Shaun Tucker

Hello, and welcome to the PracticeLab podcast, where we talk with advisors about what makes them successful so that you can apply those lessons in your business. I’m Shaun Tucker, the Director of Practice Management here at Capital Group.

So what’s your referral strategy? Do you have a clearly defined plan, or are you just hoping to get lucky? That means that you need to segment your book by how likely clients are to refer people to you, not just based on how much they’re worth. That also means knowing exactly when you’re going to ask clients for referrals. And that means identifying the right centers of influence, or COIs, to work with – including the ones advisors often overlook, not just the same old accountants and attorneys.

Then, with a plan in place, are you keeping track of how your referral tactics are performing against that plan? That means having candid conversations with COIs about whether you’re both getting value from the partnership or if it’s just one-sided.

If you want help creating, improving and executing a plan to help you get referrals from both clients and COIs, today’s episode is for you. Earlier this year, we hosted a webinar featuring Molly Bennard, the president of international operations at Focus Financial, which has over $400 billion in assets under advisement. Molly was on a panel with two Capital Group practice management consultants, Max McQuiston and Jon Wainman.

You can find the full replay of the webinar on our Capital Ideas Pro website, but here’s a condensed version of that conversation. Let’s jump in.

Shaun Tucker

Max, I'm gonna turn it over to you for the first question. You work with hundreds of advisors throughout the course of each year. Why is organic growth so important and why are we talking about it today?

Max McQuiston

I think it's a great question. I think, uh, I would frame it in two different aspects. The first is, it's the number one request we get, from advisors is, Max, can you help me grow? Or do you have other ideas or best practices that you're seeing what o- t- that other people are doing that maybe I could implement into my practice? And part of that presupposes the fact that, you know, the reality is, is, you've gotta carve out time to grow. It's gotta be intentional.

And secondly is just looking at the dynamics of a book, people are working with you, to, uh, help them, achieve the goals and dreams they want.

And those goals and dreams often include, pulling money from their accounts, whether it be for college, a second home or a first home, or maybe it's just, for what they... Most of us save for is retirement. So on average, just over 3% of a practice is leaving for reasons that they've saved it for.

But then you also have, you know, some unintentional where somebody may have taken their account away from you, or, or maybe they passed away. And the heirs, you didn't have relationships with the heirs, and they left. So, you've gotta replace both of those.

So you need to grow more than 4% in new assets.

I remember working with an advisor and I was talking to him, "How much leaves every year?" And he goes, "Max, on average it's about 30 million." Meaning he needed to grow, you know, bring in at least 30 million in order just to remain where he was. But none of us wanna stay where we're at, we're always trying to think about how do we grow. So that organic growth is really important.

And one thing I want to just point out. If you look at your book of assets and you say, at what age do half of the assets reside above and half of them fall below, meaning what's the average weighted age of your assets. If, is, you know, on average it's in the mid-sixties.

If that number creeps towards 70, it becomes really difficult to stay in, in net inflows. So it's really thinking about how important growth is. It's hard. If you're not growing, you're shrinking.

Shaun Tucker

Yeah. Um, a lot there. Average age of assets, I think that's something we should all write down and think about. But it's tough to accept what you just said, right? If you're not growing, you're shrinking. And I know a lot of you in the audience are all too familiar with that, and that's why you're here. And you probably want us to kind of rush to all the tactics around referrals as a solution to that. But before we do, there's some really important things that you have to have in place first or your referral plan won't be as successful as you want it to be. And so, Molly, I'd love to bring you into the conversation here. I know you're really passionate about this topic, and you emphasize it a lot with the large teams that you work with. But what are these foundational things that they need to focus on for their referral strategies to work?

Molly Bennard

Yeah, thank you, Shaun. You know, to the point if you're not growing, you're shrinking. You know, I, a lot of times I'll say, if you're not growing, you're dying. (laughs) But you know, the reality is, across all the businesses that, you know, I've worked with over the years, growth, from a business perspective, needs to be intentional. And so, many businesses I've encountered over the years, within the industry, they may not have growth as a strategic objective. Many firms don't have a strategic plan or a strategy laid out for the next, whether it's 12 months or three years, with goals associated with growth. And the truth is, if you don't have that in place, you know, ultimately there'll be no roadmap and there'll be no budget to make the growth happen.

