Most advisors understand that one of the best ways to deepen engagement with clients is also one of the simplest: take the time to understand clients’ life goals. When you ask the right questions and really get to know your clients and their needs, not only will they feel heard and understood, but you’re on the way to recommending a financial solution that’s personalized — built around a client’s unique priorities.

April 8, 2025

7 MIN ARTICLE

KEY TAKEAWAYS

- Ask the right questions to learn your clients’ goals

- Recommend a portfolio solution that is personalized

- Use a “core” and “satellite” approach to save time building portfolios

But the strategy of personalizing portfolio construction presents a challenge. Most advisors don’t have the time – and in some cases the expertise — to build dozens of bespoke portfolios.

“You can’t expect to customize 100% of a client’s portfolio,” says Wassan Kasey, an advisor practice management consultant with Capital Group. “The sheer volume of time it takes to monitor 40-50 tickers will take a lot of effort and keep you from what you do best, which is building relationships.”

Instead, Kasey suggests advisors take a blended approach, using model portfolios as “core” portfolio strategies when appropriate and supplementing those core strategies with “satellites” — additional investment products that help tailor the entire portfolio to the client.

“When you segment your portfolio allocations, you can have the flexibility to outsource some or all of the allocation based on the needs of each investor,” Kasey says. A core and satellite strategy can help you save time while still addressing clients’ goals. “The result is more time for you to focus on serving clients.”

Time management is an important point for advisors focused on growing their practices. According to Capital Group’s 2023 Pathways to Growth: Advisor Benchmark Study, the highest growth practices spend an average of 53% of their time on client engagement and only 25% of their time on investment management.

“We see this as a trend in our conversations with advisors,” Kasey says. “The fastest-growing advisors are continuing to move toward deeper client connectivity. This can lead to a higher level of loyalty. The crucial step is making sure the conversations you’re having are being reflected in the portfolios you’re managing.”

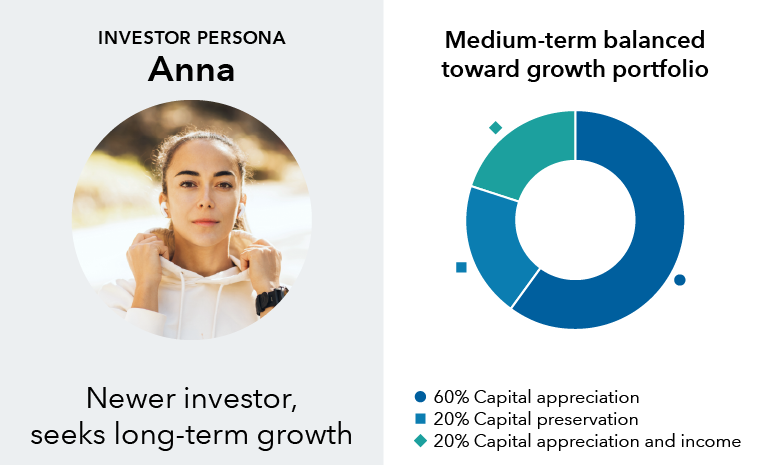

To illustrate, let’s look at three investor personas – each at a different life stage with different financial objectives.

We'll start with Anna. She’s a newer investor looking to grow retirement savings. But when you talk with her, you learn that she is what some advisors call a “Henry” – a “high earner who’s not rich yet.” You learn she’s a partner in a law firm and the bulk of her liquidity has been invested in the downpayment of her house. Her mid-term goals include recouping that downpayment to better position herself for paying her childcare (which in certain locales is more expensive than college tuition) and saving for her kids’ education, trips, as well as large purchases that may come in the future. You decide on a portfolio solution that leans heavily to equities, mixing capital appreciation, income and an element of capital preservation.

