Determining withdrawal rates is a good starting point for retirement income planning but clients could benefit from remaining flexible to adapt to changing circumstances. With retirement potentially spanning decades, retirees might consider alternative strategies based on their priorities, such as maximizing withdrawals, ensuring lifetime income, maintaining stable cash flow or leaving a legacy.

October 1, 2024

KEY TAKEAWAYS

- Flexible withdrawal methods can help enhance portfolio sustainability.

- Preserving an account balance is crucial to support ongoing retirement income needs.

- Retirees should work with financial professionals to create a personalized retirement income strategy.

Fixed-dollar withdrawals: Potential pitfalls

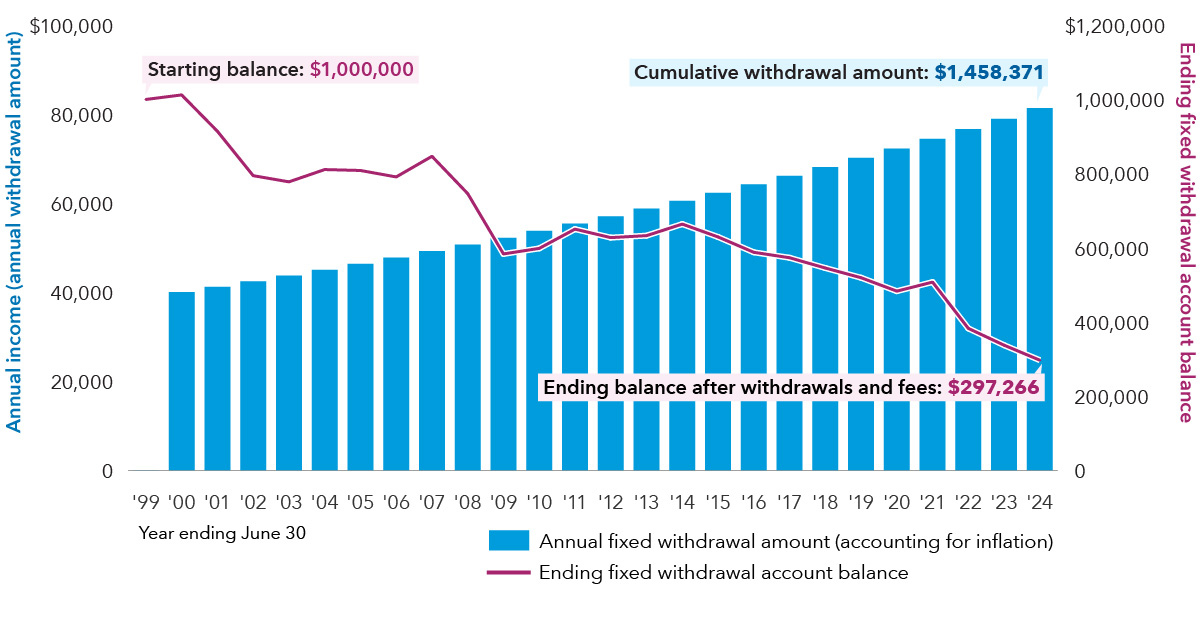

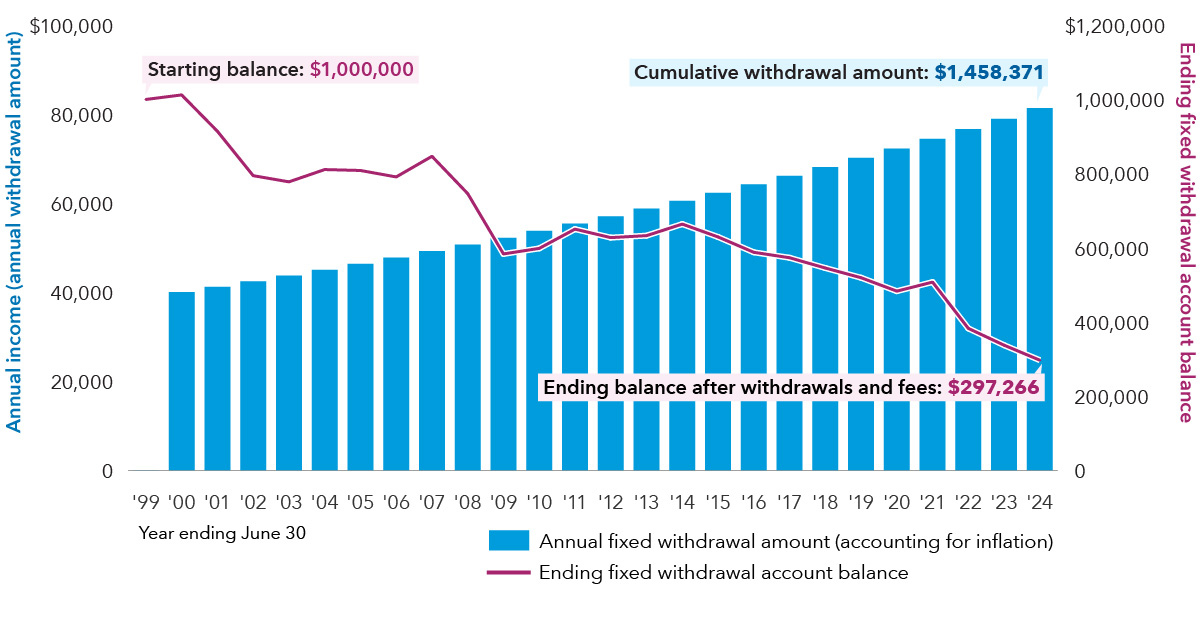

A fixed-dollar withdrawal involves regularly withdrawing a set amount from investments — often adjusted for inflation — regardless of market conditions. But some potential risks to this strategy include varying account balances, income shortfalls and principal erosion due to market volatility and inflation.

The chart below depicts a hypothetical example of a 68-year-old with a $1 million retirement portfolio aiming for $60,000 annual income in the first year. They withdraw $40,000 (representing a 4% withdrawal rate) from their portfolio starting in 2000 and receive $20,000 from Social Security per year, continuing until June 2024. If the market drops, and the portfolio’s value declines to $850,000, continuing to withdraw the same dollar amount would increase the effective withdrawal rate to 4.8%, stressing the portfolio. Over 25 years1, the account balance would diminish rapidly due to larger cumulative withdrawals and market volatility, resulting in higher reliance on the portfolio for income.

A fixed withdrawal rate may increase risk of portfolio depletion

Source: S&P Dow Jones Indices LLC, Bloomberg Index Services Ltd. We assumed a hypothetical $1,000,000 portfolio invested in 60% equities (represented by the S&P 500 Index) and 40% fixed income (represented by the Bloomberg U.S. Aggregate Index) with fixed withdrawal rate of 4% starting in the first year of retirement and continuing until June 2024. Withdrawals are increased by 3% each year after the first year to adjust for inflation, plus 1% portfolio fees. Cumulative withdrawal amount does not account for taxes. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment.

Pros and cons of fixed-dollar withdrawal strategy

Pros:

- May provide paycheck-like income, which many retirees find reassuring

- May be appropriate for investors with a shorter time horizon and no specific legacy goals

Cons:

- Does not adjust withdrawals based on market performance, increasing sequence-of-returns risk (e.g., the risk of market declines in the early years of retirement)

- Higher risk of depleting funds or encountering unexpected financial challenges over time

- During bull markets, fixed withdrawals may limit income clients could use at the time of each withdrawal.

Variable withdrawals: Adapting to market changes

While fixed-dollar withdrawals may offer paycheck-like income, some retirees may benefit from a more flexible approach.

