THE CAPITAL SYSTEMTM

Our system prioritizes superior and repeatable fund results

Jonathan Bell Lovelace 1968

Early in Capital Group history, our leaders realized that their funds would outlast the professionals who managed them

They believed they had a responsibility to provide stability and management continuity to their investors, so they asked themselves a key question: If a portfolio manager left the firm, how could they keep funds going strong?

They pioneered a plan. By dividing funds into sections and giving each of the existing managers a portion to administer, no fund would be too dependent on a single person.

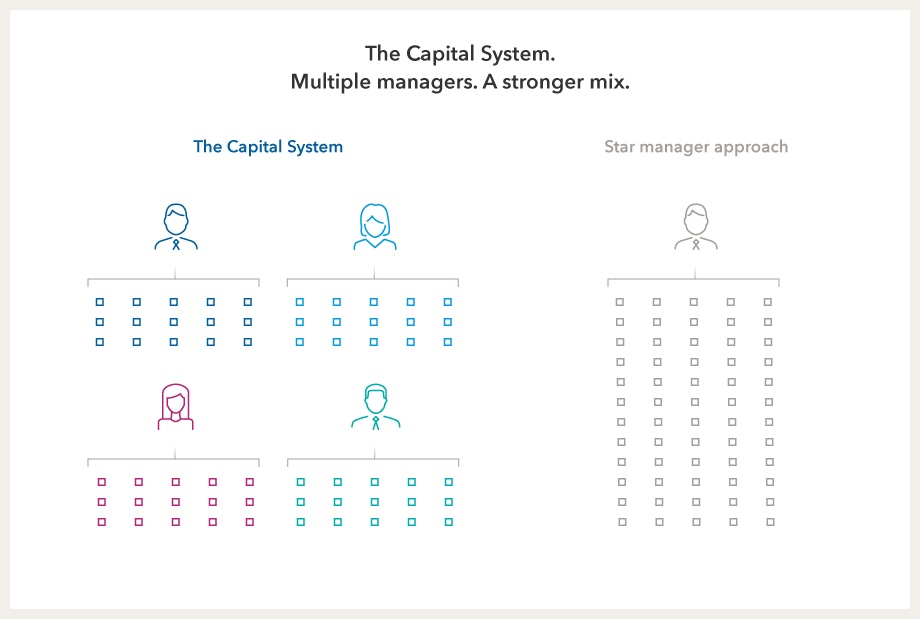

This distinctive way of managing money became The Capital System. By incorporating the highest conviction investment ideas of each manager in a fund, we aim to both increase the diversity of those ideas and reduce the volatility of a fund, which can give investors a smoother ride in bumpy markets.

The best of both worlds

Capital Group Meeting 1961: Jonathan Bell Lovelace,

Chuck Schimpff, Coleman Morton, Jim Fullerton, Mary Bauer

The Capital System can give financial professionals and investors the best of both worlds: the upside of high-conviction ideas and the power of collaboration

At Capital Group, home of American Funds, we assemble teams of managers who have different investing styles and complementary strengths to help foster a diversified investing approach.

The benefits of our multimanager approach can be boiled down to simple math: If a typical mutual fund has a star manager with 120 of her best ideas for investments, that’s a lot of ideas for one person to track. But imagine if the fund were divided among four managers, including each of their 30 highest conviction ideas — ideas they've explored inside out — that’s The Capital System.

A history lesson

For decades, many of our funds have delivered strong results, helping investors stay on the path to achieving their financial goals

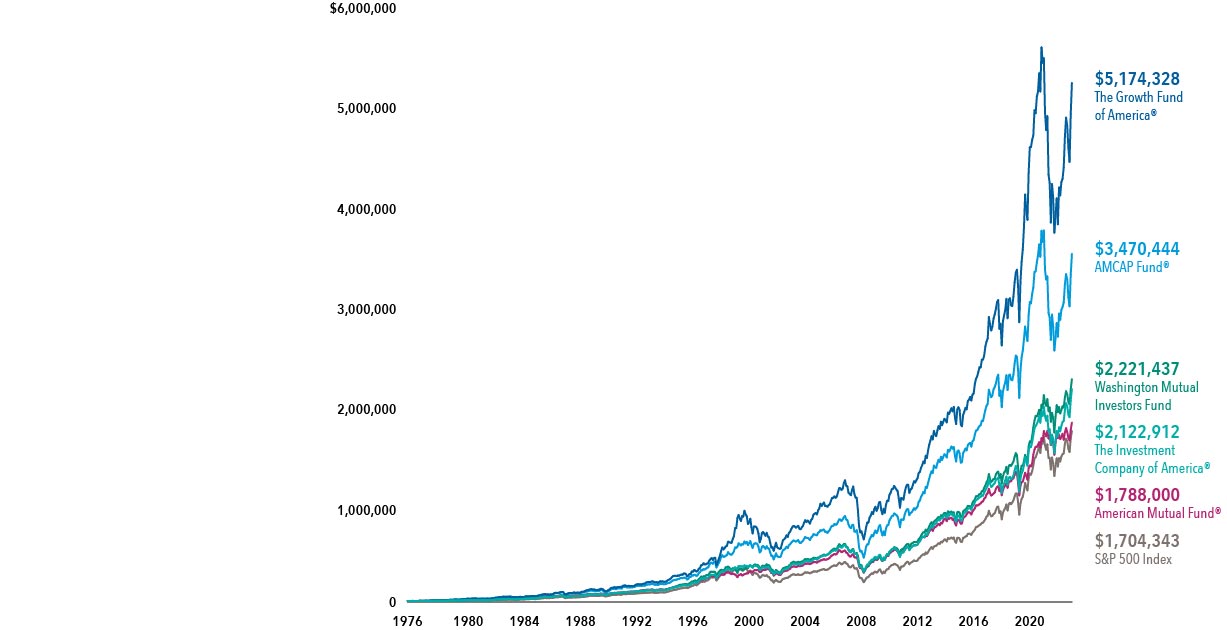

Take a look at the results of a $10,000 hypothetical investment in the S&P 500, as well as each of the five U.S. equity-focused American Funds available when the first S&P 500 index-tracking fund was founded in 1976.

Click for more information on the results of our equity, fixed income and multi-asset funds.

Class F-2 shares, net of all expenses

Source: Capital Group as of December 31, 2023. Includes all five of the U.S. equity-focused American Funds available for investment when the first S&P 500 index-tracking fund was launched on 8/31/76. The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

Aim for a smoother ride

A group of managers with complementary investing styles on a single fund seeks to diversify risk and deliver long-term results to help clients pursue their goals

Losing less when the market dips means investors stand to gain more when it climbs. And a steadier journey can help investors stay the course for the long term.

Built to last

The Capital System has stood the test of time

An innovative idea then and now, our distinctive multimanager system has become a defining feature of our success. Distinct in the market and diverse in its strategy, The Capital System has helped many of our investment vehicles pursue superior outcomes.

Capital Group has managed investment strategies through funds and other vehicles over the years, the results of which have varied.

Our beliefs

Your goals power ours

We have four core beliefs central to helping you succeed.

More beliefs

LONG-TERM APPROACH

PARTNERSHIP AND SUPPORT

Build a more personal portfolio.

Your clients need portfolios as individual as they are. Our portfolio construction approach lets you customize a mix that works with the individual goals of your clients.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.