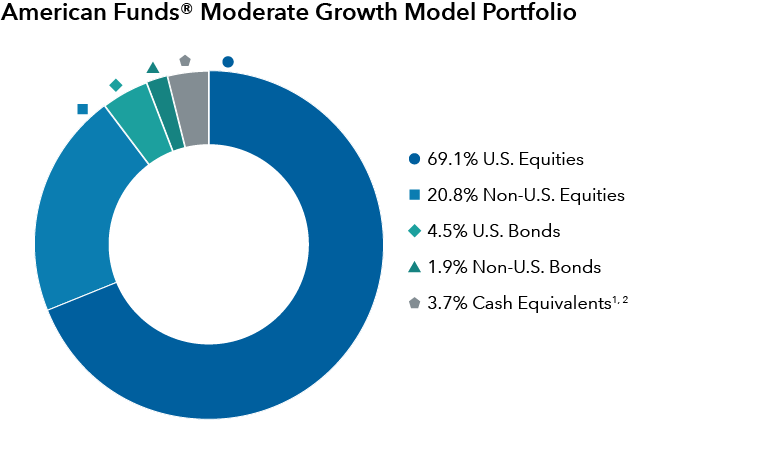

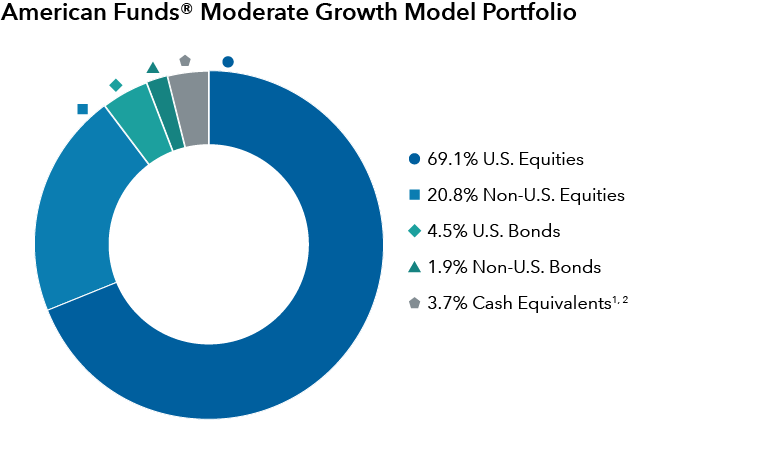

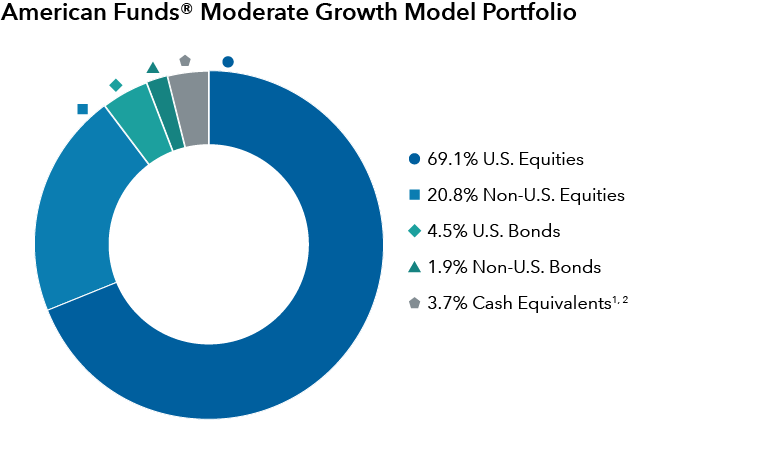

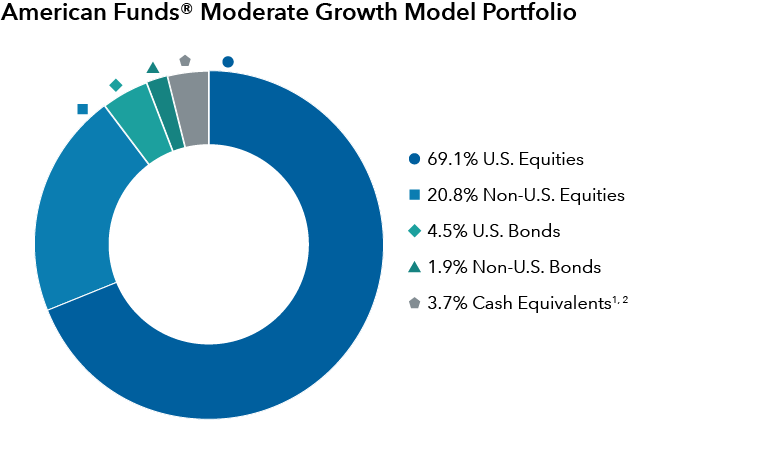

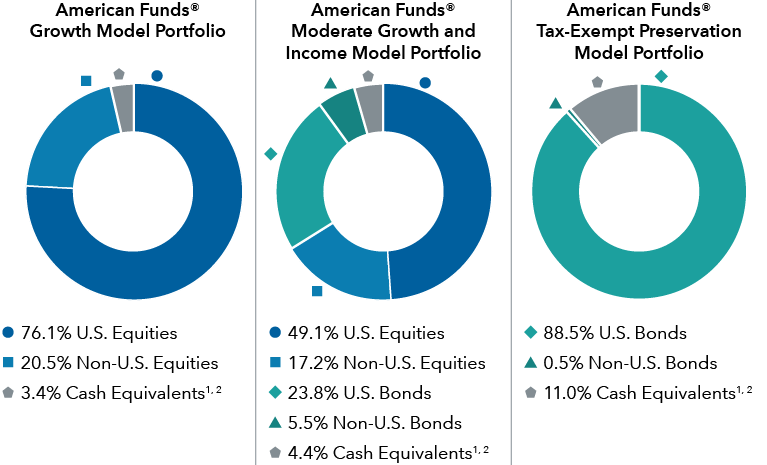

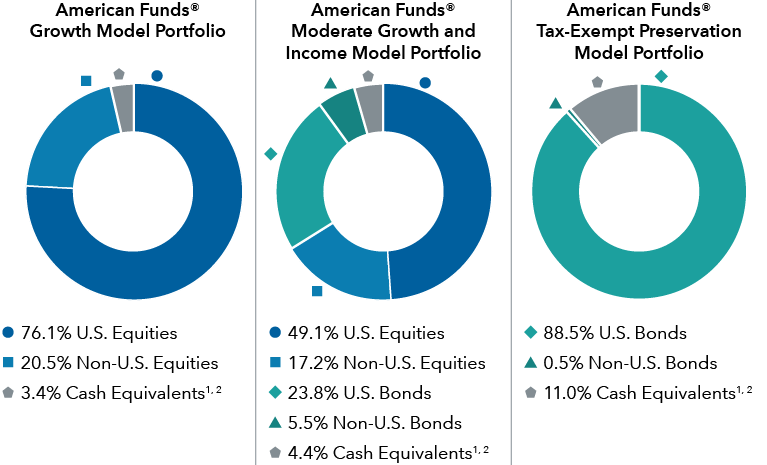

In this example, advisors looking for a “core” portfolio to build around could start with a model portfolio that aligns with the client’s goals. For Anna, an advisor might use as the “core” a moderate growth model like the American Funds® Moderate Growth Model Portfolio. As of Feb. 28, 2025, this model was roughly invested 90% in equities and