Chart in Focus

Trade

What will global trade and commerce look like in the coming years, and how will it influence the investment landscape? It’s a question that’s been top of mind for investors lately, as a new administration in the U.S. seeks to renegotiate relationships with key economic partners.

The rhetoric of trade negotiations often seems abrasive, and what we see unfold in the political arena over the next few months or years may not be that different.

While negotiations of this type are unpredictable, the outcomes need not be extremely positive or negative for one side or the other. In fact, in many ways, it’s the advancement in technologies and how they reshape industries that will determine the future of global business as much as political negotiations.

Digital trade knows few boundaries.

The contours of international commerce have already undergone a profound transformation over the past two decades.

“If the 20th century was defined by a phenomenal rise in the transfer of goods and industrial commodities, the 21st century is being characterized by the rapid digitization of services and the increasing automation of manufacturing,” says Rob Lovelace, Capital Group portfolio manager.

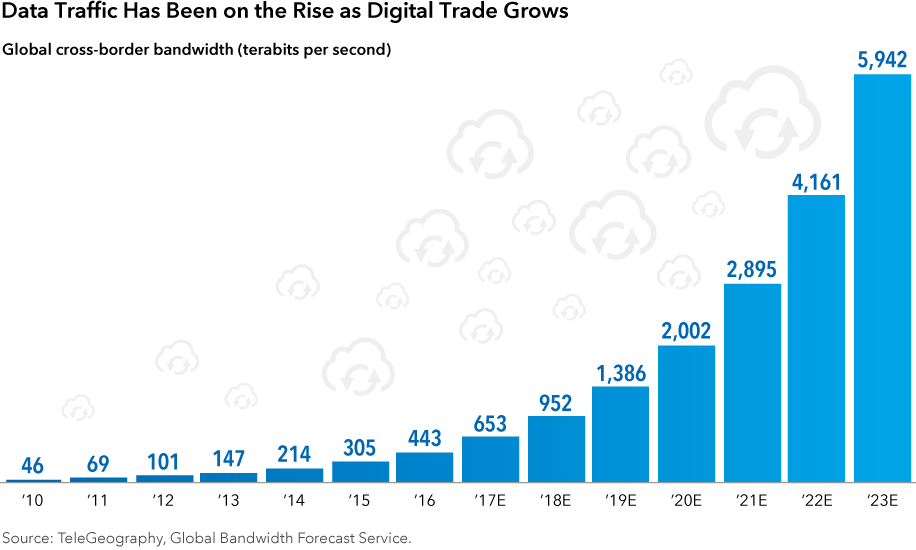

Cross-border digital traffic surged in the last decade, and it’s only projected to increase more over the next seven years. Because many aspects of this digital economy cannot be easily dictated by trade agreements, the impact of trade negotiations is likely to be less severe for technology companies than, say, manufacturers.

Global supply chains are creating irreplaceable companies.

Supply chains today are deeply entrenched across the globe and will not be easily uprooted. As they’ve become global, companies have gained specialization and scalability that is difficult – if not impossible – to replicate.

