New Perspective Fund®

DEFINED CONTRIBUTION FOCUS FUNDS

A global strategy focused on multinational firms with strong growth prospects

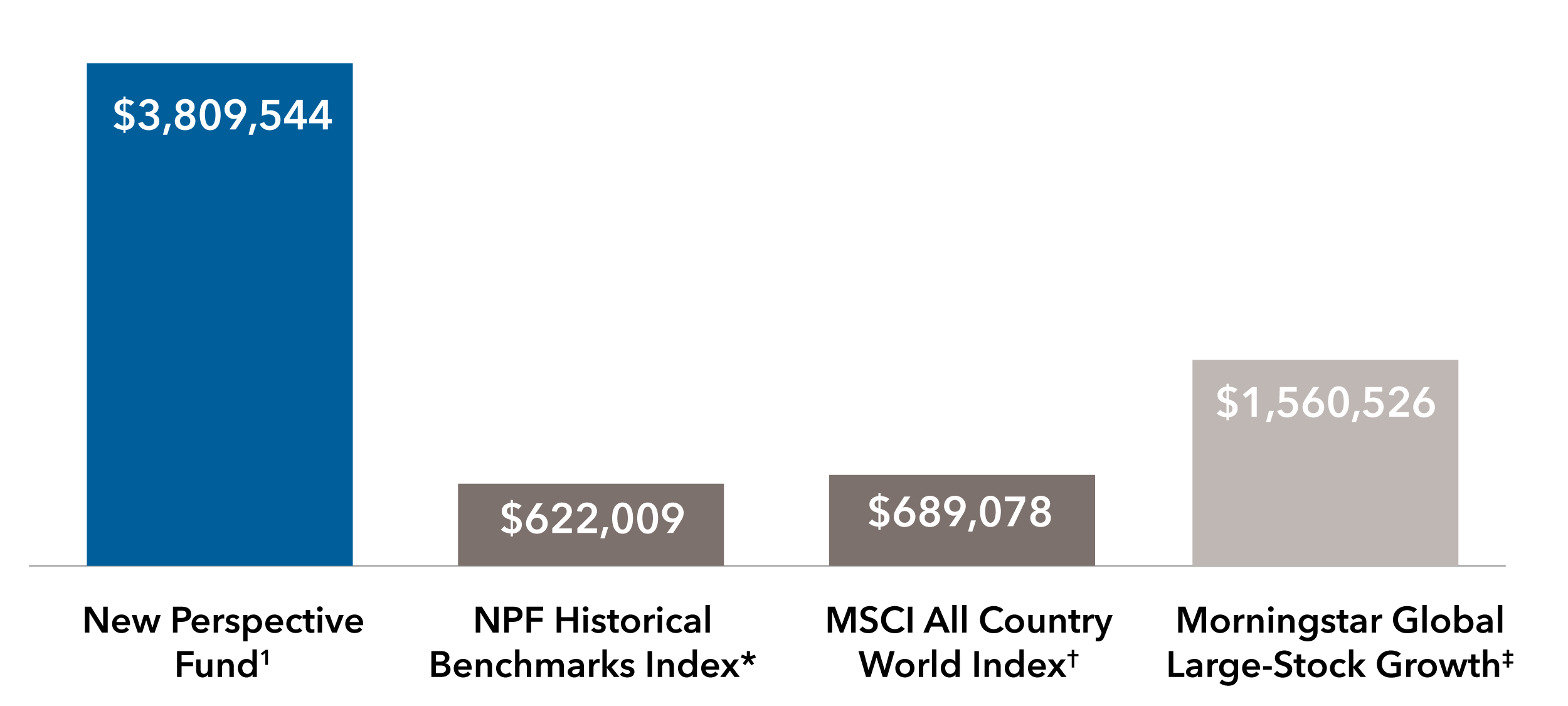

Better results

The value of a hypothetical lifetime investment in New Perspective Fund would have been more than five times that of both the NPF Historical Benchmarks Index and the MSCI All Country World Index. The fund beat its peers in 100% (250 out of 250) of rolling monthly 10-year periods over the past 30 years ended December 31, 2023.* ‡

A 50-year legacy of success

Value of hypothetical $10,000 investments since the fund began on March 13, 1973, through December 31, 2023.