So, what it looks like in practice basically is that, if you make growth a strategic objective and you set some tangible goals at the top level, it allows the leadership team to start the conversation as a firm and make growth part of the actual culture of the firm, part of your values and part of your strategic objectives. So, then from there, you basically start building a plan. And so, you know, I would frame it into four steps.

First, refine and strengthen your value proposition. Second, really focus on a specific segment of the market, or segments depending on your firm and size. Third and importantly, define goals and KPIs. And then fourth, you need to have a plan and a budget around it. So, you know, I'll kind of jump into each of those in a little bit more detail.

I would say, you know, when it comes to, articulating your value proposition, it really is a process that goes all the way to articulating your why. So, that includes things like reaffirming or confirming your vision, your values, and your mission as a company. And then ultimately your website, your marketing collateral, and how you work with your clients aligns to that proposition. So there's consistency in your ethos as a firm and also how you position yourself to clients from a marketing perspective.

The second part is, really defining your target market. And I like to call it the what, right? And so truthfully, many businesses struggle here. As the legacy approach to marketing and business development was really just to cast a wide net. But we realize nowadays that you can't be everything to everyone, and it's really important to be focused when it comes to business development and client segmentation and service. So what we know is that the more specific your target market is, the better chance you have at growing your business and driving growth.

We have some statistics, if you work within a specific target market, what we see is that firms that do that really have about two times the growth of another firm.

So that's pretty compelling, right? So, what I would say is it's really important to pick a segment, but also to pick a segment that fits within your practice or your business. So, that's ultimately where you're going to have interest and expertise, where you can effectively have the resources and services to address them, and importantly, make sure it's a market that's a meaningful opportunity, right? So that includes things like looking at the overall size, growth trends, affluence levels of the segment, and so forth.

The third step is around goals, right? And having specific and importantly, measurable goals. So once you start breaking down your strategic imperatives, you'll really wanna define activity-based KPIs. So, I'm a big numbers person. I'm an accountant by trade, so I'm all about numbers and data. (laughs)

And so, you know, you do need to start measuring things like leads by source, number of touch points, the actual outcomes, including things like number of leads or clients closed, the size of your client, revenue, and of course, segment that by each of the activities. So when you look at the activities and the source, see the effectiveness of each of those activities and the sources that are driving it. You know, as I mentioned, I'm a numbers person, so measuring data is key to this process. And if you don't measure the data and you don't have the information, quite frankly, your goal never existed, right? So, having a good tool to document your goals and your activity and outcomes is crucial. Because again, if you don't measure that data, you can't gain insights and you're unable to make decisions and then iterate on strategy.

And then, you know, the last part is really the how, right? So building your plan. As I mentioned earlier, if you don't know where you're going, how do you get there? So, firms with specific plans, um, and I think the data shows it, gain 67% more clients than those without. So that's a pretty impressive statistic. So again, you know, I always like to say go back to the data. So it's very important, to, um, create the goals and then have activity metrics alongside it. And of course with that will come a cost to conduct those activities. And, again, your plan will get pretty granular. And again, really important to measure progress against those objectives and then use that data to assess the effectiveness of your strategies, and then, of course, your return on your investment.

Shaun Tucker

Uh, Molly, thank you. There was such a wealth of wisdom there. if you can't measure it, it never existed. I think that's a mantra we should all adopt. Jon, I'm gonna bring you into the conversation now. How do you help advisors think through this process of creating that plan? And then maybe secondarily, I know you'll go there, is where do referrals fit into this?

Jon Wainman

So I think areas that I would think about if you're building a marketing plan, is what are you trying to accomplish, right? Are you trying to maintain your business? Are you trying to grow it? Where, what sources do you want to get growth from? Are you trying to build client referrals, as an example? Are you trying to boost digital leads? So I think that is question one that I would think through.

Uh, number two is, you know, Max and I engage with a lot of advisors through the course of the year. And in terms of budgeting, to Molly's point, it's really important to think through that. And quite frankly, we see a very wide array of answers. The industry average is about 2% of revenue. There's a lot of advisory practices that do either none or maybe just under 1%. And then on the far end of the curve, you do get some folks that are trying to be mega growers doing eight to 10% of revenue per year. So think about a budget.

I think number three, um, Molly hit on something that is really important, which is the need to specialize, the need to have some kind of niche. And so think about the different channels. These are very high level buckets, but I think if you're focusing on retirees, for example, right? What channels are you likely to to meet retirees? I think client events might be one, right? Facebook might be another one. Conversely, if you're thinking about business owners, I think LinkedIn would be phenomenal, right? Building out and investing in your website to broaden reach might be another approach.

