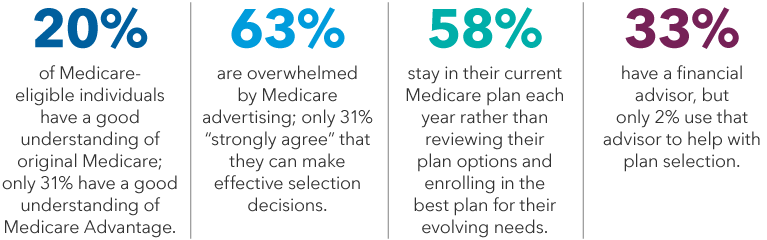

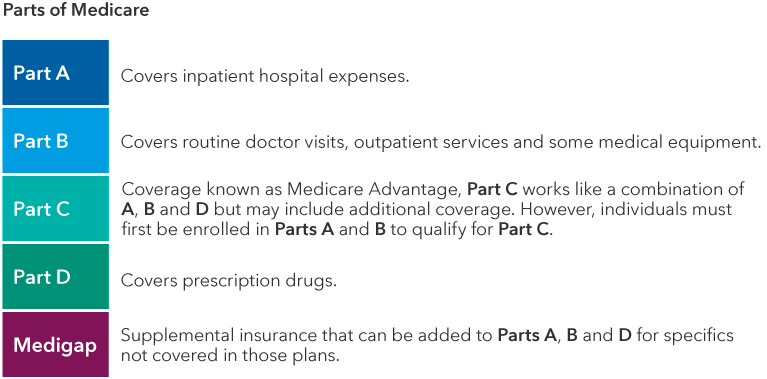

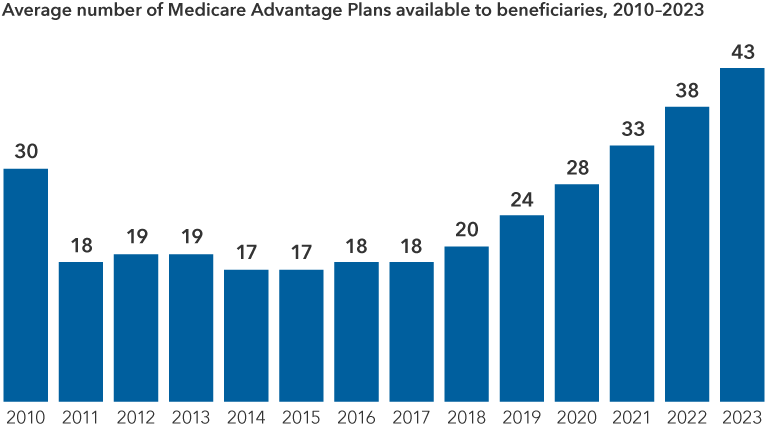

Medicare is something that most Americans will use, and yet it seems shrouded in mystery. The primary source of health insurance coverage for people ages 65 and older, Medicare covers more than 65 million people, according to the Kaiser Family Foundation (KFF), an independent health policy researcher. At least 30% find the program either somewhat difficult or very difficult to understand.

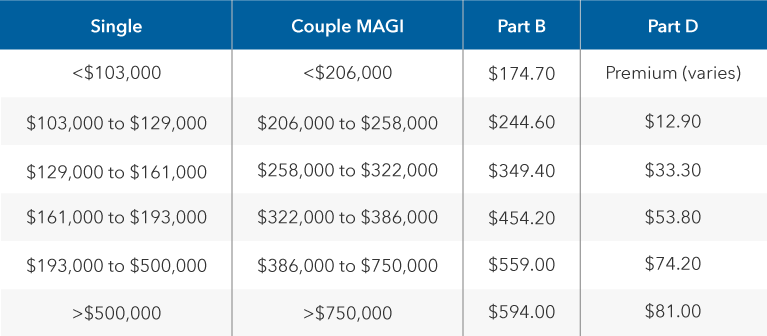

That lack of clarity can be costly. According to the KFF, helping Medicare-eligible individuals select optimal plans is critical to long-term health outcomes, but also to help keep health care costs in check. As a financial advisor, you are in a unique position to help clients prepare and understand their Medicare choices when the time comes.

“Even for clients of means, helping your clients understand their options so they can make informed decisions is a great value,” says Max McQuiston, an advisor practice management consultant at Capital Group. “Some advisors may choose to provide Medicare insurance through their office, while other advisors will refer their clients to a specialist in Medicare.”