includes taxable bonds, so a “satellite” approach might be to add some tax-efficient municipal bonds to support a measure of preservation, while also recognizing Anna’s higher tax bracket.

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Turn device sideways for larger view

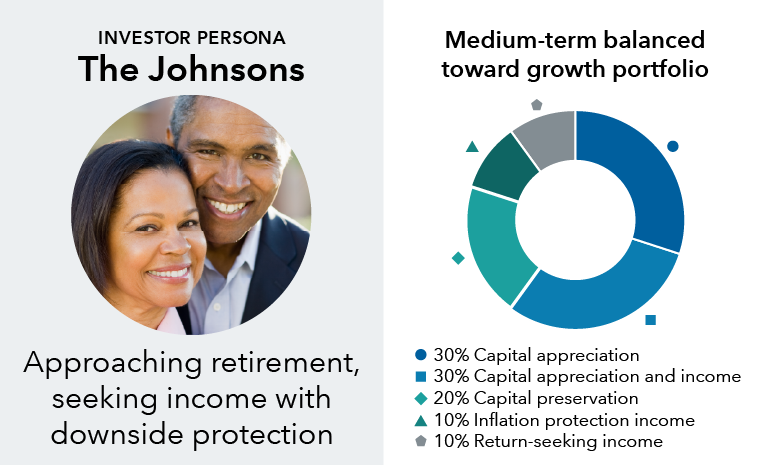

The Johnsons represent a different investor persona — they are approaching retirement, ready to begin transitioning their investment goals from growth and accumulation to income and preservation. Additional priorities include inflation protection and weathering market declines.