And then lastly, to Molly's point, I think having that marketing plan, this is all about measuring ROI, it's about not being impatient, giving it some time to see what works. And eventually over time you'll figure out this is what's driving success and what's not. So that's a little bit more in terms of building out the plan.

What's really interesting is, when we go to advisors and we ask, what channels are you leveraging today? I think predominantly what you see is you see most advisors leverage personal engagement, uh, channels, right? So it's doing client events and it's referral driven, right? That's the vast majority.

If we reverse that question, we say, all right, this is how advisors market. The flip side is how are clients actually finding their advisor?

There was some work done figuring out where are clients finding their advisor? And really what stands out is clients over the age of 45 heavily referral driven, right? Those personal engagement tactics. What's interesting is you see a switch as you go to millennials and below. So the under 45 bucket, and you see the rise of digital media, digital advertising start to take over. And so regardless of what you're doing today, I think it speaks to the importance, especially if you have generational wealth of needing to diversify the channels that you market.

Shaun Tucker

Jon, that was great. Really appreciate it. I just, Molly gotta bring you back in. I know you spend a lot of time thinking about your business, its growth, especially with respect to the next gen of clients. And, and Jon, you said it, a little bit earlier, but what do you make of that information as you think about reaching next gen clients?

Molly Bennard

We're in a world where there's a shifting preference and a trend towards digital, right? And I think it's a big realization for many of our businesses and the entire industry.

And so, no matter even if the client is referred to an advisor through another individual, they will end up on the internet validating, right, the information about that advisor or business and assess the credibility based on what Google tells you, right? So, it's a really important shift that, you know, ultimately, we all need to incorporate that into our marketing strategy. And importantly, just to the point earlier made, by Jon, if your clients are living on the internet, right, you need to meet them where they're at.

Shaun Tucker

Yeah, I think that powerful, powerful wisdom there, mindset shift, thinking about how to reach next gen clients, meeting them where they're at. I think that's terrific stuff. Uh, thank you, Molly, appreciate that, that add-on comment.

Um, okay, so now we're gonna spend time on COIs.

The first step is that we wanna understand the importance of COIs.

Schwab's latest RIA benchmarking study shows that advisors with a defined ROI referral plan generated over four times as many assets as those that didn't. Let that one sink in. Four times. Having that COI referral plan is critically important. And as a part of that plan, you've gotta spend time thinking about who are the right COIs that you gotta work with. So Jon, I'm gonna come back to you. Talk to us about that next step, finding relevant COIs.

Jon Wainman

Yeah, no, thanks Shaun. And, and to build on that, I think, um, I would echo Shaun's comments. They're, COIs are incredibly important, not only from a growth perspective, but also you saw on there a retention perspective. And so I think one thing to be thinking through is, when I talk to most advisors, estate planning attorneys and accountants are kind of the big two that you hear everybody talk about.

Um, I think what we try to do here is take it a step further and say, if you're specializing on a market or two, try to figure out what other professional providers may intersect. And so what we've tried to do is lay out different client types, right? So mass affluence, maybe it is accountants. I've seen some advisors that have had tremendous success with divorce attorneys. For example, I met an advisor a month ago, and that is their number one referral source for the mass affluent is divorce attorneys, oddly enough.

Number two is, as you move up the wealth spectrum, there is overlap in terms of COIs, but there is some shift, right? And so, as I think about high net worth, ultra-high net worth, the number one driver of high net worth and ultra-high net worth wealth is small business owners, right? What are some various COIs that also intersect with business owners? So I would say attorneys, right, CPAs, they still matter. You tend to find banking plays a bigger role. And then I think you start layering in the fact that beyond just their personal wealth, these people run businesses, right?

And so you start thinking about from a business perspective, what COIs do they engage with, right? So you think about property and casualty insurance, you start thinking about group benefits insurance, payroll companies, and I think even as you go up to the upper end of the market, M&A activity becomes a bigger deal, right? So you've got private equity becomes a bigger factor. And so I've seen advisors have success there. I've met with an advisor recently and I think he'd had tremendous success. And his biggest driver for high net worth clients was he had a trio of business bankers that fed him a ton of business, and he's drawing in a clip of $50 million a year. And so I think the point here is, yes, CPAs, estate planning attorneys are really important, but there are a lot of other professional providers that intersect with our clients. And it's good to think broad, right? It's good to expand our aperture, if you will.

