DEFINED CONTRIBUTION FOCUS FUNDS

Nine American Funds options that can help enhance and simplify the core menu

-

-

QDIA: Foundational

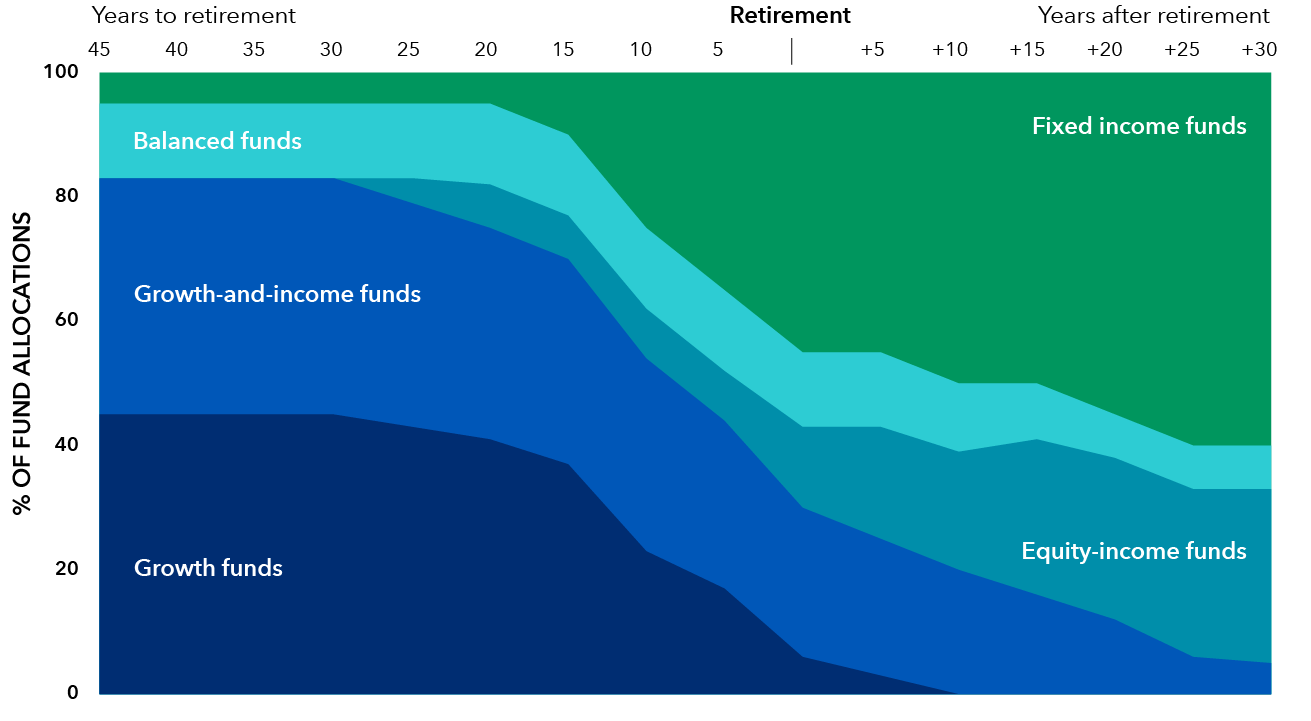

Our target date series has a distinguishing glide path

OTHER QDIA FUNDS

American Balanced Fund®

A quality balanced fund aiming for a smoother ride over the long term*

Target allocations as of December 31, 2023, and are subject to the oversight committee's discretion. Over the course of the year, the Series will be implementing changes such as increasing exposure to New World Fund, decreasing American Funds Global Balanced Fund and adding an allocation to American Funds Emerging Markets Bond Fund. For allocations to the underlying funds as of June 30, 2024, visit capitalgroup.com. New target allocations will be reached by December 31, 2024. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year.

OTHER QDIA FUNDS

American Balanced Fund®

A quality balanced fund aiming for a smoother ride over the long term*

-

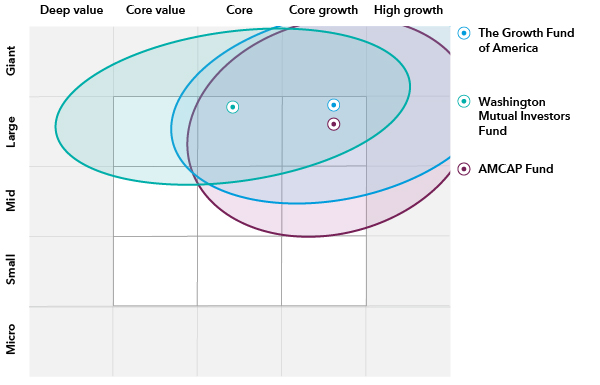

U.S. equity: Streamline

Simplify plan menus with funds that cover a wide range of styles and market caps

Source: Morningstar. As of December 31, 2023. Holdings may change.

