Retirement has changed. You may have noticed firsthand with retirees you work with, but research from Capital Group confirms it. No longer a time for slowing down or just sitting around, today’s retirees describe being in the midst of a dynamic modern midlife: a time of reinvention, renewed vitality and deep introspection. They see the future as unwritten and full of opportunity.

This retirement evolution presents a great opportunity for financial professionals to differentiate themselves, add value and support the goals of their clients. But it may take a bigger-picture view and willingness to delve into new areas of planning.

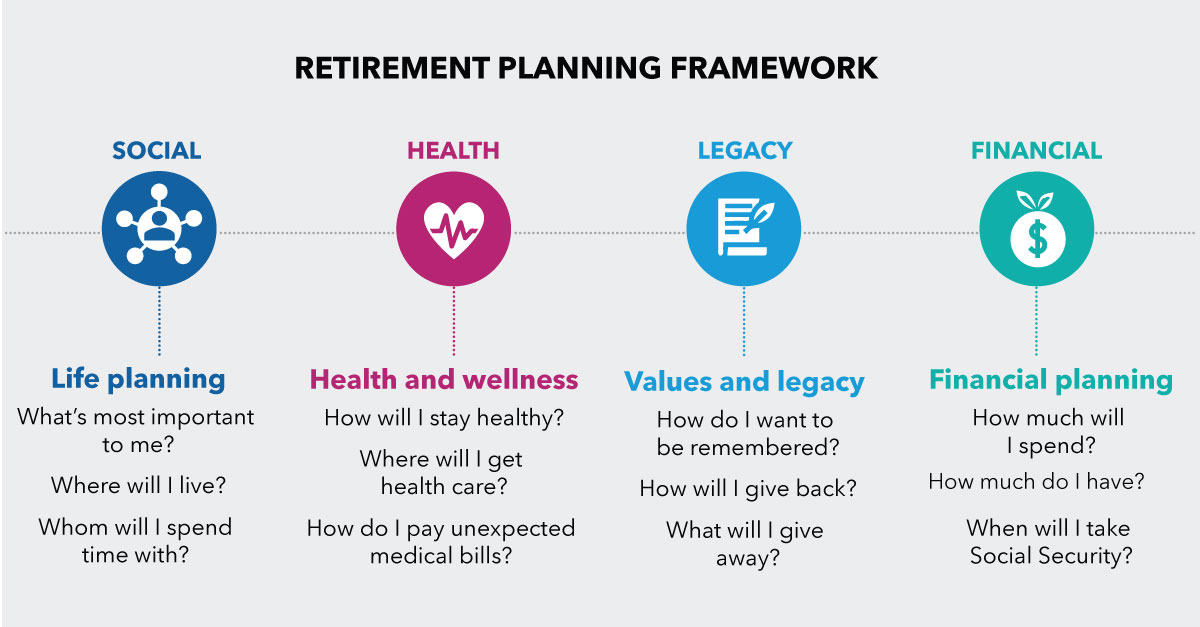

