Chart in Focus

Liability-Driven Investing

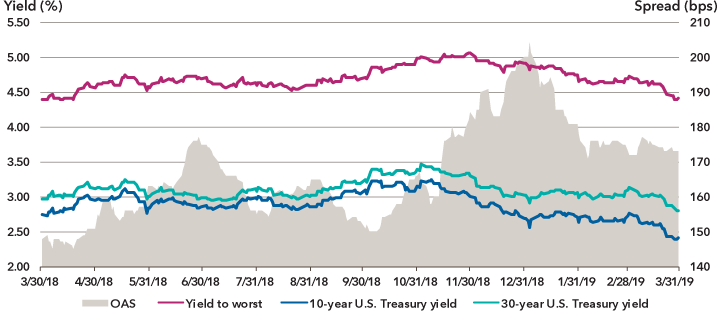

After a significant widening of spreads in the fourth quarter, credit markets rebounded along with equities and other risk assets during the first quarter. A key catalyst of positive sentiment was a more accommodative stance from the U.S. Federal Reserve. This drove U.S. Treasury yields lower across the yield curve and pushed the 10-year Treasury rate below the fed funds rate – a condition that has preceded each of the last three recessions by one to three years. Long-dated investment-grade credit spreads narrowed by 27 basis points (bps) to 173bps during the quarter. The spread tightening combined with lower Treasury yields cut the long corporate credit yield to 4.41% from 4.91%.

Option adjusted spread and yield to worst calculated for the Bloomberg Barclays Long U.S. Corporate Index as of March 31, 2019. Sources: Barclays, Bloomberg Index Services Ltd., Thomson Reuters Datastream.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

related insights

-

Asset Allocation

-

-

Chart in Focus

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Greg Garrett

Greg Garrett