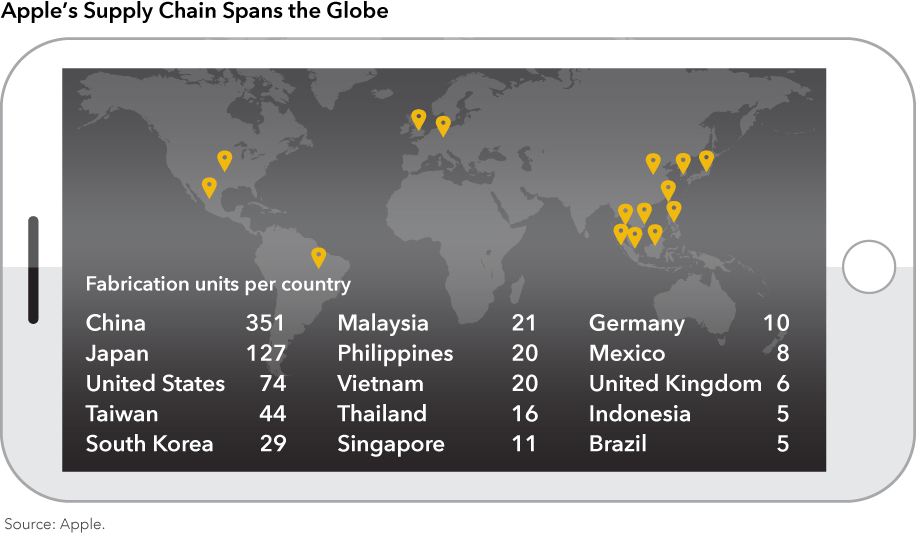

Take Apple as the most obvious example. Motivated by a need to scale and manage supply chain risk rather than cost, Apple is a master of using a large supply chain to its advantage. It sources suppliers that can turn out parts in the most cost-effective way while still adhering to the company’s quality requirements.

In some industries, companies are willing to absorb higher costs because the long-term benefits of certain locations outweigh the near-term burden. Mexico, for example, has established itself as a premier auto and auto parts manufacturing center. About 90 of the world’s top 100 auto parts makers have production operations in the country, and General Motors, Ford and Caterpillar have reaffirmed plans to move production there. The facilities are concentrated in just five Mexican states, reducing transportation costs.

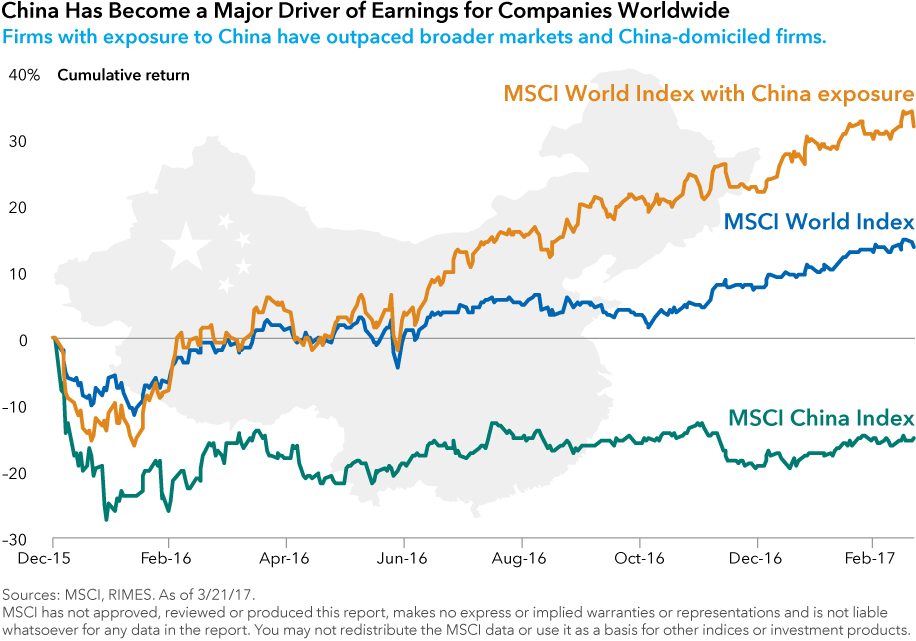

China has extraordinary influence on trade and companies’ growth prospects.

Over the past decade, China has become the largest growth market in the world for industries ranging from robotics and autos to airplanes and smartphones. In 2015, it accounted for 27% of global sales of robotics, 30% of elevators, 32% of autos and 16% of Boeing’s airplanes.

The country’s rise as an economic power will continue to have a profound impact on global trade. China’s relationship with the U.S. is multidimensional, deep and interdependent. The U.S. trade deficit with China was $347 billion in 2016, with exports at $116 billion and imports at $463 billion. A large chunk of the imports are from U.S. manufacturers that have set up assembly lines and factories in China.

Financial connections also run deep. China holds about $1.25 trillion in outstanding U.S. government debt, or a little shy of 10% of the total. In addition, Chinese companies raise capital in the U.S. financial markets through initial public offerings and offshore dollar bonds.

