Chart in Focus

United States

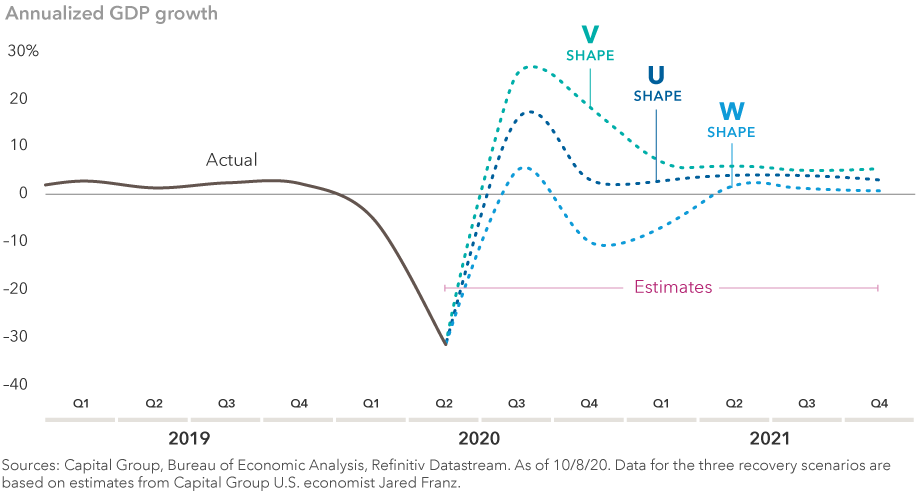

- Expect a “VW” recovery: V in the markets fueled by long-term optimism and W in the U.S. economy amid near-term COVID challenges

- GDP growth of 2% to 3% by the middle of 2021 is likely, according to economist Jared Franz

- Pent-up demand for goods and services should drive big gains once the virus is under control

COVID-19 has forced economists to become students of virology.

“The virus is the economy,” says Capital Group U.S. economist Jared Franz. “All economic growth forecasts depend on the trajectory of the virus — whether it gets better or worse, whether we can develop an effective vaccine and whether government stimulus measures will continue to help bridge the income gap for workers who have been displaced by this unprecedented downturn.”

So when is growth likely to return to pre-pandemic levels? By the middle of 2021, Franz expects the U.S. economy to grow at an annualized rate of roughly 2% to 3%, fueled by pent-up demand from months of sheltering in place, as well as the growing likelihood of a pandemic-ending vaccine becoming available to the public.

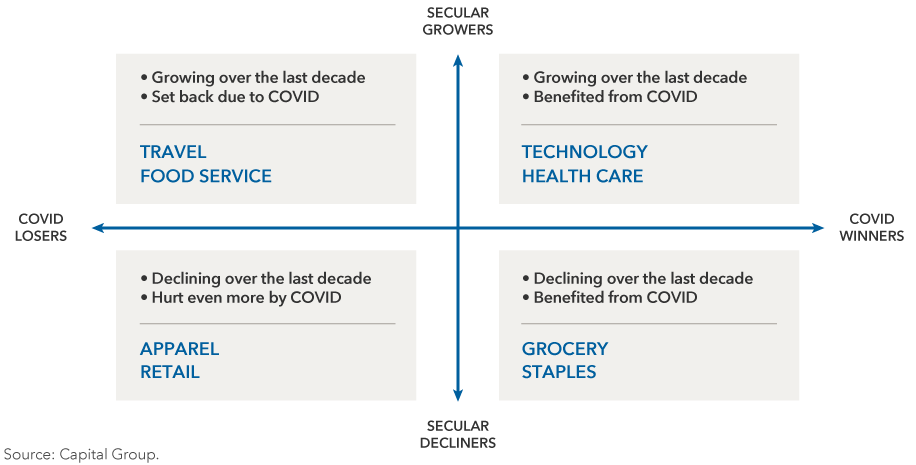

Due to the high level of uncertainty, Capital Group’s economic team has put together a scenario analysis of V-shaped, U-shaped and W-shaped economic recoveries. However, Franz said “K-shaped” — or moving in two different directions — might be appropriate, as well, given the disparity between sectors that have benefited from the pandemic and those that have been crushed by it.

U.S. economy: The road to recovery remains uncertain

COVID causing a great divide in the economy

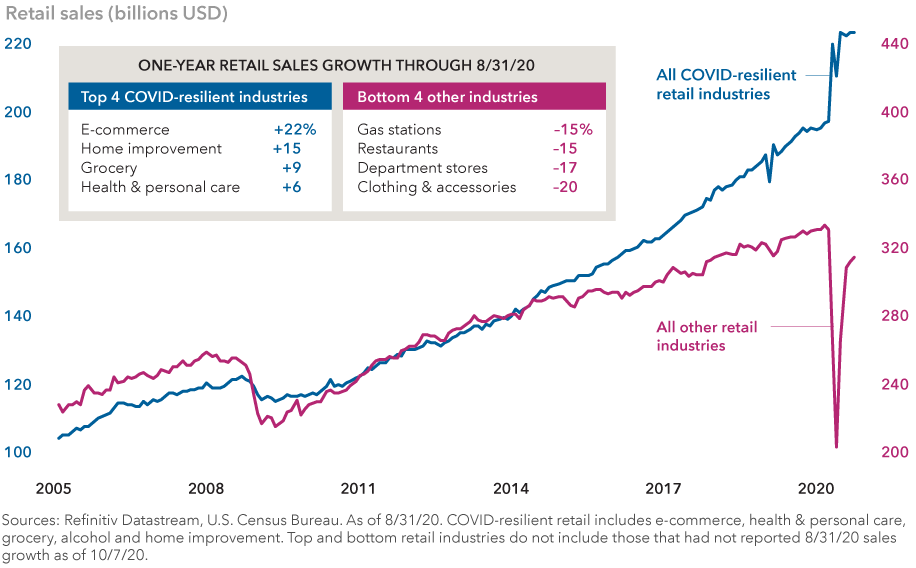

One perplexing element of the 2020 downturn is how uneven it’s been. For some areas of the U.S. economy, it has reached Depression-era levels: restaurants, hotels, retailers, airlines and, perhaps the hardest hit of all, thousands of small businesses that have closed and may never come back. But for others, it has been quite literally the best of times: e-commerce, cloud computing, video streaming and home improvement stores have skyrocketed in the stay-at-home era.