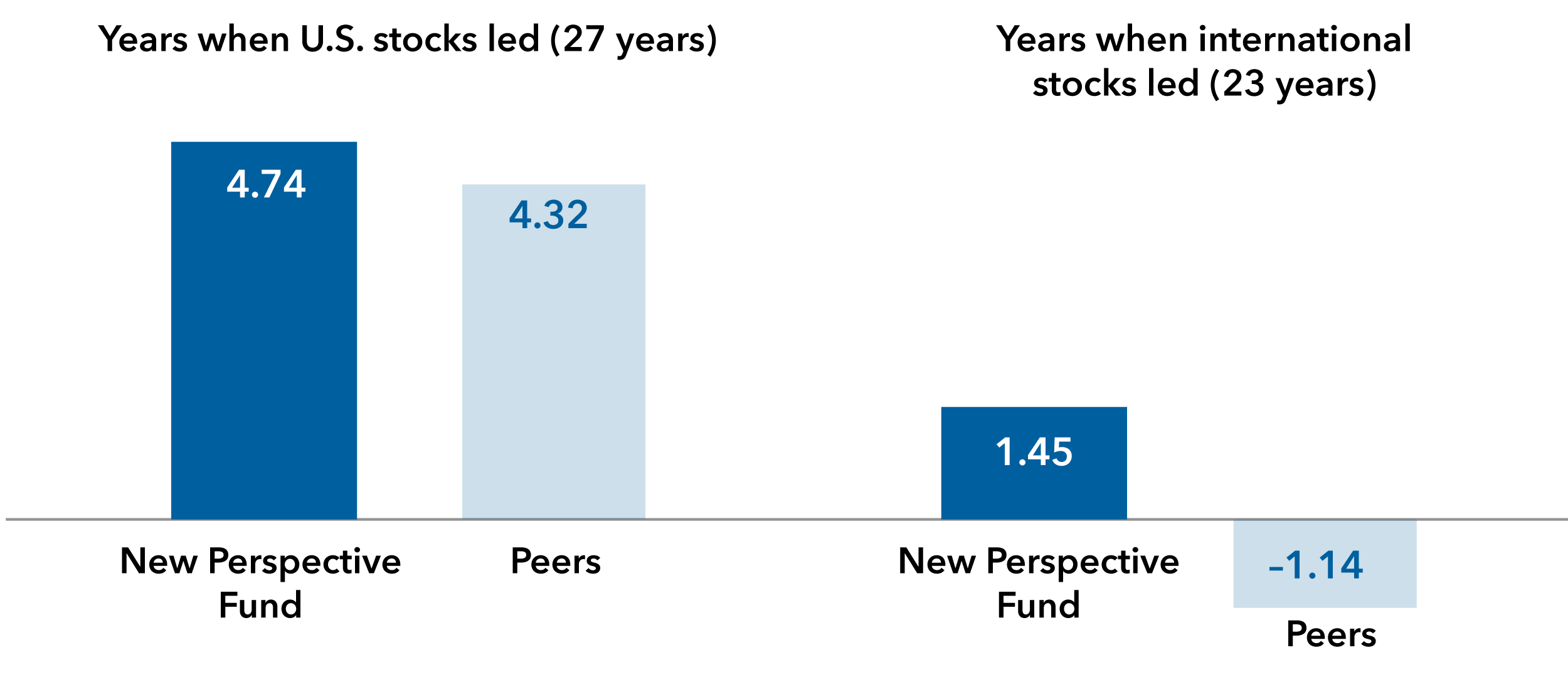

Strength in diverse environments

The fund’s global flexibility has enabled it to outpace its peers historically both when the U.S. led international markets and when international led U.S. markets.‡ §

Average calendar-year excess return over the global stock market (%, 1974–2023)‡ §

