Have you defined the ideal client for your business?

If you’ve never thought about it before, your initial description of “ideal” might be something like: high net worth, doesn’t complain, asks very little. Although this describes someone who might be easy to deal with, that doesn’t necessarily make this person the ideal client for your business. It doesn’t even mean you are the right advisor for this client.

With a more intentional approach, you might define an ideal client as someone whose needs, wants and concerns align with your competencies. It’s someone able and willing to pay for advice, who will value and follow your guidance and with whom you would enjoy building a rapport and possibly a friendship.

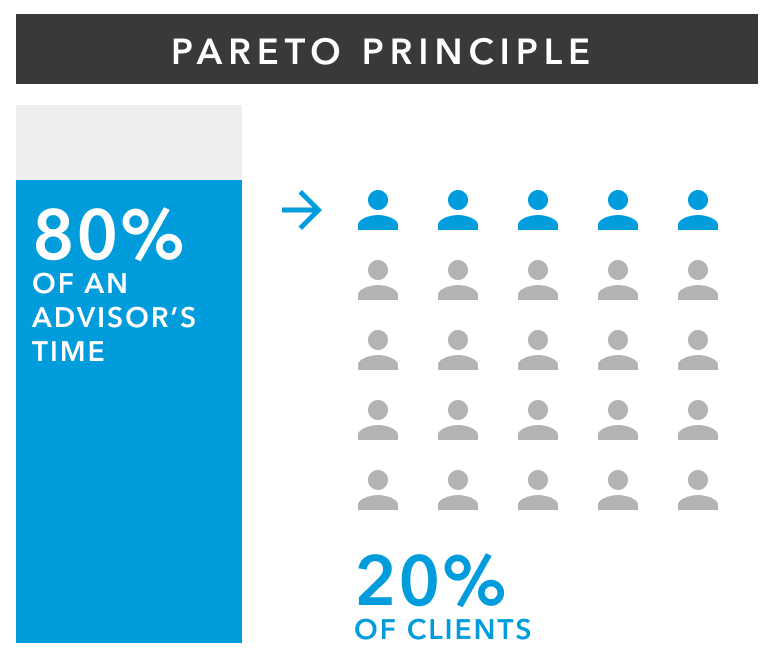

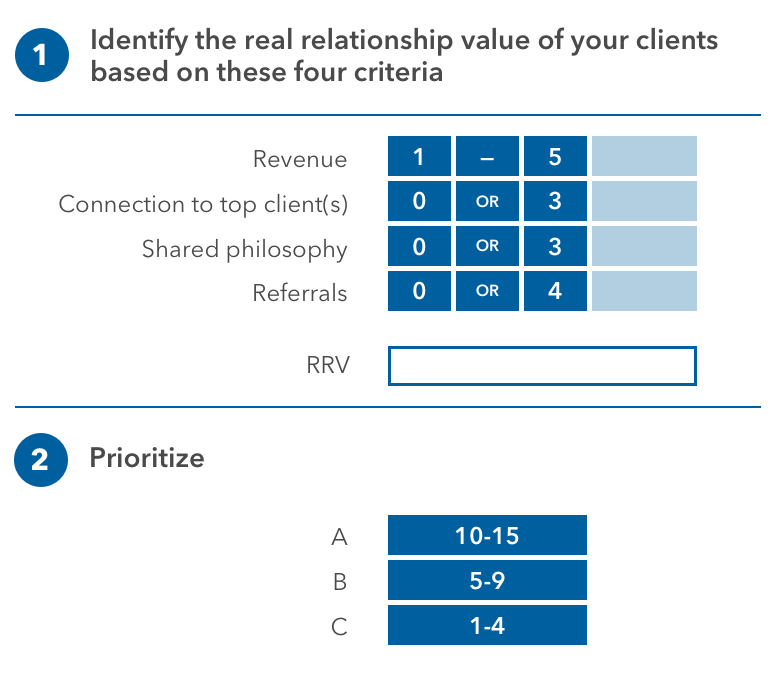

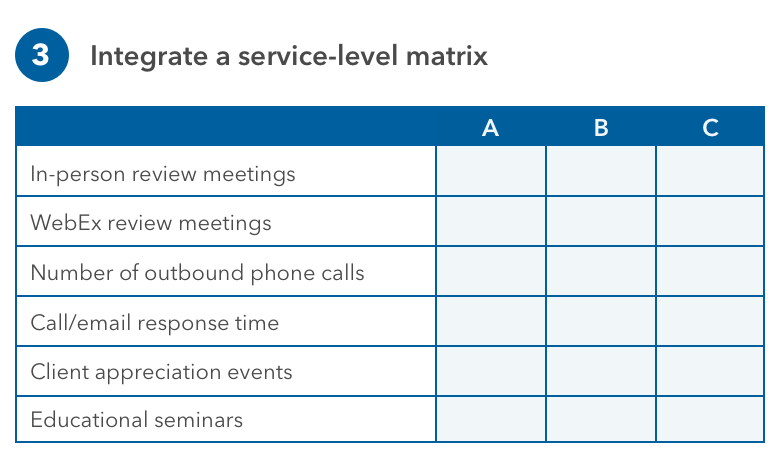

The process of defining your ideal client is less about hypothetical perfection than about identifying a set of business-boosting characteristics among the investors you serve. This client segmentation process can, in turn, shape how you serve different cohorts, what you charge them for these services and how much time you allocate to servicing them.