But there’s more to the conversation and to the advisor’s approach to the Johnsons. When a client transitions to retirement, there is heightened risk the advisor may lose the client — if the client believes another advisor has a plan better suited to meet their more conservative retirement needs. Through conversations, and portfolio design, you have a chance to establish you are the advisor best suited to the new objective.

“Your conversations with the Johnsons have always included the long-term view, including the assumption that they will retire successfully,” Kasey says. “When it comes time for them to do so, the conversation and portfolio need to converge — that is, showing them how their investment objectives will transition over time to reflect the plan and conversations you’ve been having with them over the years.”

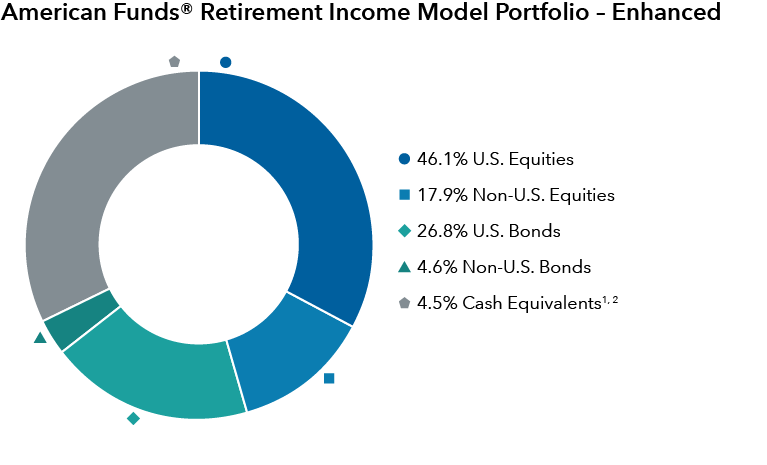

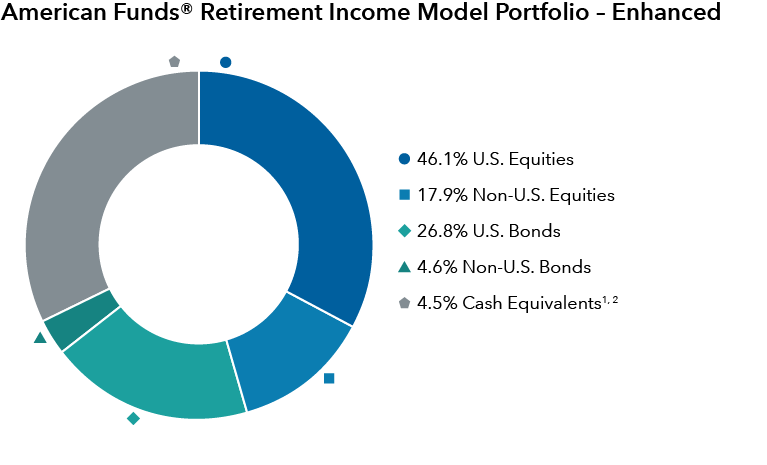

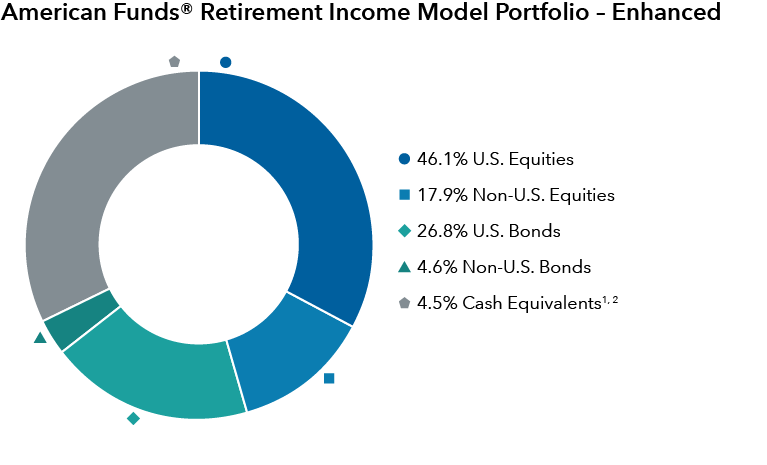

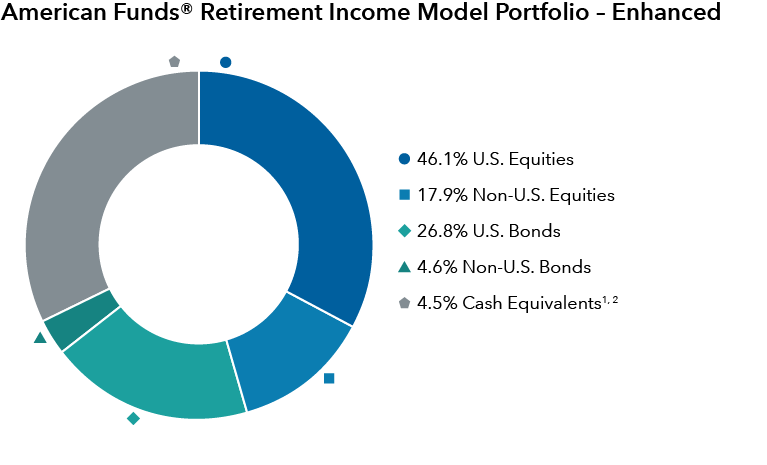

An advisor looking for a “core” model to anchor the Johnsons’ portfolio can look at retirement-themed models. A potentially good fit is the American Funds® Retirement Income Model Portfolio - Enhanced. As with Anna’s scenario, advisors can supplement a “core” model portfolio with additional investments in the event she has additional or unique needs.