Shaun Tucker

Yeah. I, I think there's a wealth of insight there around great ideas on the who, with respect to kind of good COI partners. Uh, we don't have time to get into that, but I would encourage folks on the line to, to get with your colleagues and start riffing on those better ideas. Uh, so we covered the who there. Now let's talk about engaging COIs. What do we say and when do we say it? And Max, I'm gonna ask you to take us through that.

Max McQuiston

Yeah. Jon, I think you did a phenomenal job kind of expanding our thought of who a COI might be. One advisor I was working with is, one of the centers of influence he had was, uh, someone who worked at a mortuary who was a client, but then she was running into people who, were needing help and didn't have an advisor. And so that became a referral source. There wasn't even on that page, but it's thinking about being flexible and open.

Well, I think, I think one of the things to think about, you know, as you think about when to ask for that, uh, introduction is, you know, from when you onboard a new client, and this is a place I'm really passionate about for multiple reasons, client onboarding.

Part of that is when you're collecting information and onboarding, who are their trusted partners in capturing their names? I was working with a practice a little while ago that, one of the things, and this is pretty unique, but, uh, you know, when they tell you who their CPA is, if you don't know them, if you've never met them, uh, slow them down and say, "Hey, tell me a little about so-and-so. Tell me a little about Shaun. What do you know about him? How long have you worked with him? How good is he? If you scored him on a scale of one to five, where one is, it wouldn't matter if you worked with someone else, to five is, you have to work with him."

If they score high, maybe you say, "That's someone I would wanna put on my list to meet." If they're a one, two, or three, what they do is say, "Hey, would you be open to considering one of the CPAs that we work closely with? 'Cause for us, we can deliver better value if we have a tight relationship.”

And I think to me, there's no one way to say it. This book, Exactly What to Say, Phil Jones talks about what the words are to use, but to me is, would you be open to, is a great example, but thinking about, you know, working with a CPA, "Hey Max, I just met with, a mutual client. They work with you. They think very highly of you. And one of the things we do is we wanna help coordinate and partner together so we can deliver more value." So, really thinking about what you would say and practice that, I would argue script it.

But then as you think about what to say, one of the things that's most important, get to know them, their practice, make it about them. What are the ways in which you could add value back to them? How much do you know about who they serve, who their target client is?

My sister and brother-in-law sold a business. Their CPA offered them almost no help thinking about how to minimize taxes, how to structure that deal. If you've got a business owner, are they with the right CPA, someone who specialized in that? So, get to know their business. And then if you ask a lot of questions, you ask good questions, they're gonna reciprocate and ask, "Who do you serve? And what's your target client like?" They're gonna mirror the questions you ask and they're gonna come back and ask you. And then, you know, "Who are our mutual clients? Do we have some overlap? Who's your target? Here's my target, here's where we could work together." And then, you know, share some of the ways in which you've worked with COIs.

Do you follow them on LinkedIn? You know, hear what they're saying. Do you pay attention to what they're saying? Maybe you treat 'em like you would treat a client, give 'em updates.

And to me, when you add value to them, they are gonna reciprocate. Another example of that is, you work with estate planning attorneys. "How many of you know a proactive estate planning attorney?" I'll ask that all the time when I'm doing a event, and I'll have a few people raise their hand. I go, "Let me define what I mean by proactive estate planning attorney. Shaun, we worked with you, a few years ago we did an estate plan. How often does an attorney call and say, 'Hey, I'm just wondering if there's any updates we need to make.'" I said, "Why don't they make that call?" And advisors will look at each other, and I said, "It's because they can't bill on that."

And if they bill that way ... So who do your clients count on if they need to make an update to their plan? Who do the estate planning attorneys count on if they need to make an update to that plan? You look at them in the mirror every day, how good are you at issue spotting? And as you bring in other partners as you serve as a conduit, a connector, if you will, that give and take will come back at you.

So, I worked with an advisor up in the Pacific Northwest. He spends almost a week a month just working with centers of influence. He calls them and he wants to know, every time he calls 'em, he would let ... Here's what he wants to hear. You know what, Brad? I, that's something I, I wasn't aware of. I'm so glad you let me know. If they have that kind of response when you talk to 'em, they are gonna plug you in, as that center of influence.