Winners and losers in the COVID economic downturn

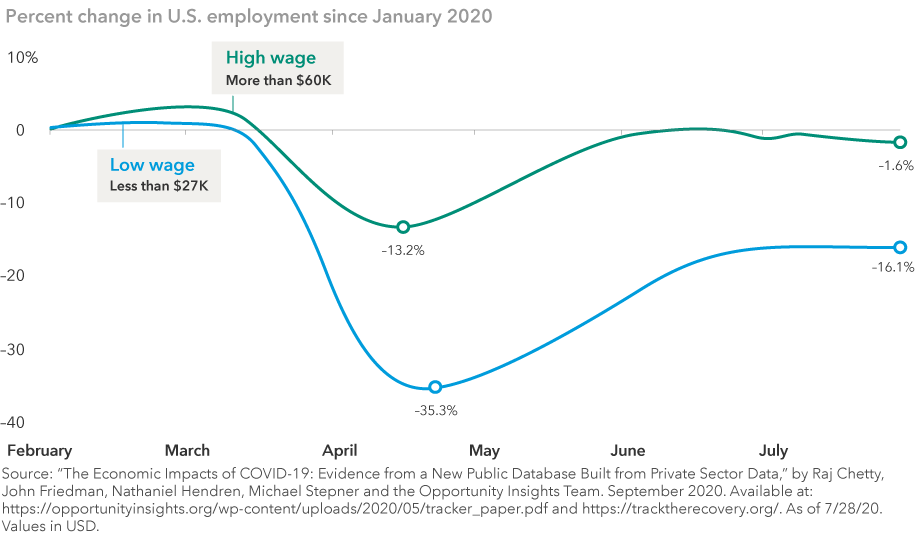

The same can be said for high-wage workers versus low-wage workers. From a job loss perspective, the 2020 downturn has been much more severe for workers earning less than $27,000 a year — many of who cannot work from home — compared to those making $60,000 or more. This disparity, of course, raises societal questions with no easy answer.

“The post-pandemic U.S. economy is probably going to be very different than the economy we had in February 2020,” Franz says. “It’s going to be more efficient and more dynamic than before, but there will be winners and losers. Historically speaking, we have not done a good job of addressing the societal problems that arise from such disparate outcomes.”

Unemployment levels are uneven among high- and low-wage workers

Expect a grinding recovery near term

Capital Group economists have also looked at the risks to a near-term recovery. What if we don’t get a vaccine right away? What if the federal government cannot agree on a new stimulus package? What if more job losses come in the months ahead?

These fears have already been underscored by recent economic data and a series of layoff announcements from major American corporations. Personal income fell by 2.7% in August, according to the U.S. Commerce Department, largely due to reductions in enhanced unemployment benefits. Allstate, American Airlines, United Airlines and Walt Disney all announced major layoffs last week as the White House and Congressional leaders failed to reach agreement on a new stimulus bill.

Capital Ideas™ webinars

Insights for long-term success

CE credit available

“I think we are going to see more of a grinding recovery in the near term,” says Capital Group economist Darrell Spence. “Since March, we’ve done everything we needed to do except get the virus under control in a manner that lets us return to some sense of normalcy. Now the fiscal stimulus is running out and, if the federal government doesn’t act soon, we could be looking at a much more difficult income profile in the months ahead.”

In the second quarter of 2020 — the latest data available — the U.S. economy contracted by 31.4% on an annual basis, the biggest decline in 70 years. However, since that data reflects the worst of the downturn from April to June, the third quarter GDP reading is expected to show a dramatic bounce back as many U.S. states partially or fully reopen their economies. That report is scheduled to be released on October 29, five days before the U.S. presidential election.

With Election Day less than three weeks away, perceptions about the U.S. economic outlook could shape the outcome. On Sunday, a Washington Post-ABC News poll confirmed that the economy is the most important issue to voters — more important than COVID by a 2-to-1 margin.

Digital divide has created opportunities for stock pickers

Investment implications

For investors, the pandemic-induced downturn has produced perhaps the biggest contrast of all. Amid the worst economic recession since the Great Depression, U.S. stock prices recovered quickly from the lows of March and hit new record highs in September.

Leading the way have been those companies with a solid “digital advantage,” including e-commerce giant Amazon, microchip maker NVIDIA and social media titan Facebook. Apple, meanwhile, became the first U.S. company in history to reach a $2 trillion valuation.

“The market is saying this has been a disastrous year, but things are going to get better,” says Capital Group portfolio manager Steve Watson. “Given the exceptional nature of 2020, I think we need to brace for more volatility ahead, but we can still find good, compelling investments for the long term.”

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Economic Indicators

-

Chart in Focus

-

Economic Indicators

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Jared Franz

Jared Franz

Darrell Spence

Darrell Spence

Steve Watson

Steve Watson