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Turn device sideways for larger view

When the client has multiple goals

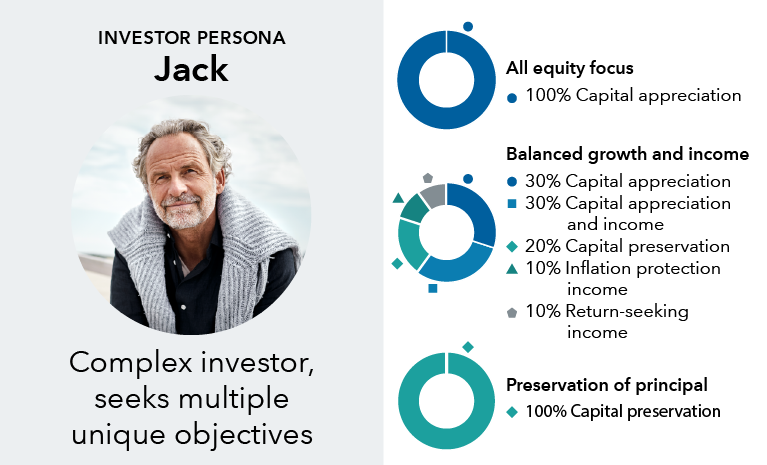

Now imagine a third, more complicated scenario. You’re recommending investment solutions for Jack — a complex investor with multiple goals. Jack is a high net worth client. You’ve known him and worked with him for decades. His goals have evolved — he’s been married twice, has children from both marriages, has been involved with several businesses and has enjoyed a significant liquidity event. You’re not the only advisor — he’s supported by others who handle his charitable giving, tax and estate planning and legal questions.

Even though Jack has achieved many of his goals, you might be surprised that continued conversations can uncover new objectives for Jack. “He's in the phase where he would tell you something like, ‘I don't need to get rich again,’” Kasey says. “That is, he's amassed his wealth, he's comfortable. Now it's about ensuring his assets work for him.”