So, you know, to me, as, you know, being thoughtful about how you engage, but it's that give and take. Think of 'em as strategic partners, not just as centers of influence. It's a two-way street. Track how many referrals you gave, not just how many they gave you. Do joint events with them. I've seen that happen, at the beginning of the year. "Hey, here's our 2025 outlook," and you have the CPA talk about here's the tax changes for 2025. Or we have the Tax Cut[s] and Jobs Act this year. That's gonna have to be updated. You know, how well do you keep in front of that? So anyway, these are examples of how to connect with COIs and have that dialogue. And, it needs to be intentional, but if it is, it can be a wonderful source of new business.

Shaun Tucker

No, I mean, uh, and for the audience, you can see how excited I was to assemble this expert panel. There's a wealth there. Um, reciprocity comes to mind. Two-way street comes to mind as it relates to COIs. Investing in them, putting them first, making it about them, and then you get the reciprocal benefits. So Molly, let me bring you back into the conversation. Goal setting, obviously is a passion of yours. Talk about what kinds of goals need to be put in place with COIs for the most fruitful relationship.

Molly Bennard

Yeah, absolutely. And just back to Max's point, I think it's really important to stress that it's a relationship. It's not a transaction, right? And so, it's really important to have commitment to one another to work together. And I find that with our advisors, the most successful COI relationships are where each party is curious about each other to learn about one another's business and clients, so you can identify mutually beneficial opportunities with one another.

And so, um, one thing I'll also note, on this is, in building COI relationships, it's also important to know when to quit (laughs). So, many times, I hear from advisors that some of their COI relationships don't give to them, but they're giving, you know, to the COI. So I'm referring relationships out to the accountant, but they never come back to me.

