Out of 15,000 fund share classes, only 36 were deemed “Thrilling” by Morningstar —

And 7 of those are American Funds*

Funds were selected based on what Morningstar believes are “high standards on the most important factors,” 9 tests assessing returns, expenses, risk, analyst ratings and more. Less than a quarter of 1% made the final cut.

Share this story with clients:

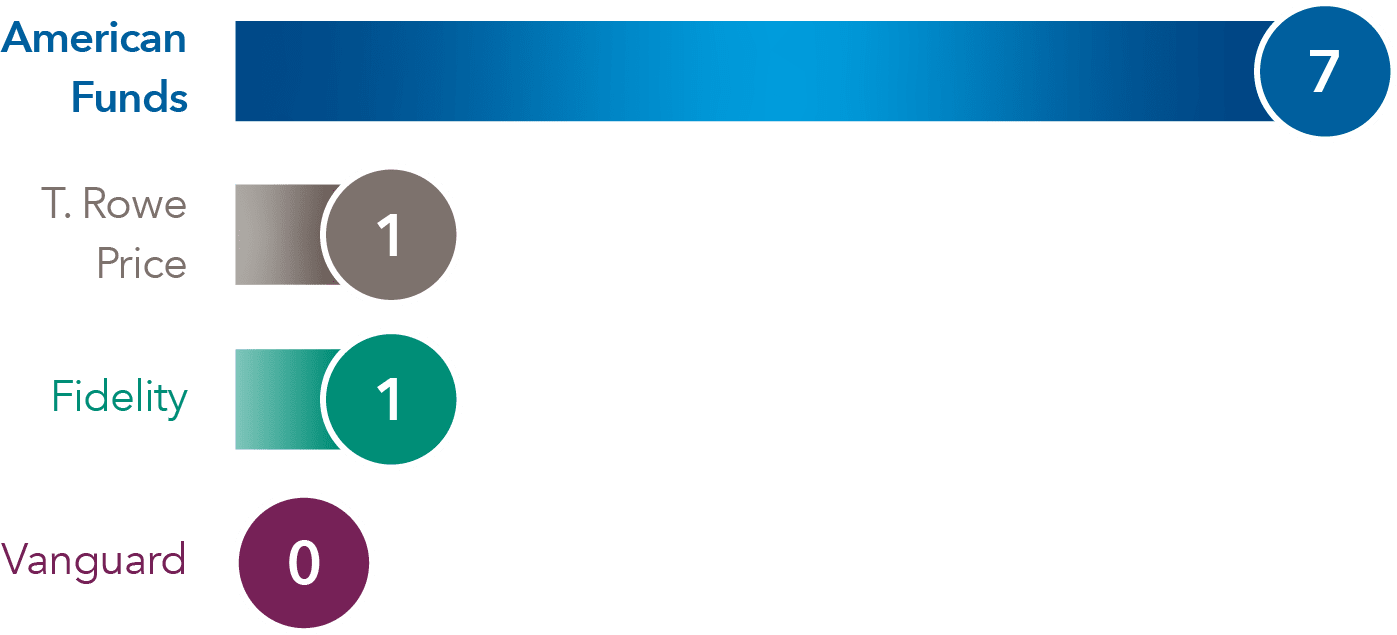

More “Thrilling 36” underlying funds than any other target date series

Nine of the “Thrilling 36” are also underlying funds among the 4 largest target date series providers.

Seven of these 9 are in American Funds Target Date Retirement Series®*

In evaluating target date funds, investors should consider how the various features of each fund, including the underlying funds, investment results, expenses and glide path construction, apply to their personal situation.

Passive funds are not managed to generate returns that exceed their benchmarks, so target date funds that have only passive underlying investments likely will not have funds on the Morningstar “Thrilling” list.

Source for largest target date series: Morningstar, as defined by mutual fund assets as of September 30, 2024.

Assess target date series

See how our series compares with others.

Use of Target Date ProView may be subject to approval by your home office.

“Thrilling” underlying funds

“Thrilling” funds in each American Funds Target Date Retirement Series vintage*

As of September 30, 2024.

American Funds Target Date Retirement Series

Discover what sets our series apart

5 things to look for when choosing a target date series

Explore the metrics that matter

*Source: Morningstar, “The Thrilling 36” by Russel Kinnel, August 20, 2024. Morningstar’s screening took into consideration expense ratios, manager ownership, returns over manager’s tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds and had been rated by Morningstar analysts. Class A shares were evaluated for American Funds. American Funds Target Date Retirement Series invests in Class R-6 shares of the underlying American Funds. Not all “Thrilling” American Funds are in each target date fund. Underlying funds may change over time. Visit morningstar.com for more details.

The Morningstar average expense ratios are based on fund statistics for each fund's prospectus available at the time of publication. The expense ratio is one aspect of plan fees and expenses.