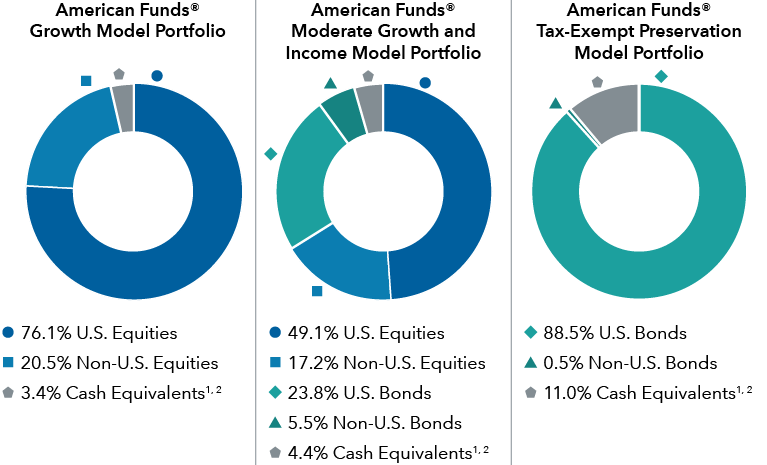

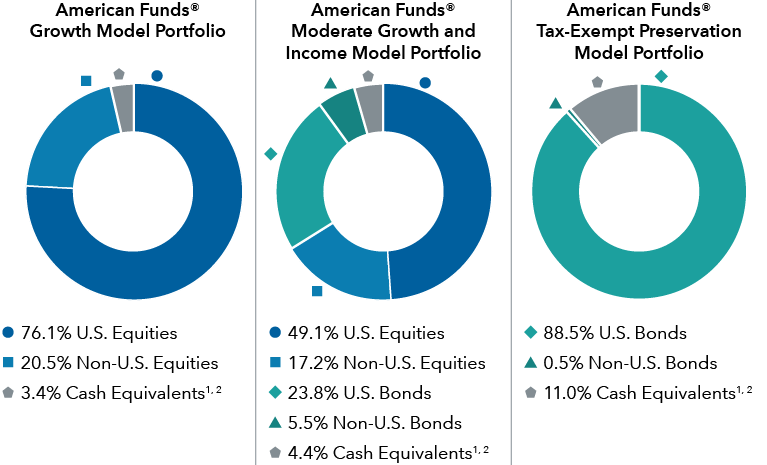

From a portfolio perspective, there is no one-size-fits-all solution for Jack — in fact, the solution is likely to be several solutions, one for each of Jack’s distinct goals: short-term and emergency spending, medium-term defensive growth and long-term growth assets earmarked for legacy. This approach is often called “bucketing” — three “buckets,” or three portfolios: 100% capital preservation, balanced growth and income and 100% capital appreciation.

From a broader perspective, don’t lose sight of other services you can provide Jack. He has many wealth and estate planning needs. “You might, for example, help him analyze when to use a family foundation versus a donor advised fund and which entity to use for certain gifts and investments,” Kasey says.

In this scenario, an advisor can seek to build each of the three portfolios and might seek out three model portfolios that can serve as a “core” to those three buckets, with additional investments incorporated into each bucket. For each objective, the “core” model portfolio might make up 40% to 60% of the portfolio for that objective. To illustrate possible model solutions, Jack’s “three bucket” approach could be built on allocations to three American Funds® model portfolios, as follows:

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Source: Capital Group

¹Accrued income and the timing of its settlement, as well as classification of convertible bonds as debt or equity, can cause slight variations in the balances displayed in different portfolio composition breakdowns.

²Includes cash, short-term securities, other assets less liabilities, accruals, derivatives and forwards. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Turn device sideways for larger view

Constructing portfolios can be time-consuming and requires research and investment experience. Kasey suggests advisors consider using Capital Group’s Portfolio Consulting and Analytics Team, which offers portfolio consultations and recommendations that are not limited to Capital Group products and solutions.

“We give you access to teams of portfolio consultants who will equip you with research, outlooks, insights and perspective,” Kasey says. “They’ll conduct risk analysis and review portfolio objectives to align with the construction of the portfolio. This service can be a real game-changer for advisors. But it starts with asking your clients questions. You’ll never go wrong taking the time to learn more about your clients.”

Want to take a more flexible, active approach in your client portfolios?

Get an unbiased point of view on portfolios and talk through solutions with trusted partners. Connect to your Capital Group representative or sign up for an in-depth portfolio analysis and review today.

Wassan Kasey is an advisor practice management consultant at Capital Group. She has 21 years of investment industry experience and has been with Capital Group for seven years. Prior to joining Capital, Wassan led the institutional and retail sales in the Western US for Milliman Financial Risk Management's downside hedge strategies. Before that, she was a portfolio manager and analyst prior to becoming an advisor coach at Wells Fargo Private Bank. She started her career as a financial advisor at Morgan Stanley. She holds a bachelor's degree in business administration from the University of Southern California. Wassan is based in Los Angeles.