U.S. EQUITY FUNDS

AMCAP Fund®

A disciplined approach to U.S. growth, combining market-cap flexibility with a focus on strong balance sheets.

The Growth Fund of America®

A time-tested growth strategy built for any market condition.

Washington Mutual Investors Fund

A blue-chip fund focusing on dividends for consistent results.

-

International equity: Broaden

Broaden the lineup with exposure to worldwide opportunities

Average rolling monthly 10-year R-6 annual return and standard deviation over 30 years ended December 31, 2023† 1

Sources: Capital Group, MSCI.

INTERNATIONAL EQUITY FUNDS

EuroPacific Growth Fund®

An opportunistic approach to non-U.S. markets.

New Perspective Fund®

Global flexibility to pursue above-average results and below-average volatility.

-

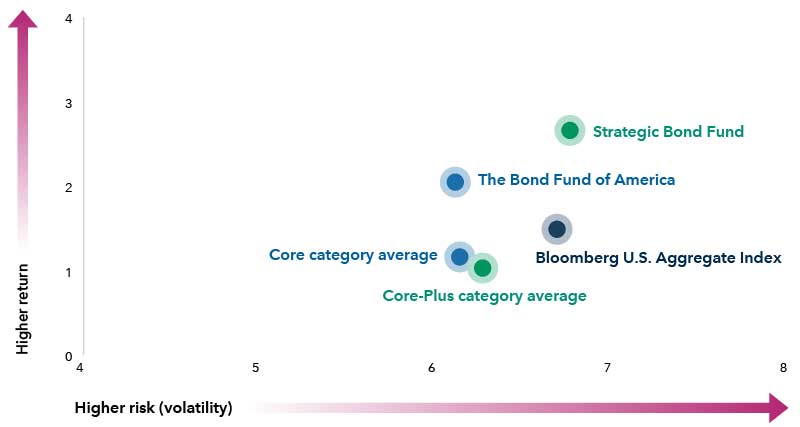

Fixed income: Anchor

The Bond Fund of America® and American Funds Strategic Bond Fund

A history of strong results with moderate volatility versus peers.

3-year Class R-6 share annualized return and standard deviation (%)†1

Sources: Capital Group, Morningstar, as of December 31, 2023. Return measure is average annual return. Volatility measure is standard deviation.

-

INSIGHTS & RESOURCES

Find a new perspective

Stay on top of retirement plan trends, investment options and regulatory changes.

* Plan sponsors should consult a financial professional before selecting an investment option other than a target date series as a qualified default investment alternative (QDIA).

†Rolling monthly 10-year periods and standard deviation over the 30 years ended December 31, 2023. Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

‡From March 13, 1973, through December 31, 1987, the MSCI World Index was used as New Perspective Fund’s index because the MSCI ACWI did not exist. MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 40 developed and emerging equity markets. MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 20 developed equity markets. MSCI World Index results reflect dividends net of withholding taxes, and MSCI ACWI results reflect dividends gross of withholding taxes through December 31, 2021, and dividends net of withholding taxes thereafter.

§From April 16, 1984, through December 31, 1987, the MSCI EAFE (Europe, Australasia, Far East) Index was used as EuroPacific Growth Fund's index because the MSCI ACWI (All Country World Index) ex USA did not yet exist. Since January 1, 1988, the MSCI ACWI ex USA has been used. The MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 40 developed and emerging equity markets, excluding the United States. The MSCI EAFE Index is a free float-adjusted market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada. The MSCI EAFE Index reflects dividends net of withholding taxes. The MSCI ACWI ex USA reflects dividends gross of withholding taxes through December 31, 2021, and dividends net of withholding taxes thereafter.

Unless otherwise indicated, data is as of December 31, 2023, and fund data is for Class R-6 shares.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. This index was not in existence when the fund’s Class A shares were first sold; therefore, lifetime results are not shown.

Intermediate-term core bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

- Class R-6 shares were first offered on 5/1/2009.

- Calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.