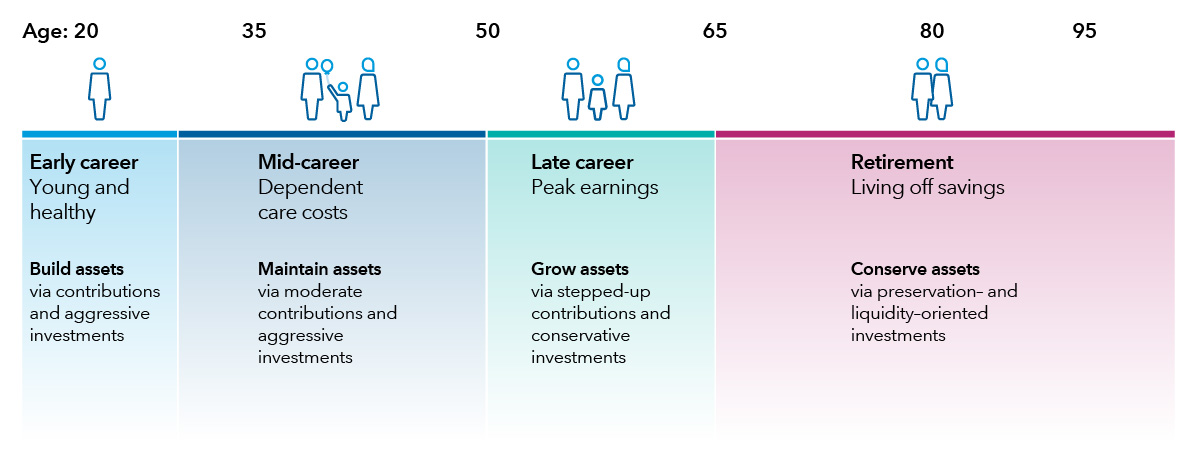

Rising medical expenses can impede retirement savings. Not only do high costs affect plan participants’ ability to make contributions during working years, but they can also consume assets post-retirement. Consider these statistics:

- 374%: Increase in U.S. health care spending per person from 1990 to 2022, from $2,835 to $13,4391

- $351K: Projected savings many 65-year-old couples will need to have a 90% chance of covering their health expenses in retirement 2

- 41%: Increase in the cost of medical care compared to the cost of consumer goods and services since 20003

To help contain these costs, many companies have moved to consumer-driven health plans (CDHPs), which carry lower monthly premiums but higher employee deductibles. Such plans are often paired with a tax-advantaged health savings account (HSA) to cover out-of-pocket expenses.