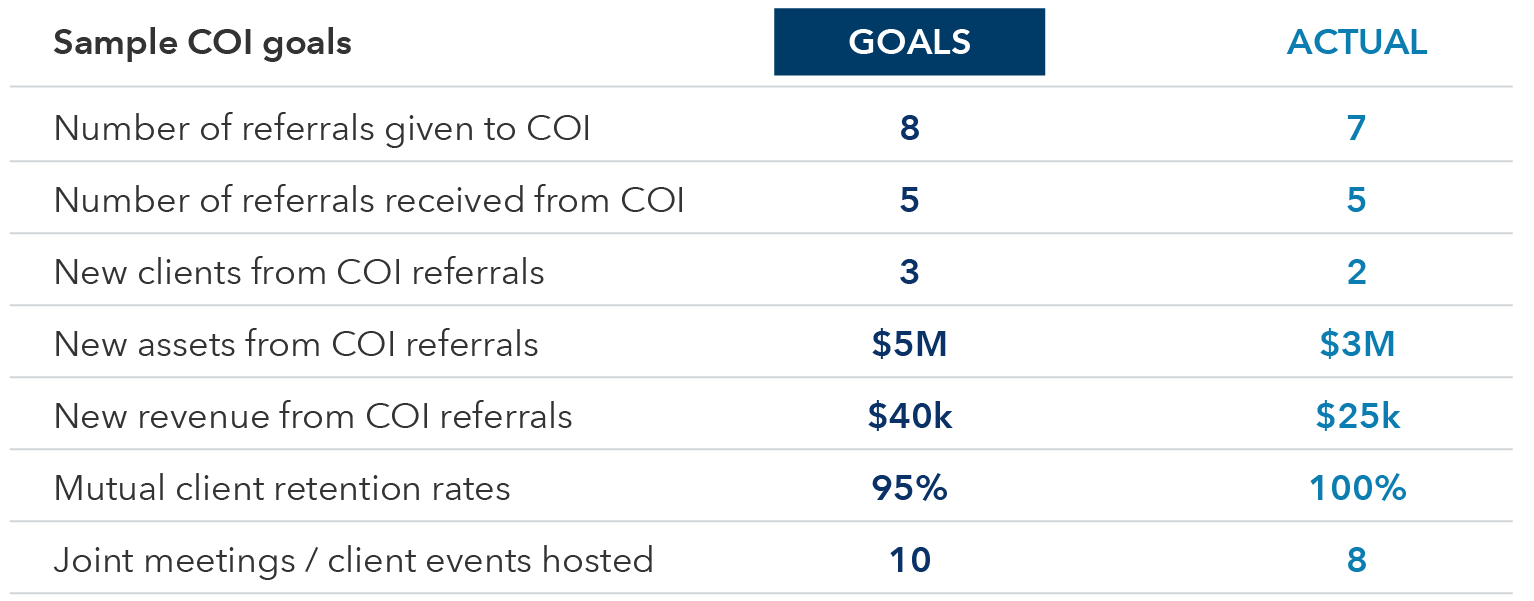

And so this goes back to having goals and transparent communication with your COIs. And really getting alignment on what are your collective goals. So, what are the objectives for, whether it's the quarter or the year or the month, or whatever it may be. But come up with some numbers, like how many meetings, you're planning on having, or how many referrals like you think the opportunity set is in sharing with one another of, "Hey, this is what we're working on here the are ... where the opportunities are," so that way you have full transparency with one another.

And it goes back to that other point as, if it's not working, then you obviously assess the situation, but also be transparent about the reality that some COI relationships don't work or not ... are not effective, given your goals may not be mutual. Or you may not be both willing to invest in the relationship in the same way. So I think that's a really important piece.

You know, I think, scheduling structured time with your COIs to revisit your relationship, is also super important. So, you know, that includes having transparent feedback with one another. "Hey, this worked, this didn't work." Or, "Hey, you sent this person over and let's go through, like, why this lead made a lot of sense and then this one was actually a really bad fit for us." And vice versa, right? Give each other that open feedback so that you can be more effective with one another and strengthen your relationship.

And I do think it's really important to take note, take your notes and share with one another around the activities that you're doing, what the results are, and again, discussing what worked, what didn't work, and how you can better support one another to be better in developing business as a partnership. And again, I think it's just all about transparency and communication, and, again, measuring data and results.

Shaun Tucker

Thank you, Molly. That was terrific. All three of you have been saying really similar things, that it's really about having a true partnership through relationship building and you earn that two-way street. And the importance of that reciprocal benefit.

Now, we're gonna turn our attention to clients. As before, we wanna understand their importance, right? I know everyone is probably familiar with Michael Kitces. He and his team do a study on advisor marketing every year. The latest one revealed that client referrals is the top source of new clients or advisors. And it was rated the highest success rate of any client acquisition tactic, right? So let that one sink in. This is important. We all need to do this. But I think we wanna clarify, we're not suggesting that you get referrals from all different clients. And Molly, I'm gonna come back to you. Talk to us about which ones we should focus on and how we should bring some vigor and some discipline to our selections.

Molly Bennard

Yeah, for sure. You know, it really comes back to working through a segmentation model, right? Many advisors segment their clients based on size, right? So, you know, I have my less than 1 million, my 1 to 3s, et cetera, et cetera. And, you know, obviously the numbers move around depending on the firm.

Um, but what many advisors forget to do is actually, when you're doing that segmentation, you should also be segmenting your clients based on other factors. And one of them includes their advocacy. And so we recommend that, you know, advisors be extremely strategic and intentional around segmenting clients based on their willingness to advocate and provide referrals. Now, of course, this is not a perfect exercise because it is a subjective analysis that the advisor makes. But, at the end of the day, it does create a much more focused group of clients to target on.

So, you know, I'm a firm believer of, again, measuring data and using your CRM and staying on top of it, right? So, when we go through a strategic segmentation exercise with our advisors, within their client lists and their business, we do often, really, push them to segment their clients, not just based on quantitative statistics, but also a lot of qualitative. And it's not just about whether they're advocates, it's other features as well. But obviously advocacy is a very important criteria that you should be segmenting your clients on. And then really stay focused, you know, when it comes to asking for referrals on those clients that you believe have a much higher level of advocacy for you.

Shaun Tucker

Yeah, that's terrific. And I want to stay on the advocacy topic, Molly, because there's a lot that needs to be leveraged there. And I love your comment about the evaluation and the use of data, and really understanding what a great advocate looks like and profiling it, if you will. One of the greater manifestations, and I know I don't need to be telling you this, of an advocacy is to be on an advisory board, a client advisory board. And you're obviously serve on our RIA advisory board.

But Jon, lemme come to you on this. Uh, can you talk to us a little bit about how powerful that is with respect to generating client referrals?