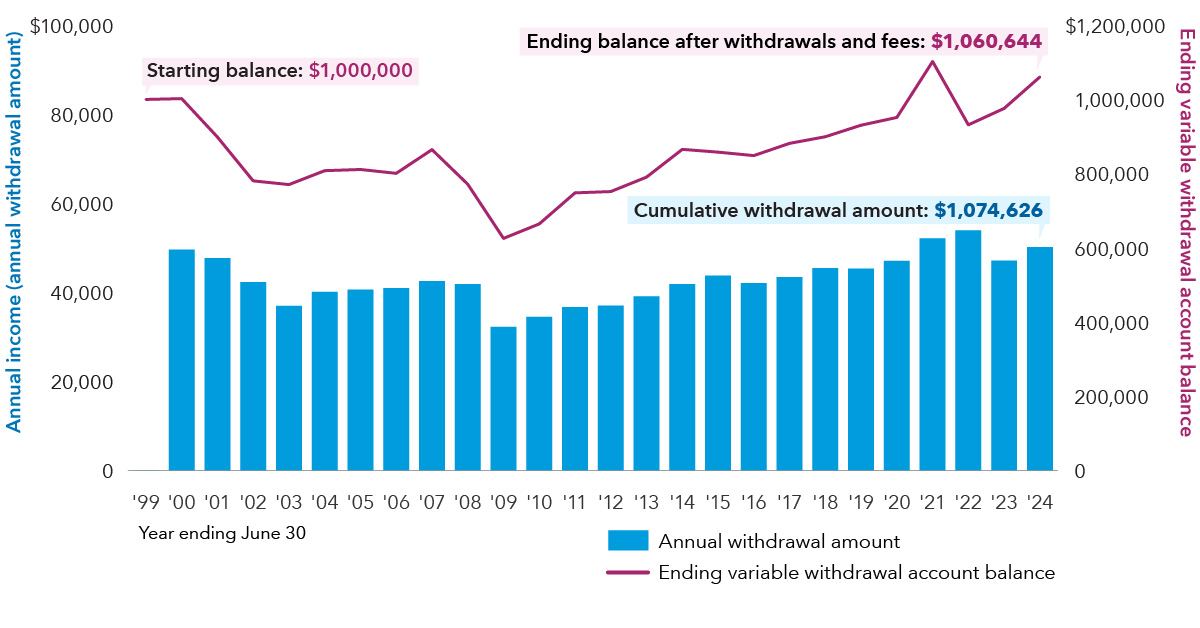

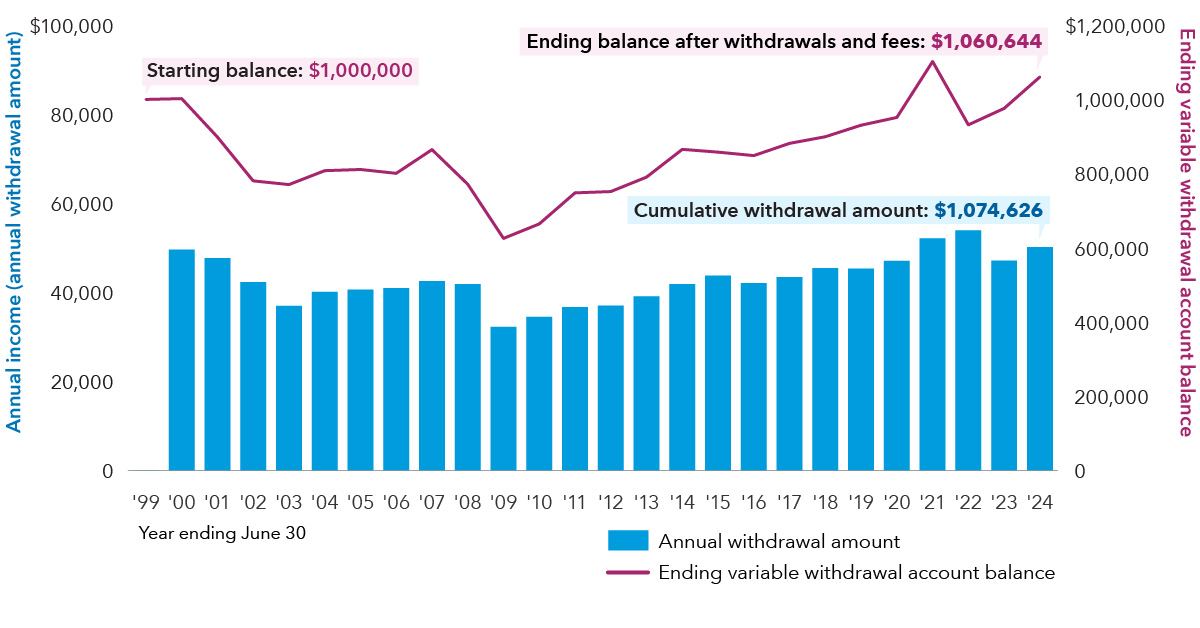

A variable withdrawal strategy adjusts the withdrawal amount based on a percentage of the remaining account balance — tying the retiree’s income with portfolio performance. This means taking lower withdrawals during weak markets and higher withdrawals during strong markets, potentially helping retirees avoid overspending during downturns and benefit from upswings.

Though spending levels will fluctuate with market returns and portfolio growth, a variable approach would have resulted in a higher ending balance than the fixed-dollar withdrawal strategy in our hypothetical. For example, at the end of 25 years, a variable strategy would result in an ending balance of $1,060,644, with cumulative withdrawals of $1,074,626 — compared to a fixed withdrawal ending balance of $297,266, with cumulative withdrawals of $1,458,371.

Flexible withdrawals may boost portfolio longevity

Source: S&P Dow Jones Indices LLC, Bloomberg Index Services Ltd. We assumed a hypothetical $1,000,000 portfolio invested in 60% equities (represented by the S&P 500 Index) and 40% fixed income (represented by the Bloomberg U.S. Aggregate Index) with an initial withdrawal rate of 5% starting in the first year of retirement. Thereafter, the withdrawal amount adjusts based on a percentage of the remaining account balance, continuing until June 2024. Cumulative withdrawal amount does not account for taxes. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment.

Pros and cons of a variable withdrawal strategy

Pros:

- May be appropriate for clients who can manage flexible cash flow and/or have legacy goals.

- Enhances the likelihood of achieving longevity and preservation objectives.

Cons:

- Varying withdrawals may add complexity in adjusting spending amounts.

- In adverse market conditions, withdrawals might become too low, potentially requiring lifestyle adjustments.

Finding a balance, weighing trade-offs

While fixed and variable withdrawal strategies represent two different approaches, most retirees aim for a balance. Diverse cash-flow needs and goals make it crucial to achieve a stable mix of income sources for reliable retirement income.

