American Funds® Strategic Bond Fund

DEFINED CONTRIBUTION FOCUS FUNDS

Active positioning with diversified core plus exposure

Resilience during equity-market declines

American Funds Strategic Bond Fund (SBF) has demonstrated resilience in equity corrections compared to strategies that had a greater focus on credit.

Cumulative returns (%) during equity-market corrections since American Funds Strategic Bond Fund (R-6) inception (3/18/2016)

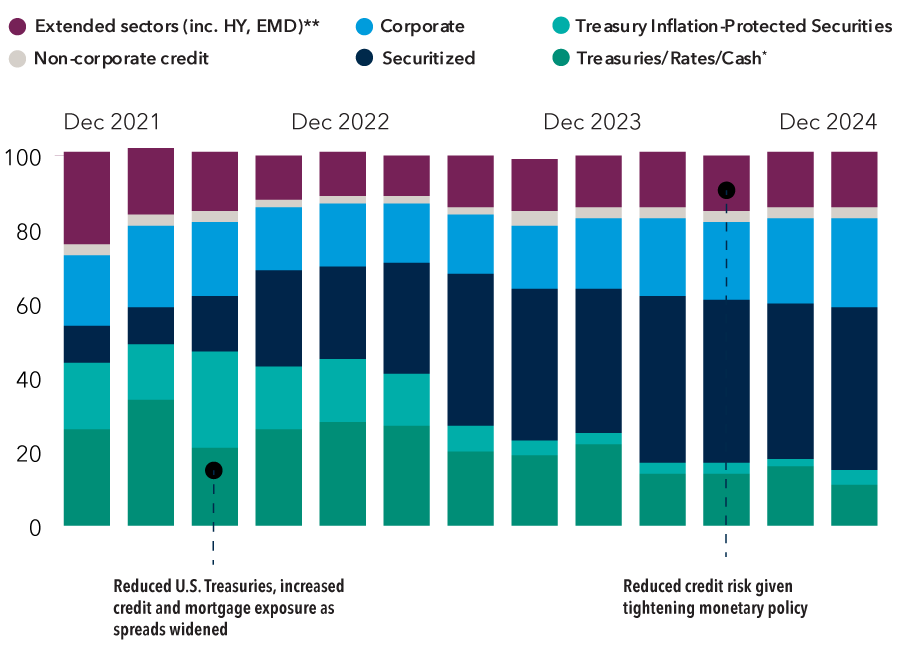

Credit: Active sector positioning

To exploit market opportunities as they develop, the fund actively manages the credit sectors in which it invests. By overweighting sectors with the potential to outperform and underweighting those less likely to deliver higher returns, it seeks to improve the potential for better investor outcomes.

Portfolio composition (%) on a quarterly basis

An opportunistic approach to interest rate positioning

American Funds Strategic Bond Fund adjusts its positioning as opportunities develop. Its portfolio managers focus on active interest rate positioning using duration, yield curve and inflation. Although important, credit is expected to be a less prominent driver of returns.

American Funds Strategic Bond Fund (R-6) duration relative to Bloomberg U.S. Aggregate Index (years)

Want to learn about the fund?

See how this fund can fit into a wealth management portfolio

We're here to help

Our dedicated retirement plan sales support can help you win and retain plans.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The indexes are unmanaged, and their results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. There have been periods when the funds have lagged the indexes.

Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Multisector bond portfolios seek income by diversifying their assets among several fixed income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high-yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below. Intermediate Core Category: Intermediate-term core bond portfolios invest primarily in investment-grade U.S. fixed income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.