Past results are not predictive of results in future periods.

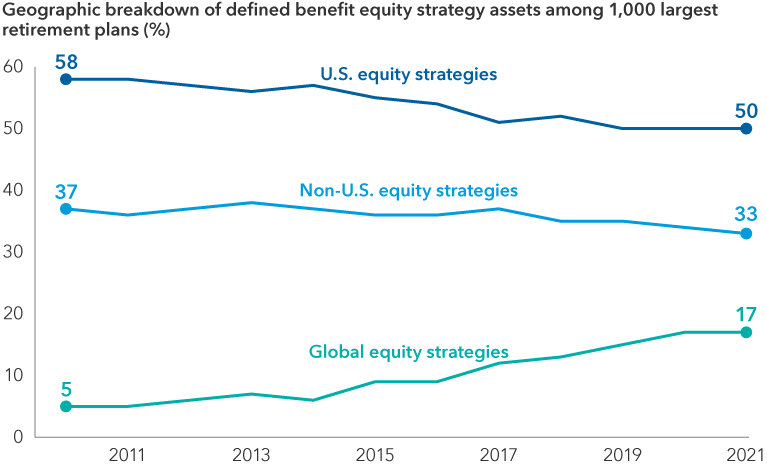

*The Capital Group Portfolio Consulting and Analytics team analyzed 1,188 portfolios in consultation with financial professionals from July 1, 2023 through September 30, 2023. Of the portfolios specifically analyzed for global flexibility, 539 had allocations to the Morningstar Global Large Blend, Value and/or Growth and Global Small/Mid Stock categories. These 539 portfolios comprised 45.37% of all portfolios analyzed, while 649 portfolios (or 54.63%) did not have an allocation to global equity strategies. To determine the average allocation to global equity strategies, the team took a weighted average of the allocation to global equities across all 1,188 portfolios. They calculated that weighted average by multiplying 45.37% (percentage of portfolios that had allocations to global equity strategies) by their average allocation (13.41%) and then added the product of those two numbers to the product of 54.63% (percentage of portfolios that had no allocations to global equity strategies) by 0% (since those 54.63% of portfolios had 0% allocated to global equities). The sum of those two products is 6.1%: the average allocation to global equities across all 1,188 portfolios analyzed from July 1, 2023 through September 30, 2023.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

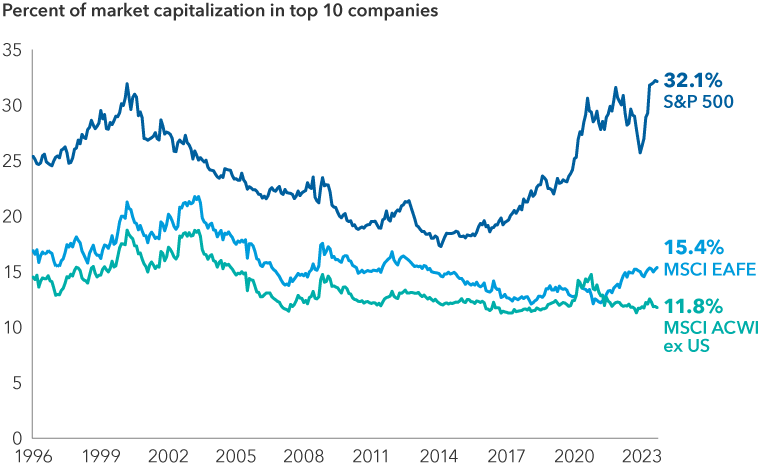

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

MSCI All Country World ex USA Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter.

MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.