Chart in Focus

Trade

Market volatility cuts both ways, of course, with sharp swings up and down. We’ve seen no shortage of either in recent months as investor sentiment rose and fell with the slightest news of agreement or animosity in the U.S.-China trade dispute.

Global equity markets rallied on Friday’s announcement that the U.S. had agreed to suspend previously planned tariff increases on $250 billion of Chinese products. China also pledged to buy up to $50 billion of U.S. agricultural goods, among other terms. The so-called “mini” deal is the first positive sign after months of trade war escalation, but how significant is it really? Markets pulled back a bit this week as investors pondered that question.

“This is a de-escalation, so from that perspective it’s a step in a constructive direction,” says Capital Group political economist Matt Miller. “But it’s far from a resolution to the conflict. In my view, the U.S. and China will be wrangling over these issues for decades to come, and Friday’s announcement simply reflects the desire on both sides to relieve some near-term pressures.”

For the U.S. administration, the near-term pressure is the 2020 presidential election, Miller explains. And for China’s leadership, there are domestic crosscurrents at play, including China’s slowing economic growth, rising food prices and pro-democracy protests in Hong Kong.

“Both sides could use something they can call a ‘win’ right now,” Miller says. “It makes sense for a new equilibrium to be reached in the short term while the larger disagreements go unresolved. If this deal holds up — and that remains to be seen — both sides can claim victory in front of their domestic constituencies and perhaps put any longer term negotiations on a less dramatic footing.”

Perspectives on trade

With the long-running trade dispute dominating headlines for the better part of two years, Capital Ideas has featured a number of investment insights on the issue.

Below, Capital Group investment professionals offer their thoughts on several key questions, including whether trade disruptions could trigger a U.S. recession, how China is reacting to the trade war on the domestic front and whether multinational corporations can overcome growing trade-related headwinds.

Will a trade war push the U.S. economy into recession?

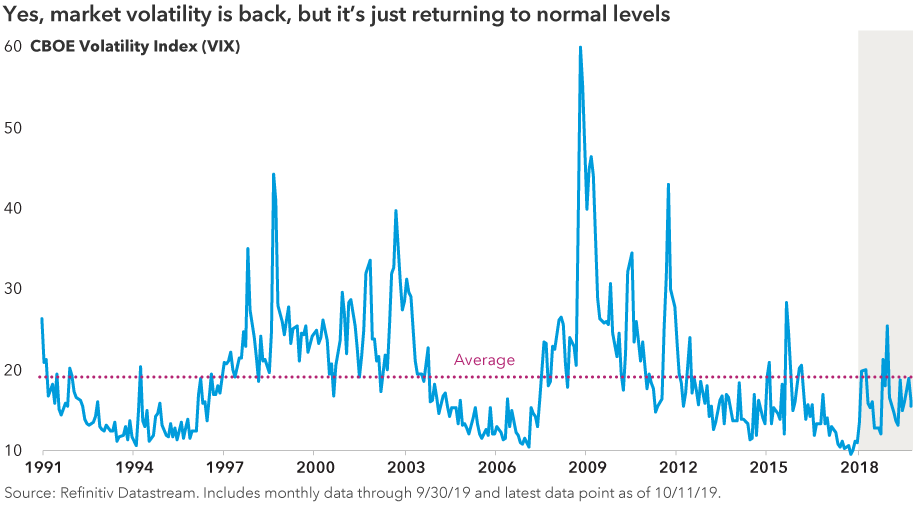

In a wide-ranging Q&A on the trade outlook for the U.S. economy, Capital Group economists Darrell Spence and Jared Franz note that market volatility may seem high these days, but it is just returning to historical averages. They also advance the view that the U.S. economy can handle a limited trade war, as long as there is no further escalation. If higher tariffs are eventually imposed by the U.S. and China retaliates, the risk of a recession rises substantially.

“It’s hard to know where the tipping point lies,” Spence says.

A view of China from the ground up

From the other side of the world, Hong Kong-based portfolio manager Steve Watson shares his thoughts on how Chinese consumers are living with the trade war. While China’s economy is slowing, the nation’s growing middle class continues to drive a powerful transition from a manufacturing and export-led economy toward a more balanced economy spearheaded by domestic consumer spending.

“When you observe China from L.A. or New York, it’s easy to imagine a country that is hunkered down, suffering from a prolonged trade war, but it certainly doesn’t feel that way in person,” Watson explains. “Life goes on and business keeps moving forward.”

Why multinationals can survive trade conflicts

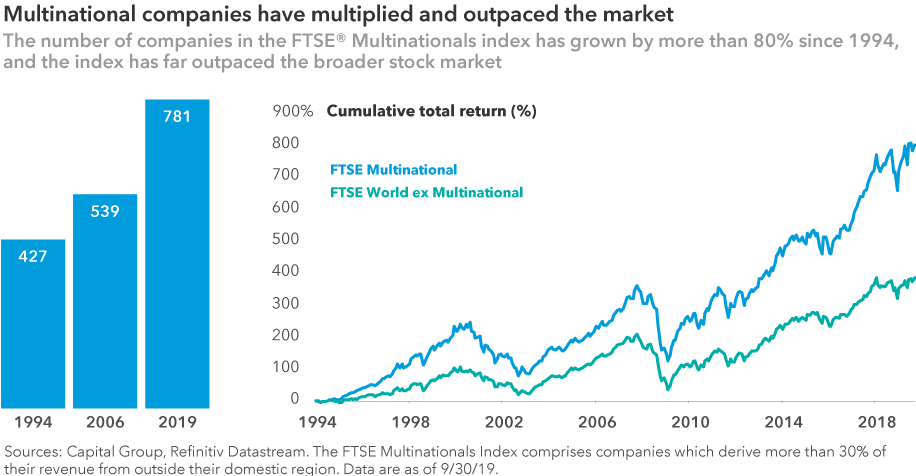

Multinational companies are at the epicenter of the trade war, but as portfolio manager Jody Jonsson argues, well-managed multinationals are also well positioned to navigate a difficult environment and come out stronger on the other side.

Smart companies will figure it out, she says. Their seasoned management teams have seen all types of trade environments — favorable and unfavorable — and they have the expertise, the resources and the sheer muscle to survive and even thrive in a trade war.

“For investors, I think it’s very important to avoid focusing too much on the noise surrounding trade and protectionism,” Jonsson says. “To the extent that these trade conflicts cause investors to shy away from multinational companies, paying too much attention to the rhetoric is a detriment to successful, long-term investing.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The CBOE Volatility Index, or VIX, is a real-time market index representing the market's expectations for volatility over the coming 30 days.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Asset Allocation

-

Global Equities

-

Dividends

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Jody Jonsson

Jody Jonsson

Matt Miller

Matt Miller

Darrell Spence

Darrell Spence

Steve Watson

Steve Watson