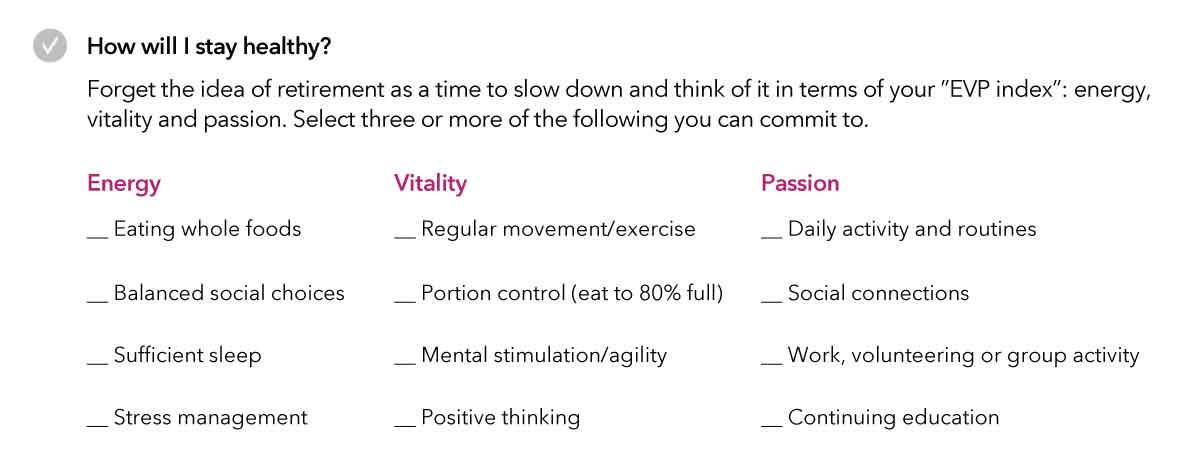

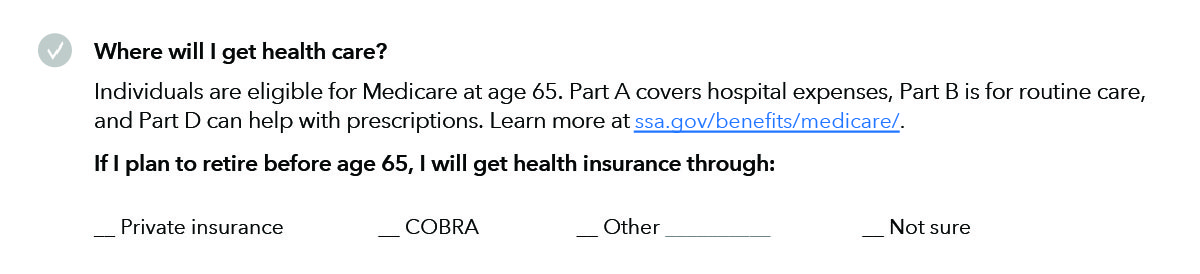

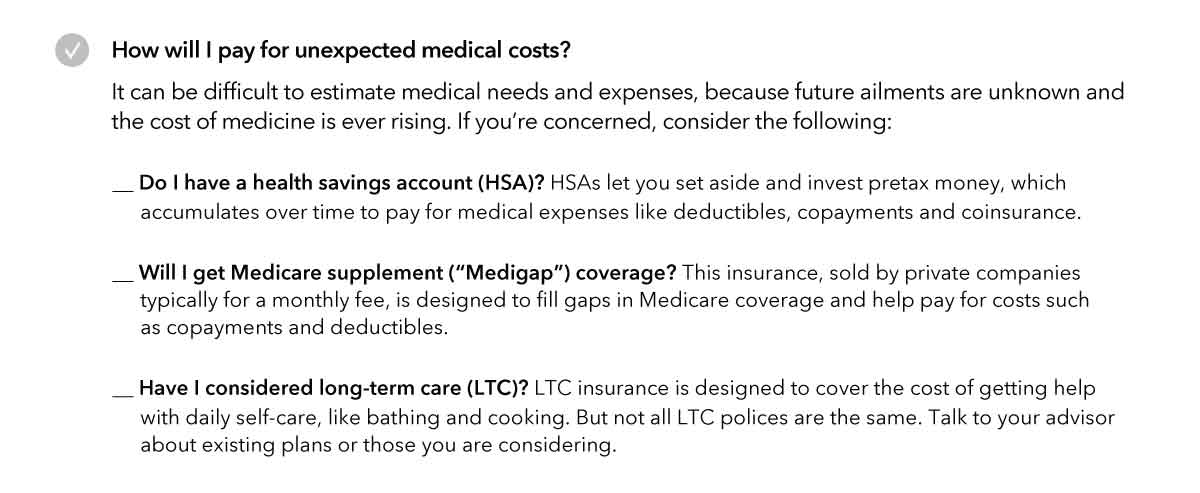

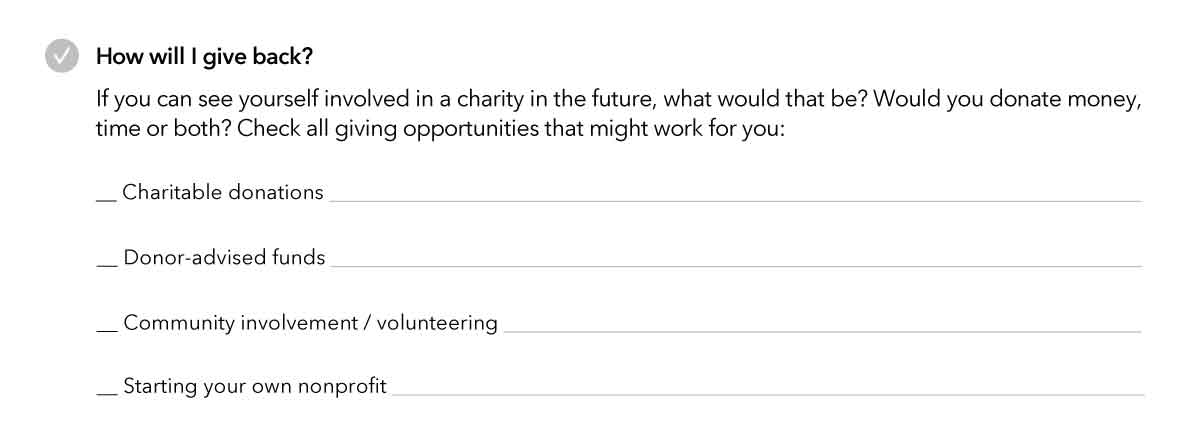

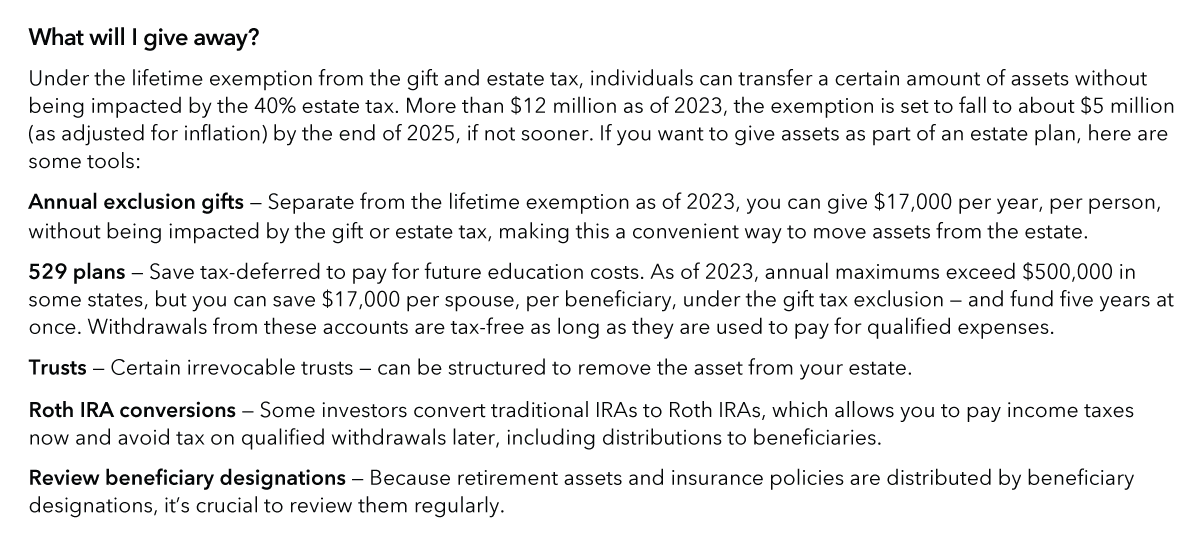

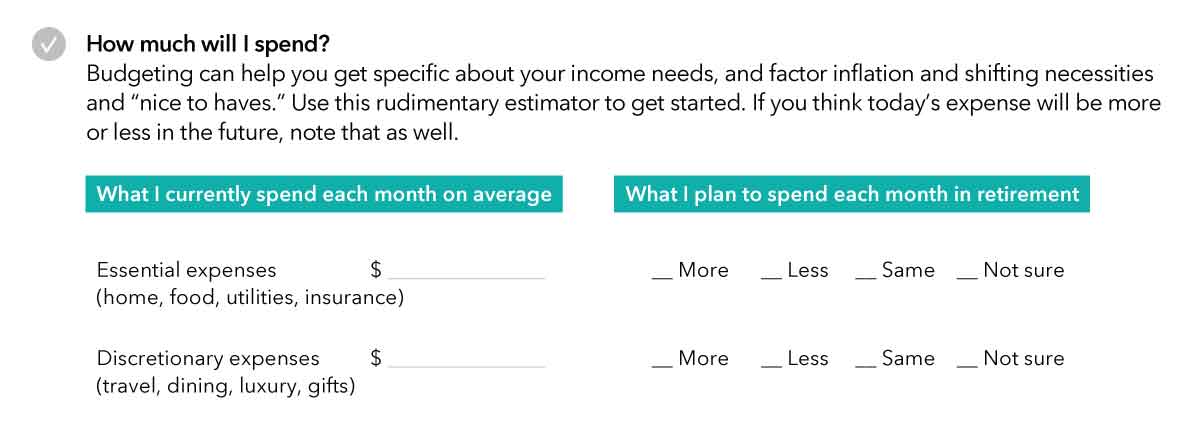

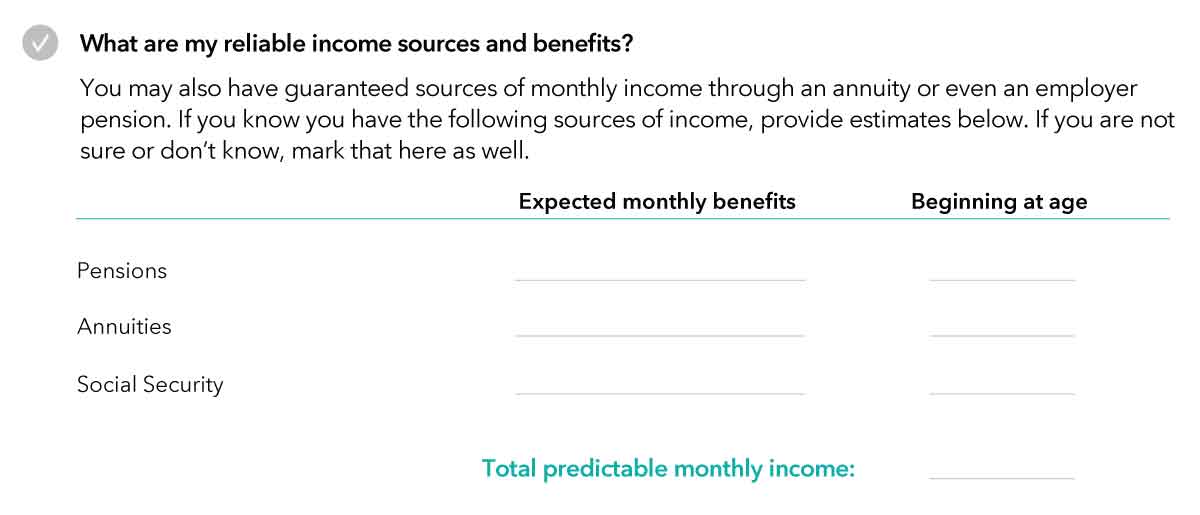

Our retirement planning workbook can help. Based on our latest research and feedback we at Capital Group receive from the thousands of advisors we work with each year, our investor-facing workbook, My Best Retirement can be used to start the conversation with pre-retirees and help you gather important information. It’s based on a framework containing four crucial aspects of planning: