Chart in Focus

Global Equities

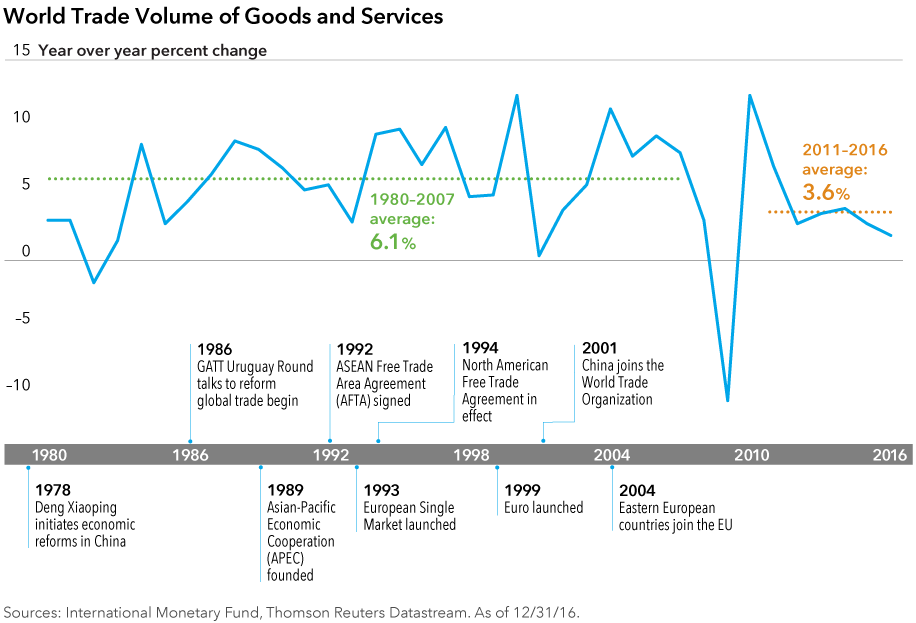

The new U.S. administration’s decision to withdraw from the Trans-Pacific Partnership and open the door to border taxes are the latest examples of a shift away from long-term globalization trends. Global trade volume grew more than 6% annually on average from 1980 through the global financial crisis, but has only averaged 3.6% growth in the past five years.

If trade protectionism persists, this deceleration will only become more pronounced. Investors should be mindful that this changing environment can affect both domestic and global companies. Hence, they should focus on firms most positioned to benefit from changing global trade patterns. These firms can span industries and regions.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.