Given the potential income and emotional effects of relying heavily on an investment portfolio, protected lifetime income can play a vital role. Building a foundation with Social Security, pension benefits, and/or annuity income helps mitigate challenges like market volatility and longevity. This foundation can help cover essential living expenses.

Our analysis shows a strategy of taking variable withdrawals from investment assets, coupled with a fixed-dollar amount from a protected income stream, may better meet retirees’ planning objectives.

What about Social Security?

The Social Security Administration estimates Social Security benefits represent about 30% of the income of people over age 65, amounting to a crucial source of protected income during retirement. Nearly 9 out of 10 individuals aged 65 and older receive benefits, with retired workers averaging $1,918 per month. Decisions on when to claim Social Security significantly impact retirement income strategies and portfolio reliance.

Source: Social Security Administration Fact Sheet, June 30, 2024.

How financial professionals can help

Use these actionable tips to assist clients in developing and maintaining effective retirement withdrawal strategies:

- Consider a flexible withdrawal strategy where applicable: A flexible withdrawal strategy adapts to market conditions and clients’ changing retirement needs. Starting with a modest withdrawal rate, such as 4%, may help mitigate investment volatility risks. The operational aspect of withdrawals will be crucial in deciding on a suitable approach.

- Review and adjust regularly: Stress the importance of annual reviews of the withdrawal strategy with clients. Highlight the need to proactively adjust the plan based on portfolio performance and evolving financial goals.

- Emphasize long-term portfolio sustainability: Consider the client’s life expectancy and educate them on maintaining a balanced portfolio that includes growth investments where appropriate. Ensure they understand that sustainable long-term growth may be key to meeting future financial needs during retirement.

Kate Beattie is a senior retirement income strategist with 18 years of investment industry experience (as of December 31, 2024). She holds a bachelor’s degree in economics with a business administration minor from Colorado State University and holds the Certified Financial Planner™ and Retirement Income Certified Professional® designations.