Chart in Focus

Capital Ideas

Investment insights from Capital Group

U.S. Equities

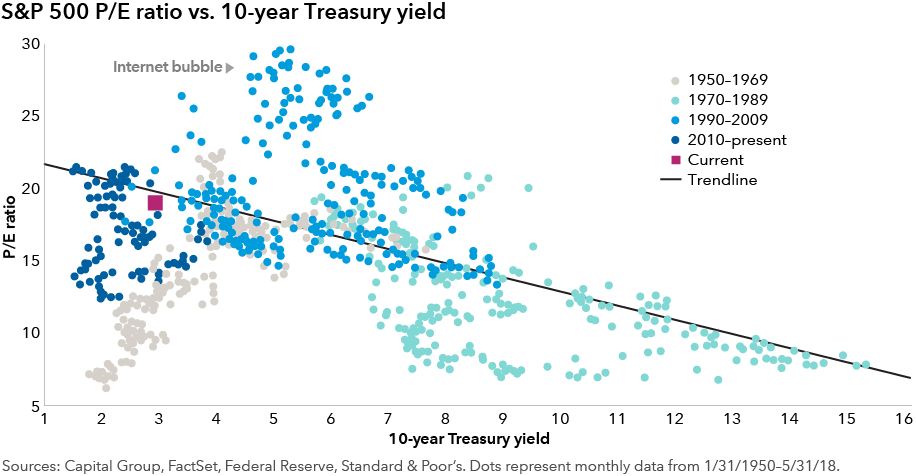

After a nine-year bull run, equity valuations have risen above long-term averages. But considering that bond yields remain low by historical standards, current levels may not be as excessive as they first appear. Strong earnings and global economic growth also provide an attractive backdrop for companies. However, if rates move substantially above 3%, equity prices could be pressured. Especially while valuations elsewhere in the world remain low on a relative basis, it may be time to consider rebalancing portfolios toward non-U.S. markets.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Related Insights

-

Asset Allocation

-

-

Chart in Focus

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.