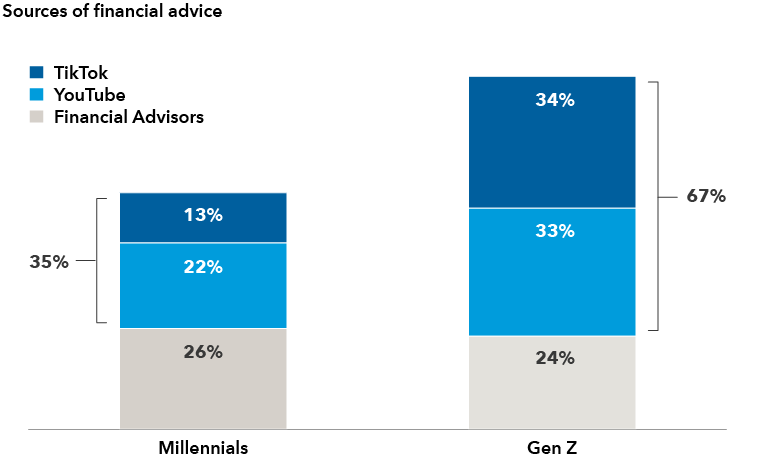

If you play a passive role in your clients’ education savings journey because you view 529 education savings plans as small accounts, a hassle to set up or an unprofitable line of business, you may want to reconsider. The benefits of helping clients with educational planning go beyond assets under management. These conversations can help you build an emotional bond for a lifetime and may offer an opportunity to become a trusted advisor for future generations.

There is a neural mechanism in the human brain that tags information with emotional associations that enhance memory.1 The birth of a child is among the most significant, life-changing events your clients will experience. The subsequent chapters of raising and educating children, then sending them off into the world, are important milestones. For financial professionals, this is a golden opportunity to form a positive emotional association with clients as you discuss investing in the education they’ll need to launch their children to the next stage of life.

Most importantly for advisors, a child represents a good reason to review many factors that can shape clients’ financial futures, including setting up a will, revising the family budget, and creating nest eggs for their children, whether in the form of trusts or 529 accounts. This is also a time when other members of the family may wish to financially contribute to children and play a greater role in investing in their future, including when it comes to education.