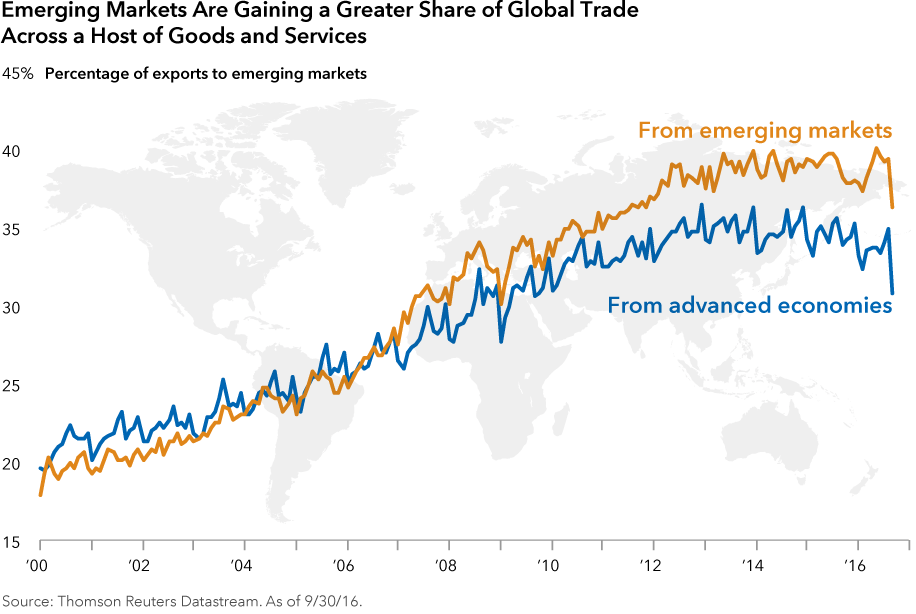

China’s stature leads to more trade for emerging markets.

Thanks to China’s influence, emerging markets have increased trade both among themselves and with developed economies. In 2015, 30% of developed-market exports went to emerging markets, and 46% of the trade by emerging markets was among themselves, according to the latest figures from the International Monetary Fund. Emerging markets’ share of global GDP has risen significantly.

As the global economy gains momentum, emerging markets should benefit. Already, we have seen a recovery in profit growth. Earnings for emerging markets companies are estimated to increase 17% in 2017, led by information technology and industrials, according to FactSet.

A rise in automation means labor costs matter less.

The low cost of Chinese labor has given the country an advantage for 30 years. But the situation is changing, as wages rise and younger workers become less willing to do repetitive tasks.

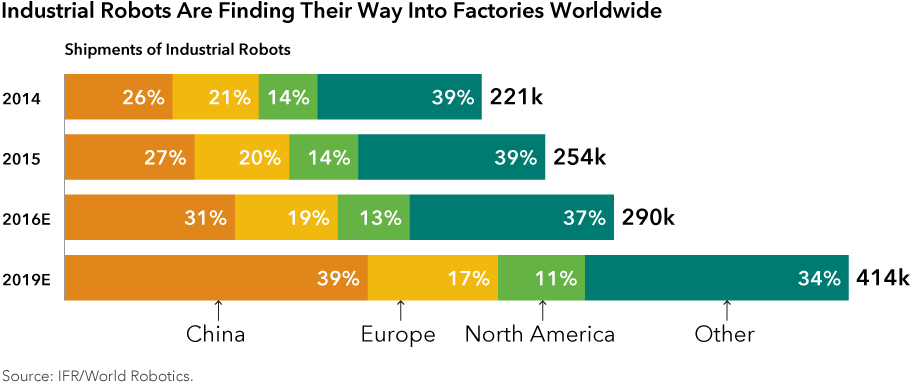

Automation is likely to further diminish the importance of labor costs. For instance, of the more than 250,000 industrial robots sold in 2015, a quarter of them were sold to China, according to the International Federation of Robotics.

The economics of automation have hit a sweet spot, where costs of robotics systems are declining and their capabilities are improving. With fewer cost advantages remaining in China, production may move closer to end-markets. It is this transformation in the economics of labor that could bring manufacturing and jobs to the U.S.

Expect new investment opportunities to emerge.

Global commerce has been transformed over the past two decades, and we’re likely to see global trade patterns evolve with the increasing digitization of commerce and the likelihood of new trade, tariff and tax structures in many parts of the world.

“Shifts in economic and trade regimes and turning points in markets provide managers like us the opportunity to capitalize on short-term distortions in asset prices and to invest in companies that we view to be winners in the long term,” Lovelace says.

Learn more about the impact of global trade on investing. Download the white paper now.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Rob Lovelace

Rob Lovelace