely to engage in behaviors that lead to growth. A focus on client book management increases with tenure.

Source: Capital Group, Pathways to Growth: 2021 Advisor Benchmark Study

Advisors with 10 years or less experience were more likely than more experienced peers to use standard operating procedures for business functions, and to manage teams and delegate work. These practice management behaviors are tied to productivity found among higher-growth firms.

Your career is a journey, and there may be unavoidable ups, downs or bumps in the road. Think strategically, and you can build pathways to growth at any age or stage of your career.

Related content