Jon Wainman

Yeah, sure. Absolutely. Um, there's different ways to build advocacy. This is one. And so I think advisors that leverage some kind of advisory board, I think you're really trying to accomplish one of two things. Number one is some folks use it as a way to build networking groups with specific client types, right? Could be business owners, could be sectors of, uh, of the industry, health care, etc. Other types of advisory boards are really focused around growth and providing strategic input, right?

And so I think if you focus on that use case, to Molly's point, building the advocates, it's heavily, um, geared around building trust with your best clients. And so I think having an advisory board where they can see the inner workings of your practice helps give people comfort and confidence on, "I should refer this advisor to my best friends out there," right?

Number two is the other benefit of an advisory board is you can have unbiased feedback in terms of what are some things that maybe I should be thinking about and incorporating into my business, right? And so you tend to see some advisory boards, and you can see at the bottom there, there tend to be a blend of strategic partnerships, COIs, as well as clients. And so I tend to see, this is a built-in feedback mechanism that practices can use to figure out what, what's on my radar, what should be on my radar? And quite frankly, what are some of my competitors doing? And it provides you some strategic input in terms of, here's some changes that maybe I should be considering.

I think the last thing that I would consider is, the best advisory boards tend not to be stagnant. So if you're considering one, having members rotate on and off every two to three years is probably a best practice.

Shaun Tucker

Yeah. Great stuff, Jon. So we just talked about the who. Let's talk about the when. So Max, when should advisors approach clients for referrals?

Max McQuiston

More often than they are, short answer. But, no, all joking aside, I think, in this book that I mentioned, you know, Exactly What to Say, Phil Jones, I think does a wonderful job. And his perspective is after client says thank you. And if you think about, you know, when a client says thank you, what do we normally say?

Shaun Tucker

You're welcome.

Max McQuiston

You're welcome. Unless we worked at Chick-fil-A and then it's my pleasure, right?

So, so the reality is, what would you say above and beyond just you're welcome. And it might sound something like ... And again, make it your own. Make it something you're comfortable with, 'cause your body language will tell if you're comfortable saying it. If it sounds comfortable to you, it'll sound comfortable to your clients. "You know, Shaun, I'm glad you really valued whatever you just thanked me for. If you know someone else that would benefit from the work that we've done for you, I would love to help them. I would welcome an introduction." And then shut up. Like pause, not, not talk through it. 'Cause sometimes when you say something uncomfortable, we like to keep talking. But pause and let them react. So, that would be, you know, number one.

Number two, I mentioned it earlier, uh, when I talked about client onboarding. But I know a lot of practices who have really focused ... They track where they get referrals from. When someone becomes a new client, they're having an experience. If it's a great experience, they want to share that. You go to a new restaurant, you want to share, you're excited about it. What kind of an experience do your clients have when they onboard with you? Have you ever asked them, could you make it better? What would you do if you wanted to make it better? And if it's not written down, if they don't see a process, they're more likely to be hesitant to refer you 'cause they're not sure how it went. If they can tell you are all over it, "Hey, here's what happens at 30 days, 60 days," you track all that stuff, you ask for feedback, people are gonna be much more apt to refer you. And if you don't get a referral in the first six to nine months, you're unlikely to get one from them for years, if ever. So make client onboarding a great experience.

Molly, let me come to you, I know you've done a lot with client events. Talk to us a little bit about how you've leveraged client events as an opportunity to get introductions and referrals.

Molly Bennard

Yeah, for sure. And, you know, I think just one of the quick comments is I'm a strong believer of you're gonna get your best outcome when it's a positive experience. And so when you're able to wow the client and provide them with the best possible experience or outcome, that is when the opportunity is to ask for the referral.

And I think what's important is instead of making it a chore for clients, it becomes an extension of their appreciation. So to the point around, not saying the best form of a compliment is a referral, it's almost like you're giving the client a job, right? Versus having that conversation with them around, do you know anyone else? So you're making it more of a collaborative effort versus providing the client a job, right? So, I think it's important in just thinking through how you frame the engagement with the client.

But as it pertains to client events, they are always a really good opportunity to drive new business and ask for those referrals. And quite frankly, many of our advisors tend to have client events where it's a more natural way of asking for a referral in that, you know, they frequently will ask clients to bring a friend. So instead of asking for the referral, they're inviting the referral in and doing it under the guise of an experience. So, whether the firm is having a wine tasting event or a unique speaker, or some type of art experience, or, you know, whatever it may be, giving your clients that opportunity to bring along a friend or a, you know, a referral that they think would enjoy the event. Which creates a really natural way to ask your client for a referral in a way that's exciting for them, right? And it becomes a reward that they get to experience something with that referral that they're bringing in, or their friend or family, or whoever it may be.

