Step 3: Get the sale details ready

Don’t wait to begin to work out a client’s preferred deal structure. Begin this process 18 months to a year before a client wants to exit the business.

Find a valuation specialist

Unlike the informal valuation discussed in Step 2, this is the time to recommend a formal, professional, third-party valuation. Large companies especially rely on business valuation firms like consultancies Duff & Phelps or BDO for a deep dive into finances, comparing the company to peers in its industry and geographic market. Small-business owners can do the same through a business appraisal service or experienced accountancy firm. (Spaulding has used NowCFO.) It’s akin to an ostensibly healthy body going to a doctor for a complete physical, where blood, hormones and physical fitness are measured, evaluated and contextualized.

Yes, the company could have what is considered to be good cash flow. But how does that compare to company averages in the industry or area? An underlying operational issue or customer trend that could depress profitability might be undetected. An evaluation by an expert can help know for certain, and offer a strategy to shore up any weaknesses before the business goes on the market.

These reviews are not cheap, and you may get pushback from clients. “There can be some ‘penny-wise and pound-foolish’ reaction, but this is crucial to getting the most value out of a sale,” Spaulding says.

Know the terms

Knowing the business’s value also comes in handy when agreeing to specific deal terms in the sale. Typically, outside buyers want an earnout, a part of the selling agreement that enables a buyer to pay a portion of the sale price through future business proceeds instead of at the time of sale. If the business is worth more than what the client needs for retirement (or what the industry average is), that gives her leverage to refuse or reduce earnouts in a sales contract.

With earnouts, there’s always concern regarding the new owner’s ability to grow the business and make payments, Spaulding says.

Think about tax strategy

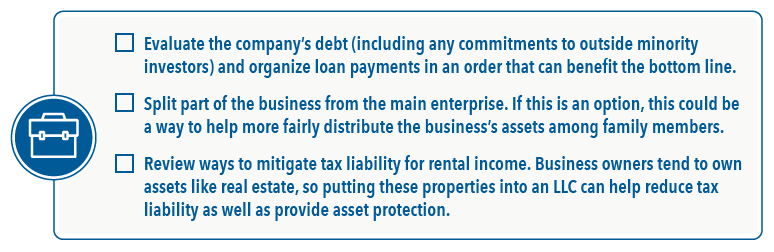

Income and estate taxes should both be considered when structuring the terms of a sale, including:

- Stock-for-stock transactions: Consider deferring realized gains and, therefore, taxes.

- Qualified small-business stock treatment: Gains up to $10 million may be exempt from tax.

- Sale to an employee stock ownership plan: Defer capital gains taxes by rolling over proceeds into qualified replacement property.

- Bargain sales to family: See Step 4 for more.

- Qualified opportunity zones: Defer capital gains tax by investing sale proceeds into qualified opportunity zone investments.

- Structured philanthropy: Charitable remainder trusts, donor-advised funds and similar options can be used to defer and/or lower the tax burden post-sale.

(Other tax tips from the SBA can be found here.)

Don’t forget the “fun money”

It’s natural for clients to want to celebrate, and you can help prepare for that, too. “I tell the clients, ‘We know you’re going to do it, so here’s $250,000 in fun money,’” Spaulding says. “’Go on a fabulous vacation; buy a boat.’“