For something generally thought of as ordinary and predictable, Social Security can be an exercise in frustration. For one thing, it’s an important source of income in retirement for many investors. Along with other sources, such as personal savings and retirement accounts, Social Security can help form the bedrock of an individual’s regular monthly “paycheck.”

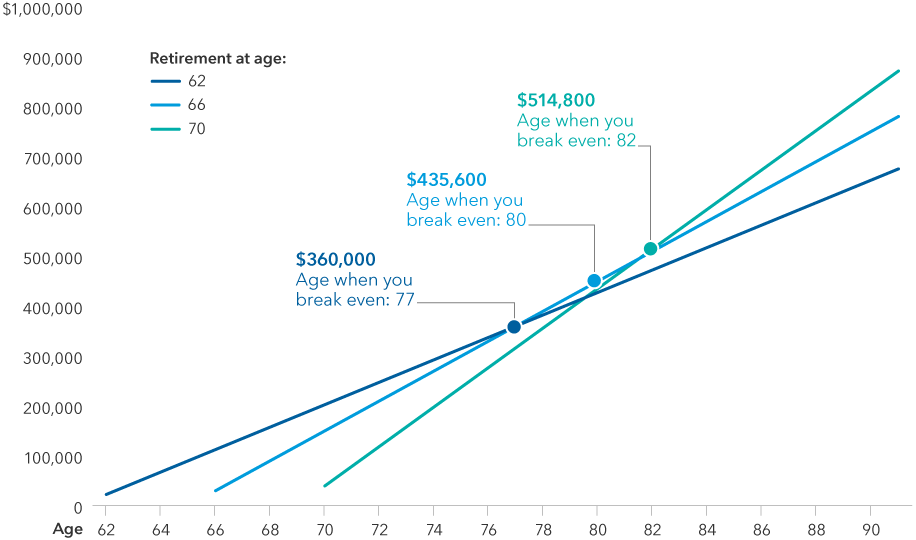

Even for clients with higher wages, Social Security may account for about 27% of income in retirement.* Depending on longevity, the benefits could amount to more than $1 million over a recipient’s lifetime.** Or it could amount to less, depending on a few key decisions made by individuals early on in the benefits process. Understanding these decisions and their ramifications is crucial, but it’s also complicated.

As a financial professional, you can help your clients understand the importance of those decisions by navigating the complexities of Social Security and offering straightforward strategies. Meanwhile, by encouraging clients to optimize Social Security benefits, you are helping them pursue monthly income goals now and throughout retirement.

Furthermore, if you don’t offer Social Security guidance to clients, you may be at risk of losing them. Today’s investors increasingly view retirement as a complex life stage requiring holistic planning and strategic decision-making on all fronts — life planning, health and wellness, values and legacy planning — not just financial planning. Providing guidance on Social Security can help you deepen the engagement with clients in or near retirement, demonstrating your facility with important topics that go beyond the investment portfolio.

“Because each client has unique circumstances, your role of helping them understand their options for claiming Social Security to make an informed decision is crucial,” says Max McQuiston, a wealth management consultant with Capital Group. “When you spend the time to understand all the options, you’re in a position to provide better, more customized advice.”

At Capital Group, we talk to thousands of financial professionals each year, and have identified six essential questions they hear most about Social Security. Here’s how to help answer them.