So many of our advisors use that tactic with events. What I would say is, and I think this is discussed quite frequently. But, small events are always better, especially when you're asking your client to bring a friend, because it creates an intimate setting, allows the advisor to naturally engage with their client and with the potential lead. And so again, small events are always better. And, you know, the intimacy does allow for that high level of engagement in a much more natural setting, versus a big room where you're, you know, selling some kind of presentation about whether it's the markets or, you know, some type of financial topic. It doesn't really lead to that natural dialogue of building relationships, right? So small events are always better 'cause it allows you to quickly dive in and start to build those relationships.

Shaun Tucker

Uh, it, it's a great point, Molly. I'm always reminded that people wanna work with people that they like, and so those smaller, more intimate settings, we get an opportunity to get to know them personally. Great point.

Max, I'm gonna come back to you. We're gonna keep rolling here. You talked to us around the COIs, about engaging COIs and some of the pointers to use. What about what you would do on the client side?

Max McQuiston

Yeah and, when I ask advisors, you know, "How many of your clients are referring you?" Generally I'll get somewhere between five and 10%. In fact, one advisor I was working with, he said, "Max, when I looked at my book of business," he said, "I could track almost 70% of my clients to three different people."

And so the greatest keep the advocates and do as much as you can. You know, I think, uh, Molly's point about making that part of your segmentation is really important, but how do you get the movable middle to help? And, uh, part of it is asking them for feedback. I don't think we ask for feedback very often. If you ask clients for feedback, both good and bad, what are you doing that they really appreciate? What else could you be doing for them?

But the other way is, and this is, uh, come from a team, a couple billion dollar team growing 20% a year. Think about that kind of growth, and you're like, so I said, I said, "What are you doing to grow at that base?" He was always complaining he couldn't get enough people to serve all the clients. And he said, "Well, Max, I finally figured out how use LinkedIn." I'm like, "Okay, I'm all ears." And, uh, he's in my age demographic. He has a five-handle, which sometimes mean they're not as technologically savvy as the younger generation. But there is an advantage, Shaun, to having a five-handle on your age. I can take advantage of the catch-up provision and, uh, you can't. But, no, just kidding.

But, but I think as you look at, how would I leverage LinkedIn, so what he did is he went and looked at all of his As and Bs, looked to see, did they have a profile LinkedIn, and then he asked to connect with them.

And then once a year and every year thereafter, whether it's at an annual review or some other time, he has on the agenda introduction and he looks ahead, what are, who are one or two people they know that he would want to meet, and then when you ask him specifically for an introduction, "Hey Shaun, I notice you're connected to Jon Wainman. How well do you know him?" "I know him pretty well." "Do you think he'd make a good client?"

And then if they say yes, then he said, you know, "Jon's the kind of a, or uh, the client that we work with really well because of X, Y and Z." You identify your ideal client and he fits one of 'em. "Can I ask you a favor? Could I ask you for an introduction?" And he goes, "Almost no one says no." And then I ask, "What would be a good way? Is it," you know, and sometimes it's grabbing a bite, playing golf, whatever it is, you know, going to a play, some kind of way to make that introduction. And he goes, "And that introduction when they make it feels just like a referral." 20% of people come from making a referral. 80% are comfortable making an introduction. Just replace referral with introduction. I think you'll have a lot more success.

Shaun Tucker

Terrific. That's terrific wisdom, uh, and encouragement to all of us. Hey, let's stop here. Really rich discussion there. We are gonna wrap up. Molly, Max, Jon, I can't thank you enough for your insights, for your time today.

Shaun Tucker

So that’s it for this episode. Thank you for listening. And don’t forget you can get the full webinar replay, including the slides, a CE quiz and some related resources, on the Capital Ideas Pro website.

So I’m going to take my own medicine here and ask for a referral. If you liked what you heard today, send it to another advisor who’s also looking for ways to grow their practice organically.

PracticeLab is brought to you by Capital Group. You can find these episodes and more at practicelab.com.

The guests in this episode used several acronyms throughout the conversation. KPI stands for key performance indicator. ROI stands for return on investment. M&A stands for mergers and acquisitions. CRM stands for customer relationship management. And RIA stands for registered investment advisor.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.