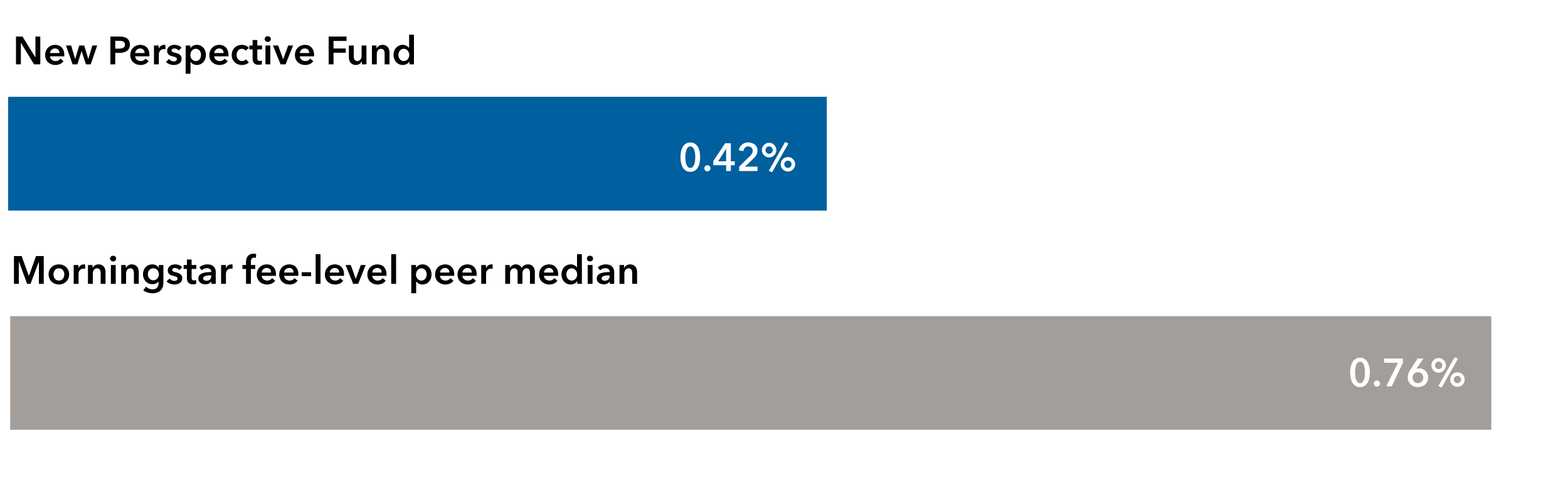

Low fees

The fund’s expense ratio was significantly lower than the median for its peer group.**2

Expense ratio**2

RECOGNITION

Morningstar Medalist RatingTM

of Gold††

Analyst-driven 100%

Data coverage 100%

Morningstar

“Thrilling 36” fund‡‡

Want to learn more about the fund?

We're here to help

Our dedicated retirement plan sales support can help you win and retain plans.

* New Perspective Fund Historical Benchmarks Index returns reflect the results of the MSCI World Index from 03/13/1973 through 09/30/2011 and the MSCI All Country World Index, the fund’s current primary benchmark, thereafter. MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends net of withholding taxes. These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

†The MSCI ACWI Index began after the fund’s inception. From March 13, 1973, through December 31, 1987, the MSCI World Index was used. MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. Results reflect dividends net of withholding taxes. These indexes are unmanaged, and their results include reinvested dividends and/ or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

‡Morningstar Global Large-Stock Growth portfolios primarily invest in international stocks that are projected to grow faster than other global large-cap stocks. Global large-stock growth portfolios have few geographical limitations. They typically invest the majority of their assets in developed markets and maintain at least a 20% absolute U.S. exposure. The Morningstar category average includes all share classes for the funds in the category. While American Funds Class R-6 shares do not include fees for financial professional compensation and third-party service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges resulting in higher expenses and lower results than American Funds Class R-6 shares.

§ Source: Capital Group, based on data from Morningstar since 1974, the first complete calendar year after the fund began on March 13, 1973. The fund’s Morningstar category is World Large-Stock Growth. Global stock market represented by MSCI World Index. Years when U.S. stocks led were those in which the S&P 500’s cumulative return exceeded the MSCI EAFE Index’s cumulative return. Years when international stocks led were those in which the MSCI EAFE Index’s cumulative return exceeded the S&P 500’s cumulative return. MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

**The fund’s Class R-6 expense ratio is as of the most recent prospectus available at the time of publication. The peer group expense ratio median was calculated based on funds in the following Morningstar Fee Level Group — Distribution category: World Stock Retirement, Large, as of March 31, 2024.

††As of June 24, 2024, based on Class R-6 shares.

‡‡Source: Morningstar, "The Thrilling 36" by Russel Kinnel, August 20, 2024. Morningstar's screening took into consideration expense ratios, manager ownership, returns over manager's tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds, and must be rated by Morningstar analysts. Class A shares were evaluated for American Funds. Visit morningstar.com for more details.

Unless otherwise indicated, data is as of December 31, 2023, and fund data is for Class R-6 shares.

Capital Group did not compensate Morningstar for the ratings and comments contained in this material. However, the firm has paid Morningstar a licensing fee to access and publish its ratings data. The payment of this subscription fee does not give rise to a material conflict with Morningstar.

- Class R-6 shares were first offered on 5/1/2009.

- Calculated by Capital Group. Due to differing calculation methods, the figures shown here may differ from those calculated by Morningstar.

- Expense ratios are as of each fund's prospectus/characteristics statement, as applicable, available at the time of publication.